Santiago Roel Santos, founder and CEO of crypto funding firm Inversion Capital, acknowledged cryptocurrencies are no longer field to optimistic network effects, but other consultants disagree.

In a fresh Substack publish, Santos wrote that “crypto is priced for network effects it doesn’t have.” He also pointed to the network end valuation machine, Metcalfe’s Law, announcing that it “doesn’t elaborate crypto’s valuation” and as an substitute “exposes it.”

Santos claimed that loads of crypto’s network effects are detrimental, as a result of congestion, fair like elevated charges, a worse user experience, and slower transactions. “Facebook didn’t receive worse when it added 10 million users,“ he acknowledged.

Rather a couple of consultants push motivate

Some analysts agree that crypto could simply be overrated, but others affirm Santos is applying the inappropriate framework.

Santos admitted that new blockchains improved transaction throughput, but he claimed that this results in decrease friction, no longer compounding price. Peaceful, he acknowledged that liquidity, developers and users can circulate whereas code would possibly also be forked, and price take dangle of is old sort.

Linked: DeFi is already 30% of strategies to mass adoption: Chainlink founder

Jasper De Maere, desk strategist at main crypto market maker Wintermute, instructed Cointelegraph that deeming layer 1 blockchains overrated as a result of detrimental network effects is “applying user-app good judgment to infrastructure,” increasing on the Facebook instance.

“Facebook’s motivate-discontinue also had congestion and outages early on; these detrimental effects were simply internalized and abstracted.“

De Maere acknowledged that “users are no longer speculated to have interplay with L1s straight,” making monthly active users and user stickiness inappropriate. In accordance with him, “the real network effects for an L1 exist on the validator, safety and liquidity layer, no longer the discontinue-user layer, and that’s the keep compounding surely happens.”

Tomas Fanta, main on the crypto funding company Heartcore, acknowledged he disagrees with Santiago that charges irritate as utilization grows. He acknowledged that on high-efficiency blockchains, “the charges switch from meaningless to meaningless,” and that liquidity improves and yields enlarge as adoption increases.

Ben Harvey, digital asset researcher at crypto shopping and selling firm Keyrock, instructed Cointelegraph that he largely is of the same opinion with Santos’ claim that L1 blockchains are overrated. Peaceful, he does not be pleased this applies to all L1s equally, with protocol scalability and man made intelligence integration being key components.

Linked: Blockchain is struggling to lift on to its customary reason: Aztec co-founder

Analysts debate crypto valuation good judgment

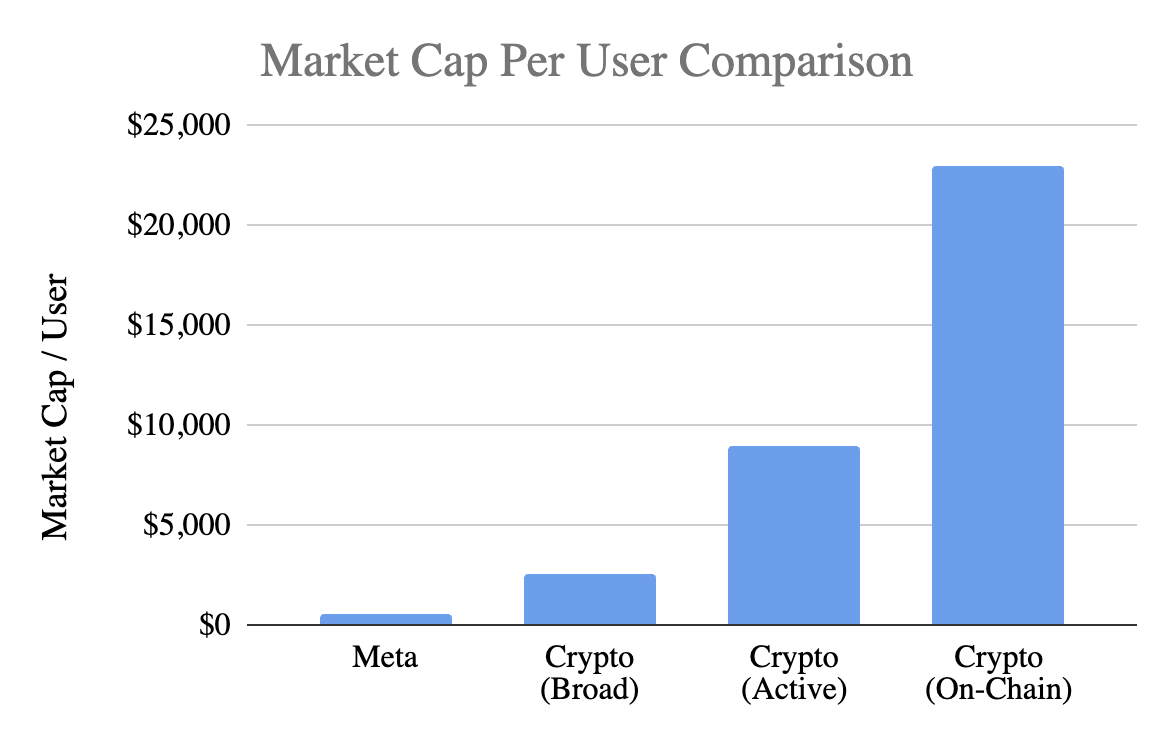

Santos pointed to a few of tough mathematical estimates of the price an onchain user holds for a blockchain. Pondering the fresh total crypto market cap except Bitcoin (BTC), of $1.26 trillion, this would mark the 40–70 million monthly active users estimated by endeavor capital firm Andreessen Horowitz closing month at $18,000 to $31,500 every.

The an identical tale estimates that 716 million of us possess crypto. This could lead to a per-user price estimate of shut to $1,760, nevertheless it is an overcount because Bitcoin will not be any longer excluded. With Santos’ estimated 400 million users, the price would be $3,150 per user.

With Facebook’s 3.1 billion monthly active users and Meta’s market cap of $1.6 trillion, we receive a per-user valuation of $516. Furthermore, Meta also runs other platforms and services and products besides to Facebook which could possibly be priced in.

Martin Kupka, a mature investor at Web3 funding company RockawayX, instructed Cointelegraph that crypto “network effects on the present time are in stablecoins, centralized exchanges and perpetual future decentralized exchanges.” He defined that “the more precious it is as a medium of switch and collateral, the more traders a CEX or perpetual venue has, the deeper the liquidity and better the execution.”

Wintermute’s De Maere acknowledged that “Web3 is modular and that makes the underlying network effects a lot more straightforward to demand” when compared to Web2. He defined that these effects usually emerge right by La safety and validator concentration, in stablecoins as liquidity, and in decentralized and centralized exchanges, as smartly as in the applying layer the keep users combination.

“Because these layers are separable in preference to bundled, you can clearly survey the keep compounding happens,” De Maere acknowledged. “That’s why, in accordance to historical metrics admire ARPU […] they’ll demand overrated,” he added. The hot deliver of crypto valuation resembles when “we were struggling to value Web2 platforms […] and created particular devices to end so,” he acknowledged.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Categorical