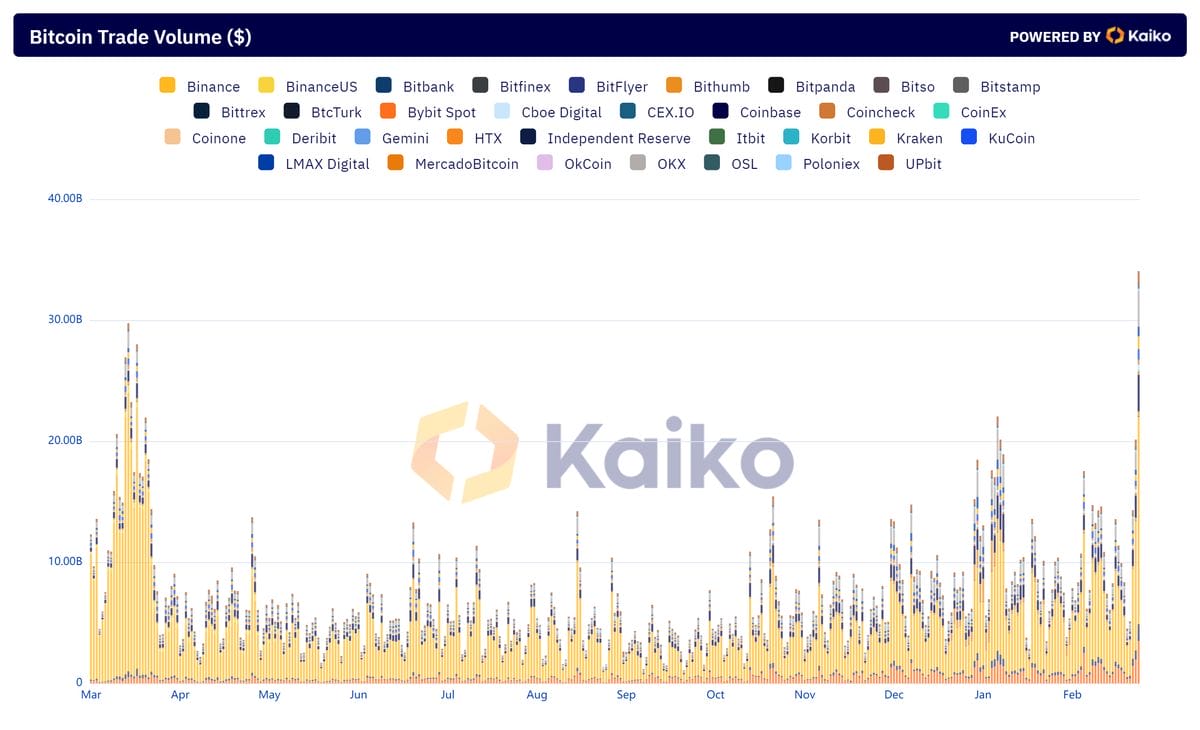

Based completely mostly on data offered by Kaiko, Bitcoin location procuring and selling quantity across all most essential CEXes hit an spectacular $34.05 billion on February 28.

Main the worth, Binance accounted for $17.09 billion, solidifying its put because the dominant force in the crypto procuring and selling sphere.

Now not a long way in the abet of, Bybit made a notable entry with $3.5 billion, adopted closely by Coinbase at $2.98 billion, OKX at $2.92 billion, and Kraken rounding off with $1.05 billion.

Describe Provide: Kaiko

Describe Provide: KaikoBitcoin Living Volume Rises As BTC Nears $64,000

The notable amplify in Bitcoin location procuring and selling quantity because the leading cryptocurrency continues to push greater amid the optimism surrounding location ETFs.

On Wednesday, BTC shoot above $63,000 for the first time since November 2021, in brief touching $64,000 sooner than turning decrease.

The flagship cryptocurrency is accurate below its all-time excessive of $68,982.20, which used to be recorded in November 2021.

With the file in stride behold, the market has been even more motivated to scrutinize that stage retested.

Bitcoin has soared practically 20% this week alone, after per week-long halt of this year’s rally. It’s now up more than 40% for 2024.

“The most modern rally in the crypto market marks a qualitatively new chapter in the arena of cryptocurrencies,” Sergei Gorev, pain manager from Web3 fintech platform YouHodler, stated in a observation.

“We can glance that, if previously most cryptocurrencies had been entertaining in the an identical direction, now the very most life like most likely quality and stable dynamics are seen in BTC, the put more liquidity is pouring in each day.”

Gorev added that money is at the moment entertaining from decrease-quality altcoins into more established cryptocurrencies.

Furthermore, the stage of margin lending is at a rather low stage, which presents opportunities for additonal growth of BTC.

“Attain no longer ignore the upcoming BTC halving, which is able to grab put on April 21, 2024, moreover the indisputable truth that on the 2nd, location BTC ETFs aquire 10 times more BTC each day than miners fabricate each day,” he effectively-known.

Declining Trading Volume on CEXes

Closing year, crypto researcher CCData reported that centralized exchanges hang witnessed a essential decline in procuring and selling quantity.

In September, the blended location and derivatives procuring and selling quantity on these exchanges dropped by 20.3% to attain $1.67 trillion, marking the bottom month-to-month procuring and selling quantity recorded since December 2022.

Despite an total reducing fashion in procuring and selling quantity across centralized exchanges (CEX), Korean exchanges hang managed to amplify their market share and procuring and selling quantity.

After reaching a height of $forty five billion in entire procuring and selling quantity in February, the amount skilled a decline, hitting $23 billion in Would possibly maybe.

On the other hand, it has since shown an upward trajectory, reaching as excessive as $37 billion in July. This growth outpaced that of Binance, demonstrating the relative strength of Korean exchanges in the arena market.

Actually, when evaluating procuring and selling volumes with Binance and Coinbase, the four most essential Korean exchanges constantly showcased greater volumes, indicating their essential presence in the arena landscape.

Over the route of the year, the market share of those exchanges relative to Binance has considered a notable amplify, rising from 7% in March to 16% in September.