Welcome to the institutional newsletter, Crypto Lengthy & Brief. This week:

- Insights on DeFi sector growth in 2026 by Martin Gaspar of FalconX

- Top headlines institutions would possibly per chance per chance per chance also fair still be taught by Francisco Memoria

- Analysis on investor sentiment from the relentless sell-off by Andy Baehr

- “Altcoins vs BTC performance” in Chart of the Week

-Alexandra Levis

Expert Insights

The Striking Dichotomy in DeFi Tokens Put up 10/10

– By Martin Gaspar, senior crypto be taught affiliate, FalconX

The October 10th shatter continues to reverberate in the crypto market with broader softness across sectors. It’s particularly indispensable in DeFi, the lifeblood of on-chain exercise nowadays, and the one sector that generates the bulk of crypto token earnings.

Let’s rob a immediate peek of the place we are. Of a subsect of 23 main DeFi names across the decentralized exchange (DEX), lending and yield verticals, handiest 2 are sure YTD as of November 20, 2025. QTD, the community is -37% on moderate, highlighting the harm this extended selloff has completed. But the blended tag walk unearths some nuances.

1) Merchants seem to be opting for safer (‘buyback’) names or allocating to names with fundamental catalysts. On the buyback aspect, names fancy HYPE (-16% QTD) and CAKE (-12%) posted just a few of essentially the most straightforward returns for larger market cap names in the cohort, indicating traders can be allocating to them or that their tag has been supported by their colossal buybacks. Meanwhile, MORPHO (-1%) and SYRUP (-13%) every outperformed their lending peers on idiosyncratic catalysts, much like minimal impact from the Circulation finance give method or seeing growth someplace else.

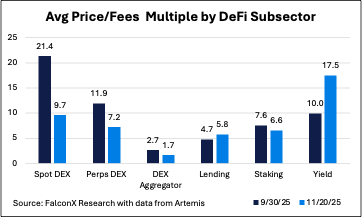

2) Particular DeFi subsectors grasp change into extra pricey, whereas some grasp cheapened relative to Sept 30, underscoring the altering landscape put up the October 10 shatter. Space and Perp DEXes grasp seen declining P/S multiples as their tag has declined sooner than protocol exercise. Finally, some DEXes much like CRV, RUNE and CAKE grasp posted increased 30D prices as of Nov 20 when put next to Sep 30. We’re seeing identical trends across perp DEXes with HYPE and DYDX multiples compressing sooner than declines in their price skills.

3) Lending and yield names grasp broadly steepened on a multiples foundation, as tag has declined seriously lower than prices. Shall we embrace, KMNO’s market cap fell 13% over this length, whereas prices declined 34%, primarily based on recordsdata from Artemis. One more factor can be that traders are crowding lending names in the selloff, interested by lending and yield-linked exercise is in general seen as stickier than buying and selling exercise in a downturn. Lending exercise would possibly per chance per chance per chance also fair even gain as traders exit to stablecoins and examine yield alternatives.

This positioning would possibly per chance per chance per chance also fair rep the place traders rep the DeFi sector will look growth in 2026. On the DEX entrance, QTD performance suggests traders search recordsdata from perps to proceed to handbook, and HYPE’s relative outperformance would possibly per chance per chance per chance also fair gift investor optimism round its ‘perps on the leisure’ HIP-3 markets, which would per chance be seeing their perfect volumes as of Nov 20. On the replace hand, essentially the most convenient crypto buying and selling category seeing file volumes no longer too long previously are prediction markets. Therefore, the cheapening in the DEX sector can be warranted on lower growth expectations. On the lending aspect, traders can be taking a look for to extra fintech integrations to pressure growth. AAVE’s upcoming excessive-yield savings fable and MORPHO’s enlargement of its Coinbase integration are fresh examples of this pattern.

Total, these trends show doubtless alternatives from dislocations in the wake of 10/10. This would per chance per chance also additionally be attention-grabbing to search if the adjustments tag the starting up place of a broader shift in DeFi valuations or if these will revert over time.

Headlines of the Week

Francisco Rodrigues

This week’s crypto market shatter despatched conflicting signals on the institutional aspect, as ancient ETF outflows and declining stablecoin liquidity indicated non permanent capital flight. No topic the threat-off sentiment, sovereign and company conviction hardened.

- BlackRock Takes First Step In direction of a Staked Ether ETF: BlackRock registered the iShares Staked Ethereum Belief in Delaware this week, signaling plans for a yield-generating ether ETF that can stake the underlying asset to reduction stable the community.

- ETF Outflows, Stablecoin Flows and DAT Reversals Signal Crypto Capital Flight: Space Bitcoin ETFs recorded $3.Seventy nine billion in win outflows in November by November 21, the supreme since February’s $3.56B, driven by $900M+ single-day exits on November 20.

- El Salvador Buys 1,090 BTC as Prices Descend and IMF Stress Mounts El Salvador took advantage of the crypto market drawdown and purchased 1,090 BTC at ~$90,000 every, boosting its holdings to merely about 7,500 BTC despite a $1.4B IMF deal discouraging public-sector crypto buys.

- Mastercard Picks Polygon to Bring Verified Usernames to Self-Custody Wallets: Mastercard expanded its Crypto Credential machine to self-custody wallets, the utilization of Polygon’s blockchain for human-readable aliases tied to KYC-verified identities.

- Metaplanet Unveils Novel Bitcoin Backed Capital Building with $150M Perpetual Most in model Offering: Japanese company Metaplanet unveiled this week a two tier most in model half structure.

Vibe Ascertain

More sellers than consumers

– By Andy Baehr, CFA, head of product and be taught, CoinDesk Indices

Bitcoin has misplaced a third in seven weeks, and folks need solutions. The prevailing sentiments among the podcasts, Substack articles, newsletters and socials are:

1. The most fresh leg down caught many of us off guard.

2. There are tons of technical explanations: ETF outflows, DATs < mNAV, 10/10 harm, retail centered someplace else and finish of the "cycle."

3. There are tons of macro explanations: Fed price lower likelihood decreasing, lingering harm from the federal government shutdown and the Readability Act extend.

4. Hello, right here’s crypto, it attracts down by 1/3 most continuously.

5. Sentiment is max detrimental.

6. Presumably environment up for a rally, however per chance no longer in time to assign 2025.

The crowd seems to grasp navigated the 5 stages of bother and emerged humble and sanguine. (A nagging search recordsdata from: used to be there sufficient bother, or is this some other erroneous backside? Did capitulation happen?)

The humility, particularly, used to be most welcome, and most productive captured in Eric Peters’s excellent “wknd notes.” With a wink, he alludes to essentially the most vacuous be pleased of market commentary, “There are extra sellers than consumers.”

“..what we mean after we insist that markets transfer because there are extra consumers than sellers is that once prices begin to actually transfer, it’s good sufficient to no longer sign why. We insist this to remind ourselves that the leisure can happen. It’s a protective mechanism.”

He reminds us that humility isn’t very any longer handiest a virtue, however major for survival:

“Merchants who blow up and lose every little thing are inclined to rep that they know precisely why a market ought to be tantalizing. They’d per chance per chance per chance also fair rep it would possibly per chance per chance per chance also fair still transfer increased, and to find stubbornly longer, leveraging up even as it moves lower, and lower and lower. Or vice versa. The survivors on this game grasp watched sufficient folks kill themselves in the form of design that we select to accept the wisdom of markets. We be taught that once prices fall even as most traders/traders rep they’d per chance per chance per chance also fair still rise, there desires to be a cause. We fair don’t comprehend it but. In the slay, we can.”

One supervisor’s glance

It be all smartly and radiant to be humble and sanguine, however need to you would possibly per chance per chance per chance be working two hedge funds, you additionally need to invent choices. On Friday, I introduced Chris Sullivan from Hyperion Decimus on for a CoinDesk Markets Outlook place of residing. (Disclosure: Hyperion Decimus is a consumer of CoinDesk Indices.)

We agreed (every being derivatives folks) that market volatility, whereas anxiogenic, can additionally be exhilarating. A roller coaster. Chris sees a V-fashioned match ahead, declaring that it is a ways (or will quickly be) time to “feast on alarm.” We additionally agreed that seeing extra developed place skew in bitcoin in the last few weeks used to be a healthy label that the market is maturing (i.e., that fresh downside hedging resembles extra obsolete asset classes). Two extra observations: 1) colossal wallets that can grasp sold above 100k seem like attempting to search out reduction 20% lower and just a few) pattern signals grasp allowed his funds to step out of the manner weeks previously and grasp tons of dry powder.

Pattern has been a radiant most attention-grabbing friend in 2025

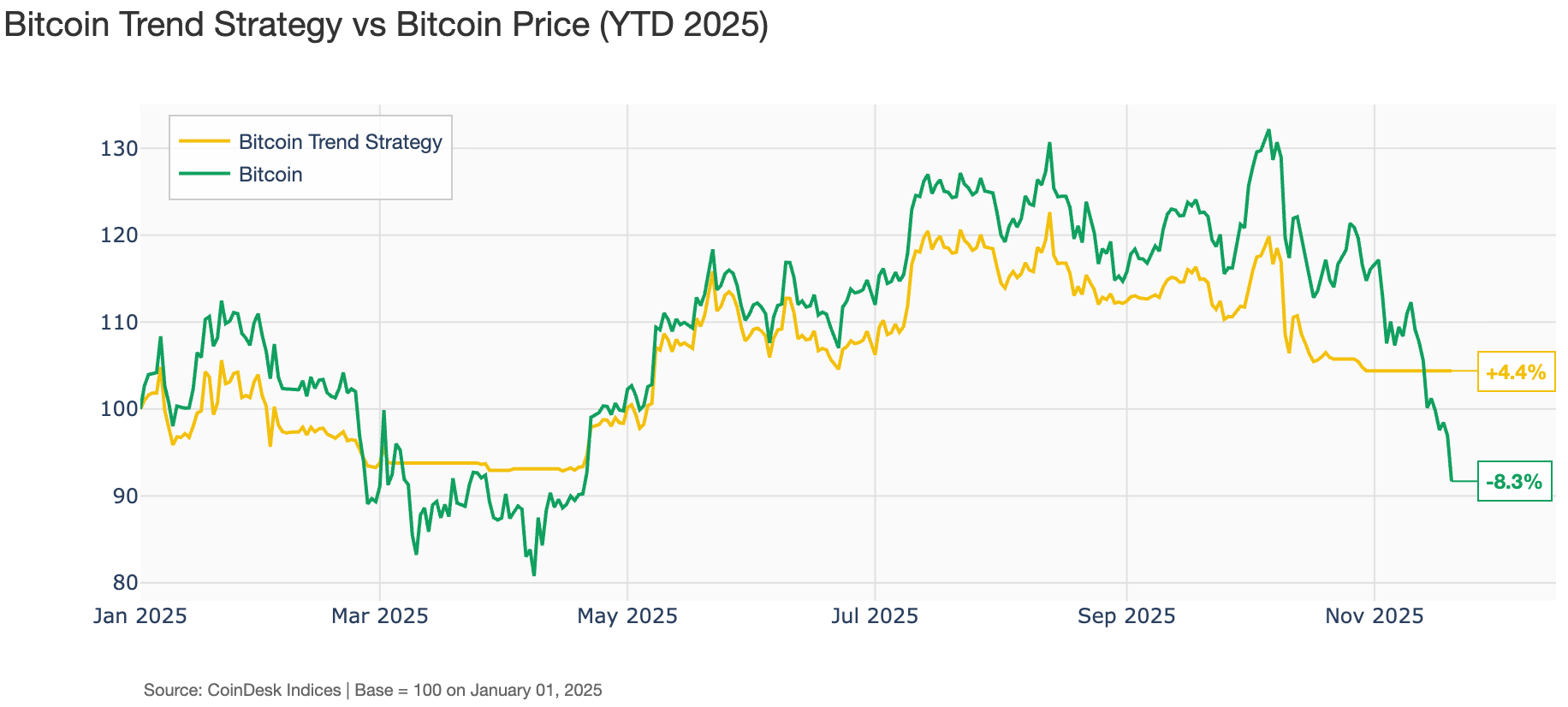

Talking of pattern, it is a ways turning out to be a savior of 2025 performance. Our Bitcoin Pattern Indicator (BTI), launched in March 2023, makes utilize of a quartet of tantalizing moderate crossover signals to level the presence and power of pattern in the tag of bitcoin. It has indicated “Critical Downtrend” for 24 days. Our purchasers grasp implemented just a few options in step with BTI to allocate to — and away — from bitcoin. The YTD performance of one in all these seems below.

As extra and extra traders and advisors undertake bitcoin and crypto into long-term portfolios, a pattern overlay can reduction “relaxed the poke” and shield folks in the game. It be particularly pertinent now, as issues that self-gratifying “finish-of-cycle” behavior weigh on bitcoin’s tag.

Chart of the Week

Altcoins vs BTC performance

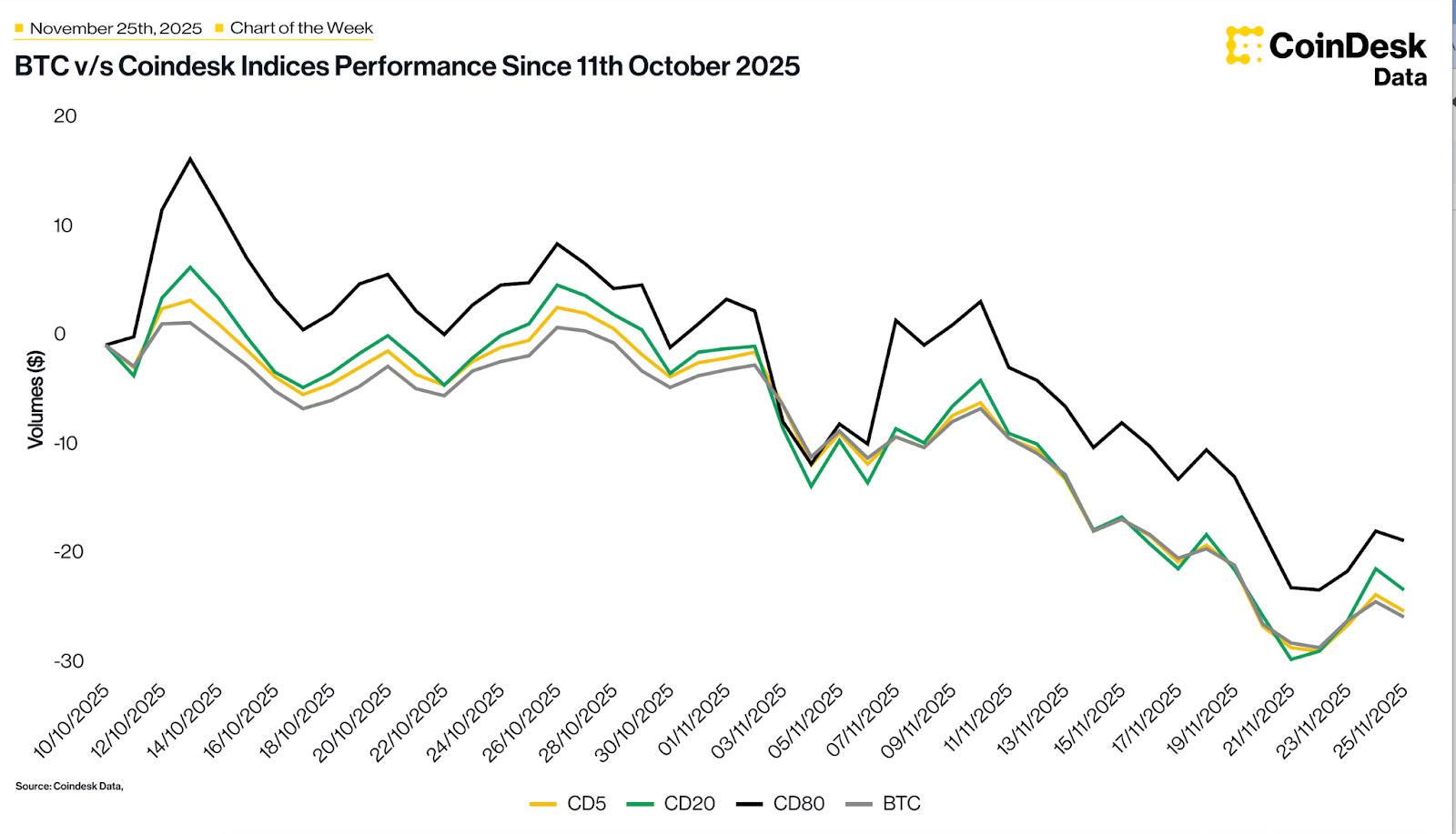

No topic the total downtrend put up essentially the basic October 10 drop, altcoins – proxied by the CoinDesk 80 Index (CD80) – grasp principally conducted primarily based on, and even higher than, BTC, with market benchmarks CoinDesk 5 Index (CD5) and CoinDesk 20 Index (CD20) showing relative outperformance. Right here’s surprising because altcoins in most cases repeat increased beta all the method by a market drop, suggesting that the sizzling selling stress can be extra BTC-centric, or that altcoin selling has already been seriously exhausted.

Hear. Read. Check. Have interaction.

- Hear: Does The Draw forward for Crypto ETPs Belong to Altcoins? Canary Capital CEO, Steven McClurg joins CoinDesk Recordsdata & Indices President, David LaValle to focus on about.

- Read: Digital asset adoption in APAC is exponentially outpacing global rates.

- Check: The fresh crypto market drawdown with Chris Sullivan of Hyperion Decimus.

- Have interaction: Don’t proceed away out THE institutional summit of the yr. Consensus and SALT are teaming up to impart collectively Asia’s high allocators and asset managers.

Shopping for added? Catch the most modern crypto recordsdata from coindesk.com and market updates from coindesk.com/indices.

Cloak: The views expressed on this column are these of the creator and attain no longer necessarily rep these of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.