MicroStrategy’s most up-to-date Bitcoin aquire has instant plot under scrutiny. Correct in the future after the firm disclosed a foremost non-public, Bitcoin fell sharply.

On December 14, MicroStrategy announced it had obtained 10,645 BTC for roughly $980.3 million, paying a mean brand of $92,098 per coin. At the time, Bitcoin changed into trading come native highs.

A Poorly Timed Aquire, At Least in the Short Term

The timing changed into wretched. Simplest a day after Approach’s reported non-public, Bitcoin had dropped toward the $85,000 fluctuate, temporarily trading even lower. At the time of writing BTC stays under $80,000.

Approach has obtained 10,645 BTC for ~$980.3 million at ~$92,098 per bitcoin and has completed BTC Yield of 24.9% YTD 2025. As of 12/14/2025, we hodl 671,268 $BTC obtained for ~$50.33 billion at ~$74,972 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/VdAz7pqce1

— Michael Saylor (@saylor) December 15, 2025

Bitcoin’s decline came amid a broader macro-driven sell-off, fueled by Bank of Japan rate-hike fears, leverage liquidations, and market-maker de-risking. MicroStrategy’s non-public landed ethical sooner than that cascade.

Bitcoin’s Label Fall Was once Driven by Liquidations — Not Space Promoting

“On this context, the most up-to-date hump desires to be seen less as a give map in traditional demand and extra as a structural deleveraging match.” – By @xwinfinance pic.twitter.com/i1DSrt2Ttw

— CryptoQuant.com (@cryptoquant_com) December 16, 2025

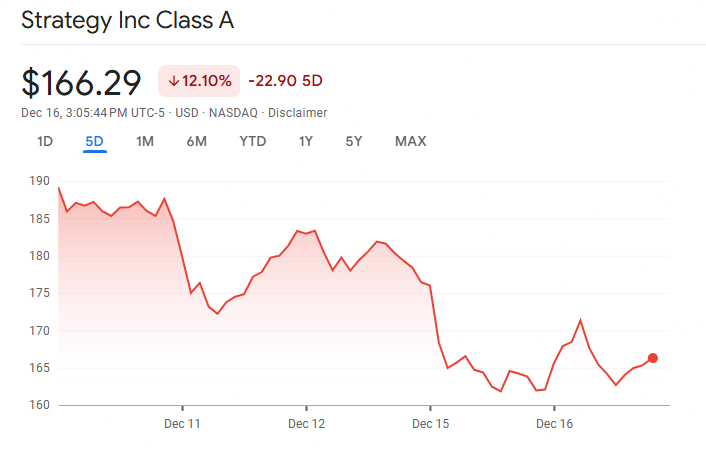

As Bitcoin slid, MicroStrategy shares fell sharply. Over the past five trading days, the stock dropped extra than 25%, enormously underperforming Bitcoin itself.

Whereas shares noticed a modest rebound this day, they live far under ranges seen sooner than the non-public announcement.

The Numbers Gradual the Ache

As of now, MicroStrategy holds 671,268 BTC, obtained for roughly $50.33 billion at a mean brand of $74,972 per coin.

On a prolonged-length of time basis, the firm stays deeply in income.

Nonetheless, short-length of time optics subject. With Bitcoin come $85,000, the most up-to-date tranche is already underwater on paper.

MicroStrategy’s mNAV in the intervening time sits spherical 1.11, which manner the stock trades handiest about 11% above the worth of its Bitcoin holdings. That top class has compressed instant as Bitcoin fell and equity merchants reassessed threat.

Why the Market Reacted So Harshly

Investors are no longer questioning MicroStrategy’s Bitcoin thesis. They are questioning timing and threat management.

The macro dangers that led to Bitcoin’s drop had been nicely telegraphed. Markets had been warning about the Bank of Japan’s doable rate hike and the threat to the yen raise alternate for weeks.

Bitcoin has historically supplied off aggressively spherical BOJ tightening cycles. This time changed into no varied.

Critics argue MicroStrategy did now not are expecting macro readability. The firm seemed to aquire aggressively come resistance, ethical as global liquidity prerequisites tightened.

🚨 JAPAN WILL CRASH BITCOIN IN 5 DAYS!!!

Folks are seriously underestimating what Japan is about to pause to Bitcoin.

The Bank of Japan is expected to lift charges but again on Dec 19.

That obtained’t sound treasure a immense deal… till you bear in mind one thing:

Japan is the greatest holder… pic.twitter.com/0a9Aimfn88

— NoLimit (@NoLimitGains) December 14, 2025

Was once It No doubt a Mistake?

That is relying on the timeframe.

From a trading level of view, the non-public seems to be poorly timed. Bitcoin fell straight away, and the stock suffered amplified losses due to the leverage, sentiment, and shrinking NAV top class.

From one map level of view, MicroStrategy has by no manner aimed to time bottoms. The firm continues to physique its purchases spherical prolonged-length of time accumulation, no longer short-length of time brand optimization.

CEO Michael Saylor has progressively argued that proudly owning extra Bitcoin issues extra than entry precision.

The particular threat is now not any longer the non-public itself. It’s what occurs subsequent.

If Bitcoin stabilizes and macro stress eases, MicroStrategy’s most up-to-date aquire will depart into its prolonged-length of time brand basis. If Bitcoin drops extra, on the opposite hand, the decision will live a focal level for critics.

MicroStrategy might well maybe also no longer have made the worst Bitcoin non-public of 2025. Nonetheless it’s miles going to also have made the most unhappy one.

The submit Did MicroStrategy Construct Its Worst Bitcoin Aquire of 2025? appeared first on BeInCrypto.