As the XRP provide shock legend continues to electrify traction, prominent commentators argue that on-chain recordsdata doesn’t assist the notify.

In latest events, several reviews bask in highlighted a decline within the quantity of XRP held on exchanges. Supporters of the provision shock thesis, including Zach Rector, bask in amplified this style, pointing in inform to Binance’s falling XRP steadiness as proof.

They argue that as change reserves shrink, XRP’s liquidity on most principal trading platforms may possibly dry up, doubtlessly ensuing in a interesting designate surge.

Exchanges Tranquil Relieve Over 15B XRP

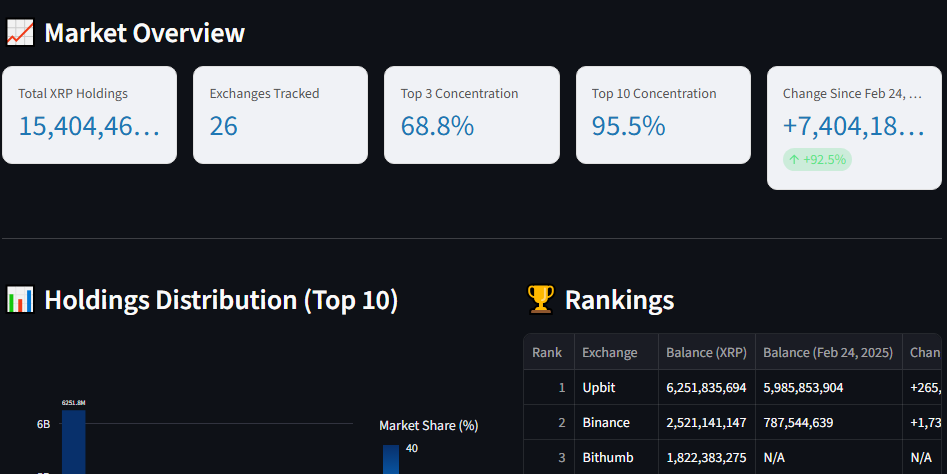

Meanwhile, as speculation intensified, a neighborhood member shared recordsdata from a platform that tracks XRP change balances. Basically the latest update shows that 15,401,504,547 XRP (15.4 billion) are mute held all over 26 exchanges.

Per the records, South Korean change Upbit holds an necessary piece, with 6.25 billion XRP spread all over 13 wallets. Binance follows with 2.52 billion XRP all over 21 wallets, while Bithumb ranks third with 1.82 billion XRP held in nine wallets. Total, varied exchanges within the ranking collectively withhold hundreds of hundreds of thousands to billions of XRP.

-

XRP Swap Balance

Knowledgeable Criticizes Provide Shock Theory

Reacting to the records, gorgeous educated Invoice Morgan mocked the provision shock legend, arguing that present figures attain no longer assist it. His commentary highlights several provide realities that undermine claims of an impending provide crunch.

Particularly, Morgan famed that the 15.4 billion XRP held on 26 exchanges represents most attention-grabbing 15% of the token’s full provide of 100 billion. He also identified that this resolve accounts for roughly 25% of the circulating provide of 60.67 billion XRP.

His argument means that in a accurate provide shock scenario, liquid tokens accessible for trading on exchanges would need to change into scarce. In its save, bigger than 15 billion XRP remain readily accessible, offering deep liquidity for both shoppers and sellers.

ETFs Relieve Much less Than 1% of Provide

Meanwhile, Morgan also addressed the role of XRP ETFs, which some shoppers imagine may possibly trigger a provide shock as they build more tokens.

In keeping along with his assessment, XRP held in save of living ETFs accounts for gorgeous under 1% of the total provide. This is noteworthy too dinky to meaningfully restrict circulation or get sustained scarcity.

For context, SoSoValue recordsdata shows that save of living XRP ETFs bask in a gain asset fee of $1.27 billion, representing gorgeous 679.14 million tokens, or 0.67% of the total provide. Unlike Bitcoin, the save ETFs bask in absorbed a most principal piece of BTC’s provide, XRP ETFs at gift bask in a negligible impact on overall availability.

Particularly, Morgan underscored his stance by overtly laughing at the “provide shock” principle, successfully mocking the muse that it could perchance trigger a most principal designate spike. Earlier this week, prominent XRPL dUNL validator Vet echoed a identical survey, brushing off the provision shock legend as ineffective.

He emphasised that exchanges mute withhold mighty XRP reserves and added that traders can mercurial bask in up change balances by sending tokens to trading platforms interior seconds at any time when costs fluctuate.