Bitcoin (BTC) may maybe well also contain confirmed a decisive shift into bearish territory after slipping below a key long-timeframe technical threshold intently adopted by seasoned market analysts.

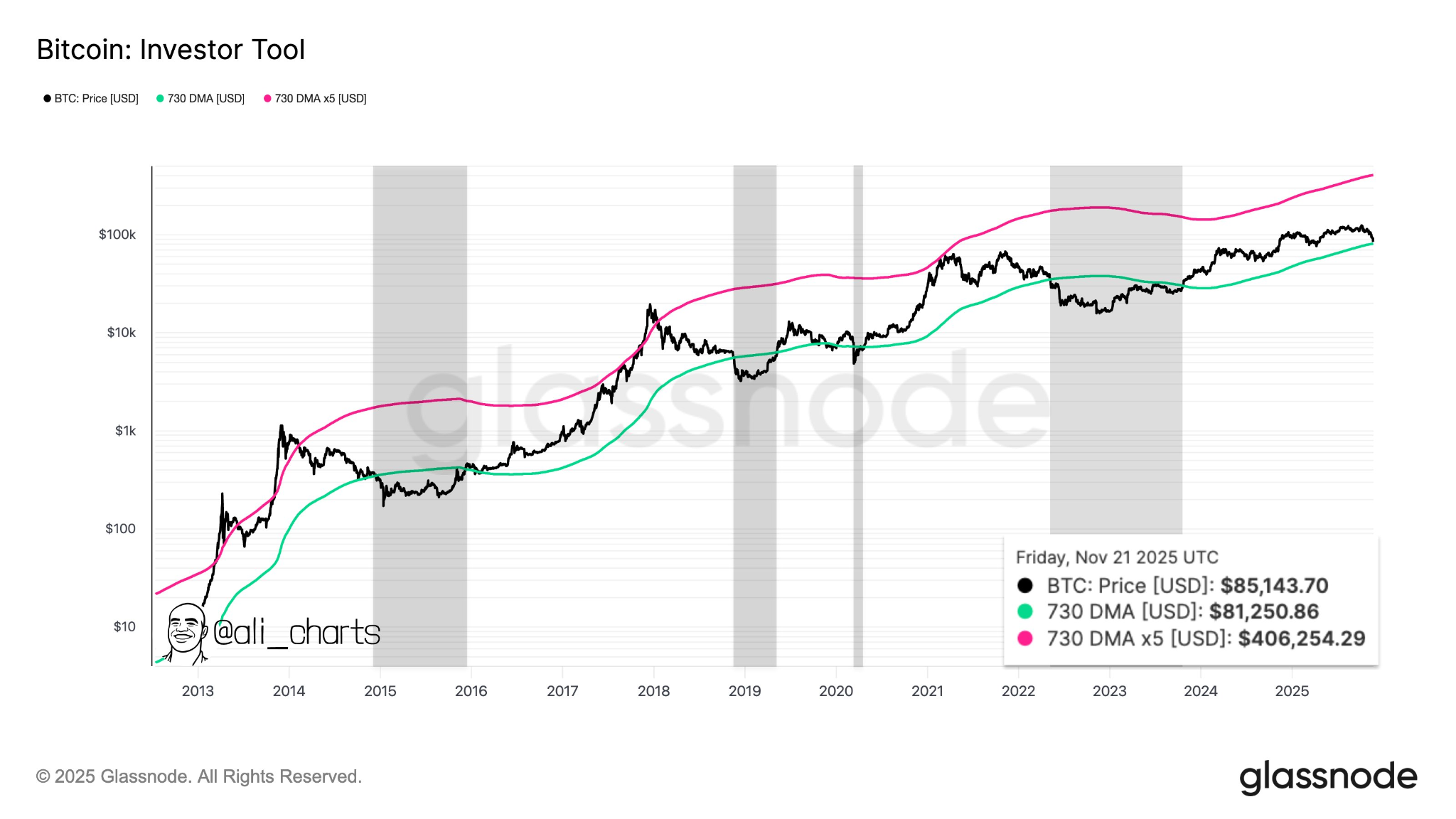

The 730-day simple transferring practical (SMA), a two-year model gauge that has historically marked transitions into Bitcoin endure markets, now sits at roughly $81,250, in accordance with insights shared by cryptocurrency analyst Ali Martinez in an X post on November 22.

Per the diagnosis, Bitcoin’s recent mark motion has pushed it below this stage, a transfer that in previous cycles has preceded extended periods of downward or sideways market performance.

The indicator, on the total frequently known as an “investor tool,” overlays Bitcoin’s multiyear mark trajectory with the 730-day SMA and its five-times multiple. Old cycles note that losing the decrease band has assuredly aligned with significant cyclical peaks already being field and market sentiment steadily turning risk-off.

The latest reading reinforces that sample, where with Bitcoin trading throughout the mid-$80,000 fluctuate, the breakdown signals weakening momentum after a long-working uptrend.

Seriously, the 2-year SMA capabilities as a structural line of reinforce correct thru bull phases, and falling below it has historically flagged macro exhaustion. While no longer a guarantee of deeper losses, the transfer suggests the market may maybe well also now be coming into a protracted cool-down segment, especially as broader risk sentiment stays fragile and liquidity traits soften.

Bitcoin key mark stages to peep

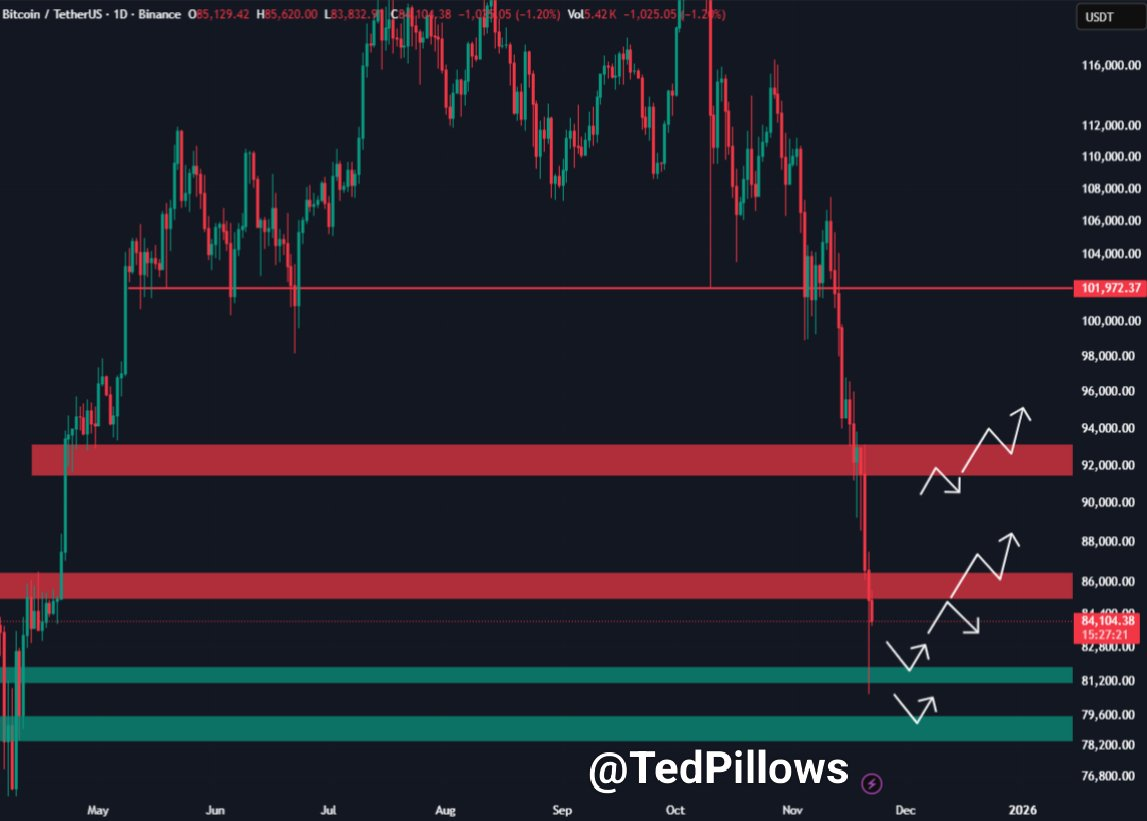

This outlook comes as Bitcoin tried to reclaim the $85,000 stage after a week of heavy selling. Diagnosis by Ted Pillows in an X post on November 22 urged that failure to recover the $85,000 resistance zone may maybe well also send Bitcoin abet toward $80,000.

Per the analyst, the next foremost zone to peep for Bitcoin is the $85,000–$86,000 home following a animated multi-week promote-off. The field, which beforehand acted as a place a matter to zone, is now being retested from below as the market attempts to stabilize after a steep descend from above $100,000.

His outlook outlines multiple doable rebound paths if Bitcoin can shut abet above this band, with upside targets clustering around $89,000, $92,000, and $95,000, stages that served as reinforce correct thru the year sooner than breaking down in November.

If patrons fail to shield the $85,000–$86,000 field, the technical image turns considerably weaker. The subsequent seen reinforce sits beautiful above $80,000, and losing that stage may maybe well also field off a like a flash transfer into the $78,000–$seventy 9,000 fluctuate highlighted in inexperienced.

As of press time, Bitcoin became trading at $84,239, down approximately 0.3% in the previous 24 hours. On the weekly timeframe, the asset has declined by over 11%.

Featured image by assignment of Shutterstock