Key Highlights

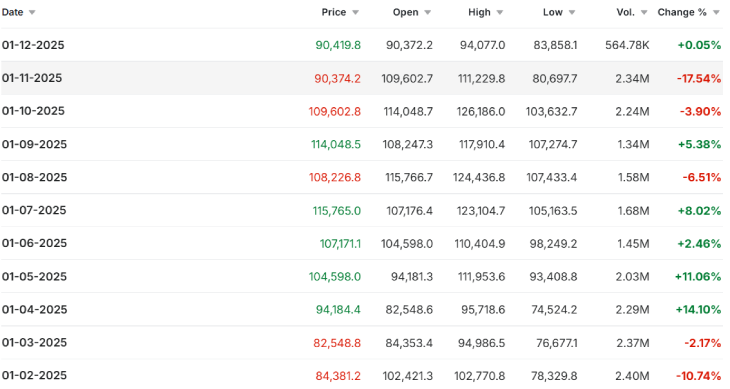

- In November, Bitcoin dropped by 17.54% as a consequence of extensive liquidation events(Love October 10) and intense sell-off stress

- After the indispensable downward growth in November, institutional investment also depleted from Bitcoin ETFs, witnessing $3.57 billion

- No topic this downfall, Tom Lee shared a bullish outlook for the cryptocurrency market, asserting the supercycle is restful crammed with life

No topic the dip in Bitcoin’s sign, experts like Justin Lee are restful bullish about its future as they’re forecasting that Bitcoin would possibly well apply an upward trajectory within the upcoming months.

“No longer-So-Correct November”: Bitcoin Fell Below $81,000 with Large Liquidation

The cryptocurrency market witnessed the biggest liquidation of its history on October 10 after U.S. President Donald Trump declared a 100% tariff on China. Following this announcement, over $19 billion worth of cryptocurrency investment modified into wiped out from the market overnight, in defending with Coinglass.

After wretched performance in October, the cryptocurrency market got a rough birth in November, where the biggest cryptocurrency modified into barely considered trading above $110,000. Love this wasn’t enough, some sad events possess triggered the biggest downfall of the three hundred and sixty five days.

According to CoinMarketCap, Bitcoin has witnessed a animated decline throughout November, including its tumble under $80,000 on November 21. This modified into a seventh-month low and wiped out over 35% of the cryptocurrency’s worth from its top at $126,000 in October.

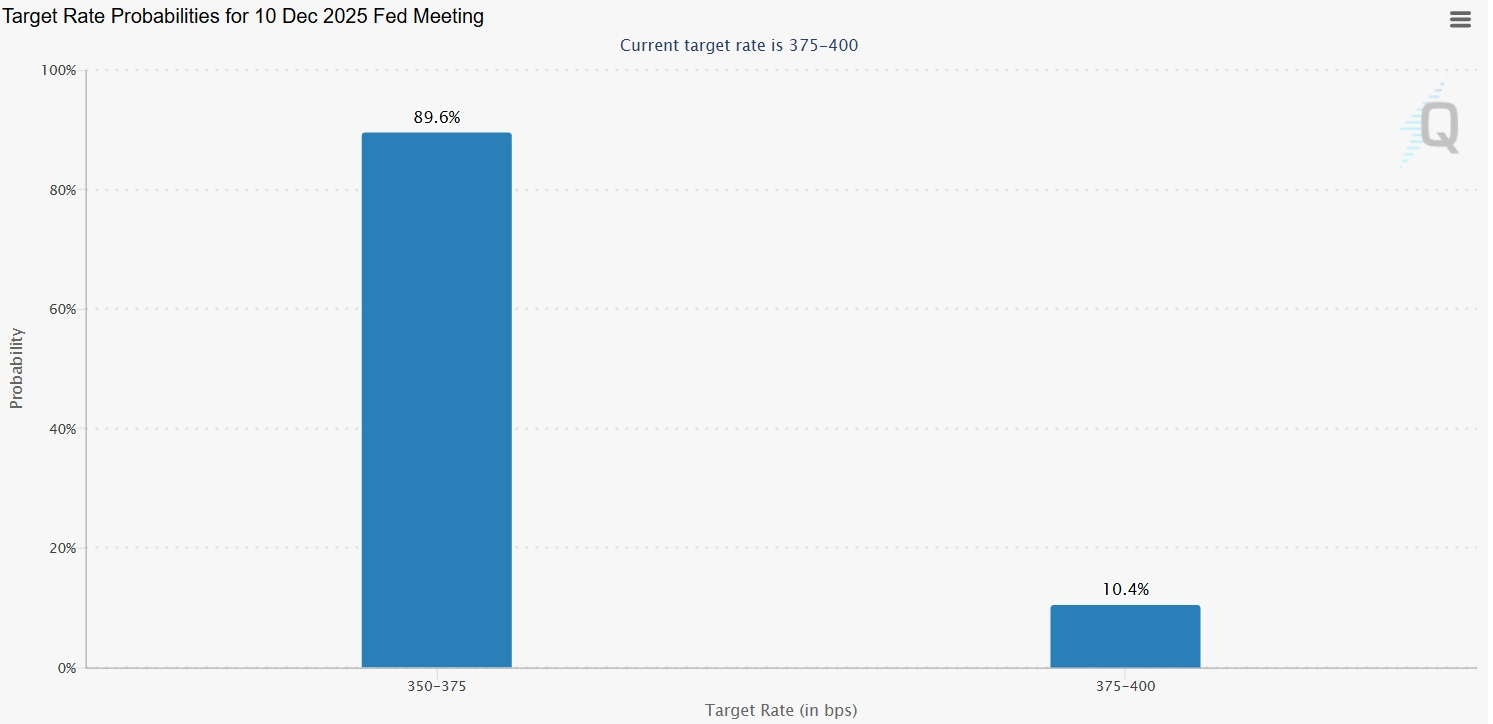

There are varied elements within the again of this sell-off, which led to an absence of roughly $1 trillion in market capitalisation from the cryptocurrency market. However, one in all the indispensable causes within the again of this downward growth modified into triggered by a replace in expectations for U.S. monetary policy. Launched Federal Reserve assembly minutes released on November 20 published low probabilities of slicing ardour rates. This hesitation has broken merchants’ self assurance in extremely unstable resources like cryptocurrencies. Adding to this, the recordsdata linked to the U.S. jobs sage has also lowered the possibilities of reach-term fee cuts.

Other than this, the turmoil within the crypto market also shook the institutional merchants’ self assurance as they began pulling out their investments from crypto-essentially based fully mostly ETPs. Bitcoin replace-traded funds (ETFs), including BlackRock’s iShares Bitcoin Trust ETF and Fidelity’s fund, noticed extensive outflows totaling $3.7 billion in November, with everyday peaks hitting $75 million.

Crypto whales and indispensable funds also participated in this selling, which intensified the downward stress on the worth.

The declining sign of Bitcoin also sparked a series of automatic sell-offs within the market. As Bitcoin fell under key technical aid levels at $100,000 after which $90,000, it forced the liquidation of billions of bucks in leveraged positions positioned by merchants who possess been anticipating the worth to rise.

On the worst day, like November 21, over 140,000 merchants had their positions liquidated, with between $500 million and $700 million in long positions being wiped out.

Other than this, the European Systemic Threat Board (ESRB) has no longer too long ago raised a warning on stablecoin. This has also impacted the crypto market.

Altcoins like Ethereum and Solana also adopted Bitcoin’s downward growth with indispensable losses, proving their correlation. Also, this bearish scurry broken the stock sign of Technique, the biggest Bitcoin holding public firm.

Will Bitcoin Follow a Downward Trajectory in December?

On the time of writing this, Bitcoin is exhibiting a signal of recovery as it is for the time being trading at spherical $91,558 with a tiny surge of 1.3%. However, its total market capitalization restful sits under $2 trillion.

According to Tom Lee, co-founder and Head of Research at Fundstrat International Advisors, the supercycle within the cryptocurrency market is restful crammed with life no topic the market’s volatility in November. He affirmed that the most modern decline and recovery length tell more upside capacity forward.

In his forecast, he talked about that the accurate golden age of cryptocurrencies has handiest accurate begun. He repute 2026 sign targets of $300,000 for Bitcoin and $20,000 for Ethereum. If here’s correct, BTC would possibly well understanding some upswing in this month, such as breaking the psychological model of $100,000.

British multinational bank Same old Chartered has lowered its 2025 three hundred and sixty five days-conclude sign forecast for Bitcoin by half, from $200,000 to $100,000. The bank’s analysts said that the aggressive company buying growth, exemplified by companies like Technique, has largely scurry its course.

(Provide: CME Community)

Other than this, the CME Community indicator reveals an 89% probability of a 25bp Fed fee lower on the December 10-11 FOMC assembly, in defending with the CME FedWatch Instrument. This would possibly lower the federal funds fee to a pair of.50% to a pair of.75%.

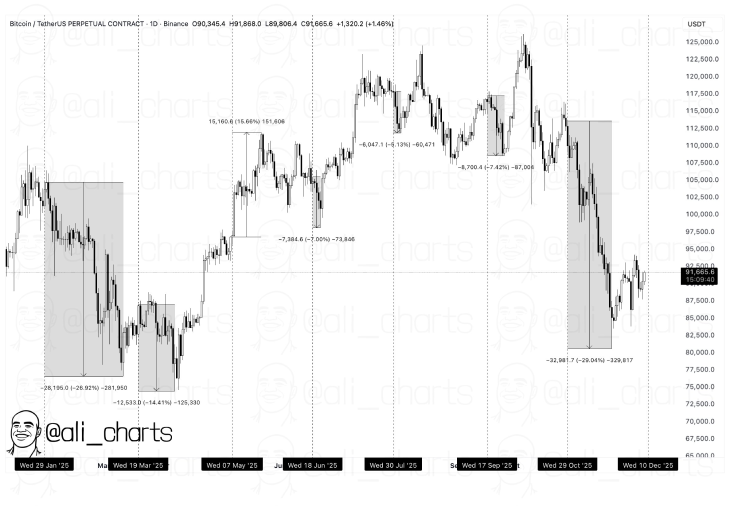

(Provide: Ali on X)

However, throughout 2025, BTC has shown a consistent tendency to plunge after conferences of the Federal Reserve. According to market analyst Ali, out of seven Federal Begin Market Committee (FOMC) conferences held to this point this three hundred and sixty five days, 6 possess resulted in immediate sign corrections for Bitcoin. Simplest one assembly modified into adopted by a short-term rally.