Some of the crucial reported trading process and quantity of prediction market platform Polymarket shall be considerably elevated than valid actuality due to the a “files malicious program,” basically basically basically based on a researcher at Paradigm.

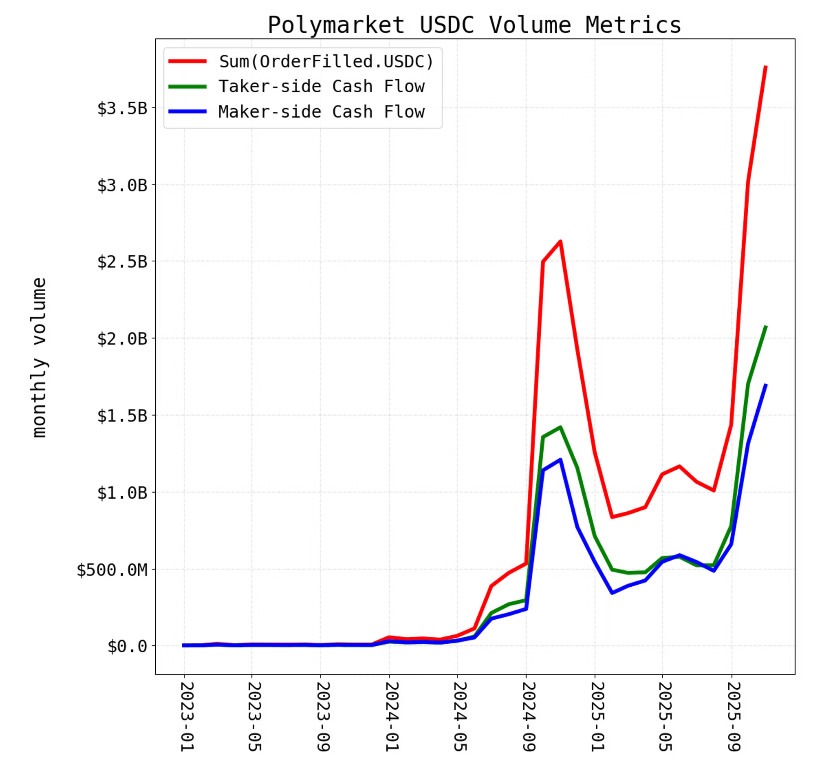

“It turns out nearly each essential dashboard has been double-counting Polymarket quantity now not connected to scrub trading,” stated Storm, a researcher at the venture capital firm.

Storm defined that this was once on narrative of “Polymarket’s onchain files contains redundant representations of every commerce.”

“Polymarket’s onchain files is moderately advanced, and this has ended in neatly-liked adoption of flawed accounting programs.”

When trades happen on Polymarket, the system emits multiple “OrderFilled” events: one characteristic for makers, who’ve existing orders, and one other for takers, who manufacture the commerce.

These events portray the the same commerce from varied perspectives, now not separate trades. Nonetheless, many essential dashboards had been combining them, counting the the same quantity twice.

Polymarket has been considered as a uncommon crypto success lately, as space and derivatives markets had been in turmoil. The discovery that its headline metric shall be incorrect at some stage in many dashboards also can dent a few of its perceived success.

Polymarket’s advanced blockchain files

The researcher went on to snort that the accounting malicious program “inflates each sorts of quantity metrics commonly dilapidated for prediction markets, notional quantity and cashflow quantity.”

“Polymarket’s files has been notoriously confusing for crypto files analysts … the knowledge has too many layers of interacting complexity to untangle the usage of glorious a block explorer.”

Linked: Polymarket plans to use in-home market maker to commerce in opposition to users: Record

This complexity arises on narrative of Polymarket trades would possibly maybe even be uncomplicated swaps or they will even be “splits” and “merges” where each parties alternate money for opposing positions.

The most effective contracts emit redundant events for monitoring functions, and fashioned blockchain explorers don’t operate this distinction decided, the researcher stated.

Cointelegraph contacted Polymarket for comment, but didn’t procure an instantaneous response.

Polymarket is valued at $9 billion

The Intercontinental Alternate (ICE) valued the prediction platform at $9 billion this week, basically basically basically based on stories, citing $25 billion in trading quantity, which also can now be in ask of.

In September, it was once reported that Polymarket was once making ready for a US inaugurate at a $10 billion valuation. In October, Bloomberg reported that it was once taking a look to take funds at a valuation between $12 billion and $15 billion.

Within the intervening time, Dune Analytics reported that the platform carried out a monthly file of $3.7 billion in trading quantity in November, but this shall be double the particular resolve if Paradigm’s overview is valid.

“DefiLlama, Allium, Blockworks and a lot Dune dashboards had been double-counting,” stated the researcher.

Prediction markets are impulsively evolving valid into a essential financial sector, “and because the category matures, the industry must converge on consistent, transparent, and arrangement reporting requirements,” the researcher concluded.

Magazine: XRP’s ‘now or by no means’ moment, Kalshi faucets Solana: Hodler’s Digest