Exploding institutional appetite for regulated altcoin derivatives is driving a extremely effective unique wave of product enhance, with fresh XRP and SOL futures poised to urge liquidity, sharpen designate discovery, and redefine the next allotment of digital-asset market evolution.

XRP and SOL Futures Kind bigger Regulated Crypto Get entry to

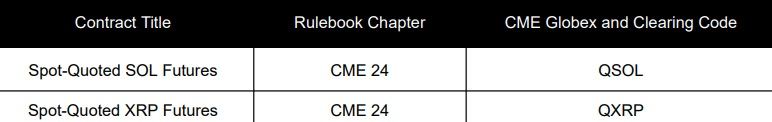

Rising ask for regulated digital-asset derivatives is accelerating product growth. CME Community launched a Special Govt Characterize on Nov. 14 citing that it would checklist Position-Quoted XRP Futures and Position-Quoted SOL Futures on Dec. 14 for swap date Dec. 15, pending regulatory overview courses.

The Special Govt Characterize outlines that each contracts are cash-settled and incorporate a every day financing adjustment to account for the premise between futures costs and the underlying space index. Position-Quoted XRP Futures will reference the CME CF XRP-Buck Reference Fee and swap under code QXRP, with a 250-token contract size, a $0.0004 minimum tick, and a $0.10 tick designate. Position-Quoted SOL Futures will reference the CME CF SOL-Buck Reference Fee and checklist under code QSOL, utilizing a 5-token contract size and a $0.02 minimum tick, moreover with a $0.10 tick designate.

Every product launches with a single June 2026 maturity—QXRPM6 for XRP and QSOLM6 for SOL—and will swap on CME Globex with clearing by CME ClearPort. The document states that trading for each contracts will discontinuance on the 2d Friday of the contract month at 4 p.m. ET until adjusted for a U.S. vacation.

Be taught more: CME Highlights Surging XRP Futures as Institutional Buying and selling Momentum Builds

The document moreover minute print payment structures, including quarterly upkeep costs of $0.15 for each the XRP and SOL contracts and CME Globex transaction costs ranging from $0.10 surely member courses to $0.20 for non-participants.

Market strategists explore the parallel introduction of XRP and SOL as a broadening of institutional hedging strategies all the diagram in which by two excessive-liquidity altcoins. While skeptics warn of altcoin volatility and evolving regulatory concerns, supporters contend that regulated XRP and SOL futures give a rob to transparency, red meat up designate discovery, and enhance instruments for institutional be troubled administration in digital resources.

FAQ ⏰

- What are the foremost functions of the unique Position-Quoted XRP and SOL Futures?

They are cash-settled contracts with every day financing changes and June 2026 maturities trading on CME Globex. - How carry out the contract sizes vary between XRP and SOL?

XRP makes employ of a 250-token contract size, whereas SOL makes employ of a 5-token contract size with same $0.10 tick values. - What costs notice to the unique altcoin futures?

Each and each merchandise elevate quarterly upkeep costs of $0.15 and CME Globex transaction costs ranging from $0.10 to $0.20. - Why are institutions attracted to regulated XRP and SOL futures?

They offer clear, regulated publicity that enhances hedging, designate discovery, and be troubled administration for excessive-liquidity altcoins.