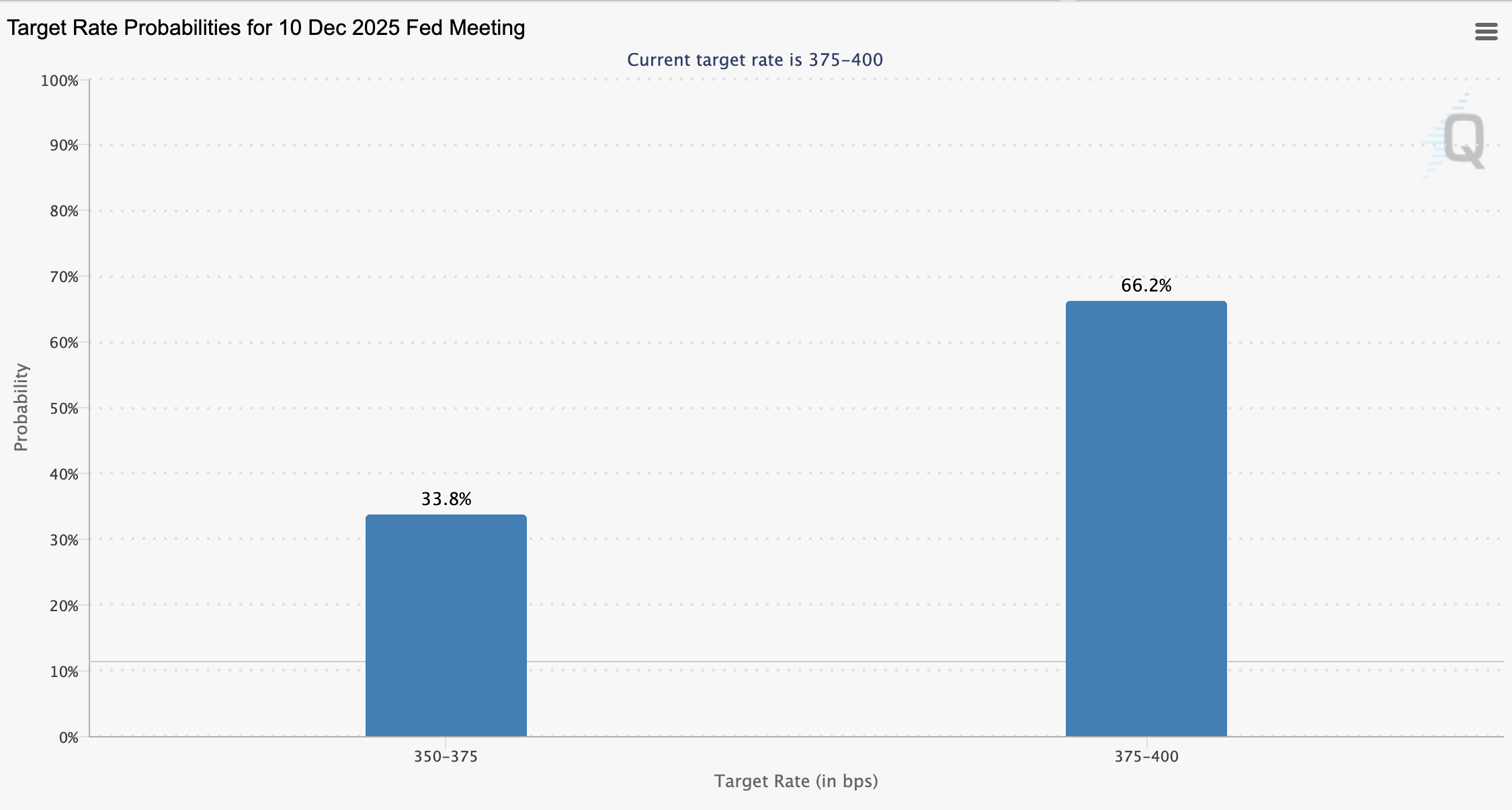

The probabilities of an interest price reduce on the December Federal Initiate Market Committee (FOMC) assembly grasp plunged to 33% as “crude apprehension” grips the crypto market and the pricetag of Bitcoin (BTC) dips below $89,000.

Merchants positioned the percentages of a December price reduce at about 67% at some stage in the main week of November, with the percentages dropping below 50% on Thursday, in line with recordsdata from the Chicago Mercantile Exchange (CME).

Merchants on prediction markets Kalshi and Polymarket forecast the percentages of a December price reduce at about 70% and 67%, respectively. Whereas better than CME, merchants fundamentally appear more hesitant about price cuts this ability that of power fears about inflation, in line with The Kobeissi Letter.

The plummeting odds of a December price reduce and declining crypto costs grasp sparked a fright, with some analysts now warning that the downturn may perchance signal the open of a long crypto grasp market and falling asset costs.

The worth of BTC falls below $89,000 as market sentiment hovers merely above the annual low

The worth of BTC fell below $90,000 again on Wednesday after failing to protect basically the major enhance level and has been trading properly below its 365-day transferring life like, a fundamental enhance level, for the final six days.

Bitcoin’s 50-day exponential transferring life like (EMA) has moreover crossed below the 200-day EMA. This signal, acknowledged as the “loss of life heinous,” suggests additional plan back for BTC.

Some analysts now forecast a drop to $75,000, the build the pricetag may perchance backside out earlier than rebounding by the pause of 2025, whereas others speculate whether or no longer the cycle prime is already in.

“The time for Bitcoin to leap, if the cycle is no longer over, would open at some stage in the following week,” market analyst Benjamin Cowen acknowledged on Sunday.

“If no jump occurs within 1 week, potentially but any other dump earlier than a bigger rally abet to the 200-day simple transferring life like (SMA), which would then designate a macro decrease high,” Cowen added.

The forecasts got here amid cratering crypto investor sentiment. Investor sentiment measured by the “Crypto Fear & Greed Index” is at 16 on the time of this writing, indicating “crude apprehension” among investors.

This areas crypto investor market sentiment at utterly one point above the annual low, in line with CoinMarketCap.