The elusive Altseason; a length of parabolic enhance for non-Bitcoin resources, has been successfully cancelled for the rest of 2025 by the U.S. industrial sector. New financial data launched Monday indicates that the macroeconomic liquidity required to fuel the kind of rally simply would not exist.

Analysts pointed to a combination of elements within the relieve of the promote-off: frequent designate reversion after months of beneficial properties, anecdote-breaking gold costs, a tranquil but traumatic stock market, and issues over the unlimited supply of competing crypto resources.

With all this volatility, experts maintain come up with an resolution as to why altseason 2025 has been delayed per the present financial data.

Linked: Bitcoin Slides Below Key Ranges as Brief-Term Holders Face Deep Losses

The Indicator That Predicted Every Old Altseason

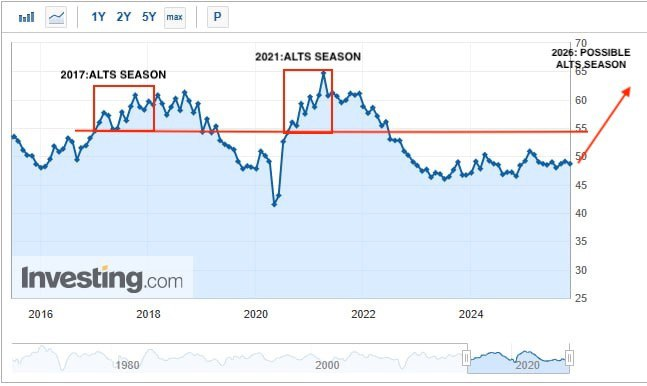

A brand current diagnosis exhibits the U.S. ISM Manufacturing PMI as one of doubtlessly the most respectable indicators of an upcoming altseason. The most contemporary finding out for November came in at Forty eight.2, undershooting expectations and confirming contraction within the manufacturing sector.

This resolve reflects responses from over 400 companies on the snarl of current orders, production job, hiring trends, inventory ranges and birth speeds. A finding out below 50 signals financial slowdown, and November’s number confirms that the U.S. industrial sector has yet to launch a first-rate restoration.

Why This Issues for Crypto

Historical data exhibits that altseasons tend to emerge handiest when the broader economy is expanding. In every 2017 and 2021, the ISM index was above 55 at the time altcoins began their greatest rallies.

This moreover explains why many altcoins continue to fight despite isolated rallies and low optimism on social platforms.

No matter the present weak point, predictions for 2026 encompass curiosity rate cuts, improved liquidity and a more supportive protection ambiance. These elements may per chance per chance per chance ceaselessly push the ISM index relieve in direction of growth territory.

Market Sentiment and Technical Outlook

The crypto neighborhood stays divided. Some investors criticize the behavior of labeling every minor jump as altseason, arguing that many tokens dropping more than 90% and doubling off the bottom would not qualify as staunch restoration.

Many money went below the bottom they made on the 10th of October.

I know calling for altseason from here is about a of us’s favorite thing because at closing a jump will happen.

If a token is 90% down and it pumps even 2x and you call it altseason, it is probably you’ll per chance per chance very properly be lawful fooling the…

— LA𝕏MAN (@Theblockvlog) December 2, 2025

Others convey altcoins were suppressed for too prolonged and that a first-rate rotation is inevitable.

Technical diagnosis exhibits Bitcoin dominance rejecting its 50-week interesting average, a pattern equal to the one considered earlier than the 2021 altseason. Analyst Michael van de Poppe says that early-month promote-offs may per chance per chance per chance very properly be share of a remaining shakeout segment earlier than a rebound.

He wrote, “The upcoming month may per chance be no completely different, with a ramification of macroeconomic events coming up that are going to persuade the path of the markets. Overall, my interior most belief is that we’re going to trot up in preference to down with $BTC and $ETH.”

Linked: Right here’s the Most main Reason Bitcoin Dipped 5% to $85,000 on December 1

Disclaimer: The certainty equipped listed here is for informational and academic capabilities handiest. The article would not constitute financial advice or advice of any kind. Coin Edition isn’t in charge of any losses incurred as a results of the utilization of negate material, merchandise, or companies and products talked about. Readers are steered to snort caution earlier than taking any action related to the corporate.