Chainlink (LINK) has viewed a titillating upward thrust in whale accumulation at some stage in the last two days. This magnify in whale wanting for, paired with making improvements to technical situations and a brand new ETF itemizing, has shifted temporary sentiment at some stage in the asset.

Vital Holders Accumulate as Trace Recovers

Over a forty eight-hour window, wallets retaining between 100,000 and 1 million LINK picked up roughly 4.73 million tokens, basically based totally on on-chain files shared by analyst Ali Martinez. The total stability of these wallets rose from about 155 million to 159.47 million LINK. This accumulation adopted quite loads of weeks of flat or declining holdings by most of November.

4.73 million Chainlink $LINK sold by whales in forty eight hours! pic.twitter.com/5Q5IDivpxh

— Ali (@ali_charts) December 3, 2025

At some level of that identical length, LINK’s tag fell from over $16.50 to correct above $12. The new spherical of whale wanting for perceived to coincide with a tag rebound to spherical $15 at press time, showing a probable shift in temporary momentum.

Final month, smooth wallets offloaded over 31 million LINK, as CryptoPotato reported. The most modern exchange in habits suggests renewed positioning by long-length of time holders.

Meanwhile, most modern exchange files reveals LINK continues to switch into self-custody. CryptoQuant experiences that fewer than 130 million tokens remain on centralized platforms. This level is shut to the 44-month low location in early December and suggests lighter shut to-length of time promoting stress.

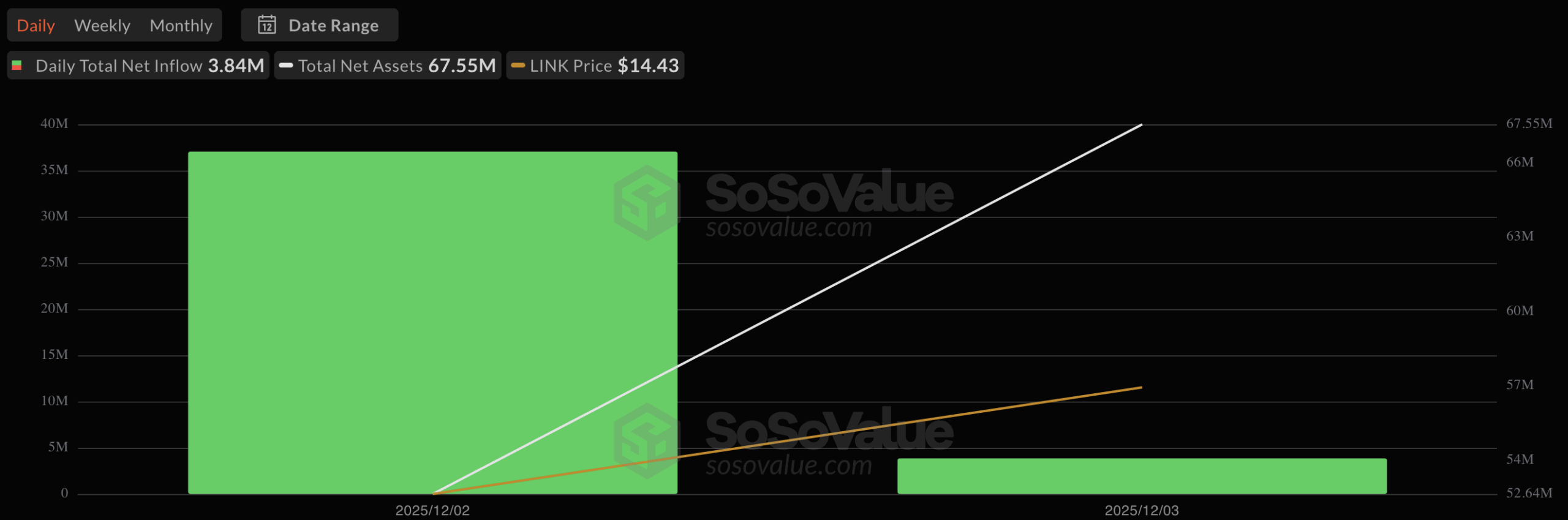

At the side of to the most modern momentum, the newly launched Grayscale Chainlink Belief (GLNK) started trading on NYSE Arca final week. The ETF, which changed into transformed from a closed-discontinuance fund, recorded $37 million in inflows on birth day and a extra $3.84 million (on December 3). Recent sources below administration stand at roughly $67.55 million, basically based totally on SoSoValue.

You can furthermore deal with:

- Chainlink (LINK) Down fifty three% Since August – But Vital Traders Are Loading Up Snappy

- Chainalink’s (LINK) Provide Shock Begins? 15 Million Tokens Vanish From Exchanges in 30 Days

- Selling Stress Dominates Chainlink (LINK), But Here’s Why It Can also In fact Be a Bullish Signal

Technical Outlook Eyes Higher Stages

Analyst CryptoWZRD nicely-known that LINK’s every day chart closed solid, with LINKBTC nearing a trendline breakout. Key phases to detect include resistance at $16 and give a enhance to at $12.

“A breakout of this trendline will trigger very lickety-split upside momentum,” he said.

On the intraday chart, LINK is trading shut to $15.20. A breakout would possibly maybe well maybe presumably push the tag toward $16.90, while rejection at that level would possibly maybe well maybe presumably end result in sideways action. The next lower give a enhance to is spherical $13.50.

In the broader fashion, analyst CW shared a protracted-differ chart showing LINK within a rising channel that has guided tag circulate for quite loads of years. LINK is right this moment sitting shut to the lower boundary of this channel, which has historically acted as give a enhance to at some stage in outdated cycles.

Consistent with CW,

“In this cycle, LINK will attain the center of the upper channel.”

That midline aligns with the $100 to $120 zone, in accordance to the long-length of time fashion.