The cryptocurrency virtually crossed into $94K territory after a lackluster jobs sage nudged up the percentages of an hobby fee reduce by the Fed.

Bitcoin Climbs on Old Labor Records

Non-public employers reduce 32,000 jobs in November, in response to human resources company ADP in its most modern jobs sage, published Wednesday. Nonetheless as a replace of sending markets decrease, every bitcoin and shares rose on the data. Portion of the reason may perchance well well must cease with how weaker employment is anticipated to amplify the percentages of a fee reduce by the Federal Reserve next Wednesday.

Read extra: Irrational Pessimism: Maintain Bitcoin Patrons Long gone Furious?

The plunge in non-public jobs came as a shock to many. Economists had predicted an amplify of 40,000 positions. Nonetheless as a replace, ADP’s knowledge reveals diminutive agencies bled approximately 120,000 roles. Medium and gigantic employers added about 90,000 new workers but it completely wasn’t enough to make amends for the cuts by smaller companies.

“Hiring has been choppy of slack as employers weather cautious patrons and an unsure macroeconomic atmosphere,” mentioned Dr. Nela Richardson, ADP’s chief economist. “And while November’s slowdown turned into as soon as enormous-basically based, it turned into as soon as led by a pullback amongst diminutive agencies.”

The Federal Reserve has already indicated that comfy employment largely dictated its outdated two fee cuts. And now, with a shock plunge in non-public jobs, virtually all consultants agree that Fed Chairman Jerome Powell and team will all be on board to decrease the coverage fee by one other 25 basis components next week. The following soar in shares turned into as soon as expected, but bitcoin, which has been falling without reference to real or defective macroeconomic knowledge, moreover inched upward, main many to breathe a articulate of reduction.

There are, needless to impart, other reasons the cryptocurrency is experiencing distinct impress action. Investment company Charles Schwab, which manages roughly $10 trillion in client belongings, announced it will most likely perchance well presumably provide bitcoin and ether order trading one day one day of the first half of of 2026, in response to Forbes. The company published an tutorial video about investing in bitcoin on its web put earlier this day.

Forefront, which boasts bigger than $11 trillion in belongings under administration (AUM) will now enable crypto replace-traded funds (ETFs) on its platform. “This day, Forefront enables trading of opt third-occasion cryptocurrency ETFs and mutual funds thru a Forefront brokerage fable,” the company wrote in an respectable assertion on Monday. “Nonetheless we cease now not offer our appreciate crypto merchandise.”

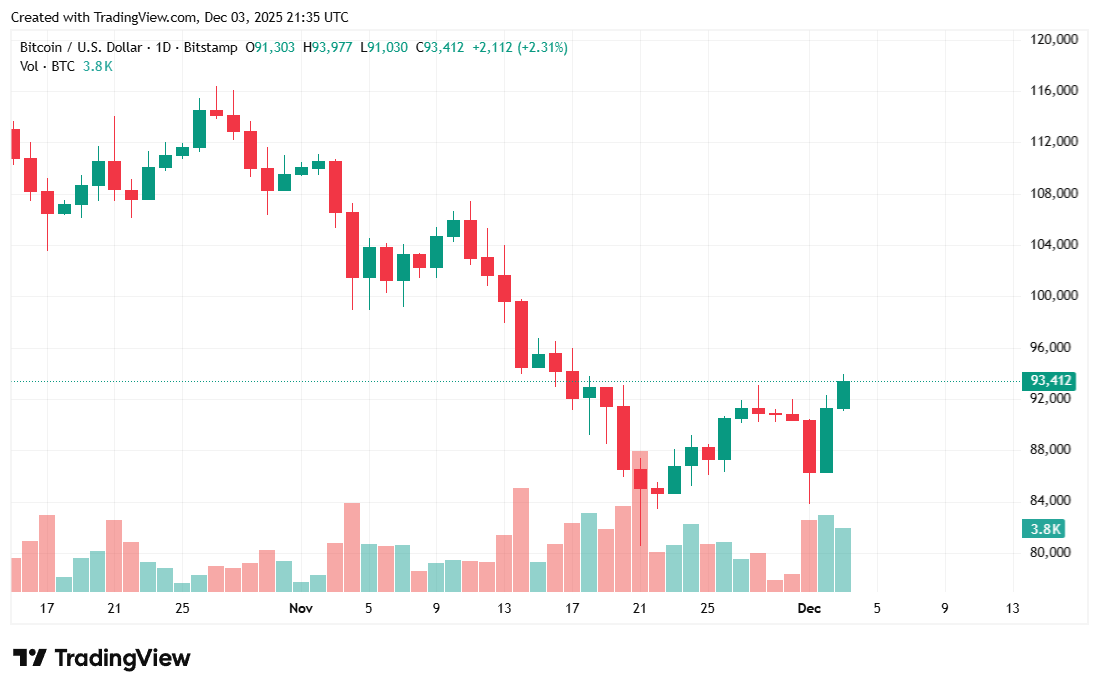

With all these tailwinds, a 2% soar in bitcoin’s impress shouldn’t be a shock, but given the carnage viewed all the arrangement in which thru the final few weeks, some traders salvage been expecting the sudden.

Overview of Market Metrics

Bitcoin turned into as soon as priced at $93,286.68 at the time of writing, up 1.98% for the day and 3.35% for the week, Coinmarketcap knowledge reveals. Imprint fluctuated in a rather slim fluctuate, between $91,056.39 and $93,965.10 over 24 hours.

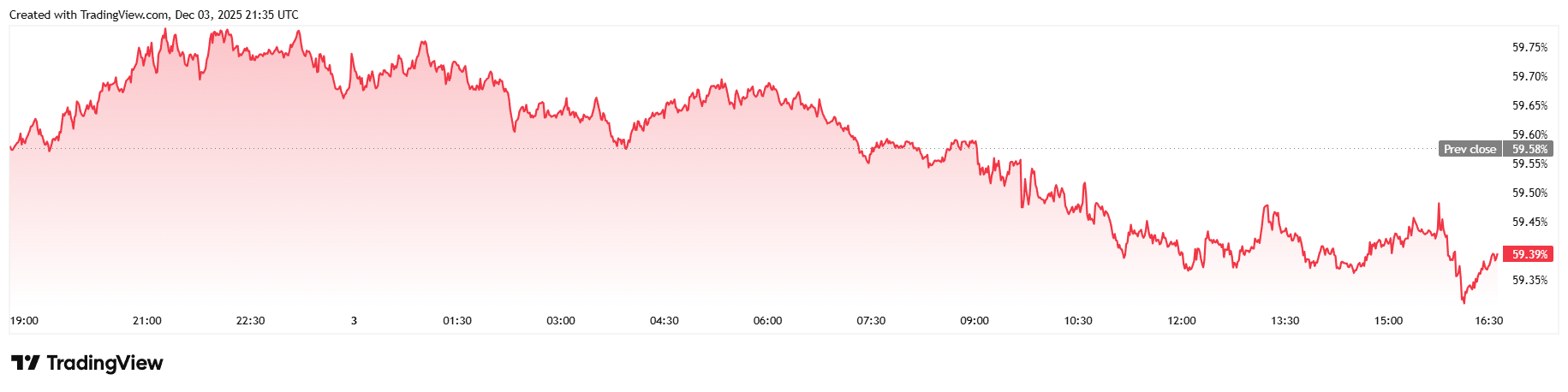

On a regular basis trading quantity turned into as soon as mostly stagnant since the day gone by, climbing a tiny by 2.52% to reach $76.77 billion. Market capitalization stood at $1.86 trillion and bitcoin dominance edged decrease, easing 0.28% to reach 59.40% at the time of reporting.

Total bitcoin futures open hobby climbed 1.55%, to reach $60.16 billion, in response to Coinglass knowledge. Liquidations fell by approximately 30%, totaling $132.59 million. Quick sellers led the losses to the tune of $92.47 million and bullish long traders lost roughly half of of that quantity, or about $40.13 million.

FAQ ⚡

- Why did bitcoin rise after the inclined jobs sage?

On fable of weaker labor knowledge boosted expectations of a Federal Reserve fee reduce, improving chance sentiment for belongings cherish bitcoin. - How did non-public employers make in the most modern ADP sage?

ADP reported a shock lack of 32,000 non-public-sector jobs, driven largely by steep cuts at diminutive agencies. - Why are analysts confident the Fed will reduce rates next week?

The sudden deterioration in employment aligns with instances the Fed has beforehand cited when justifying fee cuts. - What other catalysts helped blueprint conclude Bitcoin’s impress?

Bulletins from Charles Schwab and Forefront expanding access to bitcoin merchandise bolstered institutional strengthen and boosted investor self belief.