Bitcoin has lost more than 30% of its value since early October, triggering a exciting shift in market psychology. What turned into once viewed as a routine correction is an increasing number of being interpreted by analysts as a doable cycle top. Sentiment has deteriorated mercurial, with apprehension and apathy changing the optimism that dominated earlier within the year.

Many traders are now positioning defensively, getting ready for what they imagine would be a power endure market segment same to previous publish-top cycles.

Nevertheless, a recent CryptoQuant file challenges this an increasing number of authorized story. In response to the analysis, Bitcoin would possibly possibly additionally simply now now not be following the primitive four-year enhance-and-bust cycle that has outlined its historic notice habits.

In its build, the file introduces the Bitcoin Supercycle thesis, which argues that the basic halving-driven cycle constructing would be breaking down in pick on of a more prolonged, structurally supported bull market.

The core thought gradual the supercycle framework is that Bitcoin’s market dynamics possess fundamentally changed. Unlike old cycles driven largely by speculative retail flows, the most modern environment is fashioned by contemporary forces that didn’t exist in earlier eras.

These structural shifts would be altering how drawdowns, tops, and recoveries unfold, potentially smoothing volatility over longer time horizons.

The New Fundamentals At the serve of Bitcoin’s Supercycle Thesis

In response to the CryptoQuant file, the case for a doable Bitcoin supercycle is built on structural forces that were absent in old market cycles. Basically the most critical shift comes from institutional adoption. Topic Bitcoin ETFs, led by issuers resembling BlackRock, possess launched a power and regulated offer of quiz from primitive finance.

Unlike speculative retail flows, these autos treat Bitcoin as a strategic asset allocation, developing proper absorption in living of quick-lived hype.

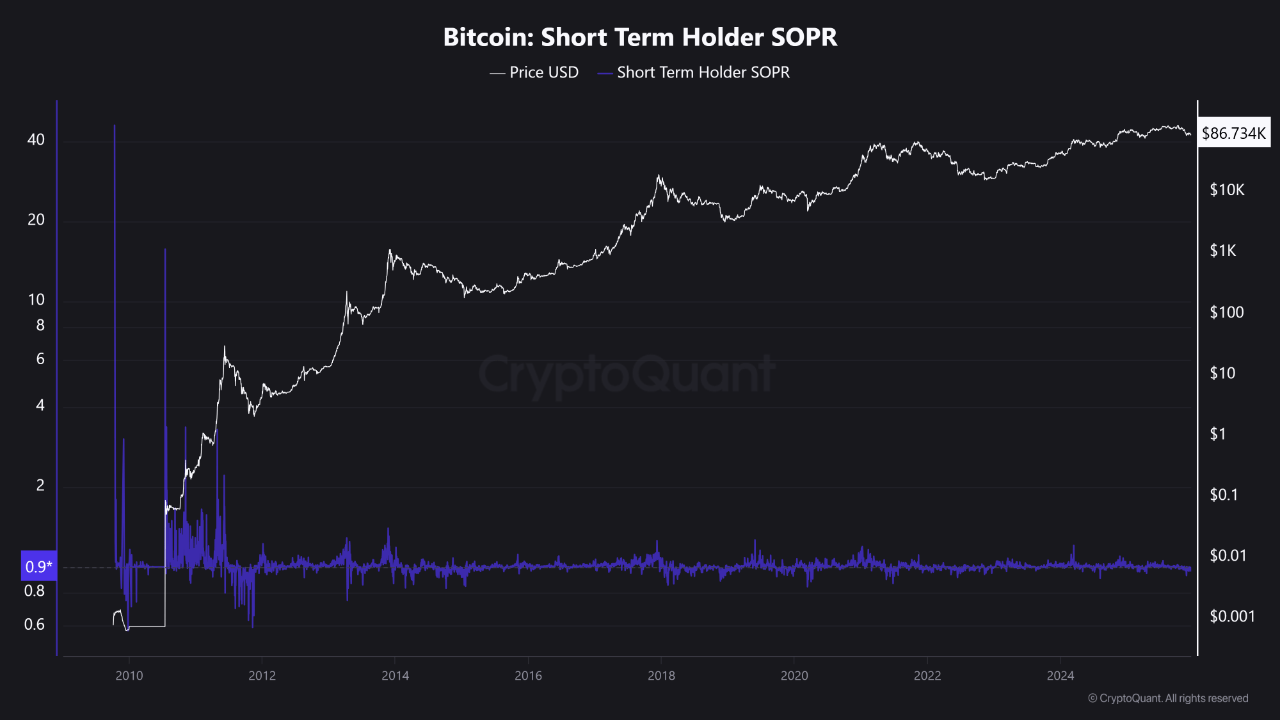

On-chain knowledge additional reinforces this story. Alternate reserves proceed to kind lower, signaling long-term accumulation and reduced promote-aspect stress. At the identical time, the Spent Output Profit Ratio (SOPR) stays relatively rational. Profit-taking is happening, but without the euphoric spikes historically connected with cycle tops, suggesting a more extinct and disciplined market constructing.

Infrastructure readiness is one other critical pillar. While Bitcoin stays the core asset, scalability enhancements across the broader crypto ecosystem—resembling Ethereum’s Fusaka make stronger and the mercurial expansion of Layer-2 networks—are enabling faster, more cost effective transactions and proper-world exercise cases. This enhances Bitcoin’s characteristic as a settlement and reserve asset internal a rising digital financial system.

Indirectly, the macro backdrop stays supportive. Geopolitical instability and the prospect of future monetary easing toughen Bitcoin’s charm as a neutral, decentralized onerous asset. Together, these forces fabricate a real foundation for an prolonged supercycle, even supposing the file cautions that exterior shocks would possibly possibly additionally light disrupt this trajectory.

Mark Action Presentations Extinct Construction Shut to Key Toughen

Bitcoin’s non permanent constructing stays fragile, as shown on the 4-hour chart. Mark continues to replace below the $90,000 psychological level, with repeated disasters to reclaim key sharp averages reinforcing the bearish bias. The 200-duration sharp realistic (red) is clearly sloping downward and performing as dynamic resistance shut to the $92,000–$93,000 zone, while the 100- and 50-duration averages (inexperienced and blue) possess compressed and rolled over, signaling fading upside momentum.

After the exciting promote-off earlier within the month, Bitcoin attempted a recovery but stalled below descending resistance. Since then, the value has fashioned a series of lower highs and lower lows, confirming a non permanent downtrend. The most contemporary consolidation spherical $86,000–$87,000 suggests indecision, but notably, bounces are becoming weaker, indicating restricted quiz on relief rallies.

From a technical perspective, the $85,000–$86,000 build represents a critical red meat up zone. A sustained shatter below this differ would seemingly open the door to a deeper correction. Conversely, bulls would desire a decisive reclaim of $90,000, followed by acceptance above the descending sharp averages, to meaningfully shift momentum. Until then, the chart favors consolidation with scheme back risk.

Featured image from ChatGPT, chart from TradingView.com