Curiosity in XRP alternate-traded funds (ETFs) is rising all all over again after widely followed investor Paul Barron printed that “substantial news” could well well ground this week.

His commentary unfold across the XRP community, fueling expectations that one other update or initiate would be drawing near near.

Solid ETF Flows in Crypto

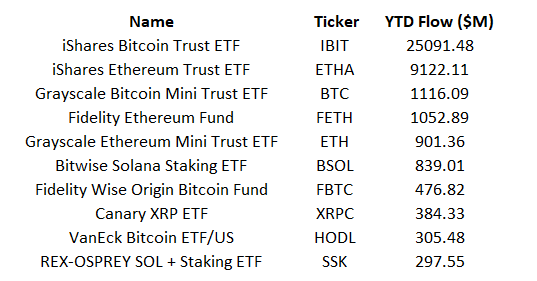

The renewed consideration comes alongside a efficiency breakdown shared by Nate Geraci, President of NovaDius Wealth. He highlighted the head ETF performers and their 365 days-to-date inflows. Whereas Bitcoin and Ethereum ETFs dominated the checklist, XRP also made a necessary appearance.

Amongst the standouts, BlackRock’s IBIT Bitcoin ETFs recorded the most sensible seemingly 365 days-to-date inflows at $25 billion. Grayscale’s Bitcoin Mini Belief ETF followed with $1.11 billion. Diversified Bitcoin ETFs included Constancy ($477 million) and VanEck ($305 million), as Bitcoin ETFs persevered to handbook inflows.

BlackRock’s Ethereum ETFs also led the ETH section with $9.12 billion. Diversified Ethereum ETFs from BlackRock, Grayscale, and Constancy ranked high as successfully, though with lower volumes. A Solana staking ETF from Bitwise also confirmed solid traction, with $839 million in inflows.

Meanwhile, for XRP holders, the Canary XRP ETF (XRPC) recorded $384.33 million in 365 days-to-date inflows. This locations it among the head ETFs total, irrespective of launching most efficient in November.

XRP ETF Landscape Retains Expanding

Beyond Canary’s product, several completely different XRP ETFs are already dwell but did no longer feature in the head-performers checklist. These consist of:

- 21Shares: about $250 million in sources beneath administration

- Bitwise: roughly $227 million

- Grayscale: spherical $244.23 million

- Franklin: approximately $206.9 million

All XRP space ETFs launched in November and December. Together, they now account for about $1.24 billion in total AUM, with cumulative inflows at $1.14 billion. For a newly launched ETF class, these figures spotlight sturdy early interrogate.

Some industry commentators, adore Teucrium CEO Sal Gilbertie, beget acknowledged that while the contemporary identify is spectacular, it will beget been noteworthy better if no longer for the bearish sentiment that has dominated the market since closing month. Even so, XRP ETFs beget shown noteworthy efficiency, generating over $1 billion in precisely 21 days of consistent inflows.

Now, consideration is on what could well well come subsequent, as Barron’s tweet hinted.

What “Mountainous News” Would possibly maybe doubtless furthermore Mean

Many are decoding Barron’s commentary as a doable update on one other XRP ETF. One product the community is closely looking out at is the WisdomTree XRP ETF, which is one of the pending ETFs expected to initiate subsequent.

WisdomTree is subsequent pic.twitter.com/5hKrdYU02E

— XRP 🅧 Military (@chachakobe4er) December 29, 2025

On the identical time, hypothesis spherical a BlackRock XRP ETF continues to waft into. Then all all over again, there could be currently no filing or pending reputation of an XRP product tied to BlackRock, making such expectations premature.

With a pair of XRP ETFs already attracting tall inflows and at the very least another space to initiate quickly, this could occasionally beget a necessary affect on market sentiment.