Toncoin worth as we notify time trades approach $1.58, stabilizing after a multi-month decline that broke every horizontal assist and trendline structure earlier in the quarter. The asset stays under valuable transferring averages and within a smartly-defined downward channel, but recent worth action reveals traders making an are trying to compose a unsuitable and defend non permanent assist.

AlphaTON Raises Eyebrows With $420M Idea As Market Stays Cautious

The rally attempts are rising in the identical week that Toncoin’s ecosystem got an sudden company catalyst, with AlphaTON Capital asserting a fundraising idea sized at $420.69 million, a meme-encoded pick supposed to grab attention and lengthen yarn.

Market members reacted to the filing with curiosity in feature of conviction. AlphaTON at this time has a market cap approach $13 million, yet it’s some distance positioning to lift shut capital portions in overall connected to mid-cap tech. The firm also holds 12.8 million TON tokens, worth about $20.5 million, and plans to magnify treasury holdings if its lift is winning. The announcement pushed the company’s stock higher by roughly 14.7%, but that enthusiasm has now now not yet translated into broader TON spot flows, which remain fragile after a heavy month of outflows right by the digital asset treasury sector.

Designate Stalls Below Main Resistance As Downtrend Stays Intact

The on daily foundation chart reveals TON locked under a declining trendline that originates from the early September swing excessive. The rejection sequence that began approach $2.70 pushed worth into a controlled downtrend, with lower highs and lower lows forming a consistent structure. The breakdown accelerated in October, with a violent selloff that forced worth into a steeper decline channel.

Contemporary lessons point to attempts to stabilize approach the $1.44–$1.52 zone, but upside growth stays shrimp by the cluster of transferring averages above worth. Key levels embody the 20-day EMA at $1.59, the 50-day EMA at $1.76, and the 100-day EMA at $1.90. All are sloping downward, forming a layered ceiling that has rejected every rally are trying.

The 200-day EMA at $2.69 stands as the principle reversal threshold. Constructing adjust does now now not shift until TON breaks and holds above this level. For now, the chart shows defensive positioning in feature of structural recovery.

Bollinger Bands assist this interpretation. Designate stays lodged approach the lower half of the band, suggesting that volatility expansion to the upside has now now not materialized. With out expansion, breakout attempts lack energy.

Triangle Compression Reveals Fair Momentum With Route To Shatter Either Plot

On the 30-minute chart, TON is compressing inner a symmetrical triangle, with traders making an are trying to assign ascending assist whereas sellers defend the upper boundary approach $1.60–$1.62. This setup on the entire resolves with a directional damage, but positioning suggests a tug-of-battle in feature of dominance by either aspect.

Parabolic SAR readings remain under worth, favoring upward tension in the short duration of time. On the alternative hand, the slope of the SAR dots suggests a fragile vogue, now now not a longtime rally. The asset need to damage above $1.62 with continuation to substantiate any breakout are trying.

Crimson meat up on this timeframe sits at $1.55, with deeper structural assist at $1.52. A breakdown below that assist exposes the recent low at $1.44, where traders beforehand stepped in with conviction. With out a damage of the upper triangle boundary, worth continues to coil and compose energy in feature of vogue.

RSI stays impartial at 51, reflecting cautious momentum. Here’s now now not overbought or exhausted. It is hesitation.

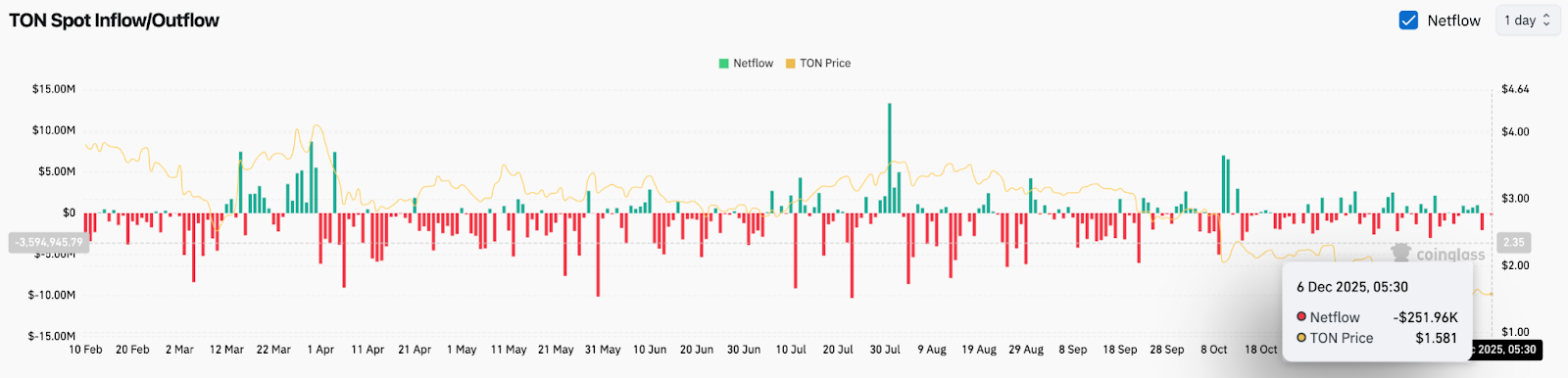

Dispute Flows Stay Veteran As Treasury Exercise Slows

Coinglass data reveals chronic outflows right by the quarter, with November marking one of the fundamental weakest months for digital asset treasury allocations in 2025.

Toncoin seen score outflows of -$252,000 in Decemmber 5 session, extending a broader pattern of liquidity leaving the ecosystem in feature of coming into it.

Outlook: Will Toncoin Scoot Up?

TON sits at a technical crossroads. Investors are making an are trying to compose a unsuitable, however the asset stays trapped under every fundamental transferring sensible and a protracted-duration of time downtrend line.

- Bullish case: A breakout above $1.62 opens a transfer toward $1.76 and the 50-day EMA. Surging quantity would be desired to elongate toward $1.90, where a more fundamental test occurs. Reclaiming and preserving the 200-day EMA at $2.69 shifts the vogue from defensive to positive.

- Bearish case: A breakdown below $1.52 exposes $1.44, and loss of that level invitations continuation toward $1.30–$1.20 as the channel continues lower. Lack of inflows accelerates downside possibility.

Disclaimer: The info supplied in this article is for informational and tutorial functions handiest. The article does now now not constitute financial recommendation or recommendation of any kind. Coin Edition is now now not accountable for any losses incurred as a outcomes of the utilization of order, products, or services and products talked about. Readers are informed to exercise caution earlier than taking any action connected to the firm.