File $23B Bitcoin alternate choices expire Dec. 26, with max effort come recent ranges and liquidity skinny, surroundings the stage for spirited BTC volatility.

- A myth $23B in Bitcoin alternate choices expire Dec. 26, the largest BTC alternate choices expiry on myth.

- Calls are stacked at excessive strikes whereas puts cluster at decrease levels, with max effort come recent costs.

- Skinny holiday liquidity and intention unwinds may maybe perchance develop BTC volatility as institutional flows reset.

A myth $23 billion in Bitcoin alternate choices contracts are scheduled to expire on Friday, December 26, representing the largest BTC alternate choices expiry in history, in line with market files.

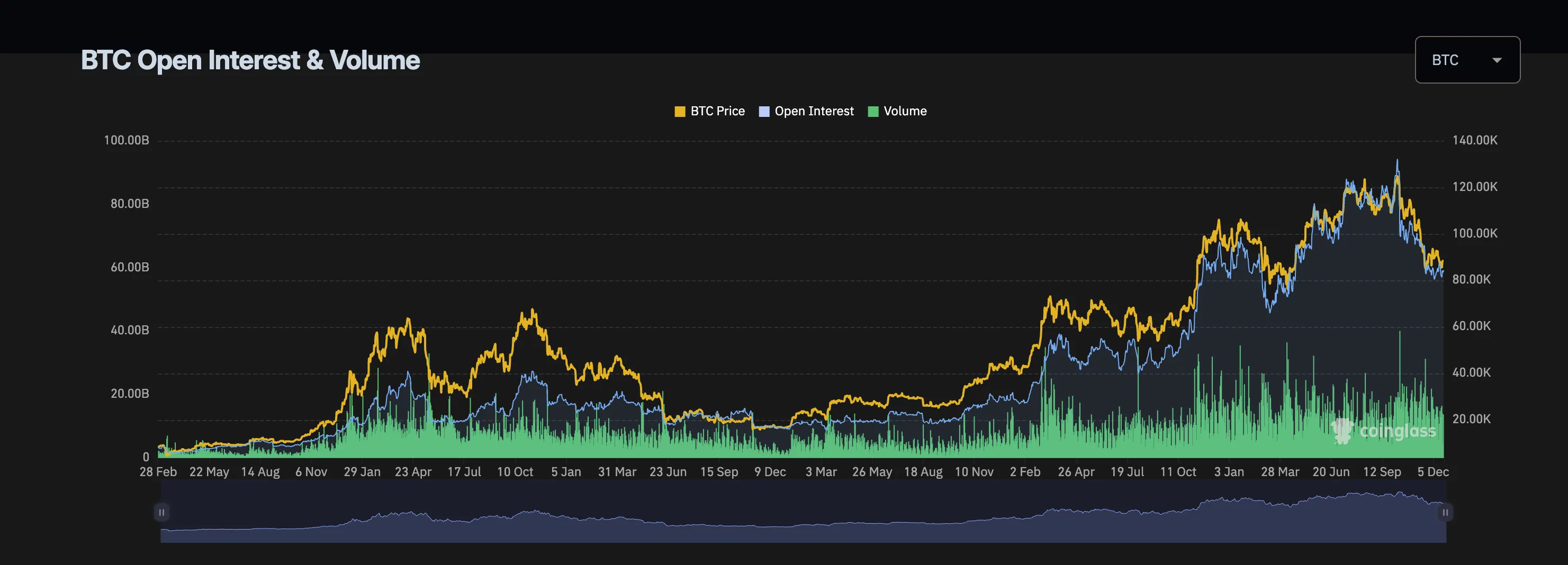

Initiate pastime files from CoinGlass shows a heavy concentration of name alternate choices at excessive strike levels, indicating traders are positioning for assign will enhance. Attach alternate choices are clustered at decrease strike costs, suggesting key enhance levels are being monitored closely.

Bitcoin alternate choices heading into Dec. 26 expiry

The Max Wretchedness Stage, defined because the cost at which possibility holders would ride the ultimate losses, sits come the excessive waste of recent procuring and selling ranges, in line with the guidelines.

The expiry total exceeds outdated years’ figures, making it one in every of an awfully indispensable Bitcoin-linked events on myth.

The set apart-to-name ratio signifies traders are in quest of upside publicity in desire to downside security, in line with market analysts.

Bitcoin became procuring and selling below recent highs at the time of newsletter. The cryptocurrency customarily experiences elevated volatility sooner than main alternate choices expiries, with spirited assign movements likely once contracts expire and originate pastime resets.

Tag fluctuations come the expiry may maybe perchance space off unstable swings as traders cease positions and unwind hedges, in line with market observers.

Explaining High-Stage Bitcoin Choices Expirations. (Dec twenty second, 2025) pic.twitter.com/gBvx1oB6D9

— Coin Manual (William Watson) (@CoinGuideWW) December 22, 2025

The expiry falls throughout a holiday week when market liquidity is customarily diminished, allowing astronomical orders to switch costs more critically than throughout identical outdated procuring and selling sessions.

The figures underscore the rising institutional presence in cryptocurrency markets, with derivatives flows an increasing selection of influencing assign movements, in line with market analysts.