Treasured metals rally to multi-week and all-time highs as Fed easing expectations climb, but crypto markets portray a varied memoir amid ETF outflows and macro headwinds.

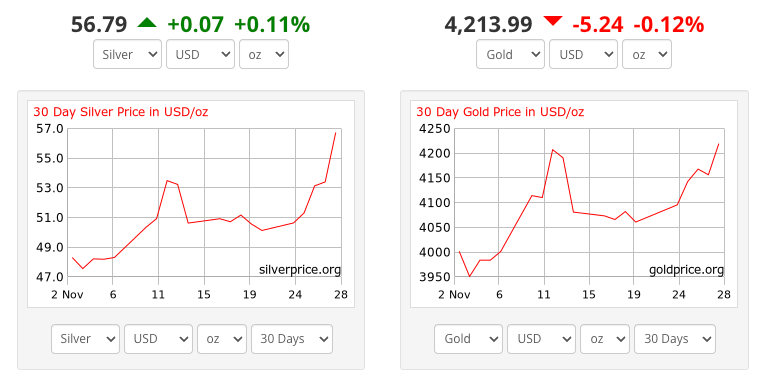

Gold prices touched a six-week high on Monday while silver struck a document, buoyed by rising expectations of US pastime rate cuts and a weakening greenback.

Silver Shines on Provide Squeeze

Space gold climbed to $4,241 per ounce, its perfect level since unhurried October, while silver soared to a document $58.83 earlier than taking flight somewhat. The white metal has extra than doubled in rate this twelve months, a ways outpacing gold’s spectacular 60% beget.

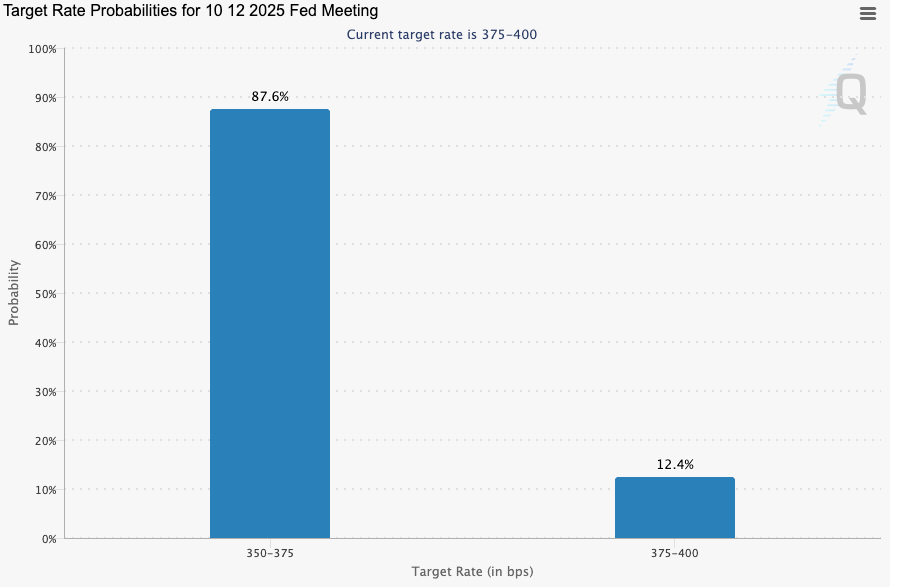

The predominant driver in the aid of this rally is rising expectations for Federal Reserve rate cuts. In accordance to CME FedWatch data, merchants are indubitably pricing in an 87.6% likelihood of a 25-basis-level rate minimize at the Federal Reserve’s December 10 assembly, with most productive a 12.4% likelihood of charges remaining unchanged.

Previous monetary policy expectations, silver is making the most of acute provide constraints. A historical squeeze in London at some level of October drew document portions of the metal into the procuring and selling hub, ensuing from this truth draining inventories in other places. Shanghai Futures Substitute-linked warehouses only in the near past hit their lowest levels in nearly a decade, while one-month borrowing charges for silver remain elevated.

The greenback’s hasten to a two-week low has further enhanced the allure of precious metals for holders of other currencies. Dovish remarks from Fed officers, alongside with Governor Christopher Waller and Novel York Fed President John Williams, personal bolstered expectations for endured monetary easing.

Bitcoin Bucks the Pattern

But Bitcoin, on the total touted as “digital gold,” has moved in the reverse route. The main cryptocurrency plunged to around $86,000, down roughly 30% from its October all-time high come $126,000.

Several factors display this divergence. US-listed Bitcoin ETFs recorded approximately $3.4 billion in accumulate outflows in November, reversing earlier inflows. A $9 million Yearn Finance hack on December 1 rattled DeFi sentiment, while Bank of Japan Governor Kazuo Ueda’s hints at a skill rate hike sparked fears of global carry alternate unwinding. Additionally, over $1 billion in leveraged crypto positions were liquidated at some level of the most modern selloff.

Other folks that talked about that the bitcoin chart will practice gold in due route.

sorry, it sounds as if it’s no longer as anticipated 😬 pic.twitter.com/7ai1FnNq3e

— DOMBA.eth 🐺 (@DombaEth27) December 1, 2025

Even although gold, silver, and Bitcoin are all non-yielding resources, precious metals are making the most of self sustaining bullish drivers—namely, physical provide shortages. Bitcoin, in inequity, stays a ways extra soft to ETF fund flows and leverage liquidations.

Whereas rate-minimize expectations desires to be favorable for Bitcoin over the medium to long length of time, rapid headwinds are for the time being exerting increased impression.