Few issues divide the crypto industry extra than politics. Donald Trump is fundamentally in most cases known as “The US’s first crypto president,” whereas the Biden administration earned a reputation for being antagonistic in direction of the field.

However when rhetoric is stripped away and changed with market recordsdata, the picture becomes extra nuanced. The key quiz isn’t any longer which administration spoke extra favorably about crypto, nonetheless below whose leadership Bitcoin in a roundabout blueprint performed better.

Bitcoin Performance: The Numbers Inform a Clear Memoir

Within the 2024 United States presidential election, Trump positioned himself as a pro-crypto candidate, vowing to develop the US the “crypto capital of the field.” He promised to end anti-crypto actions, rein in SEC crackdowns, and, in his own phrases:

“End Joe Biden’s battle on crypto and we will doubtless be in a position to make sure that that the blueprint in which forward for crypto and the blueprint in which forward for Bitcoin will doubtless be made in The US.”

This fueled optimism out there and ignited hopes for a bull mosey. Like a flash ahead to shut to the quit of 2025, and Bitcoin is down almost 5%.

The most “pro-crypto” presidency ever.

Every predominant token down since inauguration. $BTC pic.twitter.com/b1sXRNlqw7— TrendSpider (@TrendSpider) December 23, 2025

By comparison, all the blueprint by Biden’s first year as president, the field’s largest cryptocurrency obtained roughly 65%. Performance weakened in 2022, nonetheless momentum returned within the next years.

Bitcoin rebounded strongly, rising approximately 155% in 2023 and a further 120.7% in 2024.

| three hundred and sixty five days | Bitcoin return (%) |

| 2021 | 65% |

| 2022 | 64.2% |

| 2023 | 155% |

| 2024 | 120.7% |

| 2025 (As of December 26) | -5% |

When inspecting Trump’s first duration of time as president, an analyst critical that it became as soon as “the ideal crypto bull mosey” in historical previous, all the blueprint by which the total cryptocurrency market capitalization increased by roughly 115 times from the starting put of his duration of time to its quit.

“Biden’s duration of time returned 4.5x from starting up to quit, and even on the worst moment, it by no blueprint went below the annual birth for his duration of time. Trump’s 2nd duration of time up to now is below annual birth, nonetheless 3 extra years to trip,” the pseudonymous analyst wrote.

Bitcoin Underneath Trump

So what in actuality came about this year? The pullback isn’t any longer something that might well per chance even furthermore be understood by having a survey at headline 2025 returns alone.

In January, momentum became as soon as broadly on Bitcoin’s facet. Forward of Trump’s inauguration, BTC rallied above $109,000, marking a new all-time excessive on the time. There had been also trends on the regulatory facet, with the SEC creating a role force to present a transparent regulatory framework for digital property.

On the opposite hand, Trump’s subsequent moves erased all these features. After he announced tariffs on the EU and later expanded on them at Liberation Day, cryptocurrency markets declined alongside equities.

Severely, the announcement of a end led to a modest recovery. This highlighted the market’s sensitivity to broader macroeconomic trends and pointed to increased volatility.

CRYPTO MARKETS SOAR ON 90-DAY TRUMP TARIFF PAUSE pic.twitter.com/jXXiU992XF

— Reduce O’Neill (@chooserich) April 9, 2025

Within the meantime, adoption persevered to upward thrust as recount-level Bitcoin reserve initiatives and institutional involvement increased. Bitcoin’s tag persevered to pattern better, posting sure returns for four consecutive months from April by July.

A key pattern all the blueprint by this era became as soon as the emergence of digital asset treasuries (DATs). Public firms extra and extra began adopting Bitcoin as a reserve asset, following the playbook popularized by Micro (Technique).

Bitcoin benefited from this shift, as many experts argued institutional involvement might well maybe encourage cut again volatility and signal the asset’s maturation within feeble finance.

As self assurance grew, so did the risk appetite and the employ of leverage. Excessive-risk, extremely leveraged merchants drew widespread consideration. On the macroeconomic entrance, the Fed slashed rates of interest in September. This became as soon as again bullish for risk property.

Bitcoin went on to attain a new all-time excessive in October, peaking at $125,761 on October 6. Many projected extra upside, with targets ranging from $185,000 to $200,000 by year-quit.

This optimism became as soon as supported by favorable macroeconomic catalysts and Bitcoin’s historically stable efficiency all the blueprint by the fourth quarter.

BeInCrypto reported that on October 11, Trump’s announcement of 100% tariffs on China pulled the market lower. Over $19 billion in leveraged positions had been wiped out, main to significant losses for many merchants.

🚨 BIGGEST WIPEOUT SINCE LUNA, COVID & FTX.

Heading into Trump’s 100% China tariff announcement, markets bought the pullback they had been staring at for.

Almost $20 BILLION in crypto liquidations in only 24 hours, a epic wipeout. 😱

Leverage became as soon as maxed out… and it showed. pic.twitter.com/YeeTE4iPxX

— Realistic Advice (@wiseadvicesumit) October 11, 2025

The broader downturn persevered within the arriving months, amplified by leverage.

“It also looks to be to be a structural and mechanical downturn. It all began with institutional outflows in mid-to-leisurely October. Within the predominant week of November, crypto funds noticed -$1.2 billion of outflows. The topic becomes excessive levels of leverage AMID these outflows…Impolite levels of leverage absorb resulted in a apparently hypersensitive market,” The Kobeissi Letter posted in November.

Bitcoin dropped 17.67% in November and has since lost a further 1.7% of its price this month, in preserving with Coinglass recordsdata.

From Bitcoin ETFs to Altcoins: Regulatory Changes and Market Response

The Trump and Biden administrations differed on a whole lot of key problems, one in every of which became as soon as crypto ETFs. Underneath the Biden administration, the SEC on the starting put took a miles extra cautious means to the crypto sector. This stance extended to crypto ETFs.

On the alternative hand, the regulatory predicament shifted following a ruling by the US Court of Appeals for the DC Circuit, which ordered the SEC to re-evaluate Grayscale Investments’ utility to noticeably change its flagship GBTC fund trusty into a feature Bitcoin ETF.

Thus, the SEC approved feature Bitcoin ETFs in January 2024 and later greenlit feature Ethereum ETFs in July.

Severely, after Gary Gensler’s departure from the SEC, asset managers had been quickly to file a whole lot of functions for altcoin ETFs. Corporations including Bitwise, 21 Capital, and Canary Capital, among others, submitted filings to birth out a range of crypto-based mostly completely mostly funding merchandise.

In September, the SEC approved generic itemizing requirements, casting off the want for case-by-case approvals. Following this shift, ETFs linked to property equivalent to SOL, HBAR, XRP, LTC, LINK, and DOGE entered the market.

In November, Canary Capital’s XRP ETF noticed $58.6 million in trading volume on its first day, ranking because the strongest debut among extra than 900 ETFs launched in 2025. Bitwise’s Solana ETF also attracted significant interest, generating $56 million in first-day volume, whereas assorted merchandise recorded comparatively lower dispute.

From a regulatory standpoint, the ETFs absorb increased market get entry to, and the ruling diminished barriers for issuers. On the alternative hand, early efficiency recordsdata imply that the introduction of extra crypto ETFs has no longer yet translated trusty into a proportional amplify in aggregate market inflows.

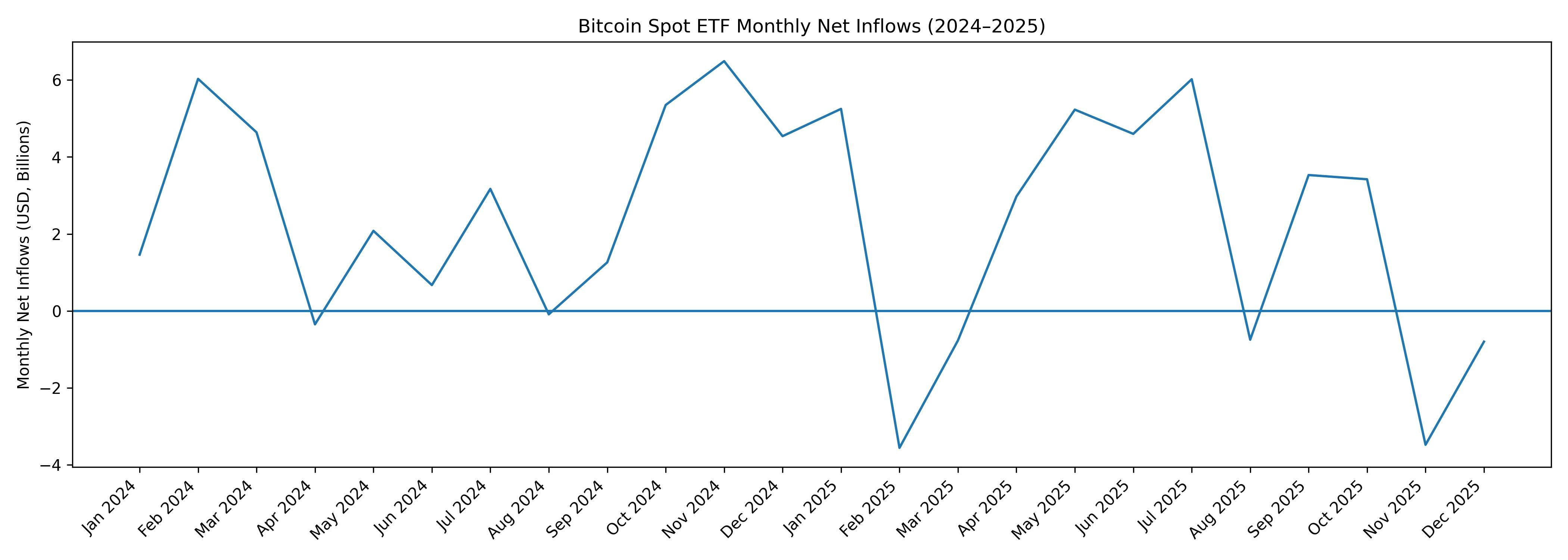

In 2024, feature Bitcoin ETFs attracted approximately $35.2 billion in obtain inflows. In 2025, inflows into Bitcoin ETFs slowed to $22.16 billion in preserving with SoSoValue recordsdata. This divergence means that the growth in ETF choices can also absorb coincided with a redistribution of capital across merchandise in predicament of a ramification of total crypto publicity.

Contained within the Trump Family’s Crypto Empire

Even supposing Donald Trump’s impact on the market is glaring, he has also change into trusty now inquisitive referring to the crypto dwelling. In January, the president supplied a meme coin, quickly adopted by a carefully similar to token launched by Melania Trump.

In March, US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., partnered with Hut 8 to birth out American Bitcoin Corp.

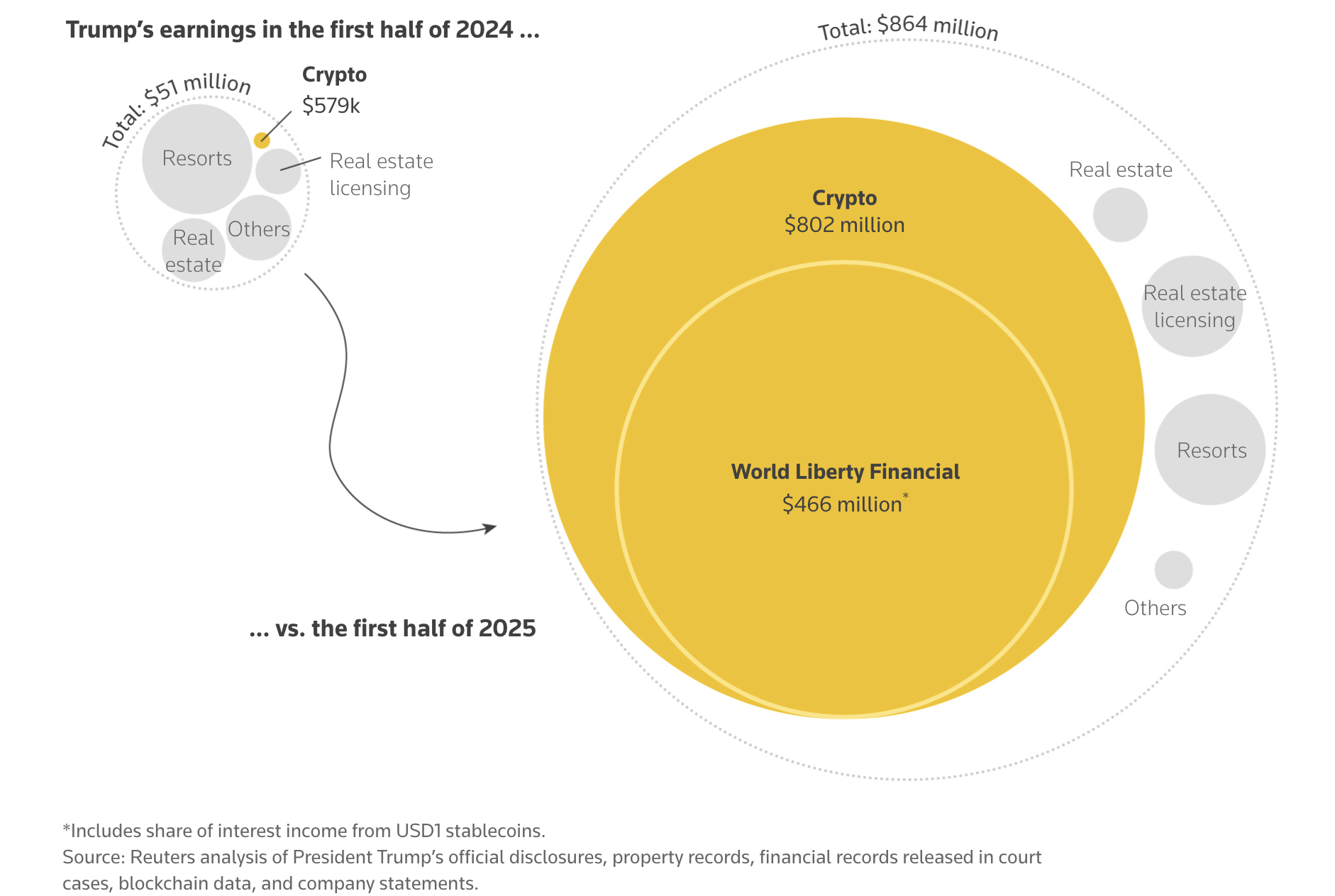

These ventures absorb generated significant wealth for the US president and his family. In accordance to a Reuters diagnosis, they earned extra than $800 million from crypto asset sales within the predominant half of 2025 alone,

One might well maybe argue that these moves helped legitimize the field and mosey up adoption. Serene, Trump’s speak and indirect involvement in crypto-related ventures raises concerns around optics, governance, and market integrity. Whereas meme coins are no longer new to the crypto dwelling, their association with a sitting US president is unheard of.

These actions absorb also drawn engaging criticism from regulators and customers alike. The Trump meme coin, WLFI, and American Bitcoin Corp absorb all suffered steep declines, main to significant losses for supporters.

$BTC is down 24% since ‘The Crypto President’ took predicament of job.

Within the meantime the Trump family reported almost $1B in crypto earnings and in mutter that they’re preserving billions of greenbacks extra of their very own tokens.

Are they in it for the valid causes? pic.twitter.com/L6HoYbmvRh

— Quinten | 048.eth (@QuintenFrancois) November 21, 2025

Conclusion

Taken collectively, the suggestions imply that the acknowledge to who helped crypto the most is dependent on how “encourage” is defined. Underneath Trump, crypto has benefited from a friendlier regulatory tone, diminished enforcement stress, and faster approval of present funding merchandise.

These changes lowered barriers for issuers and expanded market get entry to.

On the alternative hand, market efficiency tells a assorted epic. Bitcoin’s strongest features took place earlier, all the blueprint by Joe Biden’s presidency.

Within the meantime, Trump’s first year encourage moderately than job has been marked by heightened volatility.