MicroStrategy’s Bitcoin Bet: Excessive Conviction, Excessive Threat

MicroStrategy has remodeled itself from a passe instrument company into a Bitcoin proxy. Within the course of the last years, the company has continuously supplied $Bitcoin, most ceaselessly the utilization of debt, convertible notes, and equity offerings to develop so.

This capability that, Bitcoin now dominates MicroStrategy’s balance sheet. The corporate holds pretty heaps of of thousands of BTC, making its valuation highly sensitive to Bitcoin notice movements. This strategy works extraordinarily effectively at some stage in bull markets — but it absolutely moreover creates structural possibility at some stage in prolonged downturns.

At this level, MicroStrategy is no longer any longer gorgeous “exposed” to Bitcoin. It’s financially tied to it.

Bitcoin Ticket Outlook: Volatility Peaceable Principles

Bitcoin remains the most essential variable in MicroStrategy’s future.

Trying at the connected weekly $BTC chart:

- Bitcoin recently lost momentum after failing to set up above indispensable resistance

- Recent notice motion is hovering around a severe pork up zone

- Momentum indicators stay worn, suggesting persisted downside possibility

BTC/USD 1W – TradingView

Whereas Bitcoin has historically recovered after deep procure markets, those recoveries most ceaselessly came after prolonged sessions of stagnation. In outdated cycles, BTC spent one to 2 years transferring sideways or declining earlier than resuming its uptrend.

A space the establish Bitcoin drops sharply — or even trades at heart-broken ranges for years — can no longer be ruled out.

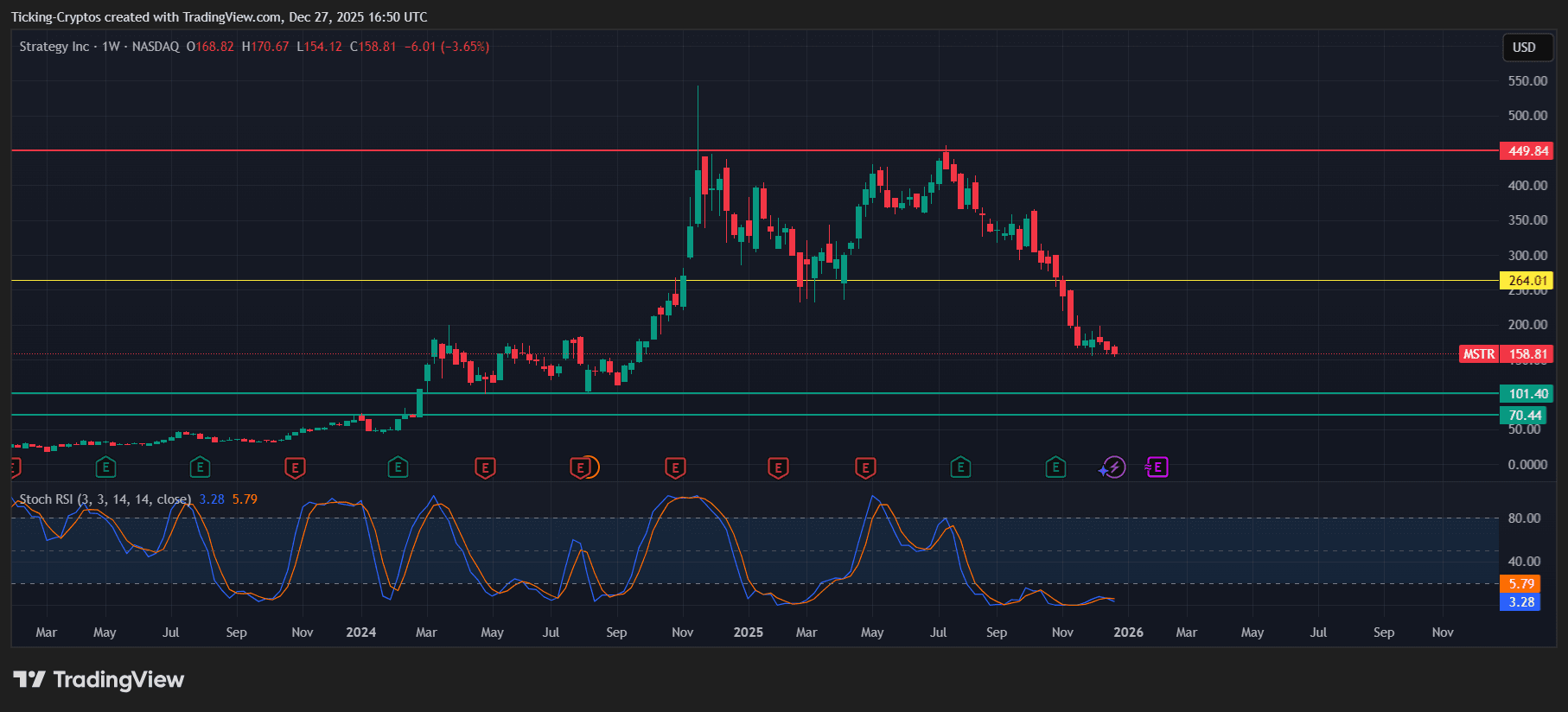

MicroStrategy Stock Analysis: Leverage Cuts Both Suggestions

The MicroStrategy chart shows this possibility clearly.

- MSTR peaked come indispensable resistance and has since entered a solid downtrend

- Key pork up ranges delight in already been lost

- The stock is now trading far below its highs, mirroring Bitcoin’s weakness

MSTR 1W – TradingView

Whereas MicroStrategy does no longer switch tick-for-tick with Bitcoin, the correlation will enhance sharply at some stage in market stress. When BTC sells off aggressively, MSTR tends to underperform resulting from leverage, debt exposure, and investor be troubled.

In bull markets, MSTR most ceaselessly outperforms Bitcoin. In procure markets, it most ceaselessly falls extra critical.

Are Bitcoin and MicroStrategy Fully Correlated?

No longer exclusively — but finish satisfactory to matter.

Bitcoin determines:

- The cost of MicroStrategy’s reserves

- Investor self perception in its strategy

- The corporate’s skill to steal capital cheaply

MicroStrategy, on the other hand, moreover carries:

- Operating costs

- Employee salaries

- Debt servicing tasks

- Company costs unrelated to Bitcoin notice

Bitcoin can afford to “develop nothing” for years.

An organization can no longer.

The Structural Disadvantage: Time Works In opposition to Companies

Bitcoin could perhaps theoretically wreck in direction of zero, set there for 2 years, and later get better. It has no payroll, no debt payments, and no operational burn.

MicroStrategy does.

If Bitcoin had been to:

- Stay deeply heart-broken for extra than one years

- Residing off mammoth unrealized losses on the balance sheet

- Restrict web entry to to contemporary financing

Then MicroStrategy could perhaps face severe sustainability issues, no matter prolonged-term Bitcoin optimism.

Right here’s no longer about perception in Bitcoin — it is about corporate survivability below prolonged stress.

Will MicroStrategy Rupture in 2026?

A wreck is no longer guaranteed, however the possibility is real.

MicroStrategy’s future relies heavily on:

- Bitcoin conserving prolonged-term cost

- Avoiding prolonged multi-year drawdowns

- Sustaining web entry to to capital markets

If Bitcoin recovers swiftly, MicroStrategy advantages hugely.

If Bitcoin enters a prolonged, deep winter, MicroStrategy carries far extra possibility than Bitcoin itself.

In straightforward terms:

- Bitcoin can wait

- MicroStrategy can no longer wait perpetually

That asymmetry is the core possibility investors have to realize heading into 2026.