Constant with market observers, this week could well well most certainly price a turning point for XRP as 5 location ETFs exchange at the the same time for the predominant full week. 21Shares’ XRP fund (TOXR) launched recently, becoming a member of Bitwise, Grayscale, Franklin Templeton and Canary Capital. Experiences bask in disclosed that ETF inflows bask in already topped Over $660 million in lower than a month, with zero outflows across 10 consecutive trading days.

5 ETFs Alternate Collectively

Bitwise lately elevated its XRP holdings to 80 million tokens. ETF managers now preserve bigger than $687 million in resources, which represents correct over 300 million XRP on file. 21Shares debuted with a $500,000 seed basket and costs a 0.50% management rate. Based mostly totally totally on reviews, competition amongst issuers will demonstrate how aggressively these funds notion to preserve procuring for over the long flee.

Question Model

A effect-route sensitivity simulation flee by Mohamed Bangura turned into as soon as shared by analysts and taken up by commentators. The model archaic a baseline ETF query of 74.5 million XRP per day, total exchange present of two.7 billion XRP, and an escrow open of 300 million XRP every 30 days.

Subsequent week is a gigantic milestone for XRP.

We are able to bask in the predominant full week of trading with 5 pure location ETF’s operating in competition.

It’s going to issue us ALOT by the stop of week what we’re going to quiz for these funds buying XRP for the long flee. https://t.co/S3TENqa4PP pic.twitter.com/LQ48QLKcgh

— Chad Steingraber (@ChadSteingraber) November 30, 2025

Elasticity values of 0.2, 0.5 and 1.0 had been tested over 180 days. The outcomes showed that low elasticity can quickly drain exchange-held present, whereas bigger elasticity could well well most certainly make sharper effect spikes as OTC liquidity absorbs flows. That end result has many traders staring at liquidity statistics carefully.

Liquidity Strain Builds

Jake Claver, CEO of Digital Ascension Neighborhood, warned that non-public OTC and darkish-pool channels will seemingly be operating thin. He estimated that about 800 million XRP of private liquidity turned into as soon as absorbed within the predominant week of ETF accumulation.

Because of much ETF procuring for happens off-exchange, effect action has no longer but matched the tightening present, and markets could well well most certainly honest seek for extra abrupt strikes when funds are forced to source money from public exchanges.

Whales Reshuffle Balances

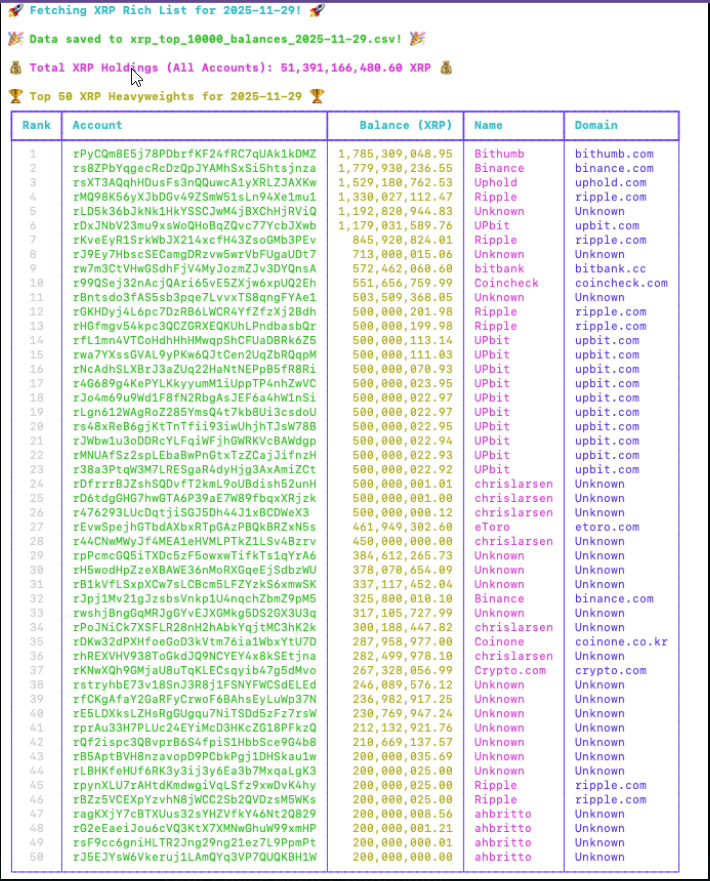

Meanwhile, reviews bask in disclosed adjustments amongst immense holders. The highest 10,000 wallets now preserve 51.39 billion XRP, or about 85% of circulating present. In a single day, 78 fresh wallets took in 77.324 million XRP. One wallet reportedly soundless 35 million XRP, but every other grabbed 3.63 million, and six wallets added 1.ninety nine million each and every.

🚀 XRP RICH LIST SHOCKWAVE (11/29/2025) 🐳

Recent records presentations the highest 10,000 wallets now regulate 51.39B+ XRP, and recently’s ledger project screams fresh whales + stealth accumulation.

78 fresh accounts grabbed 77M+ XRP in a single day.246 existing wallets elevated balances by but every other… pic.twitter.com/wpXZMJUQpI

— XRP 🅧 Army | Chacha72kobe4er (@Mullen_Army) November 30, 2025

As much as 44 fresh wallets had been reported to bask in accumulated over 300 million XRP each and every, whereas 246 existing wallets elevated their blended balance by 17.91 million XRP. These strikes demonstrate aloof accumulation one day of fresh market weak spot.

What Comes Subsequent

Analysts yelp the present setup is a take a look at of liquidity bigger than a straightforward query yarn. ETF holdings of roughly 300 million XRP are grand but aloof dinky when put next with skill everyday query if inflows stop high and extra funds open.

If OTC channels dry up and ETFs must buy on exchanges, volatility could well well most certainly upward thrust quickly. Merchants and portfolio managers will be staring at show books, OTC reviews and ETF filings within the approaching days to undercover agent how the provide list adjustments in observe.

Featured image from Procuring and selling News, chart from TradingView