By Omkar Godbole (All times ET unless indicated in every other case)

Bitcoin BTC$87,102.65 has churned between $86,000 and $88,000 over the last 24 hours, with Tuesday’s U.S. jobs files failing to inject vital volatility. The ticket sits shut to a predominant technical level which, if damaged, might maybe well carry more concern.

The quantity of BTC/USD longs (bullish bets) on Bitfinex continues to climb, reaching 72,184 at press time, the most realistic since February 2024. It’ll simply sound counterintuitive, nonetheless rising longs fetch historically became out to be contrarian indicators, accompanying extended downtrends.

Including to the gloom, the 11 U.S.-listed map bitcoin ETFs bled $227 million on Tuesday following Monday’s $357.69 million outflow. So, in two days, the ETFs fetch lost over $584 million. That’s more than double last week’s salvage influx of $286.60 million, basically based on SoSoValue. Clearly, institutional hotfoot for food for BTC has weakened, leaving the market in a fragile advise.

The inability of a bullish response to Tuesday’s spike within the U.S. jobless rate to its most realistic level since April 2021, a make a selection that supports Fed rate-decrease bets, additionally aspects to market exhaustion.

“For crypto, the dearth of response is telling. Markets appear more centered on within liquidity and positioning than macro releases,” acknowledged Timothy Misir, head of study at BRN. “Except macro files meaningfully shifts rate expectations or liquidity prerequisites, ticket motion is seemingly to remain differ-trail and reactive in preference to directional.”

Speaking of positioning, alternate strategies market files point to expectations for a tall differ alternate between $85,000 and $100,000 within the shut to term.

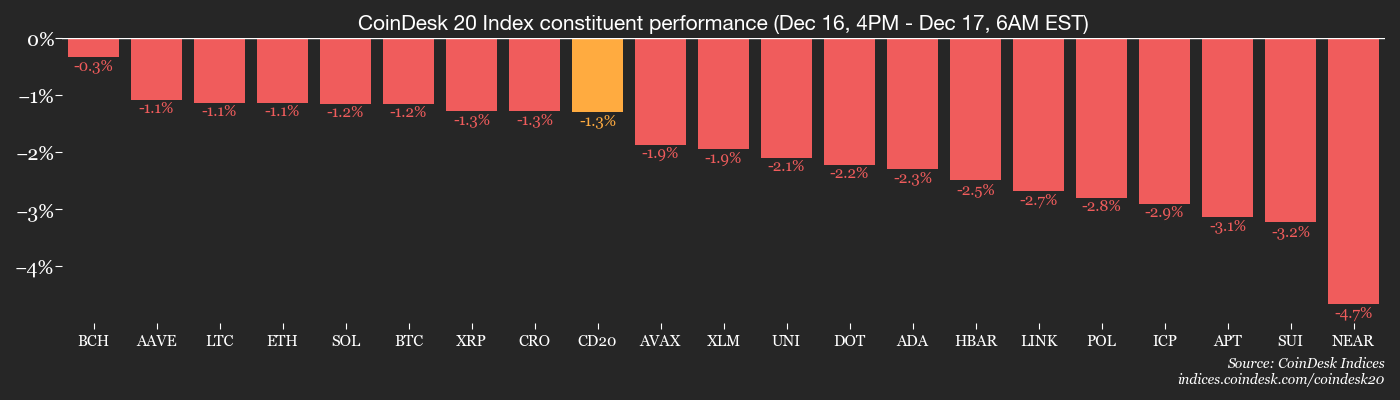

Within the broader crypto market, there are some gainers relish the Cardano-basically based NIGHT$0.06184 token, which has obtained 9% in 24 hours. SKY and XMR fetch added 4% every, while the rest of the pause 100 tokens are within the red. The CoinDesk 20 and CoinDesk 80 indices are both down over the duration.

Shares in crypto change HashKey fell 5% early Wednesday following their debut in Hong Kong.

In faded markets, the dollar index has recovered from 2.5-month lows to above 98.00, with the 10-year Treasury yield keeping precise above 4.10%. The Chinese language yuan stays whisper at two-month highs, offering policymakers room to supply stimulus to the slowing economy. Cease alert!

Be taught more: For analysis of as of late’s job in altcoins and derivatives, look for Crypto Markets This present day

What to Be taught about

For a more entire list of events this week, look for CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Dec. 17, 5 p.m.: Coinbase design update: A location of contemporary aspects for the Coinbase platform, expected to comprise tokenized shares and prediction markets livestream on X.

- Macro

- Dec. 17: Federal Reserve Governor Christopher J. Waller speech (“Financial Outlook”). Be taught about are dwelling.

- Earnings (Estimates in accordance to FactSet files)

- Nothing scheduled.

Token Events

For a more entire list of events this week, look for CoinDesk’s “Crypto Week Ahead”.

- Governance votes & calls

- SSV Community is voting to streamline committee operations (DIP-47) and cap the ETH/SSV rate ratio at 700 (DIP-49). Voting ends Dec. 17.

- Dec. 17: VeChain, Plume, and Aleo to focus on rising institutional momentum in RWAfi.

- Dec. 17: Venus Protocol, Solv Protocol, BounceBit, BNB Chain and Lista DAO to focus on BNB Chain’s Unique Chapter in 2026 and Beyond

- Unlocks

- No predominant unlocks.

- Token Launches

- Dec. 17: Binance to delist FIS$0.01869, REI$0.004046, and VOXEL$0.01409.

Conferences

For a more entire list of events this week, look for CoinDesk’s “Crypto Week Ahead”.

- Nothing scheduled.

Market Actions

- BTC is down 1.51% from 4 p.m. ET Tuesday at $86,436.95 (24hrs: +1.14%)

- ETH is down 0.89% at $2,924.forty five (24hrs: -1.17%)

- CoinDesk 20 is down 1.forty five% at 2,702.96 (24hrs: -0.88%)

- Ether CESR Composite Staking Payment is up 1 bp at 2.85%

- BTC funding rate is at 0.0098% (10.7222% annualized) on Binance

- DXY is up 0.41% at 98.55

- Gold futures are up 0.24% at $4,342.80

- Silver futures are up 4.13% at $65.94

- Nikkei 225 closed up 0.26% at 49,512.28

- Grasp Seng closed up 0.92% at 25,468.78

- FTSE is up 1.68% at 9,847.03

- Euro Stoxx 50 is up 0.2% at 5,729.49

- DJIA closed on Tuesday down 0.62% at forty eight,114.26

- S&P 500 closed down 0.24% at 6,800.26

- Nasdaq Composite closed up 0.23% at 23,111.46

- S&P/TSX Composite closed down 0.7% at 31,263.93

- S&P 40 Latin The usa closed down 2.46% at 3,100.62

- U.S. 10-Year Treasury rate is up 2.1 bps at 4.17%

- E-mini S&P 500 futures are up 0.34% at 6,879.50

- E-mini Nasdaq-100 futures are up 0.38% at 25,476.25

- E-mini Dow Jones Industrial Common Index futures are up 0.21% at forty eight,583.00

Bitcoin Stats

- BTC Dominance: 59.34% (-0.11%)

- Ether-bitcoin ratio: 0.03373 (0.03%)

- Hashrate (seven-day transferring real looking): 1,068 EH/s

- Hashprice (map): $36.97

- Complete expenses: 2.72 BTC / $236,707

- CME Futures Originate Ardour: 122,645 BTC

- BTC priced in gold: 20 oz.

- BTC vs gold market cap: 5.82%

Technical Diagnosis

- The chart reveals day to day changes within the dominance of USDT, the very most realistic stablecoin, a measure of the token’s part of the entire crypto market.

- The dominance rate has surpassed the three-year descending trendline, confirming a bullish breakout.

- It approach that tether might maybe well rob more market part in coming weeks, a scenario in general viewed all the intention in which by intention of endure markets.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $252.61 (+0.87%), unchanged in pre-market

- Circle (CRCL): closed at $83 (+9.Ninety nine%), -0.12% at $82.90

- Galaxy Digital (GLXY): closed at $24.31 (-0.94%)

- Bullish (BLSH): closed at $42.96 (+1.25%), -0.33% at $42.82

- MARA Holdings (MARA): closed at $10.69 (-0.09%), -0.47% at $10.64

- Rebel Platforms (RIOT): closed at $13.47 (-1.75%), -0.3% at $13.43

- Core Scientific (CORZ): closed at $14.73 (-3.6%)

- CleanSpark (CLSK): closed at $11.86 (-0.46%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $38.36 (+1.13%)

- Exodus Motion (EXOD): closed at $14.43 (+6.42%)

Crypto Treasury Companies

- Technique (MSTR): closed at $167.50 (+3.34%), -0.87% at $166.05

- Semler Scientific (SMLR): closed at $17.40 (+8.55%)

- SharpLink Gaming (SBET): closed at $9.71 (+2.1%), -0.21% at $9.69

- Upexi (UPXI): closed at $2.05 (+0.49%)

- Lite Technique (LITS): closed at $1.52 (-0.65%)

ETF Flows

Save BTC ETFs

- Each day salvage flows: -$277.2 million

- Cumulative salvage flows: $57.25 billion

- Complete BTC holdings ~1.31 million

Save ETH ETFs

- Each day salvage flows: -$224.2 million

- Cumulative salvage flows: $12.66 billion

- Complete ETH holdings ~6.23 million

Offer: Farside Customers

While You Had been Sleeping

- Why Customers Are Timid About Japan’s Bond Market (Bloomberg): Customers are uneasy as Japan’s central monetary institution buys fewer bonds proper as authorities borrowing rises, leaving mature ask to absorb contemporary debt and pushing prolonged-term yields to multiyear highs.

- Bitcoin trades shut to key ticket security salvage that Technique already breached (CoinDesk): The cryptocurrency is hovering shut to its 100-week transferring real looking after keeping it for 3 weeks, while shares of its biggest company holder fetch already fallen under the same prolonged-term make stronger.

- Grayscale outlines top crypto investing subject issues for 2026 as institutional adoption grows (CoinDesk): The asset-administration firm says regulatory readability is utilizing institutional funding, and fiat forex debasement is rising hobby in different stores of ticket, similar to BTC and ETH.

- Oil jumps over 1% as Trump orders blockade of sanctioned oil tankers leaving, coming into Venezuela (Reuters): Markets reacted to a Fact Social put up from Trump by pricing in attainable disruptions to Venezuelan low flows, halting a most contemporary downturn driven by easing war risks and continual ask concerns.