Binance’s most modern Proof of Reserves finds a serious shift in consumer positioning, the save Bitcoin balances are hiking, whereas ETH and USDT tumble.

On the same time, Binance’s stablecoin over-reserves hit six-month highs, strengthening liquidity real thru ongoing market volatility.

Bitcoin Accumulation Jumps as User Habits Shifts

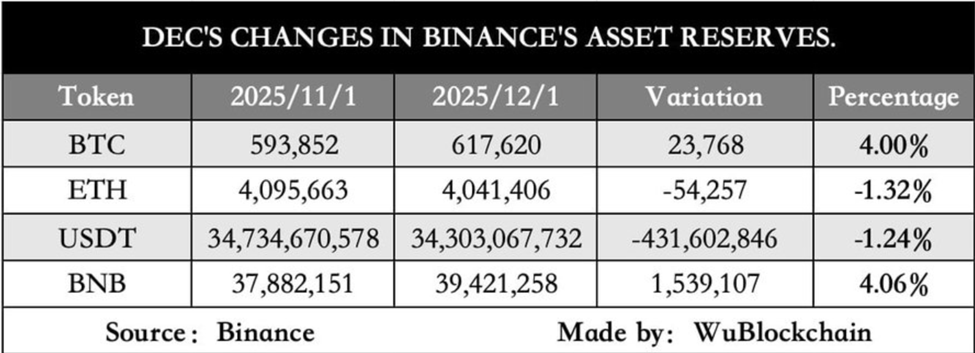

Binance customers elevated their Bitcoin balances by 4% month-over-month, reaching 617,620 BTC, in accordance with the alternate’s 37th Proof of Reserves snapshot. That’s an addition of 23,768 BTC since November 1.

The alternate utilizes Merkle trees and zk-SNARKs to permit customers to verify their balances without disclosing private knowledge. Present reserve ratios embody:

- BTC: 102.11%

- ETH: 100%

- USDT: 109.16%

- USDC: 137.7%

- BNB: 112.32%

This methodology provides true-time transparency, no longer like used audits, that are episodic and rely on third-celebration belief.

As of November 30, Binance reserves had been hovering near $120 billion, with USDT (ERC-20) reaching a anecdote $42.8 billion. Despite volatility, Binance stays the 2nd-largest holder of world Bitcoin reserves.

CONFIRMED: #Binance Now Holds $120B in Reserves 🚀

Source Crypto Quant 👇

On-chain data reveals Binance total reserves maintaining near ATHs (spherical $120 billion) and USDT (ERC20) reserves reaching a anecdote $42.8 billion despite most modern market volatility.

The alternate also stays… pic.twitter.com/xy8ZIY5siV

— Altcoin Day-to-day (@AltcoinDaily) November 29, 2025

Fashioned sentiment on X (Twitter) is that this pattern is bullish for Bitcoin, with customers stacking the pioneer crypto as ETH and stablecoin balances decline.

User Ethereum holdings dropped 1.32% to 4.04 million ETH (-54,257 ETH), whereas USDT balances slipped 1.24% to 34.3 billion USDT (-430 million USDT).

The pattern suggests rebalancing as a replace of a gigantic withdrawal, with customers migrating into Bitcoin real thru sessions of uncertainty.

Stablecoin Over-Reserves Hit Six-Month Highs

Analyst AB Kuai Dong highlighted a racy rise in Binance’s stablecoin buffers:

- USDT over-reserve ratio: 109.16% (up from 101.52% in June)

- USDC over-reserve ratio: 137.7%

- Overall platform over-reserves: 12.32% above consumer funds

- BNB over-reserve ratio: 112.32%, very top amongst most well-known resources

He added that rising over-reserves “beef up the platform’s likelihood resistance capabilities,” especially for stablecoins. The Binance alternate reiterated that each consumer resources remain backed 1:1.

Our December 2025 Proof of Reserves is now stay.

The #Binance PoR machine lets anyone independently test that consumer resources are backed 1:1.

Overview this month’s change right here 👉 https://t.co/nspWeaiQDz pic.twitter.com/McrtJV1vTK

— Binance (@binance) December 7, 2025

The consistent produce-up, from June to December, indicators stronger liquidity administration. It also aligns with regulatory expectations that reserves remain absolutely available for redemptions as a replace of inner buying and selling.

Alerts for Likely Future Strikes?

CryptoQuant illustrious that Binance’s Bitcoin reserve ratio honest recently touched its lowest level since 2018. This condition has historically preceded unheard of Bitcoin rallies on account of lowered sell-side liquidity.

“History reveals that hitting such lows recurrently precedes unheard of Bitcoin rallies, merely for the reason that liquidity required to fuel a tag surge is now absolutely available on the alternate,” wrote CryptoQuant analysts.

But, most modern market data reveals that Bitcoin is leaving exchanges globally, at the same time as Binance balances rise. This implies that Binance is gaining market part from competitors as a replace of reversing the broader pattern toward self-custody.

The combo of rising Bitcoin accumulation, increasing stablecoin over-reserves, and historically low reserve ratios creates a mixed however doubtlessly optimistic setup.

If macro prerequisites stabilize, Binance’s reinforced liquidity and lengthening buffers plight the alternate to beef up elevated buying and selling process in a future rally allotment.

The post Binance PoR Reveals BTC Pile-Up, Rising Over-Reserves, and Bitcoin Rally Alerts regarded first on BeInCrypto.