The Grayscale Chainlink Have confidence ETF ($GLNK) launched on Tuesday, attracting approximately $41.5 million in its first day and marking a milestone for altcoin ETFs in the U.S.

Institutional inquire for cryptocurrency publicity is increasing previous Bitcoin and Ethereum. Which capability, many investors for the time being are searching at to take a look at if LINK can reach contemporary all-time highs.

ETF Launch Displays Rising Institutional Curiosity

The Grayscale Chainlink Have confidence ETF, trading below the ticker $GLNK on NYSE Arca, is the first way Chainlink ETF for US investors. In accordance with SoSoValue data, as of Dec 3, it saw $40.90 million in procure inflows on its debut, with full procure sources reaching $67.55 million and $8.Forty five million in volume. The ETF closed up 7.74% at $12.81 per fragment.

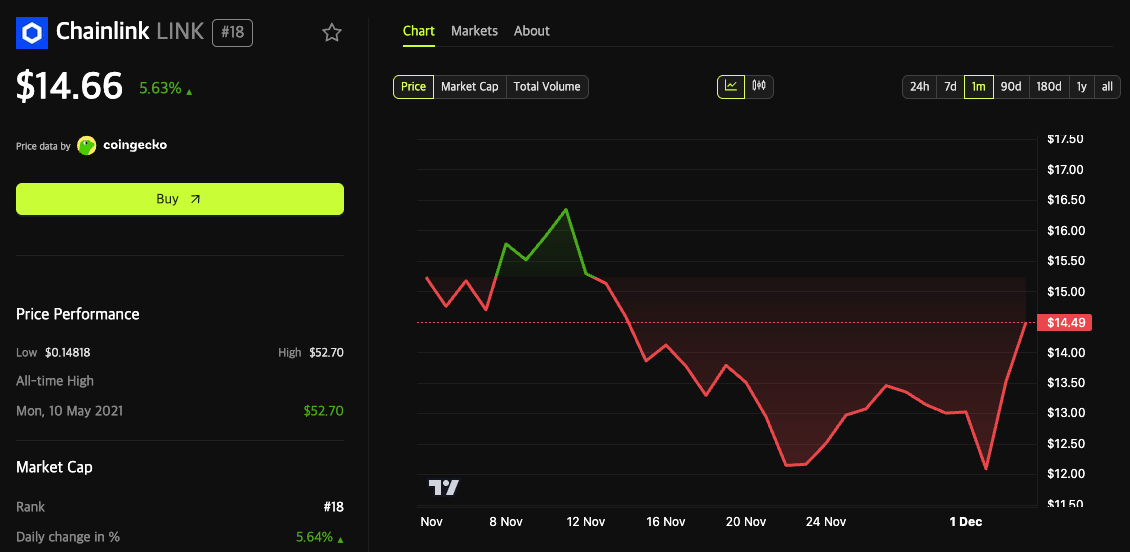

Grayscale remodeled its present Chainlink Have confidence, first launched in February 2021, into this ETF. This circulate aligns with the firm’s broader strategy and offers institutions with mutter publicity to LINK by extinct accounts. On the time of reporting, LINK, Chainlink’s native token, became priced at $14.66.

Grayscale CEO Peter Mintzberg well-liked the initiate became “a favorable signal of broader market inquire for Chainlink publicity,” pointing to increased institutional curiosity in oracle network tokens. With its solid first day, $GLNK has turn into one of many pause-performing contemporary crypto ETFs, launching amid rising market process and regulatory modifications.

LINK Technical Breakout and Whale Activity

Technical analysts like considered a serious pattern shift in LINK’s mark constructing as the ETF debuted. The token broke out of a month-long downward channel. Many observers now imagine this might well presumably attend power LINK previous 2021 highs, as institutional flows by $GLNK will be a catalyst for contemporary data.

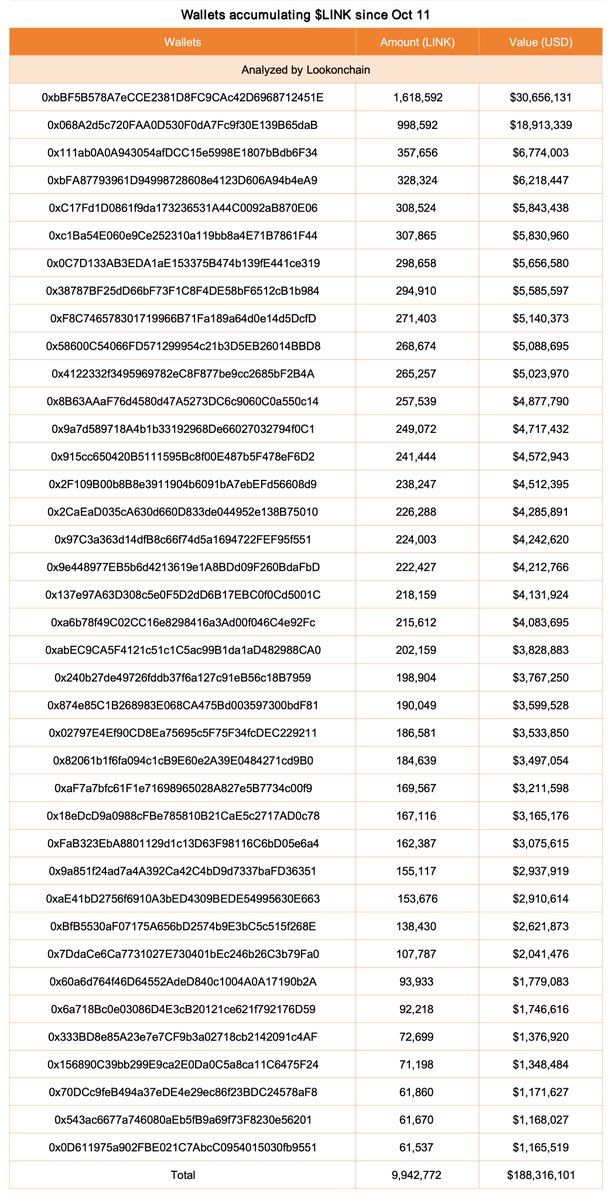

On-chain data highlights valuable whale accumulation ahead of and after the ETF initiate. Lookonchain reported that 39 contemporary wallets withdrew 9.94 million LINK, fee $188 million, from Binance since October’s market correction. This behavior underscores self belief amongst extensive holders, despite most modern volatility.

Yet now now not all extensive investors like benefited. OnchainLens identified one address that received 2.33 million LINK over six months for $38.86 million. This whale now faces an unrealized lack of $10.5 million, with the placement valued at $28.38 million. The case highlights the hazards and volatility in LINK accumulation, severely for early purchasers at higher prices.

Market Dynamics and Ability Risks

Originate Curiosity data gifts a nuanced study after the ETF initiate. Originate Curiosity has risen to around $7 million, following a outdated dip. This pattern indicators renewed trader engagement and higher self belief in LINK’s skill. A simultaneous mark prolong and Originate Curiosity generally facets to bullish momentum and intelligent derivatives trading.

Nonetheless, analysts caution that whales who accumulated LINK ahead of the ETF initiate might well presumably soon system destroy-even or profit targets. If these holders promote, selling stress might well presumably restrict short-timeframe beneficial properties despite solid institutional inflows. Merchants are closely searching at as LINK tests resistance, weighing optimism in opposition to that you just might imagine reversals while searching at for added momentum.

The ETF’s outlook is dependent on whether or now now not institutional inquire meets skill whale selling and continues to entice capital. As technical breakouts, whale accumulation, and Originate Curiosity upward thrust alongside file ETF inflows, each and every breakout and correction remain that you just might imagine. Market participants are searching at to take a look at if LINK sustains its upward momentum or if profit-taking will power a correction ahead of contemporary highs.

The put up $41M Pours Into First LINK ETF: Will Chainlink Finally Atomize Its ATH? seemed first on BeInCrypto.