President Donald Trump publicly signaled hesitation about transferring Kevin Hassett to the Federal Reserve, casting doubt on Hassett’s probabilities to prevail Jerome Powell as Fed Chair.

Talking at a conference, Trump said he needs to support Hassett in his present feature, citing issues about losing a relied on adviser if Hassett were sent to the Fed.

BREAKING: President Trump feedback on Kevin Hassett, the anticipated change for Fed Chair Powell:

“You were powerful on TV as of late, I in fact wish to support you where you are.”

“If I transfer him, these Fed guys don’t talk powerful, I’d lose you. It’s a serious screech to me,”… pic.twitter.com/em0C28Oe6A

— The Kobeissi Letter (@KobeissiLetter) January 16, 2026

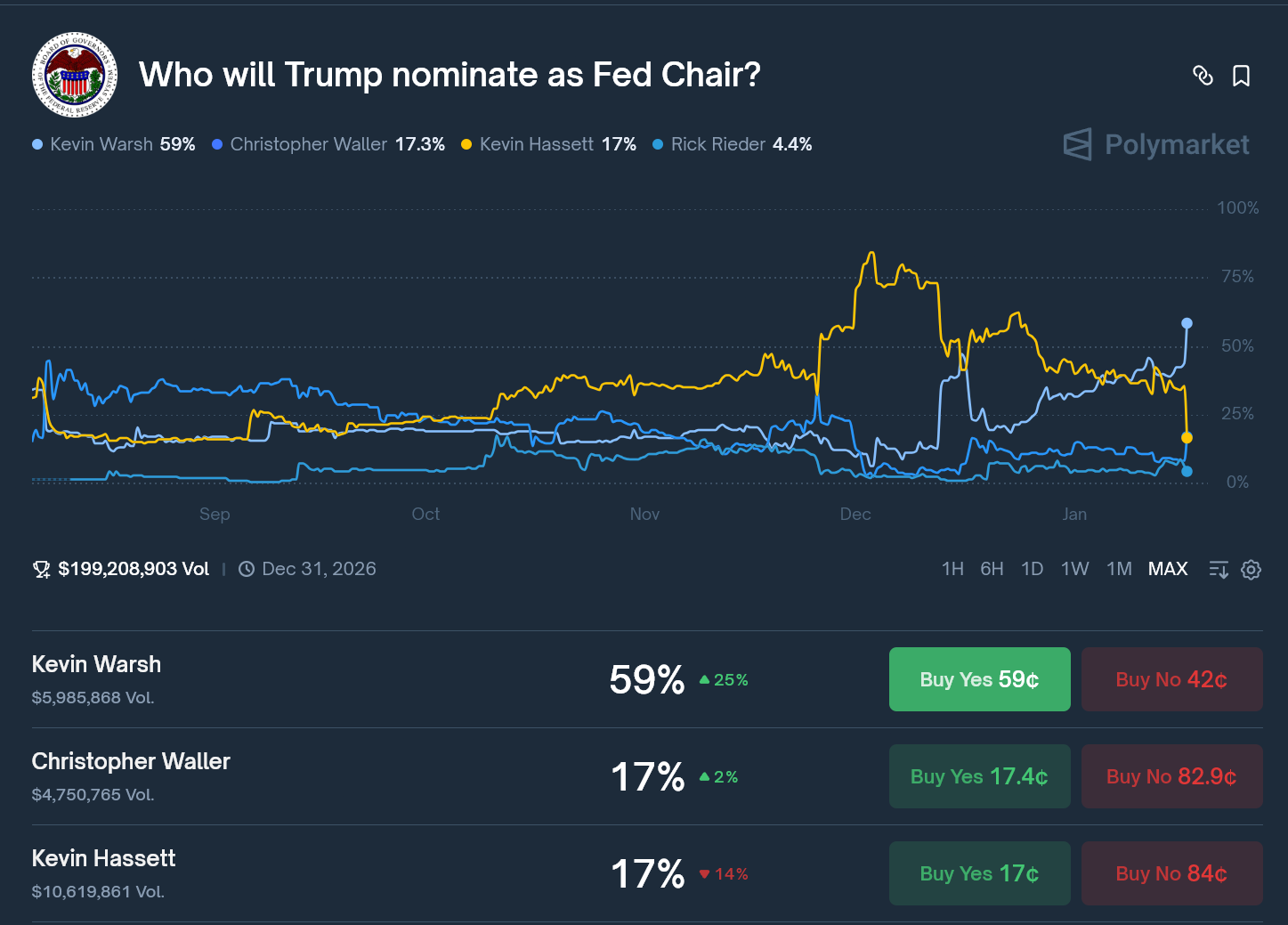

Kevin Hassett’s Probabilities Cool

That comment right away reshuffled expectations across the following Fed chair. With Hassett’s odds slipping, attention has shifted to Kevin Warsh, now considered by markets and Washington insiders as a number one contender.

Hassett had been widely discussed as a high change for Powell before the Could presumably maybe maybe additionally merely 2026 transition.

Trump’s feedback, on the opposite hand, counsel a want for continuity within the White Home in wish to a transfer to the central bank.

As a consequence, prediction markets and analyst chatter procure moved away from Hassett in present days.

Kevin Warsh Strikes to the Entrance

Kevin Warsh brings prior central-bank skills, having served as a Fed governor in the end of the world monetary crisis. His profile has long appealed to Republicans who want credibility with markets and a clearer separation between monetary policy and day-to-day politics.

Trump’s reluctance to allotment with Hassett has elevated Warsh into the cease tier of candidates.

Crypto Lens: Warsh vs. Powell

On crypto, Warsh and Powell differ more in tone than in outcomes. Powell has maintained a cautious, institution-first potential, many instances stressing monetary stability, shopper security, and likely regulatory lines for stablecoins and exchanges.

FORMER FED GOVERNOR KEVIN WARSH: Bitcoin “might well presumably present market self-discipline or it might well presumably expose the enviornment that things must be mounted.”

“Bitcoin does NOT create me worried.”

“It might well most likely maybe presumably customarily be a in fact factual policeman for policy.” pic.twitter.com/3pYKyCFiCy

— Fiat Archive (@fiatarchive) December 27, 2025

He has steer clear off endorsing crypto as money while permitting markets to manufacture below present tips.

Warsh’s file aspects to pragmatic skepticism. He has acknowledged Bitcoin’s potential as a store of price, customarily evaluating it to gold, however he stays cautious of personal cryptocurrencies functioning as everyday money.

That stance suggests tighter guardrails in wish to outright hostility. In contrast with Powell, Warsh might well sound more birth to debate on digital sources, yet policy outcomes would likely end conservative.

Powell’s Clock is Working Down

Powell’s term as Fed chair ends on Could presumably maybe maybe additionally merely 15, 2026. He can live on the Board of Governors unless 2028, despite the indisputable reality that chairs hardly ever ever live so after stepping down.

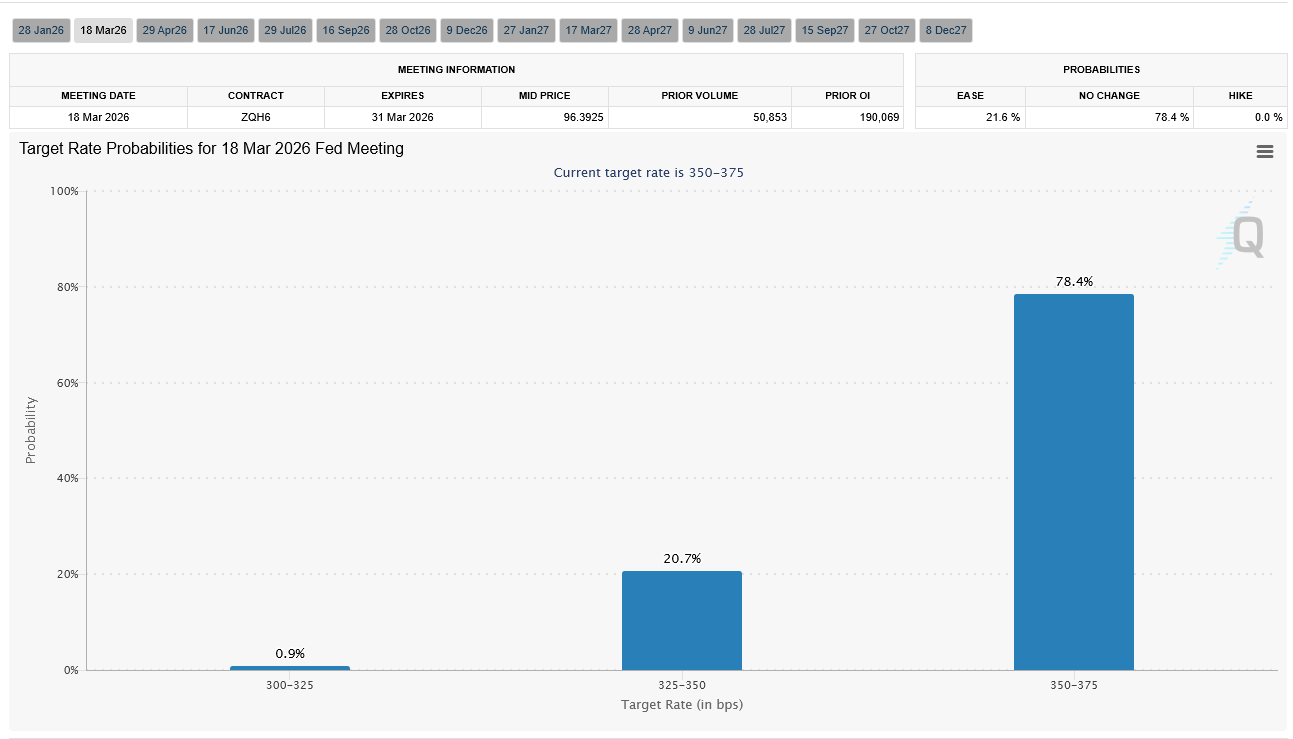

With inflation easing however not fully defeated, markets ask restricted room for important policy shifts before his departure.

Merchants an increasing selection of model one more rate gash below Powell before the transition, assuming records cooperates.

Any better pivot now appears to be like not likely, reinforcing the sense that the following chair will account for policy route for 2026 and previous.

Meanwhile, Powell faces an bizarre political backdrop. A Department of Justice probe tied to his congressional testimony on model overruns for the Fed’s headquarters renovation has included subpoenas for files.

Powell has said the matter does not procure an label on monetary policy. But, the investigation has intensified debate over central-bank independence as the leadership switch approaches.