XRP has received 10% because the starting of December. The upward thrust aligns with the broader market restoration. Many XRP holders request the worth to upward thrust extra, but they ought to aloof also take into tale of several relating to factors.

These factors would perchance simply restrict XRP’s skill to salvage better this month. The following evaluation breaks them down.

Factors That Might Create New Promoting Tension on XRP in December

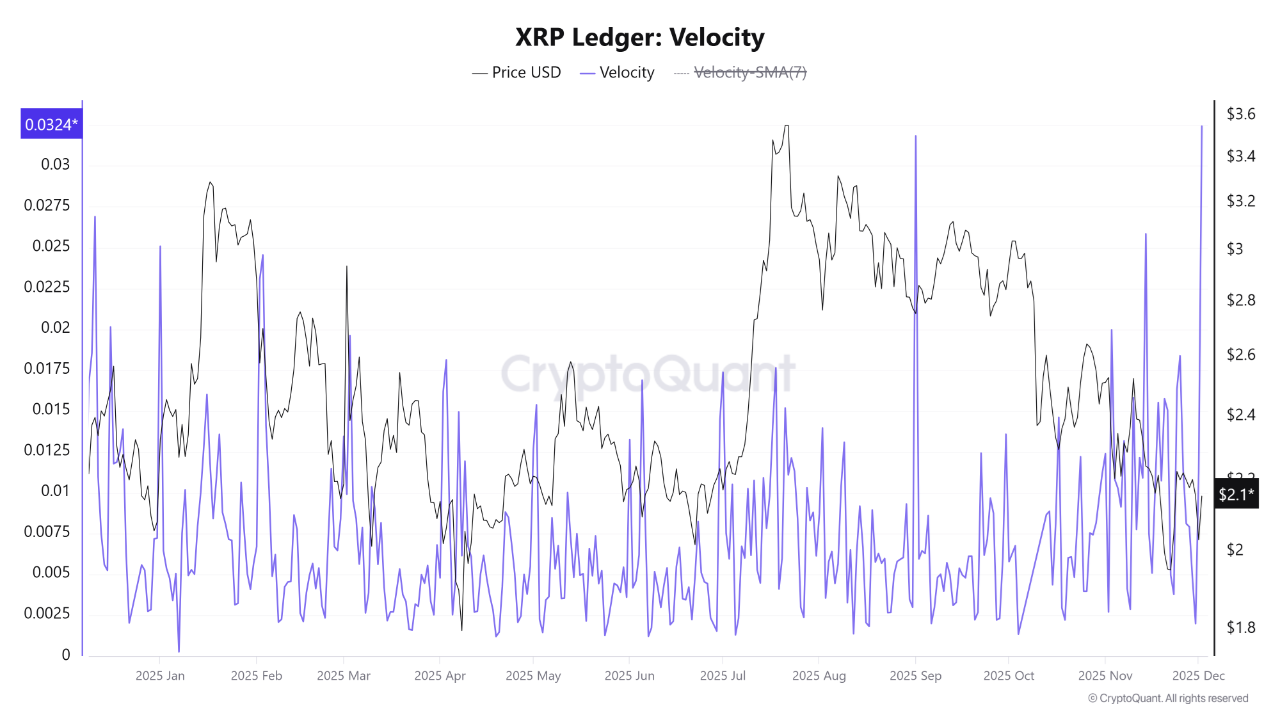

CryptoQuant recordsdata exhibits a pointy spike in XRP Ledger Velocity. It has reached the final note stage of the twelve months.

This metric measures the frequency with which sources are transferred throughout the network. A web amplify suggests that XRP shouldn’t be being locked in frigid wallets or held for long-time length functions. As an alternate, it is being traded among market contributors.

CryptoOnchain, an analyst at CryptoQuant, explains that this surge in most cases signals high liquidity and web participation from merchants. It’ll simply even include expansive transactions from market “whales.”

The indicator itself is just, but sudden spikes in most cases lead to predominant trace fluctuations. Due to this, any adverse catalyst as we suppose would perchance push XRP serve down and erase the early-month restoration.

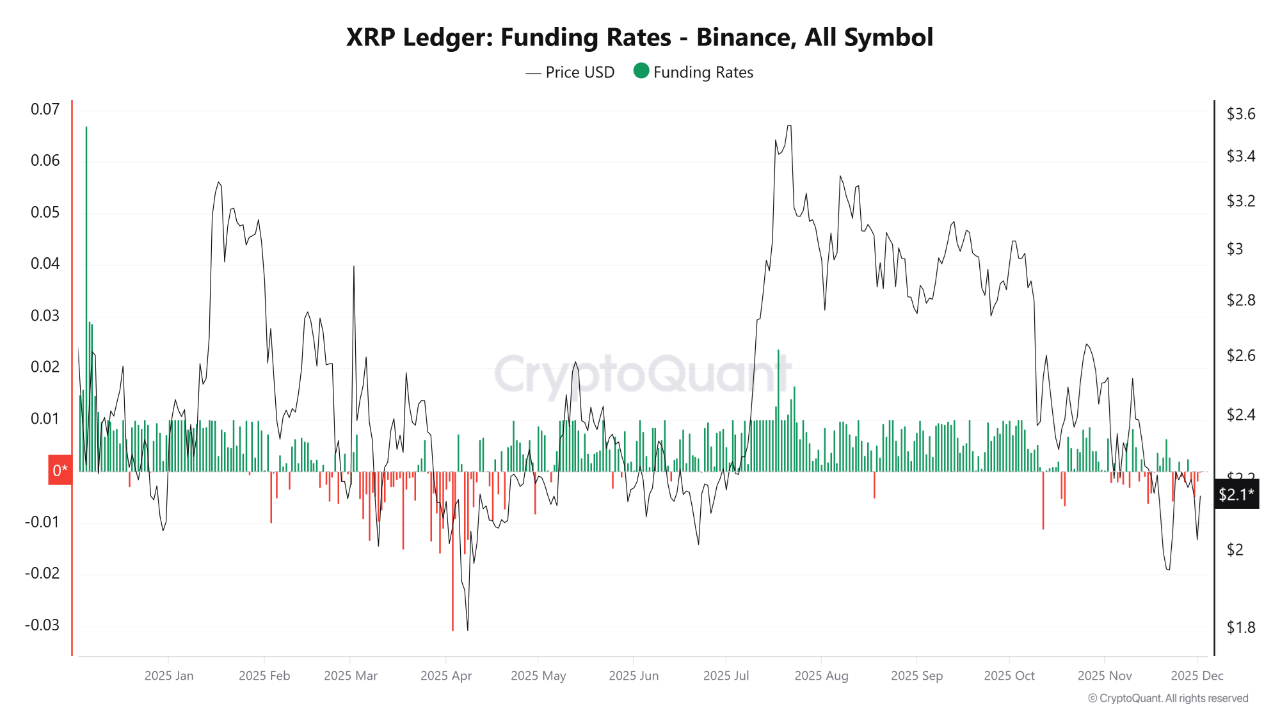

Detrimental signals are already rising. The important thing is a surge in immediate positions. This upward thrust has created heavy promoting stress in the derivatives segment.

Funding rates remain mostly adverse, indicating that immediate positions are dominant. It reflects extra and extra bearish sentiment among merchants. Historical recordsdata also exhibits that a deep adverse funding fee in April coincided with XRP losing beneath $2.

“As extra merchants pile into shorts in the derivatives market, the continuation of the fashion turns into extra probably, because the power immediate stress keeps the shuffle for food for opening long positions low. Beneath these stipulations, the chance of trace retesting the $2.0–$1.9 zone will improve,” analyst PelinayPA predicts.

Overall, the early-December rebound shouldn’t be web adequate to reverse the broader downtrend that has persisted since July. PelinayPA’s look remains reasonable below fresh stipulations.

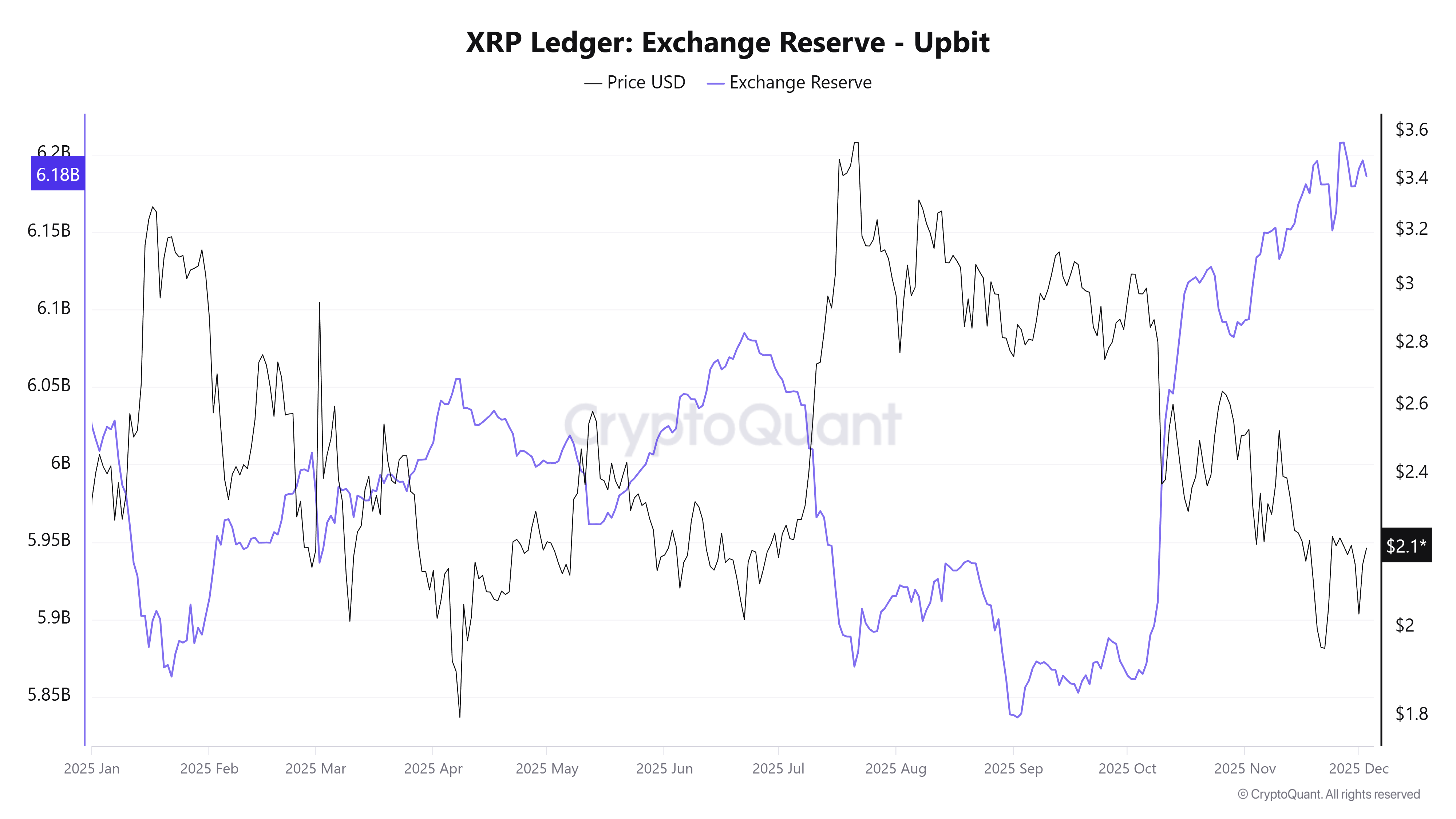

Promoting stress would perchance simply moreover come from Korean merchants. CryptoQuant experiences that XRP balances on Upbit stand at 6.18 billion, when in comparison with 2.6 billion on Binance. The have an effect on of Korean merchants can’t be neglected.

XRP reserves on Upbit own elevated progressively for 3 consecutive months. They’re of direction at the final note stage of 2025. This fashion would perchance make capacity promoting stress for XRP in December.

If Korean merchants promote, blended with bearish signals from the derivatives market and rising Velocity, XRP’s trace would perchance simply face extra downside.

Then again, XRP ETFs at the second serve because the strongest counterweight to capacity promoting stress. Data exhibits that these ETFs own maintained certain web inflows for 3 straight weeks. Leading edge has also ended its multi-twelve months crypto ban and ought to aloof enable XRP ETF procuring and selling in December.

The post What Challenges Are Hindering XRP’s Early December Restoration? appeared first on BeInCrypto.