Key Notes

- DACM boosted its HYPE holdings previous $1 million.

- The asset manager withdrew 15,000 tokens from FalconX on December 4.

- Hyperliquid’s HIP-3 custom markets crossed $5 billion in entire trading volume.

On Dec. 4, DigiAssetFund (DACM) withdrew 15,000 HYPE HYPE $34.ninety 9 24h volatility: 2.3% Market cap: $9.46 B Vol. 24h: $361.05 M , valued at roughly $525,000, from FalconX. In step with blockchain analytics platform Nansen, the switch raised their entire Hyperliquid holdings in that pockets to extra than $1 million.

.@DigiAssetFund (DACM) correct withdrew 15K $HYPE (~525K USD) from @FalconXGlobal

They now shield extra than 1M USD in $HYPE in this pockets. pic.twitter.com/mbpkjk6hxp

— Nansen 🧭 (@nansen_ai) December 4, 2025

The right identical day, DACM’s Executive Chairman and CIO, Richard Galvin, launched a fundamental investment into Ostium Labs’ Series A round.

Galvin acknowledged that the global CFD market strikes extra than $10 trillion every month, but restful relies on outdated, opaque programs that step by step trade against customers. DACM backs Ostium for rebuilding this infrastructure by design of oracle-pushed, RFQ-based entirely entirely perpetuals.

Hyperliquid’s Customized Markets Hit $5 Billion in Volume

In the meantime, Hyperliquid’s HIP‑3, which enables permissionless, particular person‑deployed perpetual markets, saw over $5 billion in trading volume generated at some stage in these custom markets. Merchants receive begun exploring contemporary synthetic assets tied to tech stocks and non‑crypto indices.

HIP-3 pairs receive correct surpassed $5 billion, with a total of 21,831 traders.

$4.92 billion used to be traded on @tradexyz.

$93.47 million on @felixprotocol.

$28.78 million on @ventuals. pic.twitter.com/CD1y7lkKvE— Hyperliquid News (@HyperliquidNews) December 3, 2025

Hyperliquid’s truly fair correct layer‑1 infrastructure permits excessive‑tempo derivatives execution with out counting on centralized intermediaries. Moreover, HIP‑3 permits builders to originate equity‑style perpetuals alongside with customary crypto derivatives.

HYPE Trace Diagnosis: Making an attempt out a Major Trendline

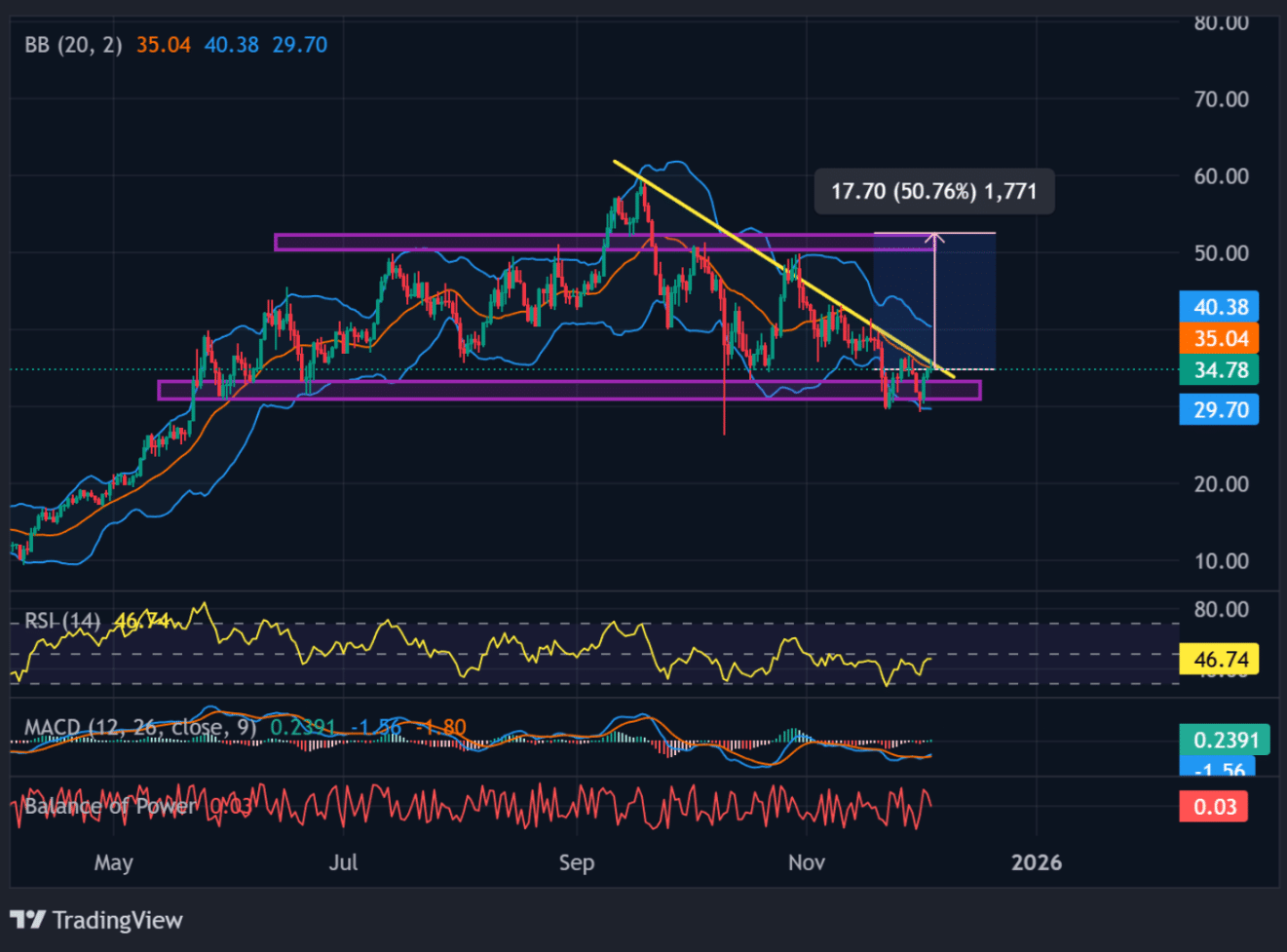

The HYPE chart presentations that the token is sitting correct below a clear descending trendline that has capped every rally for months. Current price sits advance $34.78 with Bollinger Bands at $40.38 (upper), $35.04 (mid), and $29.70 (lower).

HYPE has also bounced several instances from a stable enhance block marked between the 29–31 fluctuate. This zone has held since early summer time.

Apparently, the RSI stands at 46.74 whereas the Steadiness of Strength holds advance 0.03, meaning gentle purchaser presence.

Trendline capping HYPE rallies for months | Source: TradingView

A decisive breakout above the descending trendline, in particular above the $40 space, would novel the next target at $52, a imaginable 50% rally from novel levels. This doable upward switch makes HYPE one amongst the simplest crypto to aquire in the novel cycle.

Nonetheless, if HYPE rejects from the trendline once again, price could maybe well well revisit the $29 enhance diploma. Shedding this enhance space could maybe well well lead to a deeper pullback against $24.

Disclaimer: Coinspeaker is committed to offering independent and clear reporting. This article targets to exclaim lawful and neatly timed recordsdata however ought to now now not be taken as financial or investment advice. Since market stipulations can change with out be aware, we attend you to envision recordsdata in your receive and seek the advice of with a official sooner than making any choices based entirely entirely on this verbalize material.