Bitcoin trace has began to direct sure indicators of weak point, and essentially the most long-established pass abet below six figures has forced a reassessment of the near-term outlook. With loads of indispensable technical and on-chain stages now misplaced, I if truth be told comprise recalibrated my injurious case so as that the likelihood of retesting new all-time highs within the upcoming weeks has fallen below 50%. That might commerce hastily if main stages are reclaimed, but until then, the stipulations resemble a market transferring faraway from trending energy and in the direction of a deeper corrective share.

Desk of Contents

Bitcoin Tag: Is “Procuring The Dip” Composed the Trusty Transfer?

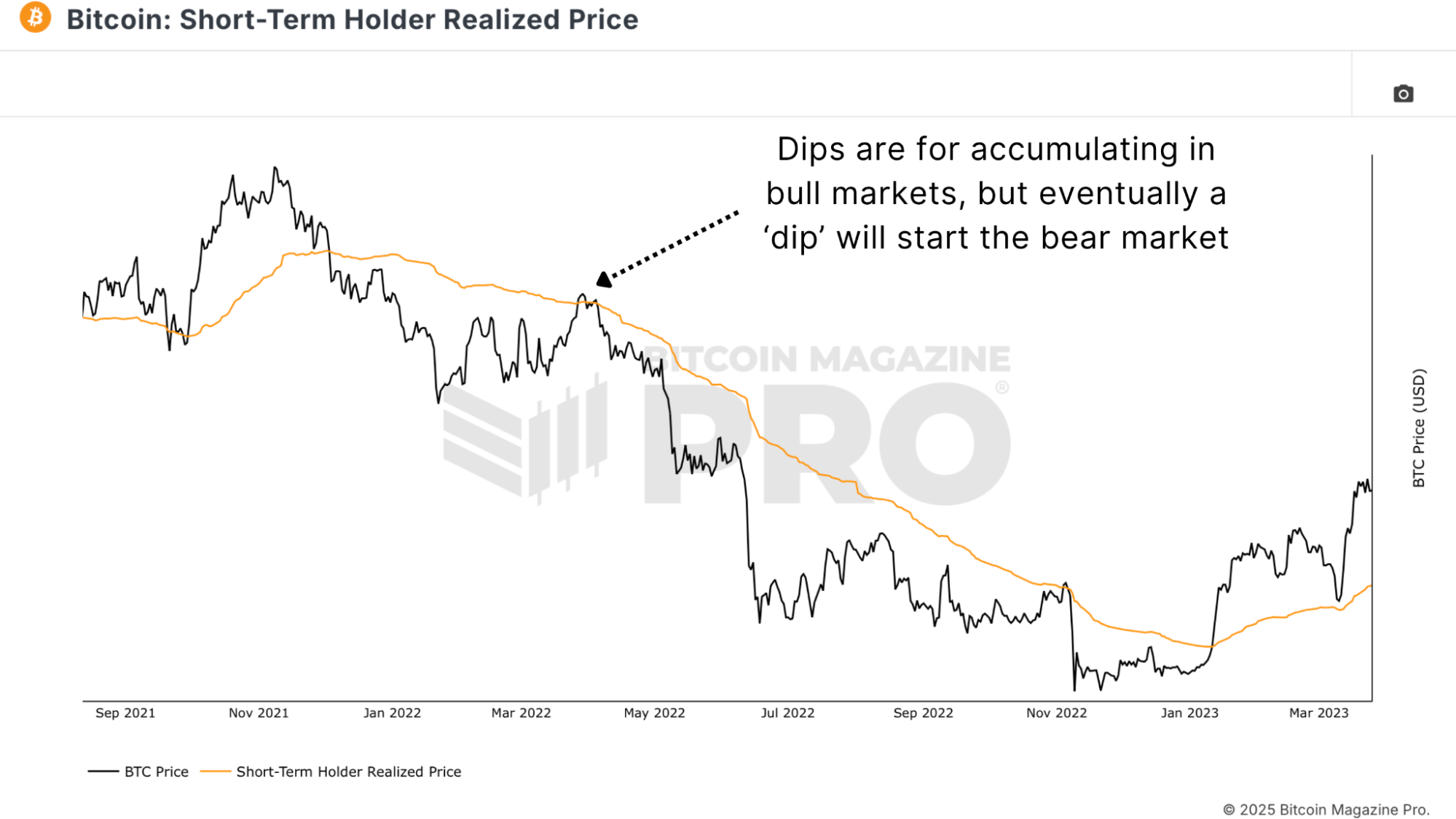

Bitcoin is already in a sizeable pullback, but shopping for every decline isn’t repeatedly the optimum manner start air of a confirmed bull construction. In a undergo-market atmosphere, what seem like elegant dips can restful result in critically lower costs. Temporary rallies and involving retracements are conventional in downtrending markets, so reacting to files reasonably than pre-emptively predicting a bottom turns into design more indispensable.

This pattern of multiple dips is evident when we analyze the Brief-Length of time Holder Realized Tag chart at some stage within the closing cycle. It’s far moreover sure to gape how this metric acted as a key resistance at some stage in this share, with sustained restoration perfect experienced as soon as BTC reclaimed STH Realized Tag stages.

There is one caveat: if trace meaningfully reclaims key stages, the total portray shifts. That’s why a limited allocation on this dip can procure sense, whereas conserving off on further shopping for until we gape deeper macro confluence is a more defensive manner.

Dark Friday Sale: 40% Off Annual Plans!

The BEST saving of the twelve months is here. Rep 40% off all our annual plans.

Unlock +100 Bitcoin charts.

- Rep admission to Indicator signals – so that you just never pass over a thing.

- Non-public TradingView indicators of your approved Bitcoin charts.

- Members-perfect Reports and Insights.

- Many new charts and functions coming soon.

Pondering about stunning $17/month with the Dark Friday deal. Right here is our perfect sale all twelve months!

Bitcoin Tag: Key Levels You Must Survey Trusty Now

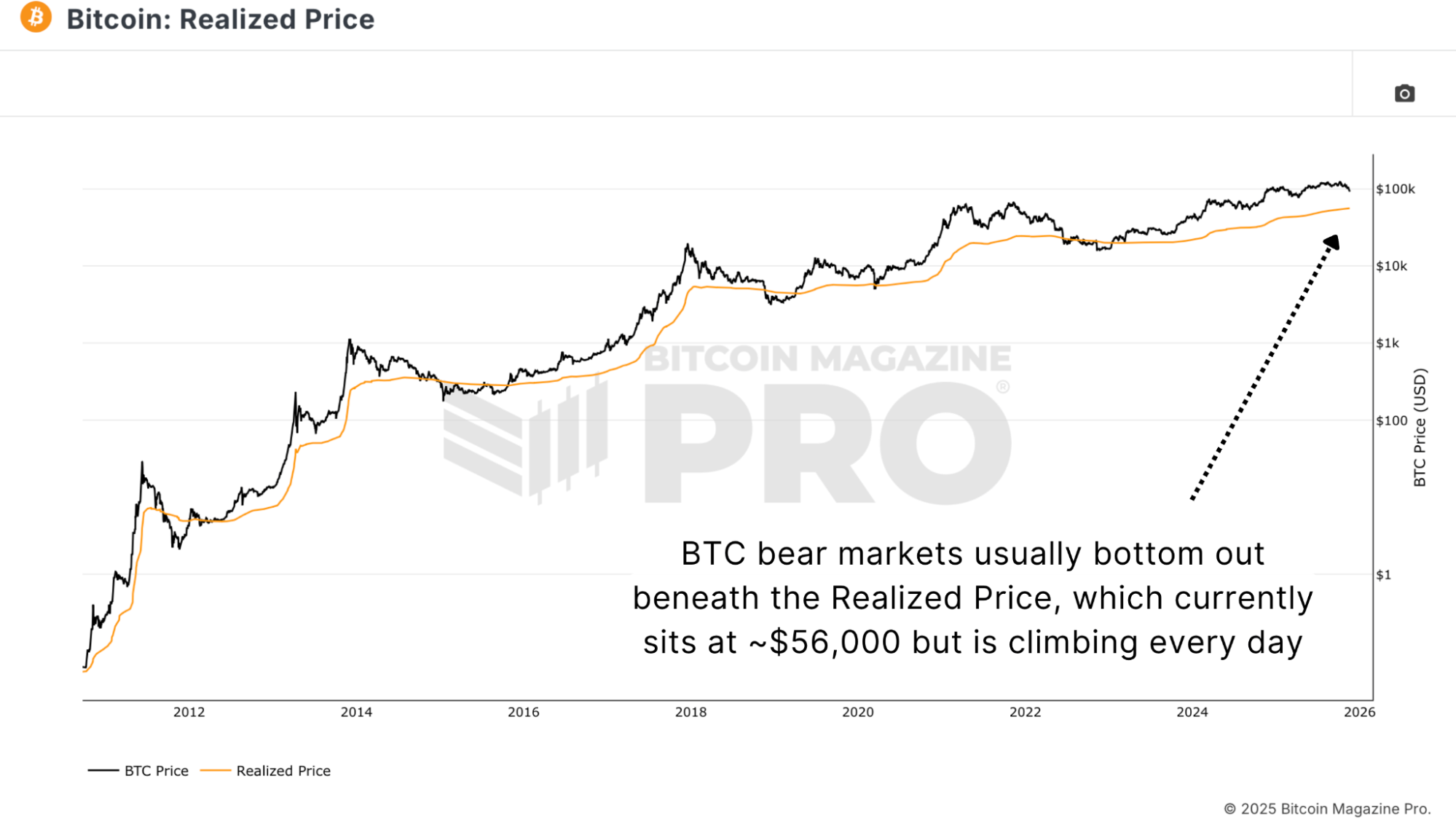

The MVRV Z-Receive and the Bitcoin Realized Tag give a clearer sense of where the broader market’s trace foundation sits. The realized trace foundation of the community currently clusters all around the mid-$50,000s, but this figure continues rising on an everyday foundation.

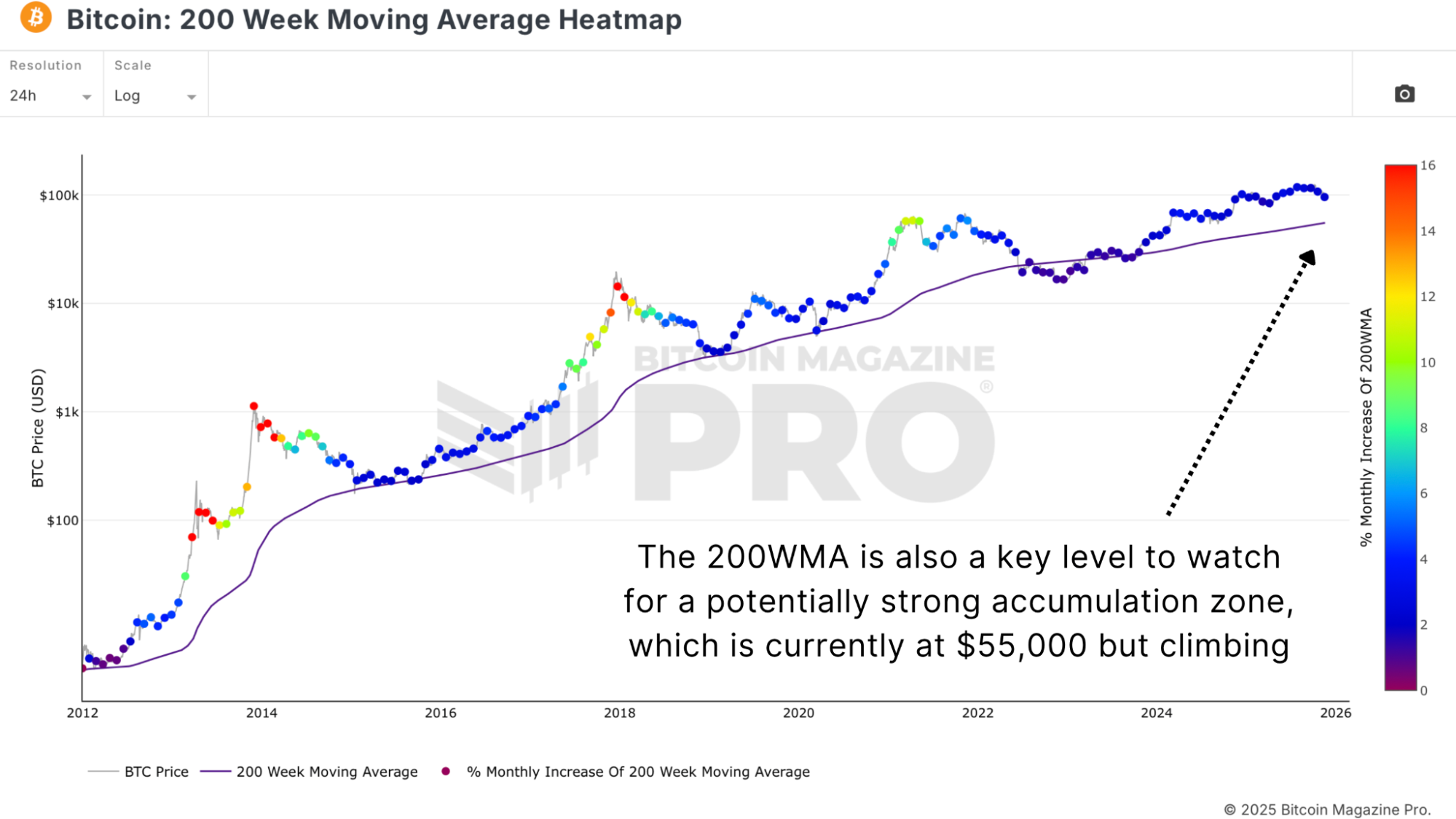

A identical narrative emerges from the 200-Week Transferring Life like, as this moreover currently sits within the mid-$50,000. Historically, functions where this metric meets trace comprise presented sturdy long-term accumulation alternatives.

Those stages upward thrust slowly on each day foundation, meaning a possible bottom might well procure at $60,000, $65,000, or elevated, searching on how long Bitcoin spends trending downward. The indispensable point is that worth tends to emerge when assign of abode trace trades shut to the practical historic trace of the community, and confluence is equipped from key stages of buy enhance.

Bitcoin Tag: What Provide & Assign a matter to Indicators Are In actuality Saying

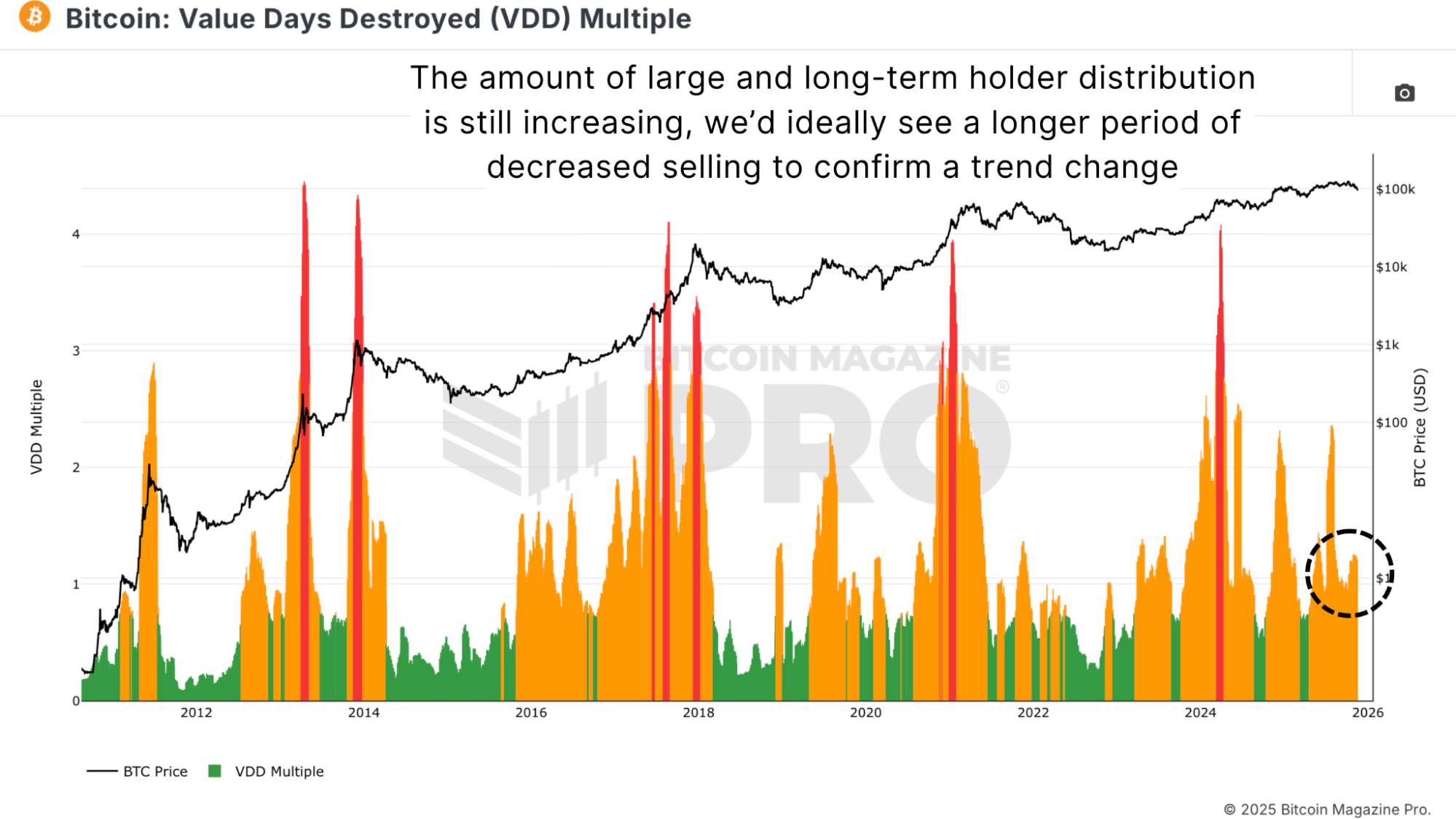

Price Days Destroyed (VDD) Plenty of stays a actually indispensable metric in identifying stress functions amongst long-term and experienced holders. Very low readings counsel neat, feeble coins are no longer transferring, which has customarily aligned with market bottoms. A pointy spike, on the opposite hand, can direct capitulation stress, which generally accompanies or precedes indispensable market turning functions.

Trusty now, the metric continues rising as trace falls, suggesting many holders are distributing into weak point. That’s no longer characteristic of a cycle bottom, where forced promoting is continuously wrong and compressed into a brief window. At this stage, the market restful looks to be unwinding reasonably than exhausting. Alongside this, Long-Length of time Holder Provide has been in a downtrend. Ideally, this stabilises and begins to procure bigger as soon as more earlier than calling any main bottom, as bottoms procure when essentially the most affected person contributors start conserving, no longer exiting.

Bitcoin Tag: What Funding Charges Speak About Capitulation (Or Lack Thereof)

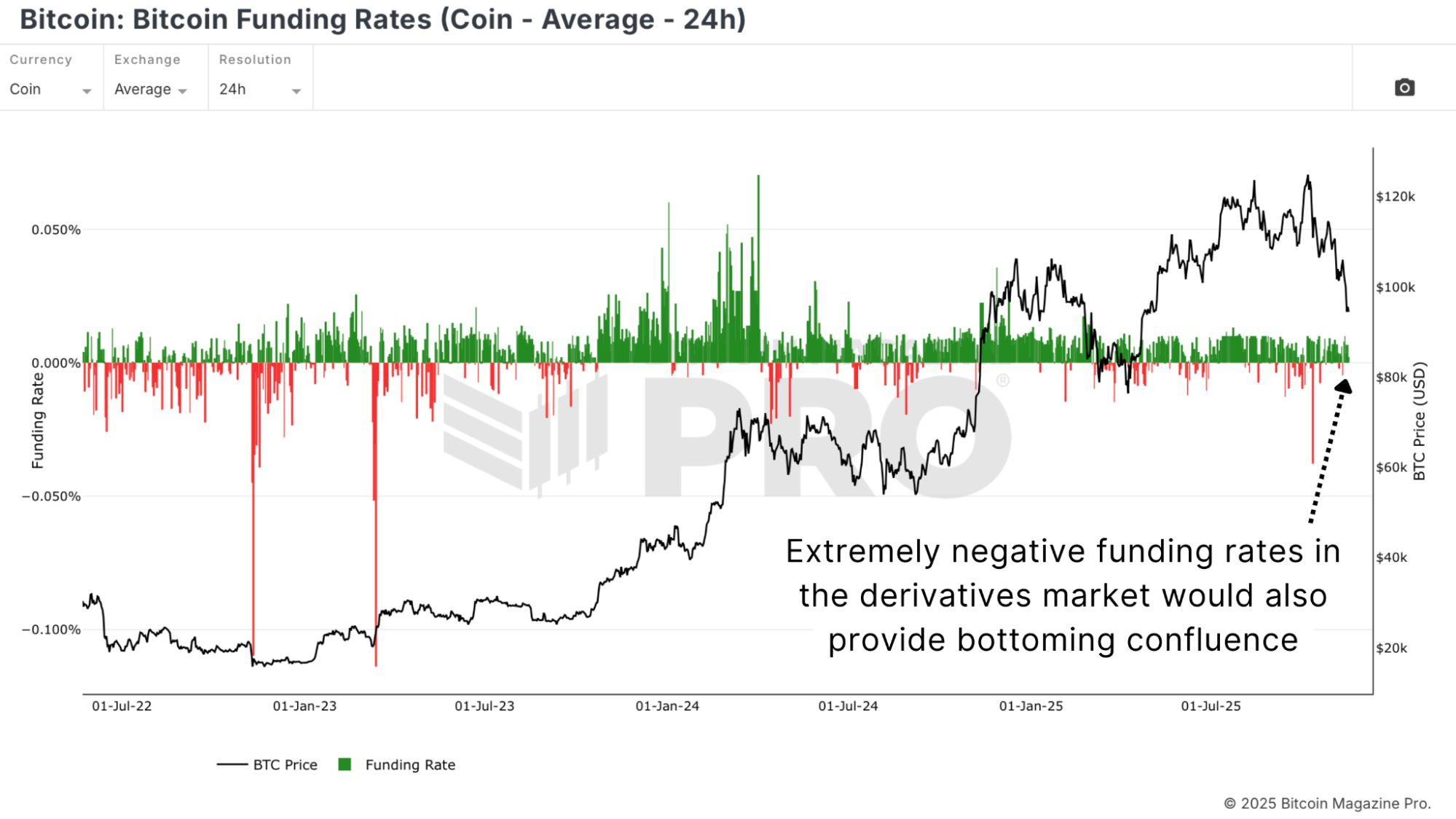

Intervals of peak difficulty are inclined to direct up clearly by design of heavy short positioning, unfavorable funding as confirmed within the Bitcoin Funding Charges, and neat realized losses. Those stipulations signal that weaker fingers comprise capitulated, and stronger fingers are moving that present.

The market has no longer but confirmed the signature anxiousness promoting and shorting customarily connected with main cyclical lows. With out stress in derivatives and with out a high-tail of loss-taking, it’s miles complicated to argue that the market has fully flushed out.

Bitcoin Tag: The Trusty Levels That Must Be Reclaimed to Fracture the Endure Case

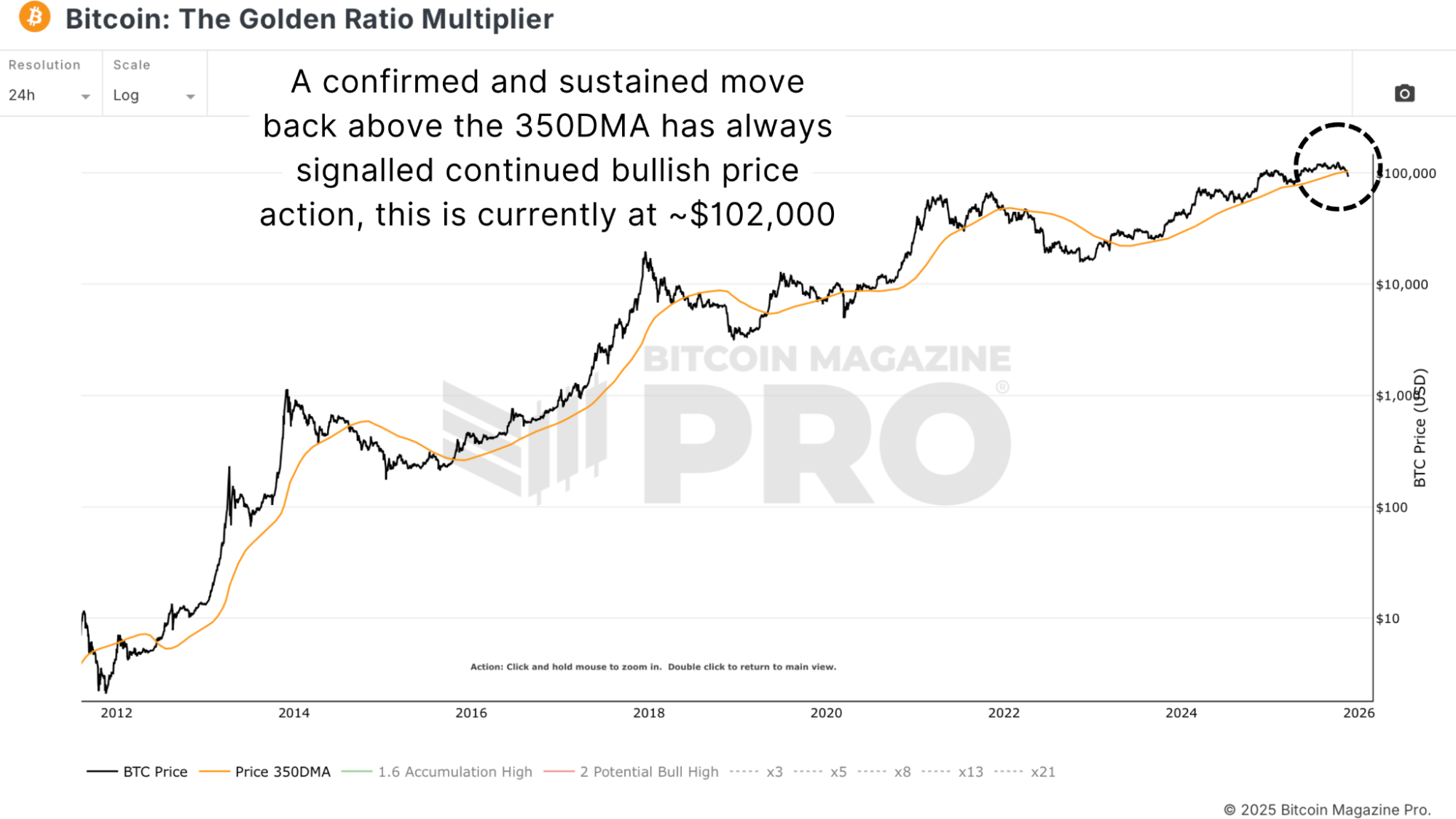

Scream the bearish issue is contaminated, which clearly might well be the most approved result. If that’s the case, Bitcoin needs to start out reclaiming key structural stages, including the $100,000 psychological zone, the Brief-Length of time Holder Realized Tag, and the 350-day transferring practical as depicted within the Golden Ratio Multiplier chart.

Non permanent wicks or single-day closes are no longer sufficient. Sustained closes above these stages, along with energy in possibility assets globally, would counsel the construction is transferring. Nonetheless until that occurs, the facts leans cautious.

Bitcoin Tag Outlook: Closing Ideas on Dip vs. Recent Endure Market

Since breaking below loads of indispensable stages, the outlook has change into more defensive. There’s no structural weak point in Bitcoin’s long-term fundamentals, however the momentary market structure doesn’t resemble a healthy bull construction.

For now, the instructed approach includes no longer shopping for at every dip, expecting confluence earlier than heavy scaling in, respecting macro stipulations and ratio developments, and perfect turning aggressive as soon as the market proves energy. Most merchants never name the explicit high or bottom; the goal is to situation near areas of excessive likelihood with sufficient affirmation to have faraway from months of pointless drawdown.

For a more in-depth leer into this subject, sight our most most long-established YouTube video here: My Bitcoin Strategy Going Ahead

For deeper files, charts, and professional insights into bitcoin trace developments, discuss over with BitcoinMagazinePro.com. Subscribe to Bitcoin Journal Expert on YouTube for more expert market analysis!

Disclaimer: This article is for informational functions perfect and might well no longer be thought about monetary advice. Continuously attain your maintain research earlier than making any funding choices.

This post Bitcoin Tag Dip Or Recent Endure Market? first seemed on Bitcoin Journal and is written by Matt Crosby.