Welcome to our institutional e-newsletter, Crypto Lengthy & Brief. This week:

- Insights by Jared Lenow on the finest, the execrable and the gruesome implications of the DOJ’s elevated focal point on crypto seizures on the broader commerce

- Two observations, two predictions and reader favorite quotes from 2025 by Andy Baehr

- Top headlines institutions would possibly perhaps perhaps well also just tranquil learn by Francisco Rodrigues

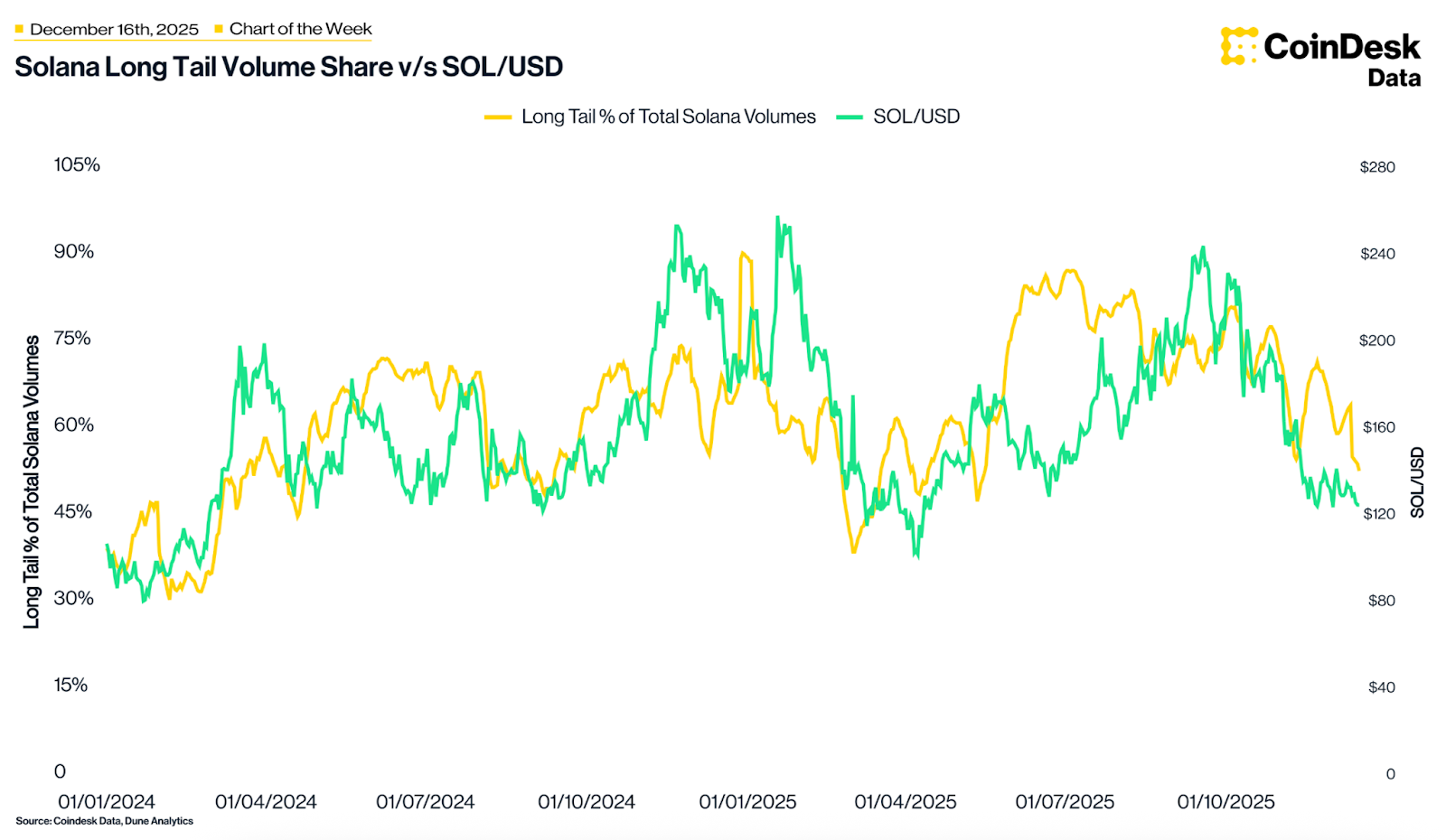

- Solana Lengthy Tail Quantity Half vs SOL/USD

– Alexandra Levis

Skilled Insights

What the DOJ’s Huge Crypto Seizures Point out for the Industry

-By Jared Lenow, accomplice, Friedman Kaplan Seiler Adelman & Robbins LLP

Over the final six months, the U.S. Division of Justice has announced a assortment of huge cryptocurrency seizures. Most notably, in October federal prosecutors seized approximately $15 billion price of bitcoin, extra than three cases the cost of the resources that the Division recovered in connection with the Bernie Madoff fraud. And the DOJ’s aggressive pursuit of crypto seizures presentations little ticket of slowing. Fair appropriate ideal month, the Division announced the advent of a “Rip-off Heart Strike Power” to target what the governmenttermed a “increasing epidemic” of cryptocurrency-related fraud schemes costing Individuals nearly $10 billion every twelve months. Already, prosecutors within the Strike Power salvage seized over $400 million in crypto.

What are the implications of this legislation enforcement pattern for the digital asset commerce? Consistent with my prior journey serving for over a decade as a federal prosecutor within the Southern District of Unique York, as effectively as my most modern role representing companies and contributors within the commerce, I question four most important takeaways.

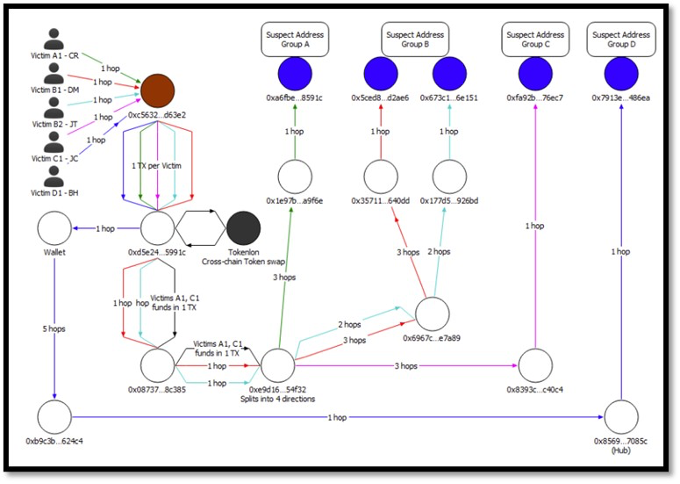

First, the DOJ’s heightened focal point on crypto seizures will increase the percentages that innocent users will question their cash wrongly caught within the dragnet. Many crypto seizures are received in conserving with inferences that govt investigators device from public blockchains and other transaction recordsdata. Here is an illustration of this kind of research excerpted from even handed one of the Strike Power’s court docket filings, showing the alleged transfer of fraud proceeds through a gigantic choice of wallets:

Nonetheless investigators are as soon as in a whereas working with incomplete data and below time stress, and it’ll lead to errors about whether notify transactions mediate cash laundering or perfectly upright exclaim. That is dejected, because whereas doable paths exist to solve an harmful crypto seizure, the restoration course of can even be expensive, time-moving and anxious.

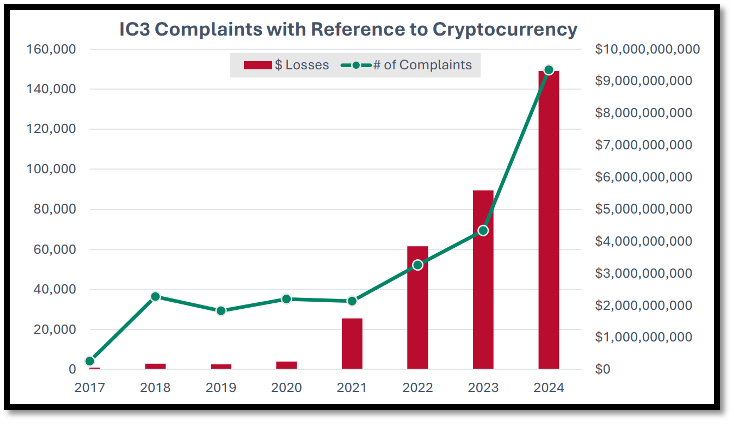

2nd, this enforcement pattern drives house the need for safeguards to protect remote from transactions with doable execrable actors. Consistent with a most modern epic from the FBI Internet Crime Complaint Heart (most regularly known as “IC3”), the selection of crypto transactions bright alleged fraud appears to be to be increasing exponentially:

Fortunately, there are a diversity of commercially on hand compliance instruments to abet minimize the threat of inadvertently receiving deplorable crypto resources, and the DOJ’s enforcement push has drastically shifted the tag-earnings analysis toward investing in such instruments.

Third, digital asset companies would possibly perhaps perhaps well also just be ready to address some of their upright risks by setting up ongoing cooperative relationships with the DOJ and other legislation enforcement agencies. Certainly, in asserting the Rip-off Heart Strike Power, the DOJ “namely called on U.S. companies to accomplice within the initiative,” declaring that the “Strike Power will collaborate with U.S. companies to carve gain admission to to the rip-off facilities, and prevent U.S. infrastructure from being weaponized in opposition to American voters.” Then as soon as more, companies must moreover be aware of their users’ privacy, and would possibly perhaps perhaps well also just consult counsel as they advise to decide what data they voluntarily part with legislation enforcement.

Fourth, the digital asset commerce would possibly perhaps perhaps well also just tranquil be encouraged by the DOJ’s articulated legislation enforcement technique of rooting out unlawful habits that victimizes handsome crypto holders and companies, whereas averting a “law by enforcement” agenda. Clearly, allegations of wrongdoing in any notify case would possibly perhaps perhaps well also just be misplaced, and judges and juries would possibly perhaps perhaps well also just within the kill reject the Division’s claims after they question the honest proof.

In sum, the DOJ’s unusual focal point on crypto seizures items every risks and opportunities. Digital asset companies and users would possibly perhaps perhaps well also just tranquil reevaluate and redouble their investments in compliance and threat-mitigation instrument, make basically the most of opportunities to gain relationships with legislation enforcement agencies the set up appropriate and be reassured that this most modern enforcement push appears to be geared toward finest alleged execrable actors somewhat than the commerce as an complete.

Headlines of the Week

– Francisco Rodrigues

This week saw most important advances in every regulatory readability and mainstream integration for the cryptocurrency sector. From the SEC’s tacit approval of tokenized securities to the OCC’s nod for 5 unusual have faith banks, the as soon as most important regulatory hurdle retains slowly vanishing.

- U.S. SEC Affords Implicit Nod for Tokenized Stocks: The SEC has issued a “no-dawdle” letter enabling the Depository Belief & Clearing Corp. (DTCC) to open tokenizing choose securities.

- HashKey Seeks $215 Million in Hong Kong IPO While Racing Against Its Cash Burn Payment: Crypto exchange HashKey is decided to tag its Hong Kong preliminary public offering (IPO) come the head of its fluctuate, driven by stronger-than-expected hobby from institutional investors. Its cash burn price, then as soon as more, stays a wretchedness.

- Five Crypto Firms Internet Initial Approvals as Belief Banks, Including Ripple, Circle, BitGo: Ripple, Circle, Constancy Digital Sources, BitGo, and Paxos moved nearer to federal charters after receiving conditional approval by the OCC. These charters permit them to present regulated custody and payments companies and practice within the footsteps of Anchorage Digital.

- Senate Punts Crypto Market Structure Invoice to Next twelve months: Bipartisan talks stalled over SEC/CFTC jurisdiction and DeFi provisions, postponing markup and increasing regulatory uncertainty despite commerce push for clearer set up market principles.

- Binance Wins Full ADGM Acclaim for Alternate, Clearing, and Brokerage Operations: Three Binance entities secured elephantine regulatory approval from the Abu Dhabi Global Market (ADGM) to feature below a complete exchange, clearing and brokerage framework.

Vibe Compare

twelve months Discontinue Vibes

-By Andy Baehr, CFA, head of product and compare, CoinDesk Indices

Two observations, two predictions and reader favorite quotes from 2025

Instruct 1: The crypto market’s attention span is 3 months

Crypto market performance appears to be to salvage a quarterly cadence. 2024: sturdy Q1, sideways Spring/Summer, sturdy Q4 (bookended by Sept 18 and Dec 18 Fed conferences). 2025 was as soon as a similar, but shuffled: frail Q1, grand rally in Q2 and Q3, heartbreak drawdown in Q4. Three months for a surge (or sag) to bound its course feels aligned with our Pattern Indicators’ performance over the final two years, curbing volatility and helping to navigate the seasons.

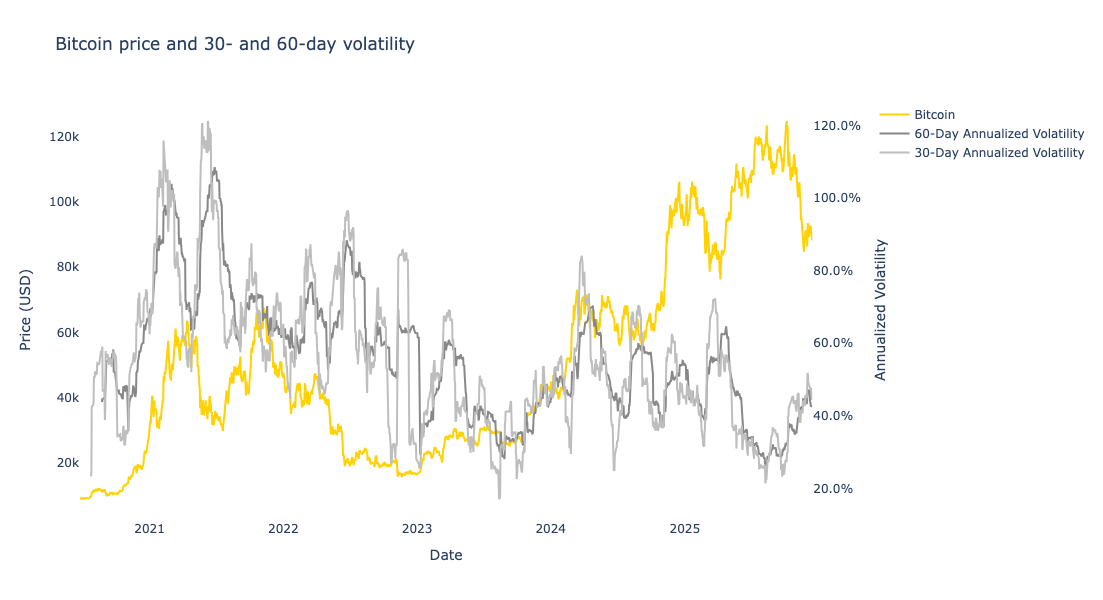

Instruct 2: Bitcoin’s return properties have gotten extra equity-admire

In 2025, the connection between bitcoin’s tag and its volatility persevered to extra carefully resemble equities. Volatility and price moved inversely, and vol remained very low for the length of bitcoin’s two ATH events within the Summer. Extra pronounced “assign skew” in alternate choices costs means that ETF and DAT choice habits is having a nearer have an effect on. The generation of bitcoin’s tag-up + vol-up “meltups” would possibly perhaps perhaps well also just be over.

Bitcoin tag (gold) and volatility (grey) – veteran to race together, now race reverse

Source: CoinDesk Indices

Prediction 1: Bitcoin will stay important, but increasingly a long way-off from other digital resources.

“There is bitcoin, and there is all the pieces else,” is a speaking point I heard an increasing number of in 2025. Bitcoin’s advantages — epic head originate, horny epic (scarce, moveable, treasured), liquid US markets — will take care of it entrance and center. Nonetheless the “slack cash” constructing blockchain infrastructure is taking place in numerous locations: stablecoins, tokenization and DeFi. As we saw for the length of 2025, M&A persevered (Coinbase/Echo, Ripple/Hidden Street), law superior (SEC generic checklist requirements), and integration accelerated (JPMorgan accepting BTC/ETH as collateral). Narratives will diverge, and broader indices admire CoinDesk 20 will emerge because the related asset class reference. We can question if lower correlations practice.

Prediction 2: Patrons will request clearer connection between blockchain boost and token cost.

Traders bought extra to play with in 2025, with a bounty of most modern ETFs and DATs listed in U.S. markets. The prospect of gigantic-scale and controlled prediction markets and tokenized equities will gain markets even richer. Then as soon as more, as investors and advisors discover about to gain extra serious prolonged-term allocations to digital resources, they’ll request a extra cogent funding framework. Why would possibly perhaps perhaps well also just tranquil ETH race up superb because there are extra stablecoins and tokenized resources? Etc. (The one exception is, actually, bitcoin, whose funding thesis is decided: a scarce asset with store-of-cost properties.)

For 2025’s ideal Vibe Compare, listed below are a dozen quotes that other folks told me they enjoyed:

1. “Out with the veteran mettlesome, in with the mettlesome veteran. Mass adoption, retirement fund fashion.” (January 5)

On reversing a bishop’s Unique twelve months’s message: retirement funds because the next frontier for crypto adoption. “Imagine if some of those newly-minted 65-twelve months-olds had been ready to stow some bitcoin (or some CoinDesk 20) in their thought for 10 years. It will maybe well perhaps well finest be existence-altering in an finest formulation.”

2. “Bitcoin, tranquil in its formative years… there are things I kind now now not rely on or enlist my teenage kids to kind.” (April 13)

On why bitcoin must now not be expected to feature as a mature safe-haven asset for the length of outrageous volatility.

3. “You would possibly perhaps perhaps well now now not superb express, ‘Approach.’ It is advisable to claim, ‘Approach; you know, it veteran to be Microstrategy.’ Love Prince, Puff Daddy, Kanye West and Twitter.” (Might just 4)

On the title exchange confusion and having to suppress the question-roll reflexes that MSTR triggers.

4. “Wall Street is a big ‘selling machine.’ When you gain that, all the pieces falls into space.” (Might just 18, Consensus)

Anthony Scaramucci’s key quote from the panel dialogue on whether crypto had reached “asset class” set up.

5. “Saylor’s formulation appears to be to be: 1/CFA.” (June 1)

On Michael Saylor reprogramming followers remote from diversification and volatility administration — the inverse of CFA principles.

6. “This wasn’t the smartly-liked opening bell tea ceremony.” (June 8, Circle IPO)

Describing the NYSE ground event for Circle’s checklist: “It didn’t salvage the vibe of MSTR rapture or youthful DeFi exuberance. It felt mature and monetary — adults celebrating.”

7. “Fair appropriate bananas or execrable bananas?” (July 13)

On a quant analyst requesting clarification: “You can as soon as in a whereas express something is ‘bananas.’ Generally it’s very superb, as soon as in a whereas very execrable. I kind now now not continually know which formulation to elaborate the match.” From that day ahead, the physique of workers made definite to give an explanation for.

8. “One other prolonged sideways Summer of uneven bitcoin and dishevelled alts?” (July 13)

Describing the pre-breakout doldrums sooner than the July rally.

9. “Five days, 5 European cities. Planes, trains, automobiles and one funicular. Suits, ties and finest shoes veteran with out irony or costumery. Demitasse after demitasse of sturdy coffee with a chocolate positioned beside.” (October 5, “The hills are alive”)

Opening description of a 20-meeting, 100 investor European roadshow that was as soon as fortunately postponed six months when my appendix let race hours sooner than the flight over.

10. “My YouTube feed showed Moses the Jeweler taking an iced-out AP to the melter, harvesting the gold. If that is now now not a high, what is?” (October 26)

After gold fell 5.7% from its high, the most important one-day fall in over 10 years.

11. “There is a pair of irony that the U.S. govt did extra to depress crypto costs by being shut than by being open” (November 16)

Reflecting on the governmentshutdown’s market impact.

12. “Market volatility, whereas anxiogenic, can moreover be exhilarating.” (November 23)

On a conversation with Hyperion Decimus’s Chris Sullivan about derivatives buying and selling psychology for the length of bitcoin’s 1/3 drawdown in seven weeks.

Chart of the Week

Solana Lengthy Tail Quantity Half vs. SOL/USD

The a part of Lengthy Tail token volumes on Solana has dropped to 55%, reaching its lowest point since the second quarter of 2025. Traditionally, the cost of SOL has generally mirrored the dawdle of this Lengthy Tail quantity market part, which acts as a proxy for speculative or ‘playing’ hobby on the chain. As a consequence, with out a brand unusual, decided catalyst to power a pickup within the Lengthy Tail quantity part from these lowered ranges, the momentum required to push the SOL tag drastically higher appears to be.

Listen. Read. Watch. Engage.

- Listen: “One day of the CFTC’s Digital Asset Pilot Program,” with acting CFTC Chairman Caroline D. Pham and CoinDesk’s Jennifer Sanasie.

- Read: Alternate Review, November 2025. Mixed set up and derivatives volumes experienced their largest month-on-month decline since April 2024

- Watch: Andrew Baehr, CFA joins NYSE to discuss relating to the subject matters dominating the digital asset headlines and Twenty One Capital’s NYSE checklist.

- Engage: Is Consensus Miami in your calendar? Watch the speaker lineup and register on the present time sooner than costs lengthen.