HBAR ticket is down about 6% within the previous 24 hours, underperforming an already feeble crypto market. Even with this stress, the chart is flashing a uncommon mix of three early rebound clues that nearly all mid-caps will now not be displaying moral now.

If the broader market steadies, HBAR will be with out a doubt one of many main to toddle, particularly if it protects a key toughen stage discussed later.

Accumulation Signs Assemble Beneath the Decline

HBAR has moved within a tall falling wedge since early September. This pattern typically turns bullish when sellers lose control plot the decrease boundary, and that shift first regarded spherical November 21.

The first clue comes from the changing quantity behavior. HBAR’s process follows a Wyckoff-vogue color pattern: purple shows sellers up to speed, yellow shows sellers gaining control, blue marks traders gaining control, and inexperienced shows traders fully up to speed.

Since HBAR peaked at $0.155 on November 23 and fell virtually 15%, the bars receive shifted from heavy purple to a blend of yellow and blue. That blend is a conventional ticket of vendor exhaustion and early tug-of-battle. The final time this combination showed up — between October 15 and October 28 — HBAR climbed 41% moral after.

Desire extra token insights love this? Be a a part of Editor Harsh Notariya’s Day-to-day Crypto Newsletter right here.

A 2d clue looks within the MFI (Money Float Index), which tracks looking out to search out and promoting stress using both ticket and quantity. Between November 23 and December 1, the HBAR ticket kept making decrease highs whereas MFI made bigger highs. That divergence shows dips are being quietly sold. An identical divergence fashioned between October 6 and October 24 and ended in a 33% jump once it done.

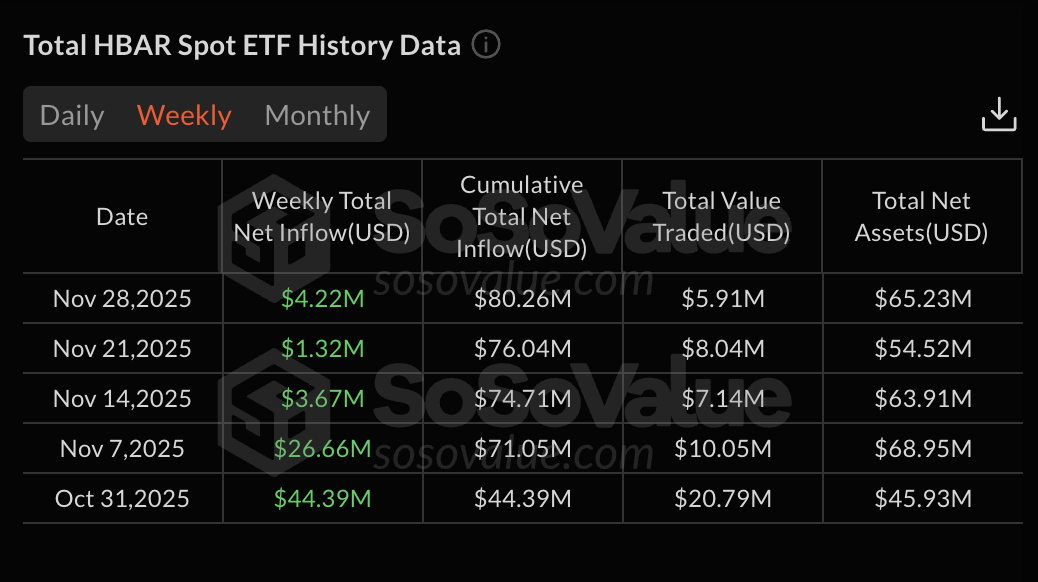

The third clue comes from neatly-liked predicament ETF search files from. The Canary HBAR Plot ETF has posted definite weekly inflows in four of the final five weeks, with bigger than $80 million in cumulative inflows. Inflows are smaller than gradual October, but they remain definite at the same time as ticket falls — which intention broader search files from has now not vanished.

Together, these three clues — consuming quantity control, dip-looking out to search out stress, and ongoing ETF inflows — conceal early accumulation forming under the ground.

Key HBAR Worth Phases Deem Whether or now not the Rebound Can Withhold

The wedge’s decrease boundary plot $0.122 is the superb toughen for HBAR moral now. Maintaining that predicament keeps the rebound case alive. Dropping it exposes the next main zone plot $0.079, which could per chance well flip the structure from “early accumulation” to a deeper chase.

For strength, HBAR must reclaim $0.140 first, a 5% rebound from the latest stage. That will per chance well conceal that traders are lastly overpowering the promote-side stress. If $0.140 breaks, the next main stage sits at $0.155. Clearing $0.155 opens the trudge toward $0.169 and even $0.182 if the crypto market improves.

The put up HBAR Drops 6% as Market Weakens, Yet 3 Early Rebound Clues Seem regarded first on BeInCrypto.