European Central Bank chief economist Philip Lane delivered a warning that almost all markets treated as European housekeeping: the ECB can preserve on its easing path for now, nevertheless a Federal Reserve “tussle” over mandate independence might maybe destabilize world markets by intention of better US term premiums and a reassessment of the dollar’s feature.

Lane’s framing matters on narrative of it names the actual transmission channels that topic most to Bitcoin: steady yields, dollar liquidity, and the credibility scaffolding that holds the most up-to-date macro regime collectively.

The on the spot catalyst for cooling modified into as soon as geopolitical. Oil’s danger top rate faded as fears of a US strike on Iran receded, pulling Brent to around $63.55 and West Texas Intermediate to roughly $59.64 as of press time, a correction of roughly 4.5% since the Jan. 14 top.

That defused the pipeline from geopolitics to inflation expectations to bonds, on the very least swiftly.

Nonetheless, Lane’s comments pointed to a assorted roughly danger: not supply shocks or boost files, nevertheless the possibility that political stress on the Fed might maybe pressure markets to reprice US sources on governance grounds in space of fundamentals.

The IMF has flagged Fed independence as necessary in most up-to-date weeks, noting that erosion would be “credit rating negative.” Right here’s the roughly institutional danger that displays up in term premiums and foreign-exchange danger premiums prior to it displays up in headlines.

Term premiums are the proportion of lengthy-term yields that compensate patrons for uncertainty and duration danger, destroy free anticipated future rapid charges.

As of mid-January, the New York Fed’s ACM term top rate sat around 0.70%, while FRED’s 10-year zero-coupon estimate registered roughly 0.59%. The 10-year Treasury nominal yield stood at approximately 4.15% on Jan. 14, with the ten-year TIPS steady yield at 1.86% and the five-year breakeven inflation expectation at 2.36% on Jan. 15.

These are true readings by most up-to-date requirements, nevertheless Lane’s point is that stability can vanish swiftly if markets originate pricing a governance carve worth into US sources. A term-top rate shock does not require a Fed rate hike, as it’s some distance going to occur when credibility erodes, pulling lengthy-end yields better even because the protection rate stays assign.

The term-top rate channel because the carve worth-rate channel

Bitcoin operates in the same carve worth-rate universe as equities and duration-sensitive sources.

When term premiums rise, lengthy-end yields climb, financial conditions tighten, and liquidity premiums compress. ECB be taught has documented how dollar appreciation follows Fed tightenings in the future of multiple protection dimensions, making US charges the enviornment’s pricing kernel.

Bitcoin’s historical upside torque comes from expanding liquidity premiums: when steady yields are low, carve worth charges are free, and danger appetite is excessive.

A term-top rate shock reverses that dynamic with out the Fed altering the federal funds rate, which is why Lane’s framing matters for crypto even supposing he modified into as soon as addressing European policymakers.

The dollar index sat at roughly ninety nine.29 on Jan. 16, reach the lower end of its most up-to-date fluctuate. But Lane’s phrase “reassessment of the dollar’s feature” opens two obvious scenarios, not one.

Within the classic yield-differential regime, better US yields toughen the dollar, tighten world liquidity, and stress danger sources, along with Bitcoin. Review displays that crypto has became extra correlated with macro sources post-2020 and, in some samples, displays a negative relationship with the dollar index.

But in a credibility-danger regime, the bifurcates: term premiums can rise even because the dollar weakens or chops if patrons query a governance danger carve worth on US sources. In that danger, Bitcoin can exchange extra esteem an destroy out valve or but every other monetary asset, especially if inflation expectations rise alongside credibility concerns.

Additionally, Bitcoin now trades with a tighter linkage to equities, man made intelligence narratives, and Fed signals than in earlier cycles.

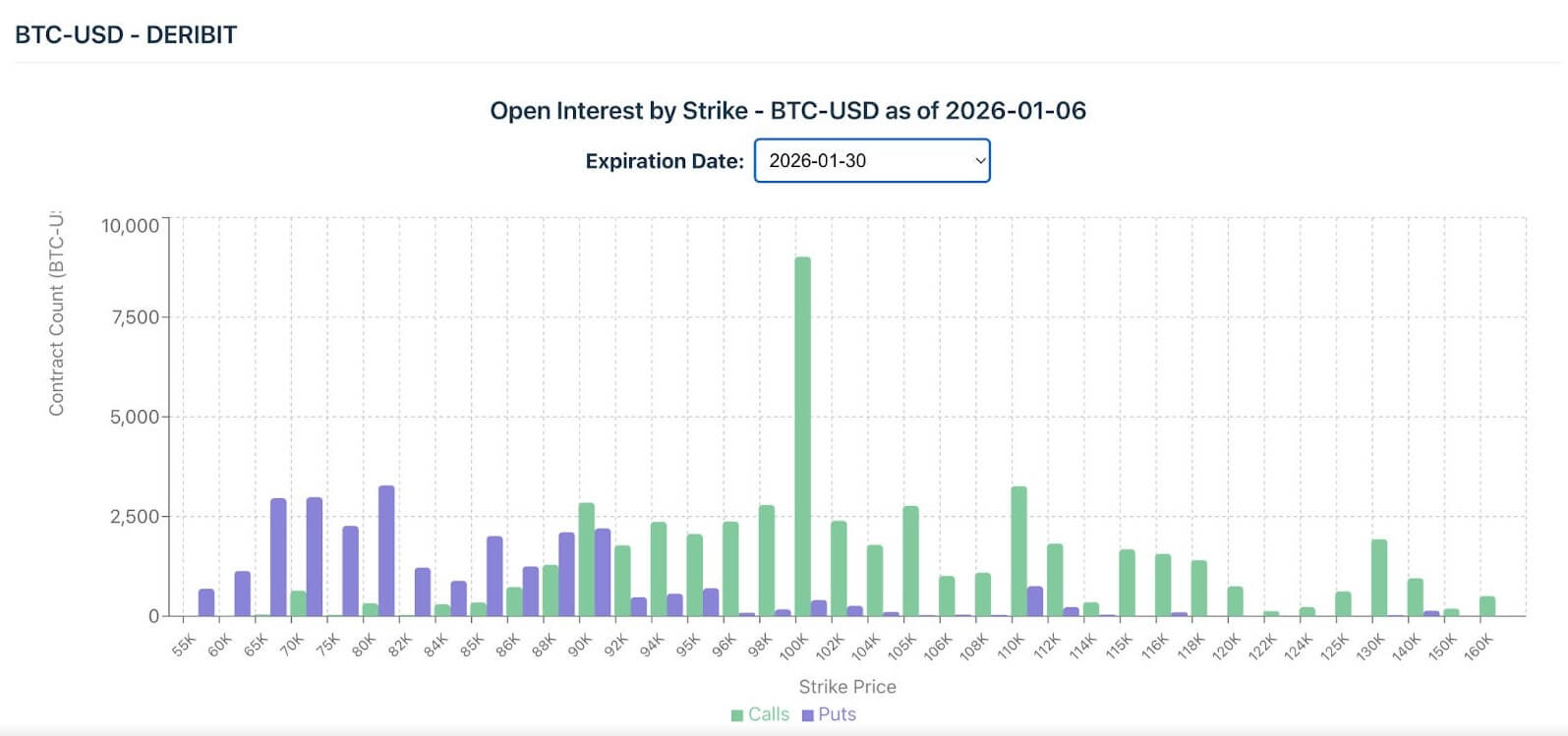

Bitcoin ETFs flipped support to build up inflows, totaling over $1.6 billion in January, in accordance to Farside Merchants files. Coin Metrics illustrious that space alternate options launch pastime clustered at $100,000 strikes into slack-January expiries.

That positioning structure formula macro shocks can rating amplified by intention of leverage and gamma dynamics, turning Lane’s abstract “term top rate” danger staunch into a concrete catalyst for volatility.

Stablecoin plumbing makes dollar danger crypto-native

A huge portion of crypto’s transactional layer runs on dollar-denominated stablecoins backed by stable sources, in most cases Treasuries.

Bank for Global Settlements be taught connects stablecoins to stable-asset pricing dynamics, that formula a term-top rate shock is not vivid “macro vibes.” It’ll feed into stablecoin yields, query, and on-chain liquidity conditions.

When term premiums rise, the worth of holding duration will increase, which is ready to ripple by intention of stablecoin reserve management and alter the liquidity available for danger trades. Bitcoin would maybe also honest not be a straight away Treasury change, nevertheless it lives in an ecosystem where Treasury pricing sets the baseline for what “danger-free” formula.

Markets on the 2d assign about a 95% chance to the Fed holding charges true at its January assembly, and main banks have pushed anticipated rate cuts later into 2026.

That consensus displays self assurance in reach-term protection continuity, which keeps term premiums anchored. But Lane’s warning is forward-taking a watch: if that self assurance breaks, term premiums can soar by 25 to 75 basis parts over the route of weeks with none commerce in the funds rate.

A mechanical instance: if term premiums rose 50 basis parts while anticipated rapid charges stayed flat, the ten-year nominal yield might maybe drag along with the drift from around 4.15% toward 4.65%, and steady yields would reprice better in tandem.

For Bitcoin, that can mean tighter conditions and shrink back danger by intention of the same channel that pressures excessive-duration equities.

The choice danger of a credibility shock that weakens the dollar creates a assorted danger profile.

If world patrons diversify some distance off from US sources on governance grounds, the dollar might maybe weaken even as term premiums rise, and Bitcoin’s volatility would spike in both route counting on whether or not the yield-differential regime or the credibility-danger regime dominates.

Academic work debates Bitcoin’s inflation-hedge properties, nevertheless the dominant channel in most danger regimes remains steady yields and liquidity, not breakeven inflation expectations on my own.

Lane’s framing forces both possibilities onto the table, which is why “dollar repricing” is not a single directional bet, nevertheless a fork in the regime.

What to survey

The rules for tracking this narrative is straightforward.

On the macro aspect: term premiums, 10-year TIPS steady yields, five-year breakeven inflation expectations, and the dollar index stage and volatility.

On the crypto aspect: space Bitcoin ETF flows, alternate options positioning around key strikes esteem $100,000, and skew changes into macro events.

These indicators join the dots between Lane’s warning and Bitcoin’s worth movement with out requiring speculation about future Fed protection choices.

Lane’s message modified into as soon as aimed toward European markets, nevertheless the pipes he described are the same ones that establish Bitcoin’s macro atmosphere. The oil top rate faded, nevertheless the governance danger he flagged hasn’t.

If markets originate pricing a Fed tussle, the shock would maybe also honest not preserve US-native. This might transmit by intention of the dollar and the yield curve, and Bitcoin will register the impact prior to most usual sources label.