US inflation delivered its greatest arrangement back surprise in months. But in place of residing of a sustained rally, each Bitcoin and US equities sold off sharply ultimately of US buying and selling hours.

The price action puzzled many merchants, but the charts demonstrate a acquainted rationalization rooted in market structure, positioning, and liquidity in preference to macro fundamentals.

What Came about of residing After the US CPI Release

Headline CPI slowed to 2.7% twelve months over twelve months in November, neatly below the three.1% forecast. Core CPI also undershot expectations at 2.6%.

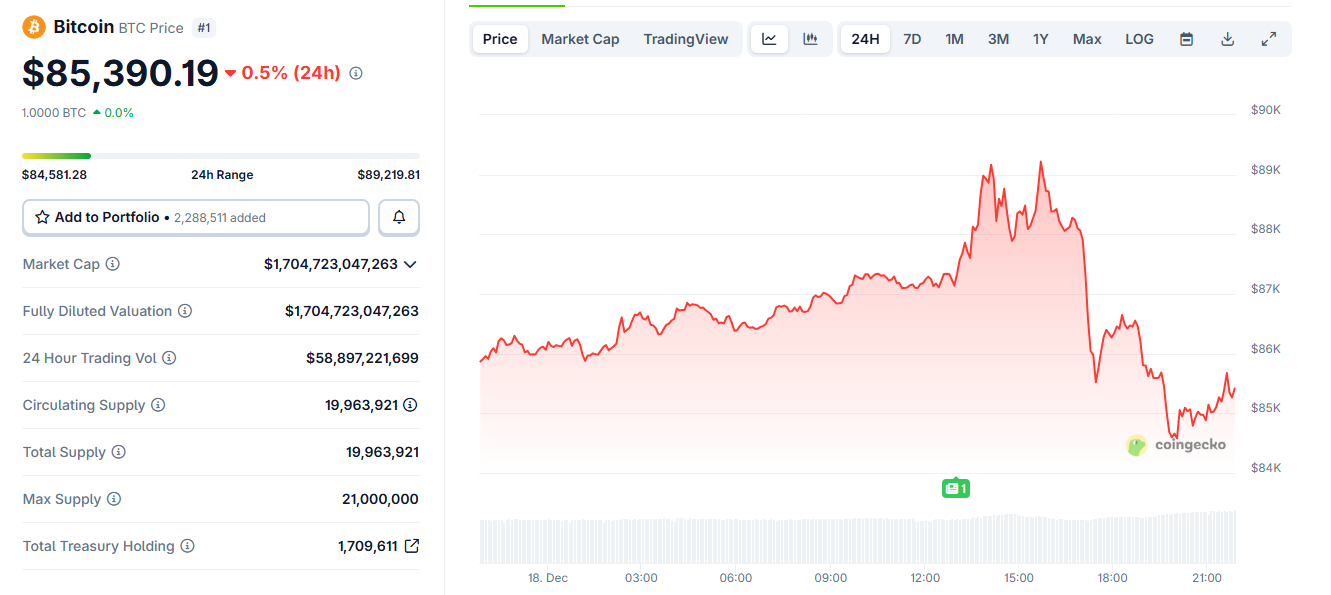

On paper, this became as soon as one among essentially the most threat-optimistic inflation prints of 2025. Markets before the whole lot reacted as expected. Bitcoin jumped toward the $89,000 residing, whereas the S&P 500 spiked better shortly after the knowledge hit.

That rally did not final.

Inner roughly 30 minutes of the CPI print, Bitcoin reversed sharply. After tagging intraday highs shut to $89,200, BTC sold off aggressively, sliding toward the $85,000 residing.

The S&P 500 followed a the same course, with enchanting intraday swings that erased much of the initial CPI-pushed positive components earlier than stabilizing.

This synchronized reversal across crypto and equities issues. It indicators that the pass became as soon as not asset-particular or sentiment-pushed. It became as soon as structural.

Bitcoin Taker Promote Volume Tells the Myth

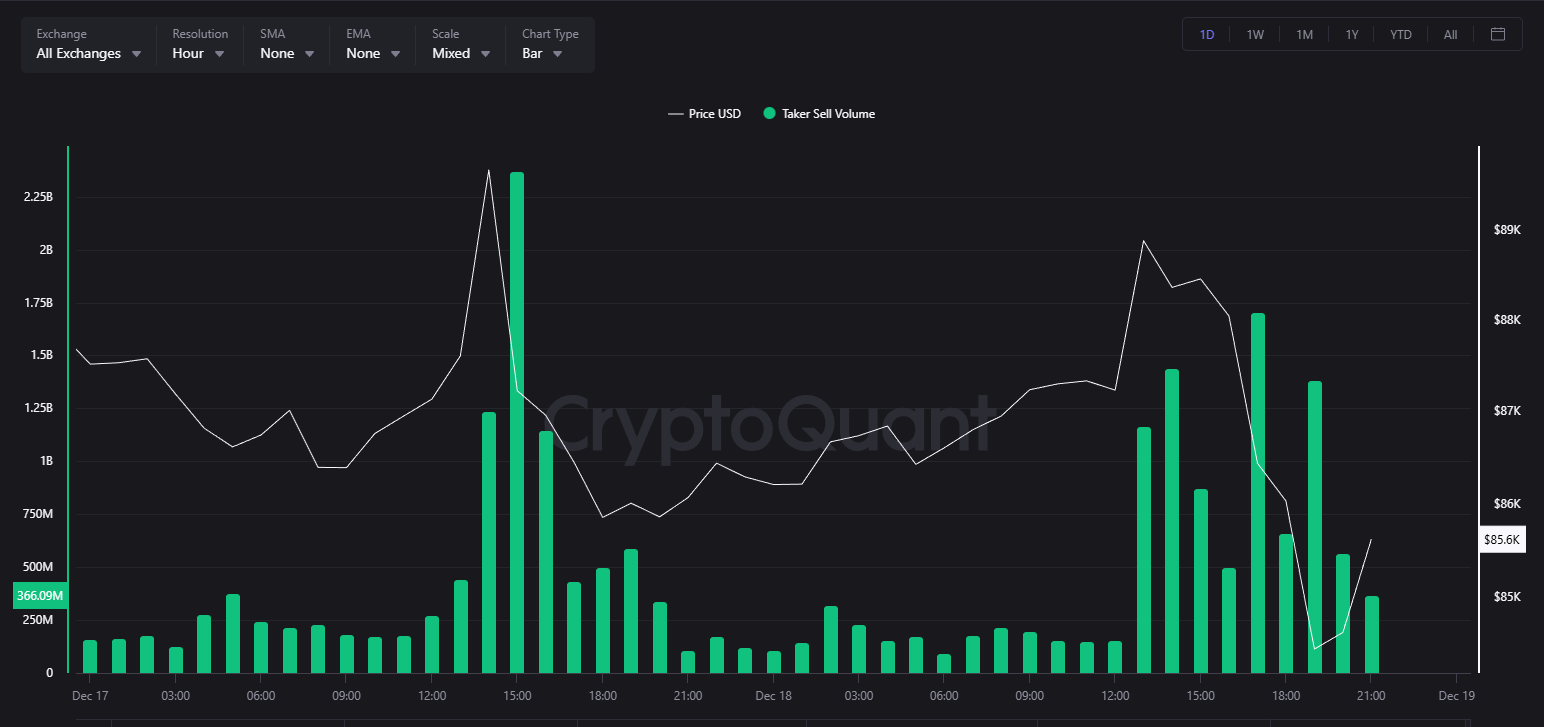

The clearest clue comes from Bitcoin’s taker sell quantity recordsdata.

On the intraday chart, mountainous spikes in taker sell quantity regarded precisely as Bitcoin broke lower. Taker sells replicate market orders hitting the repeat — aggressive promoting, not passive income-taking.

These spikes clustered ultimately of US market hours and coincided with the fastest half of the decline.

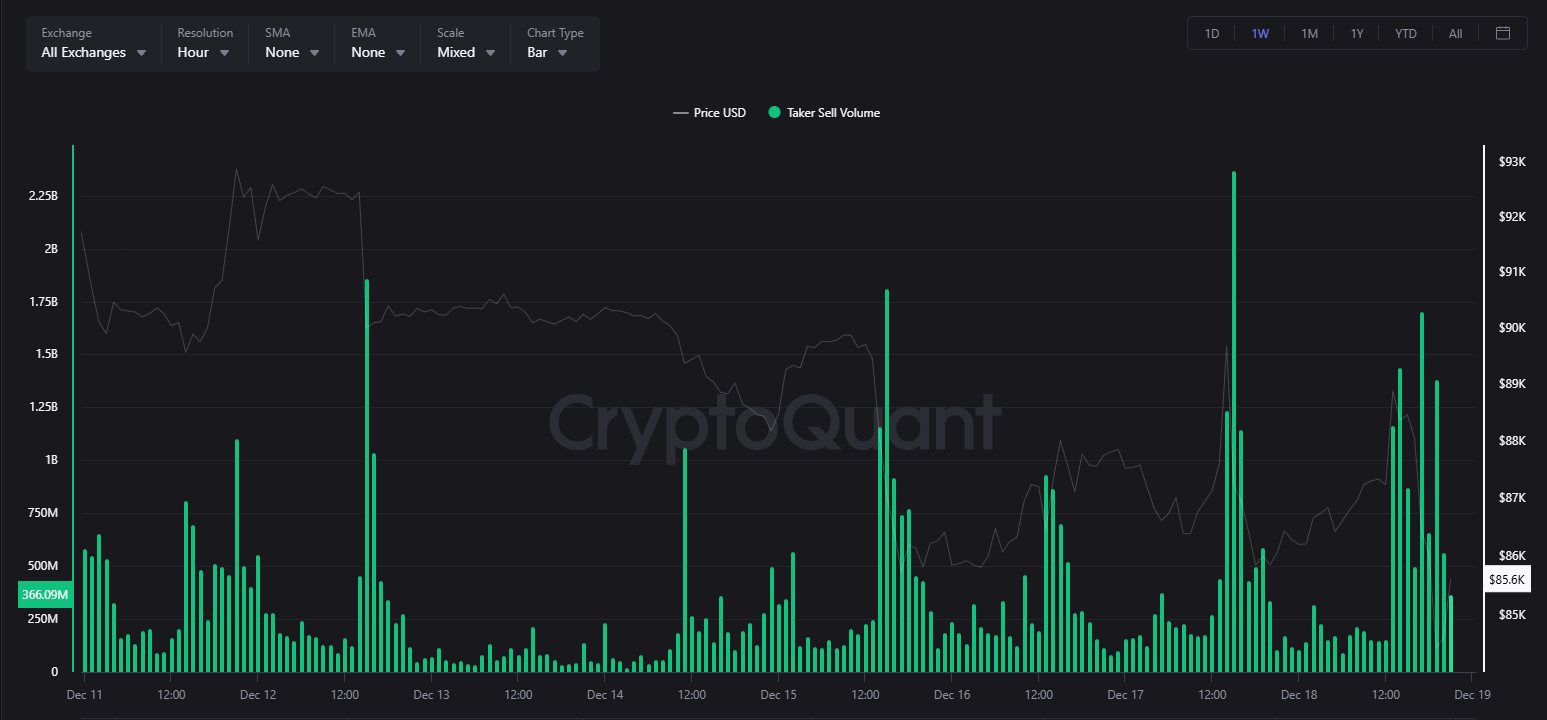

The weekly set a question to reinforces this sample. The same sell-facet bursts regarded extra than one cases over the previous week, customarily ultimately of high-liquidity windows, suggesting repeated episodes of compelled or systematic promoting in preference to isolated retail exits.

This behavior is in line with liquidation cascades, volatility-focusing on strategies, and algorithmic de-risking — all of which trail as soon as price begins transferring towards leveraged positions.

Why ‘Actual News’ Grew to turn out to be the Situation off

The CPI listing did not situation off the selloff because it became as soon as deplorable. It precipitated volatility because it became as soon as steady.

Softer inflation briefly elevated liquidity and tightened spreads. That atmosphere permits mountainous avid gamers to close measurement successfully.

Bitcoin’s initial spike likely met a dense zone of resting orders, cease losses, and short-term leverage. Once upside momentum stalled, price reversed, triggering long liquidations and cease-outs.

As liquidations hit, compelled market promoting amplified the pass. Right here’s why the decline accelerated in preference to unfolded gradually.

The S&P 500’s intraday whipsaw reveals a the same dynamic. Hastily arrangement back and restoration patterns ultimately of macro releases customarily replicate dealer hedging, alternatives gamma outcomes, and systematic flows adjusting threat in precise time.

🚨 Right here’s insane degree of manipulation.

8:30 a.m.

CPI got here in lower than expected.

– On the bullish CPI recordsdata, Bitcoin pumped $2217, from $87,260 to $89,477 in only 60 minutes.

– $70B added to the crypto market.

– $94 million price of shorts liquidated.10:00 a.m.

The… pic.twitter.com/FmJqLDKbBw

— Bull Theory (@BullTheoryio) December 18, 2025

Does This Look Enjoy Manipulation?

The charts close not enlighten manipulation. But they trace patterns customarily associated with cease-runs and liquidity extraction:

- Hastily strikes into apparent technical phases

- Reversals at as soon as after liquidity improves

- Immense bursts of aggressive promoting ultimately of breakdowns

- Tight alignment with US buying and selling hours

These behaviors are customary in highly leveraged markets. Basically the likely drivers are not folks, but mountainous funds, market makers, and systematic strategies working across futures, alternatives, and web site markets. Their impartial will not be narrative administration, but execution efficiency and threat administration.

In crypto, the place leverage stays high and liquidity thins mercurial birth air key windows, these flows can survey crude.

🚨 THEY ARE MANIPULATING BITCOIN AGAIN AND I HAVE EVIDENCE!!!

Bitcoin dumped $4000 in minutes…

and nearly nobody genuinely understands what correct occurred of residing.

It’s the identical neighborhood of avid gamers manipulating the associated price… AGAIN.

Cease making an strive at charts, YOU NEED TO CHECK THE OUTFLOWS.… pic.twitter.com/ymU4kXdWvb

— NoLimit (@NoLimitGains) December 18, 2025

What This Skill Going Forward

The selloff does not invalidate the CPI price. Inflation if reality be told cooled, and that stays supportive for threat resources over time. What the market experienced became as soon as a short-term positioning reset, not a macro reversal.

In the shut to term, merchants will hold whether Bitcoin can stabilize above most in style make stronger and whether sell-facet strain fades as liquidations optimistic.

If taker sell quantity subsides and price holds, the CPI recordsdata could per chance well per chance also smooth swear itself over the impending courses.