Monetary establishments are transferring some distance off from Ethereum (ETH) and selecting motive-built blockchains tailored to meet their institutional wants.

Recent inclinations, akin to Klarna’s launch of its stablecoin on one more community and the upward thrust of privacy-centered chains admire Canton, lift questions referring to the community’s dominance.

Company Blockchain Adoption Alerts Unique Menace to Ethereum: Here’s Why

On November 25, Klarna presented KlarnaUSD, changing into the first monetary institution to advise a stablecoin on Tempo, a funds blockchain from Stripe and Paradigm. This decision has sparked debate in the crypto neighborhood. Some ogle it as a bearish signal for Ethereum.

“Any individual expose me why this isn’t bearish for Ethereum? A valuable fintech with a tall transfer into stablecoins is no longer launching it on Ethereum. If Tempo didn’t exist then this might possibly occupy seemingly launched on Ethereum or an ETH L2…Tempo taking marketshare in what is the predominant thesis for Ethereum: stablecoins,” an analyst acknowledged.

Ethereum hosts predominant stablecoins, alongside with Tether (USDT) and USDC (USDC), which together describe over $100 billion in market capitalization. They force valuable community exercise and charges. By selecting Tempo, Klarna bypasses Ethereum’s ecosystem, potentially diverting liquidity and innovation.

One other analyst, Zach Rynes, emphasised that Klarna’s decision demonstrates that company blockchains are gaining adoption, whereas public chains continue to be overshadowed by tall fintech firms.

“One other confirmation that corpo L1 chains are here to stop and that your current commoditized ‘neutral’ public chain #375936 is getting steamrolled by Fintech but again,” he mentioned.

The upward push of the Canton Network further exemplifies this. It’s miles a Layer 1 community built with privacy controls at its core. Establishments can resolve how considered or restricted their exercise is, enabling setups that adjust from entirely permissionless to entirely deepest systems.

Despite these differences, applications on Canton can silent connect and work together across the community. Goldman Sachs’ Digital Asset Platform (GS DAP) makes spend of the Canton community natively.

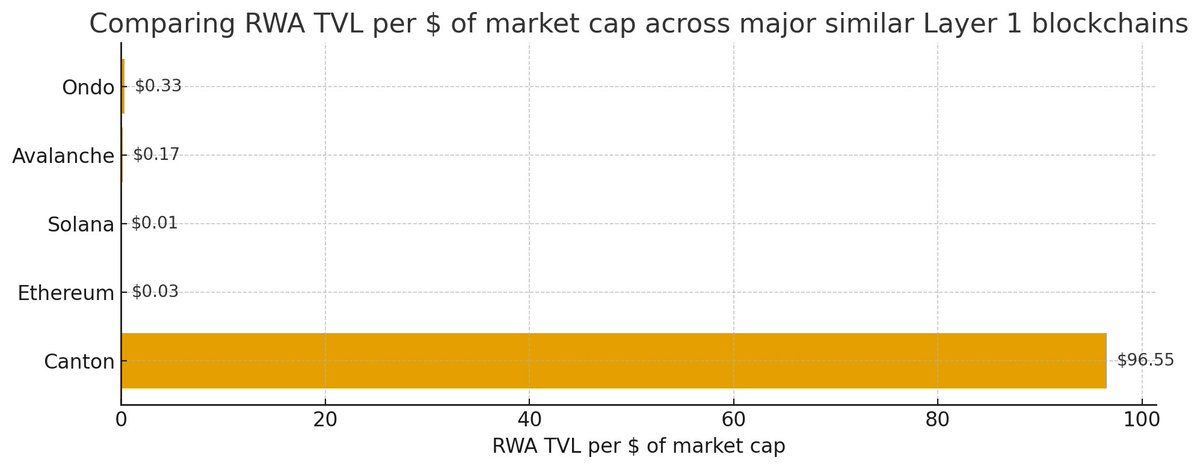

Particularly, Canton shows a predominant level of capital effectivity, producing around $96 of RWA Complete Price Locked (TVL) for every $1 of market capitalization. In incompatibility, Ethereum generates approximately $0.03 of RWA TVL for every $1 of market cap.

Nonetheless why are establishments titillating some distance off from Ethereum? Privacy will most certainly be the predominant driver of this exodus. Public blockchains admire Ethereum set all transactions completely considered, a core enviornment for establishments.

When banks or firms transfer tall sums, this transparency poses a predominant threat. Competitors can analyze patterns, front-scamper trades, and present strategic commercial ties.

In step with COTI Network’s diagnosis, enterprises adopting Web3 in general fail to see blockchain transparency as a licensed responsibility. The article notes that public blockchains expose all transactions and metadata, that will cowl sensitive records or undermine negotiation leverage. This creates regulatory concerns with rules akin to GDPR and exposes commerce secrets and tactics.

This disconnect explains why establishments are constructing deepest blockchains or looking for public networks with enhanced privacy. Transparency, a celebrated virtue in crypto, creates vulnerabilities when handling billion-dollar trades and confidential relationships.

This vogue indicators a split: public networks admire Ethereum for decentralized or retail spend, whereas establishments transfer to deepest or undoubtedly good chains with confidentiality. Whether Ethereum can procure support institutional have faith or undoubtedly good networks steal over remains unsure as finance undergoes a digital transformation.

The put up Establishments Flip to Purpose-Built Blockchains as Privacy Concerns Drive Shift Far flung from Ethereum regarded first on BeInCrypto.