A crypto market bull flee might well very well be on the system as Bitcoin and most altcoins proceed their uptrend this day, Nov. 27.

- A crypto bull flee might well be about to initiate within the impending weeks or months.

- The Federal Reserve will likely hang a dovish tone in 2026.

- There are indicators that the futures begin ardour retreat is nearing its ending.

Bitcoin (BTC) model held valid, reaching a high of $91,345, its top likely level since Nov. 20, and ~14% above the lowest level this month. Completely different altcoins, comparable to Ethereum (ETH) and Toddle (DASH), had been also rising. Listed below are the tip the clarification why a brand new crypto market rally might well very well be starting.

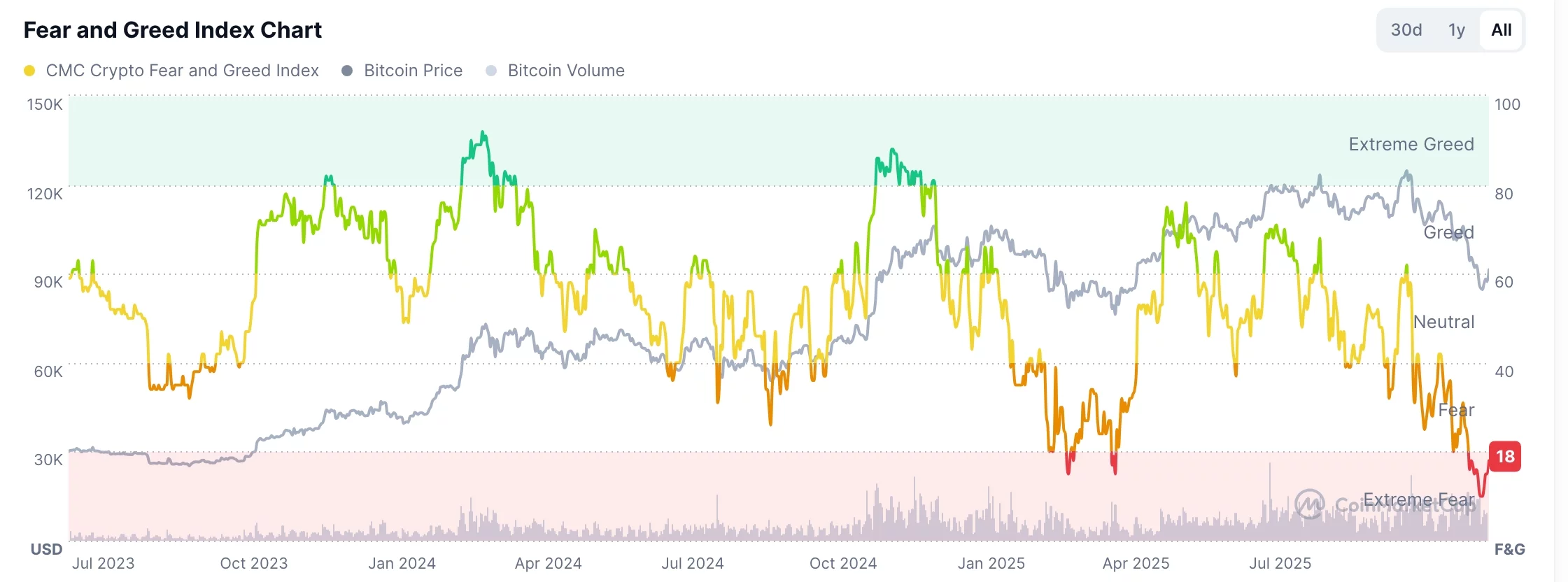

Concern and Greed Index rises

One key the clarification why the crypto bull flee might well very well be all the device via the nook is that the Concern and Greed Index has likely bottomed. It dropped to eight on Saturday and has since rebounded to 18.

A nearer survey at the chart below reveals that practically all crypto market rallies initiate up in sessions of panic. A factual example of here’s the panic that unfold via the market after President Trump announced his reciprocal tariffs in April.

These tariffs had been a dim swan occasion that resulted in a major panic amongst stock and crypto market merchants, pushing the Concern and Greed Index to 17. The coin then rebounded and moved to a yarn high a month later.

Wall Boulevard analysts are bullish

One other build that a crypto market rally is able to happen is that top Wall Boulevard analysts are extremely bullish on the stock market.

In a degree to on Wednesday, analysts at JPMorgan Private Bank boosted their S&P 500 Index forecast. They now effect a question to that the index will soar by 20% by 2027.

Completely different Wall Boulevard analysts from corporations esteem ING, Bank of The united states, Morgan Stanley, and Deutsche Bank are also optimistic referring to the stock market.

A stable stock market bull flee will likely spill over into the crypto business, as both are assuredly categorized as unhealthy sources.

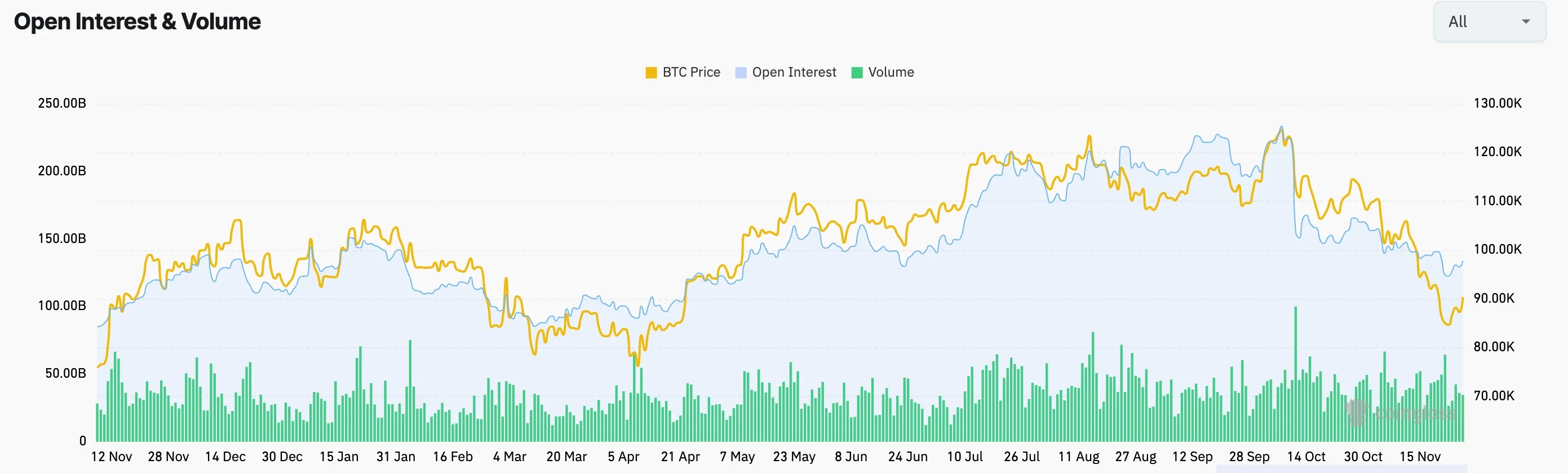

Futures begin ardour might well perhaps bottom

One other attainable build that a crypto market rally is able to happen is that futures begin ardour have plunged within the previous few weeks. This atomize is now about to pause, a disappear that might boost crypto costs when it begins to rise.

One motive at the aid of here’s, because the chart below reveals, is that the ardour continuously rebounds after falling. To illustrate, it dropped from $141 billion in December final yr to $92 billion in March after which rebounded to over $225 billion in October.

Federal Reserve ardour payment cuts

Within the period in-between, the crypto market bull flee is assuredly boosted by the Federal Reserve, which is expected to lift a extremely dovish tone within the impending yr.

Polymarket odds of a payment minimize in December have soared to 84%, whereas President Trump is furious by Kevin Hassett because the subsequent Federal Reserve chair. Odds of Hassett becoming the chair have jumped within the previous few days.

Hassett, not like Jerome Powell, is extra aligned with Trump and has expressed hopes that the monetary institution must minimize ardour charges powerful extra. As such, it is potentially no longer a shock if charges disappear from the sizzling 3.75% to 1%. This explains why US bond yields have dropped no longer too long within the past.