Hedera has confronted continual bearish stress all the plan via the last two months, monitoring weakness across the broader crypto market. HBAR tag declined gradually as probability appetite feeble and capital rotated into defensive positions.

No topic new losses, market constructing suggests January would possibly per chance per chance tag a valuable shift in momentum for the altcoin.

HBAR’s Historical past Speaks For Itself

January has traditionally been one amongst the strongest months for HBAR tag performance. Over seven years of tag ancient past, the token posted an sensible January return of 38%. The median return stands at 19.7%, highlighting consistent seasonal energy slightly than remoted rallies.

Seasonality info stays linked for lengthy-term market contributors. If ancient patterns repeat, HBAR would possibly per chance per chance survey renewed query early in 2026. Such behavior would align with publish-year-cease repositioning, when merchants reassess undervalued resources following extended drawdowns.

Favor extra token insights like this? Trace in for Editor Harsh Notariya’s Day after day Crypto Publication here.

Hedera Traders Seem Bearish

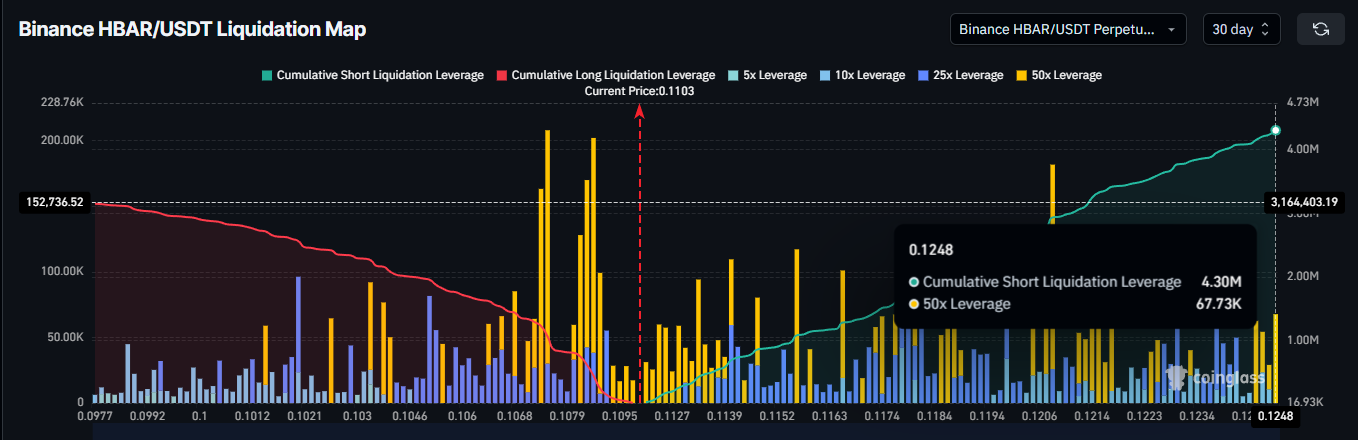

Derivatives info toughen a cautiously bearish outlook amongst active merchants. Futures positioning shows immediate exposure at approximately $4.30 million, while immediate exposure currently sits decrease, terminate to $3.16 million. This signifies an imbalance favoring design back expectations.

This positioning reflects a insecurity that design back probability would possibly per chance per chance be puny terminate to new stages. HBAR merchants most ceaselessly enhance immediate exposure once they are expecting additional decline. Whereas leverage will increase volatility, the new constructing suggests a extra pessimistic manner slightly than optimistic hedging.

Bitcoin Is Main The Technique

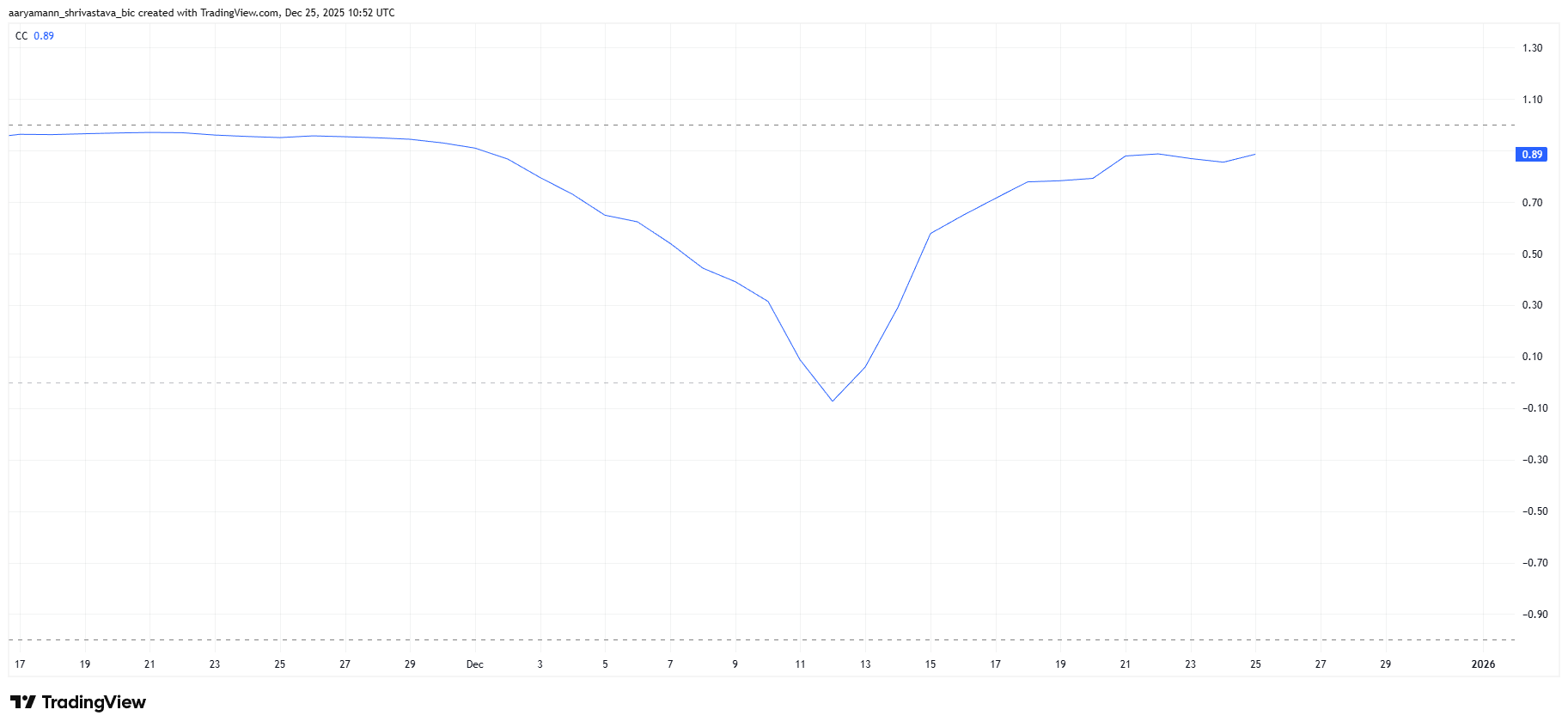

HBAR maintains a stable correlation with Bitcoin, currently measured at 0.89. This relationship has strengthened over new days, signaling that Hedera tag movements extra and extra specialise in broader market route. Such alignment reinforces Bitcoin’s role as a foremost driver of non eternal momentum.

Correlation gifts both replacement and probability. A Bitcoin restoration would possible take cling of HBAR alongside assorted big-cap altcoins. Conversely, renewed weakness in BTC would possibly per chance per chance undermine any standalone restoration strive by Hedera.

Macro stipulations, therefore, remain serious. As lengthy as Bitcoin holds key toughen stages, HBAR would possibly per chance per chance also secure pleasure from sure spillover. Any appealing BTC correction would possible weigh intently on Hedera’s tag constructing.

Can HBAR Tag Reclaim This Main Make stronger?

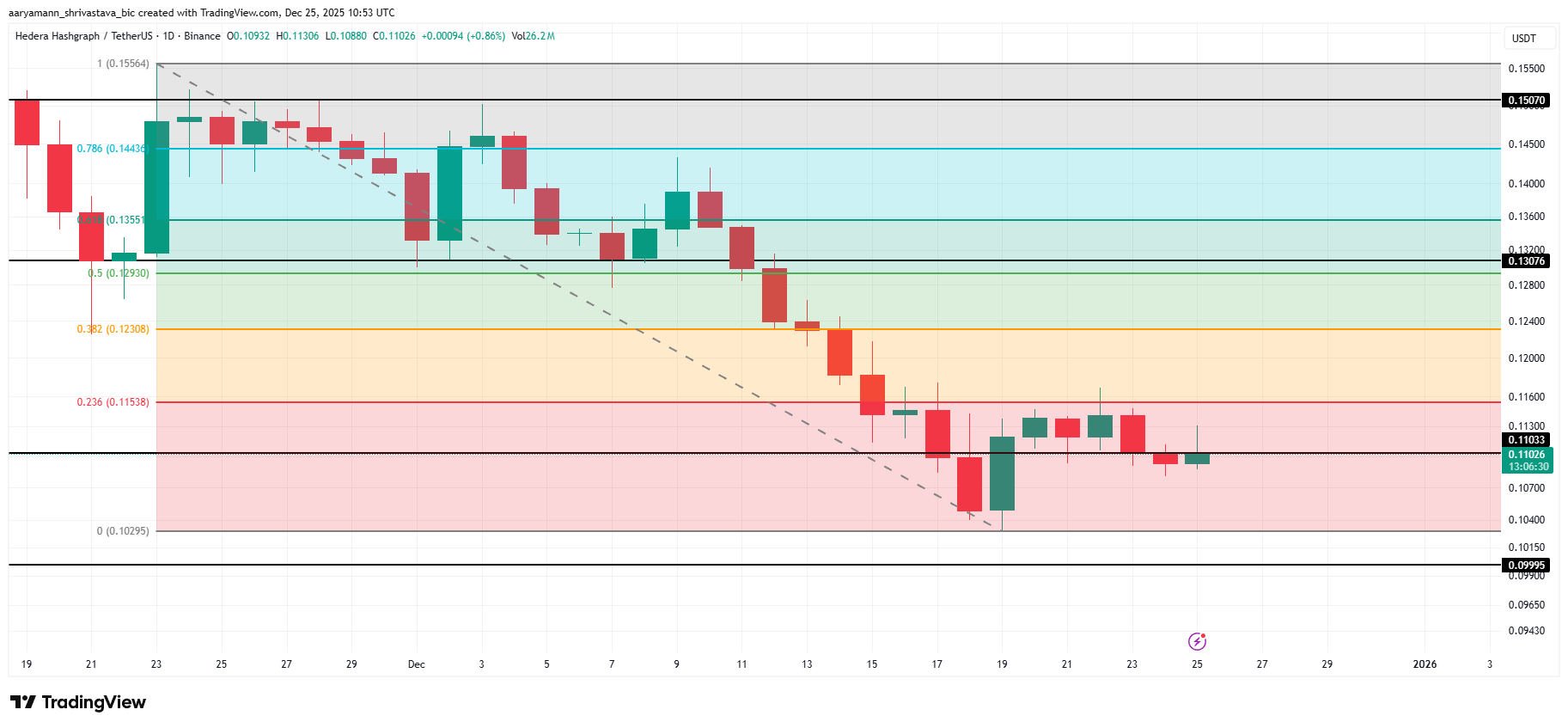

HBAR tag traded terminate to $0.110 on the time of writing. The token stays capped underneath the 23.6% Fibonacci retracement drawn from the $0.155 high to the $0.102 swing low. Recovery from this zone stays that you just are going to be in a predicament to ponder, though momentum appears slack slightly than impulsive.

A deeper pullback would possibly per chance per chance be required to rebuild energy. A skedaddle toward the $0.100 psychological level would possibly per chance per chance entice stronger query. Liquidity on the final concentrates terminate to round numbers. As lengthy because the tag stays underneath the $0.112–$0.115 differ, process reflects distribution slightly than accumulation.

If merchants gain alter, the foremost aim would possibly per chance per chance be reclaiming the 23.6% Fib level at $0.115 as toughen. Success there would possibly per chance per chance open the route toward $0.130 at some level of January. On the replacement hand, a failure to maintain bullish momentum or a downturn in Bitcoin would possibly per chance per chance push HBAR underneath $0.100. The kind of skedaddle would expose the HBAR tag to $0.099 or decrease, invalidating the bullish prediction.

The publish Hedera (HBAR) Tag Prediction: What To Query in January 2026? seemed first on BeInCrypto.