Dogecoin faces resistance below key Fibonacci ranges as it approaches most fundamental benefit. Will DOGE get dangle of benefit?

Dogecoin (DOGE) has skilled a modest 1.8% develop within the closing 24 hours, for the time being procuring and selling for $0.1406. The charge has fluctuated between $0.1366 and $0.1423 right thru this length, reflecting some level of volatility.

Over the past week, Dogecoin has seen a 3.9% decline, whereas the 14-day efficiency reveals an even bigger drop of 6.8%. The 30-day and one-year performances level to extra fundamental losses, with declines of 18.1% and 66.4%, respectively, highlighting long-time length ongoing struggles.

Despite most contemporary immediate-time length positive components, Dogecoin faces challenges in sustaining momentum, significantly given the broader downtrend over the past month and year. The present funds, at the side of the blended efficiency, suggests that Dogecoin is caught in an even bigger bearish model. Can bulls get dangle of benefit and defy the bears?

Dogecoin Charge Prognosis

Searching at the technical charts, DOGE has faced stiff resistance below the 0.236 Fibonacci level at $0.15030. The charge is for the time being hovering appropriate above the 0 level, with the next doable benefit around $0.13000. Dogecoin has previously seen a jump after touching this benefit, as an example essentially the most contemporary pump to $0.154 on December 3.

If Dogecoin fails to protect above this benefit, it would possibly well well well face further declines, with the 0.382 Fibonacci level at $0.16162 acting as the next resistance level for any doable jump.

In the period in-between, the Chande Momentum Oscillator (ChandeMO) reading of -36.21 suggests that Dogecoin is seeing a decline in momentum, signaling a probably for instant-time length reversal or consolidation. This adversarial momentum would possibly well well continue if the charge fails to spoil above the 0.236 level and rep momentum.

On the opposite hand, if Dogecoin manages to protect above the $0.13200 benefit level and recapture the 0.236 level, it would also honest try to retest increased Fibonacci ranges, with the 0.618 level at $0.17992 being a really most fundamental resistance to gaze for any upward transfer.

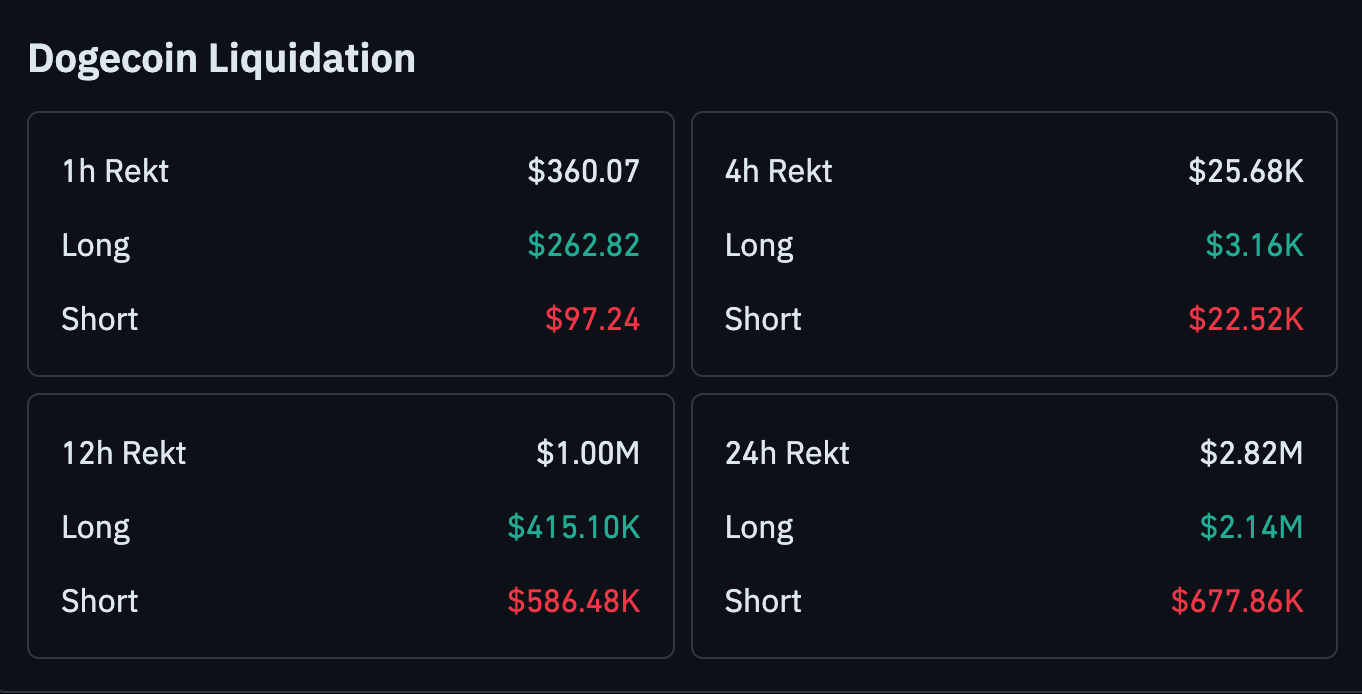

Dogecoin Liquidation Data

Dogecoin’s liquidation knowledge highlights growing volatility, with long positions dominating most contemporary liquidations. Over the closing 12 hours, Dogecoin skilled fundamental liquidation job, with a complete of $1.00 million in liquidations. Long positions accounted for $415.10K, whereas immediate positions seen a increased liquidation of $586.48K, indicating stronger stress on immediate positions right thru this length.

In the closing 24 hours, the liquidation quantity increased to $2.82 million, with long positions totaling $2.14 million and immediate positions at $677.86K. This reveals that long positions had been hit more sturdy. The dominance of long liquidations suggests that Dogecoin would possibly well maybe maybe also honest face further downside if the model continues.