Bitcoin has been below intense promoting stress in latest classes, leaving market participants more and more cautious about come-length of time direction. On Wednesday, BTC like a flash surged from the $86,000 attach in opposition to $90,000, providing non permanent merchants a 2nd of relief after weeks of plan back volatility.

That rebound, then again, proved short-lived. Mark like a flash retraced lend a hand to the $86,000 level, as soon as more stalling bullish momentum and reinforcing the perception that sellers live firmly up to the mark.

This failed recovery strive has weighed heavily on sentiment, particularly amongst non permanent holders who entered positions at increased stages right via the outdated consolidation vary. Per a file by Axel Adler, on-chain files finds that this cohort has entered a clear stress regime. Bitcoin’s designate has fallen below the everyday have designate of non permanent holders, a condition that historically will enhance the likelihood of reactive promoting habits.

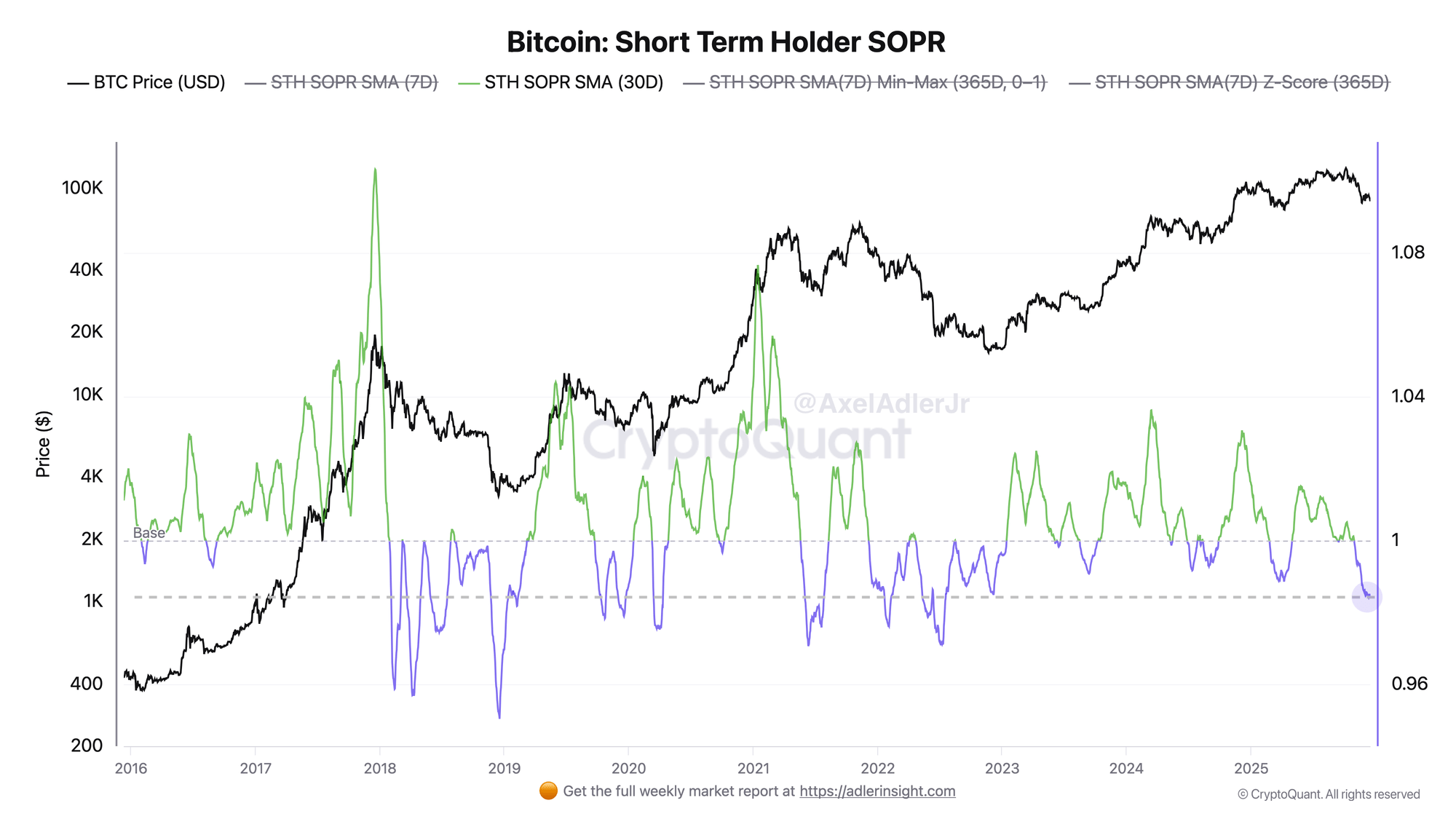

The stress is extra mirrored in the Fast-Time length Holder Spent Output Profit Ratio (STH-SOPR, 30-day), which has declined to 0.98. This reading signifies that non permanent holders are, on practical, realizing losses as soon as they promote. Such environments on the total coincide with deteriorating self belief and heightened sensitivity to extra plan back strikes.

With BTC unable to protect latest relief rallies and non permanent participants more and more underwater, the market enters a fragile phase. The coming days will seemingly be famous in figuring out whether or no longer this stress evolves into deeper capitulation or stabilizes into a uncomfortable-building process.

Fast-Time length Holders Under Stress as Loss-Taking Speeds up

Adler explains that the Fast-Time length Holder Spent Output Profit Ratio (STH-SOPR 30D) is a famous gauge of non permanent market stress, as it measures whether or no longer latest coin gross sales are going on at a profit or a loss. Values above one indicate that non permanent holders are promoting profitably, whereas readings below one signal loss realization.

Historically, sustained sessions below one replicate deteriorating self belief and develop the threat of extra plan back, as loss-taking habits can cascade into extra promote stress. A continued decline in SOPR would seemingly intensify this dynamic and start the door to contemporary native lows.

By incompatibility, a meaningful recovery would require the metric to reclaim and protect above the one level, signaling that promoting stress is being absorbed and losses are now no longer dominant.

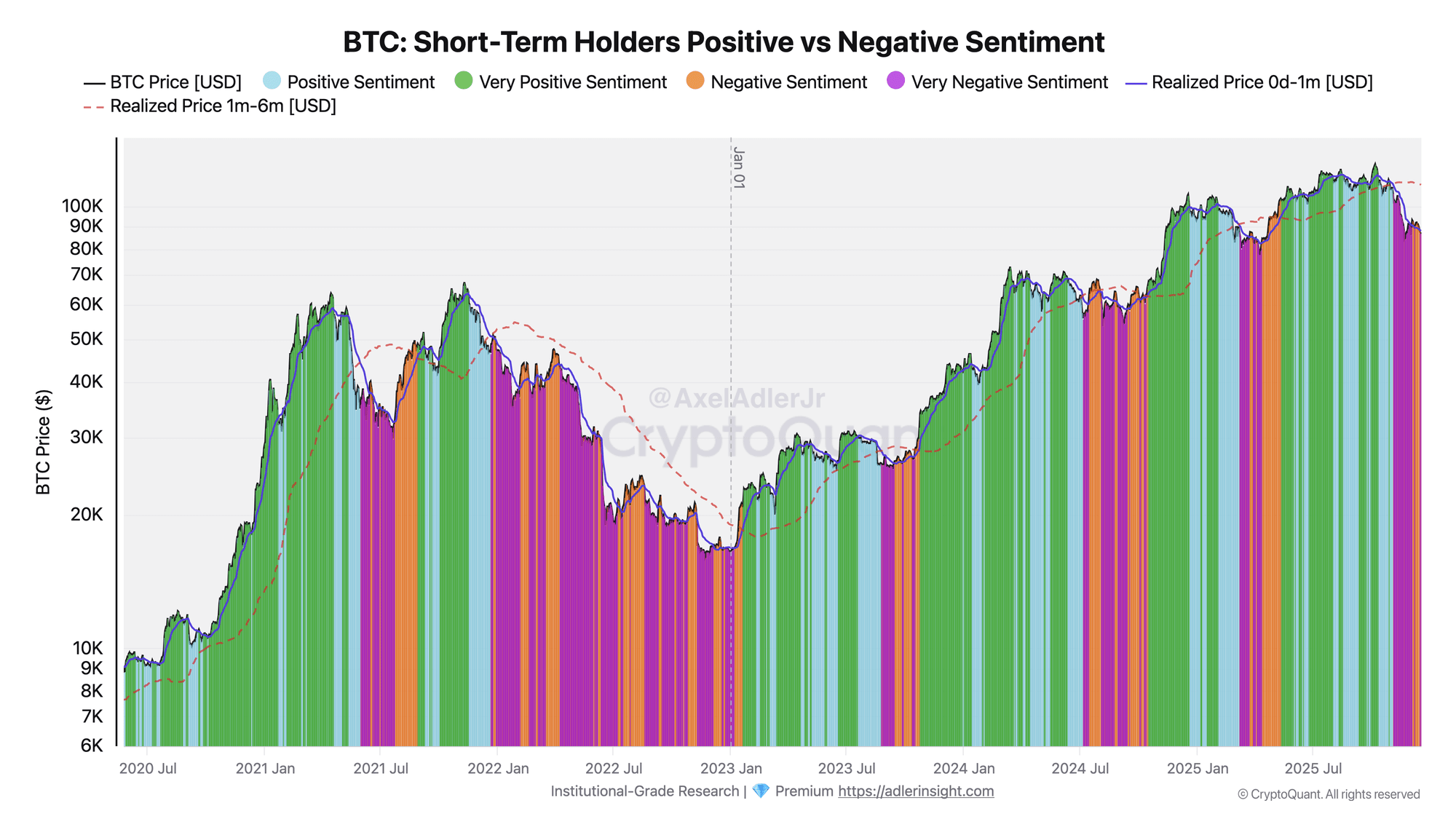

This stress is reinforced by the Fast-Time length Holders Certain vs Adversarial Sentiment chart. The indicator classifies holders in accordance as to whether or no longer they’re in profit or at a loss. Over the final five weeks, sentiment has shifted decisively in opposition to the orange and purple zones, representing detrimental positioning.

The rising dominance of underwater holders will enhance the likelihood of alarm-driven promoting. Collectively, every charts elevate a consistent message: non permanent participants are below stress, and the most contemporary atmosphere stays fragile until optimistic signs of relief emerge.

Bitcoin Tests Essential Encourage as Bears Persist

Bitcoin continues to alternate below stress, with the chart exhibiting designate consolidating spherical the $87,000 attach after a intelligent corrective pass from the October highs come $125,000. The rejection from the upper vary marked a clear shift in market structure, as BTC misplaced the 50-day and 100-day appealing averages and didn’t reclaim them on subsequent rebounds. The blue appealing practical has now grew to turn out to be downward, reinforcing the short- to medium-length of time bearish bias.

Mark is currently hovering true above the 200-day appealing practical, plotted in red, which sits come the $86,000–$88,000 zone. This level represents a famous attach of prolonged-length of time query and structural make stronger. Historically, sustained closes below the 200-day practical are at threat of coincide with deeper corrective phases or prolonged consolidation.

Volume dynamics add to the cautious outlook. Promoting stress expanded vastly right via the breakdown in October and November, whereas latest rebound attempts get dangle of happened on somewhat muted volume. This means that short-covering and tactical buying, in preference to tough enlighten query, are driving designate stabilization.

Structurally, Bitcoin is forming lower highs since the tip, preserving the broader trend weak. A recovery area would require BTC to reclaim the $95,000–$100,000 attach and protect above the declining appealing averages. Except then, the chart favors continued consolidation or extra plan back threat spherical the prolonged-length of time make stronger zone.

Featured image from ChatGPT, chart from TradingView.com