Crypto Daybook Americas aren’t published tomorrow owing to Thanksgiving. This could occasionally return on Friday.

By Omkar Godbole (All times ET unless indicated otherwise)

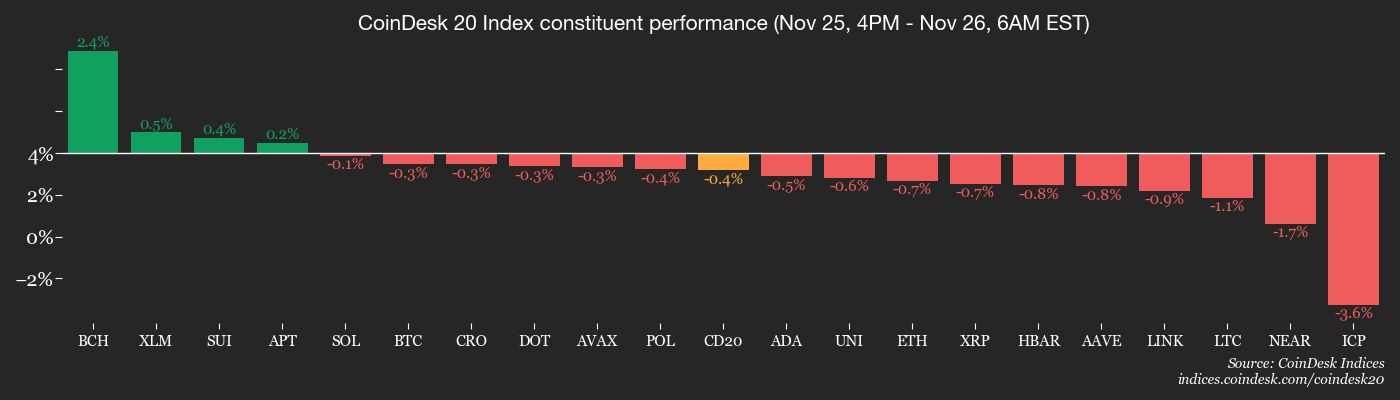

The crypto market hit “snooze” over the final 24 hours. Bitcoin BTC$87,830.49 shuffled aimlessly between $86,000 and $88,000 and the CoinDesk 20 Index (C20) barely budged. Meanwhile, the CoinDesk 80 Index managed a modest flex with a 1% occupy, indicating pockets of strength within the broader altcoin market.

Zooming out, the image appears to be like to be even extra lackluster. Bitcoin is down 7% yr-to-date, whereas the U.S. 10-yr Treasury repeat, that unexciting, mounted-income instrument is up 2.5%.

What this means is that parking your cash in dreary former bonds would had been the smarter switch this yr. And that’s the reason despite truckloads of BTC shopping for by digital asset treasuries. Sorry, maximalists.

From a macro perspective, the outperformance of the ten-yr bond, a perennial secure haven, rings fear bells for diverse wretchedness sources, including stocks. This performs proper into the theme we mentioned final week: Institutional outflows from the region bitcoin ETFs is more doubtless to be the smoke sooner than the anticipated macro firestorm.

Definite, the script would perhaps well additionally commerce sooner than the yr-cease, particularly if the Federal Reserve delivers an outright dovish message with the anticipated 25 foundation level rate gash early subsequent month, sending the Dollar Index (DXY) decrease. For now, on the replacement hand, the index is having a be taught about to place a foothold above its 200-day easy intriguing sensible (SMA), unfazed by the dovish Fed hopes.

Or no longer it’s no longer as despite the indisputable truth that alternate suggestions flows are offering any directional readability.

Early this week, we seen a spike in hedging teach around the $80,000 bitcoin assign, followed by hefty block commerce hinting at a that potentialities are you’ll well perhaps factor in differ reboot above $100,000 by yr-cease. On Tuesday, a wild $220,000 name aquire gave the affect bullish at the starting up, but it used to be paired with a $40K name aquire, signaling the trader’s proper wager is on volatility fireworks, Greeks.Are living told CoinDesk.

All this parts to a annoying trading atmosphere within the shut to-term.

That said, one half of positive news has long past largely unnoticed: the unique U.S. financial institution rule reducing capital requirements for low-wretchedness sources like Treasuries. The capital gash rate is considered freeing up liquidity at banks, potentially boosting lending and boosting sellers’ skill to intervene in authorities bond markets throughout times of stress.

James Thorne, the manager market strategist at Wellington-Altus Private Wealth, described the switch as a determined signal of “deregulation on the capability.” Live alert!

Read extra: For prognosis of today time’s teach in altcoins and derivatives, look Crypto Markets As of late

What to Peek

For a extra entire listing of events this week, look CoinDesk’s “Crypto Week Forward.”

- Crypto

- The Bitwise Dogecoin ETF (BWOW) is anticipated to originate trading on NYSE Arca.

- CTC-1, the first satellite constellation operating the Spacecoin (SPACE) protocol, will inaugurate from Vandenberg Space Power Unsuitable in California.

- Macro

- 7:30 a.m.: Rachel Reeves, the U.Sufficient.’s Chancellor of the Exchequer, will carry the 2025 Budget Assertion within the Home of Commons, atmosphere tax and spending plans for the 2026-2027 U.Sufficient. tax yr. Peek live.

- 8:30 a.m.: U.S. Sept. Durable Goods Orders MoM Est. 0.3%.

- 8:30 a.m.: U.S. Initial Jobless Claims for week ended Nov. 22 Est. 225K, Persevering with Jobless Claims for week ended Nov. 15 (Prev. 1974K).

- Earnings(Estimates essentially based entirely totally on FactSet knowledge)

- Nothing scheduled.

Token Events

For a extra entire listing of events this week, look CoinDesk’s “Crypto Week Forward.”

- Governance votes and calls

- Nomina (NOM) to host a trader name on substandard-DEX alternatives and perps market outlook at 10.30 a.m.

- Unlocks

- None scheduled.

- Token Launches

- Minswap (MIN) lists on Bitrue with MIN/USDT pair.

Conferences

For a extra entire listing of events this week, look CoinDesk’s “Crypto Week Forward.”

- Day 2 of three: Finance Magnates London Summit 2025

- Nov. 26: Digital Securities and Digital Cash Summit Frankfurt

- Day 1 of three: Excellence in Digital Banking Global Summit 2025 (Amsterdam)

Market Actions

- BTC is down 0.28% from 4 p.m. ET Tuesday at $86,779.61 (24hrs: -0.48%%)

- ETH is down 0.91% at $2,903.77 (24hrs: +0.81%)

- CoinDesk 20 is down 0.31% at 2,857.32 (24hrs: -0.17%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.86%

- BTC funding rate is at 0.0069% (7.5303% annualized) on Binance

- DXY is up 0.14% at 99.81

- Gold futures are up 0.41% at $4,194.40

- Silver futures are up 2.15% at $52.74

- Nikkei 225 closed up 1.85% at 49,559.07

- Hang Seng closed up 0.13% at 25,928.08

- FTSE is up 0.21% at 9,629.60

- Euro Stoxx 50 is up 0.58% at 5,606.20

- DJIA closed on Tuesday up 1.43% at 47,112.Forty five

- S&P 500 closed up 0.91% at 6,765.88

- Nasdaq Composite closed up 0.67% at 23,025.59

- S&P/TSX Composite closed up 0.97% at 30,900.65

- S&P 40 Latin The United States closed up 1.32% at 3,094.Seventy 9

- U.S. 10-Yr Treasury rate is up 0.6 bps at 4.008%

- E-mini S&P 500 futures are up 0.33% at 6,803.75

- E-mini Nasdaq-100 futures are up 0.46% at 25,201.00

- E-mini Dow Jones Industrial Average Index are up 0.19% at 47,268.00

Bitcoin Stats

- BTC Dominance: 58.61 (+0.19%)

- Ether-bitcoin ratio: 0.0335 (-1.12%)

- Hashrate (seven-day intriguing sensible): 1,040 EH/s

- Hashprice (region): $36.10

- Total expenses: 3.14 BTC / $274,424

- CME Futures Originate Passion: 131,460 BTC

- BTC priced in gold: 20.9 oz.

- BTC vs gold market cap: 5.83%

Technical Prognosis

- The chart shows the Dollar Index’s each day label swings, along with its 200-day easy intriguing sensible (SMA) line.

- The DXY is having a be taught about to place a foothold above the 200-day SMA despite the string of mild U.S. economic knowledge, including the ADP payrolls, and the spicy upward push within the percentages of the Fed rate gash in December.

- Or no longer it’s miles a conventional bullish scenario: a market that shrugs off harmful news, generally signaling that a well-known rally is more doubtless to be on the horizon.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $254.12 (-0.72%), unchanged in pre-market

- Circle Web (CRCL): closed at $70.11 (-3.62%), +0.67% at $70.58

- Galaxy Digital (GLXY): closed at $25.48 (+2.82%), +0.82% at $25.69

- Bullish (BLSH): closed at $40.5 (-2.41%), +0.49% at $40.70

- MARA Holdings (MARA): closed at $11.17 (-0.36%), unchanged in pre-market

- Rise up Platforms (RIOT): closed at $14.39 (+3.67%), unchanged in pre-market

- Core Scientific (CORZ): closed at $15.55 (-1.27%)

- CleanSpark (CLSK): closed at $11.82 (+2.96%), -1.86% at $11.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $43.65 (+1.23%)

- Exodus Race (EXOD): closed at $14.65 (-3.49%)

Crypto Treasury Companies

- Arrangement (MSTR): closed at $172.19 (-3.83%), -0.57% at $171.21

- Semler Scientific (SMLR): closed at $20.32 (-2.66%)

- SharpLink Gaming (SBET): closed at $9.93 (-1.49%), -0.1% at $9.92

- Upexi (UPXI): closed at $2.99 (+6.41%)

- Lite Arrangement (LITS): closed at $1.84 (+0.55%)

ETF Flows

Save BTC ETFs

- Each day find flows: $128.7 million

- Cumulative find flows: $57.59 billion

- Total BTC holdings ~1.31 million

Save ETH ETFs

- Each day find flows: $78.6 million

- Cumulative find flows: $12.83 billion

- Total ETH holdings ~6.2 million

Offer: Farside Patrons

While You Were Sleeping

- Very indispensable Bitcoin Tag Suggestions Merchants Could perhaps well peaceable Music Now (CoinDesk): Merchants are looking at key label ranges around $88,000 and $102,000 as indicators of pattern reversal, whereas a fall below $83,000 would perhaps well additionally ascertain extra downside wretchedness for bitcoin.

- Bitcoin Dip in 2026, Surge in 2028: JPMorgan’s IBIT-Linked Structured Screen Fits Halving Cycles (CoinDesk): The financial institution’s unique funding product ties likely payouts to bitcoin’s four-yr cycle, offering capped protection if BTC drops in 2026 and amplified beneficial properties if it rallies by 2028.

- Merchants Are Flooding Markets With Unhealthy Bets. Robinhood’s CEO Is Their Cult Hero. (The Wall Street Journal): By prioritizing excessive-wretchedness, excessive-reward merchandise like alternate suggestions, crypto and prediction markets, the firm has regained momentum and helped flip co-founder Vlad Tenev correct into a retail trading icon.