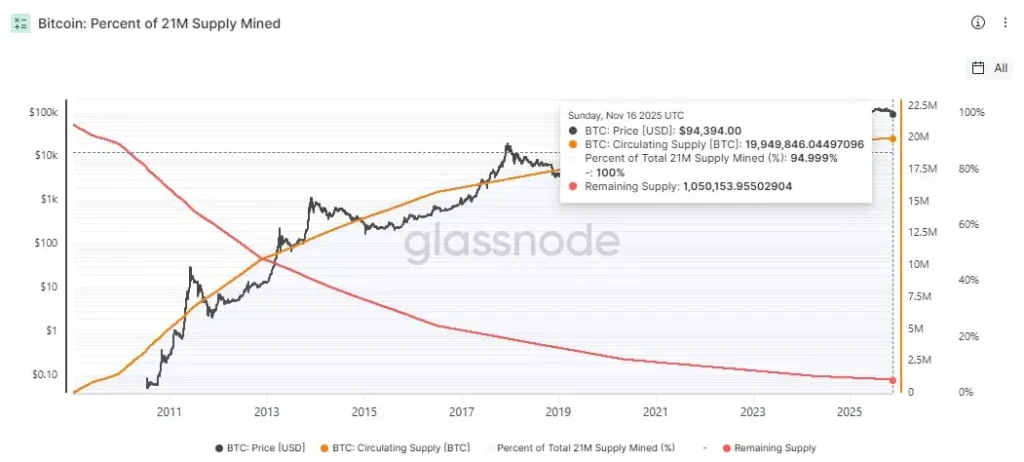

Bitcoin has entered one of essentially the most titillating chapters of its 17-twelve months history. Contemporary records from Glassnode confirms that 95% of the cryptocurrency’s fixed 21 million present has now been mined. Roughly 19.949 million BTC is in circulation, leaving actual 1.050 million BTC left to be mined, money that will enter the market at an an increasing number of slower slump due to the programmed halvings.

Provide: Glassnode

The milestone reinforces the cornerstone of Bitcoin’s fabricate: engineered shortage. With easiest 5% of present final, Bitcoin’s issuance is transitioning into its slowest and strictest piece yet, making shortage a central theme for analysts, institutions, miners, and long-length of time holders tracking the asset’s monetary evolution.

A Provide Milestone Almost 17 Years in the Making

Satoshi Nakamoto mined Bitcoin’s genesis block on January 3, 2009, embedding a present agenda supposed to end inflation, debasement, and discretionary issuance. This day’s 95% threshold marks essentially the most neatly-liked affirmation that the protocol continues running precisely as designed.

Per essentially the most neatly-liked present breakdown:

- Maximum Provide Cap: 21,000,000 BTC

- Circulating Provide: 19,949,776 BTC

- Share Mined: 95%

- Issuance Final: 1,049,996 BTC

- Unspendable BTC Identified: 230.09 BTC

What stays will be disbursed over extra than a century due to the the halving mechanism, which reduces block rewards roughly every four years. The final Bitcoin is anticipated to be mined spherical 2140, long after the present generation of miners has exited the scene.

For economists who analyze digital shortage, this occasion is extra meaningful than merely crossing a spherical amount. Talking to Cointelegraph, Thomas Perfumo, a world economist at Kraken, outlined that Bitcoin’s annual present inflation now sits at 0.8%, a price vastly decrease than that of most fiat currencies. Per Perfumo, Bitcoin functions as a “world, proper-time and permissionless settlement protocol” whose shortage resembles the rarity of a masterpiece such because the Mona Lisa.

“This milestone is a reminder of Bitcoin’s resistance against debasement and intervention, running as designed with reference to 17 years later,” Perfumo mentioned.

But even with the significance of the milestone, analysts emphasize that its impression does no longer staunch now translate to instantaneous word motion. The final 5% of present will rob extra than 100 years to mine due to the the halving agenda, limiting any surprising issuance shock. But structurally, the milestone strengthens the long-length of time shortage fable that Bitcoin has carried since its inception.

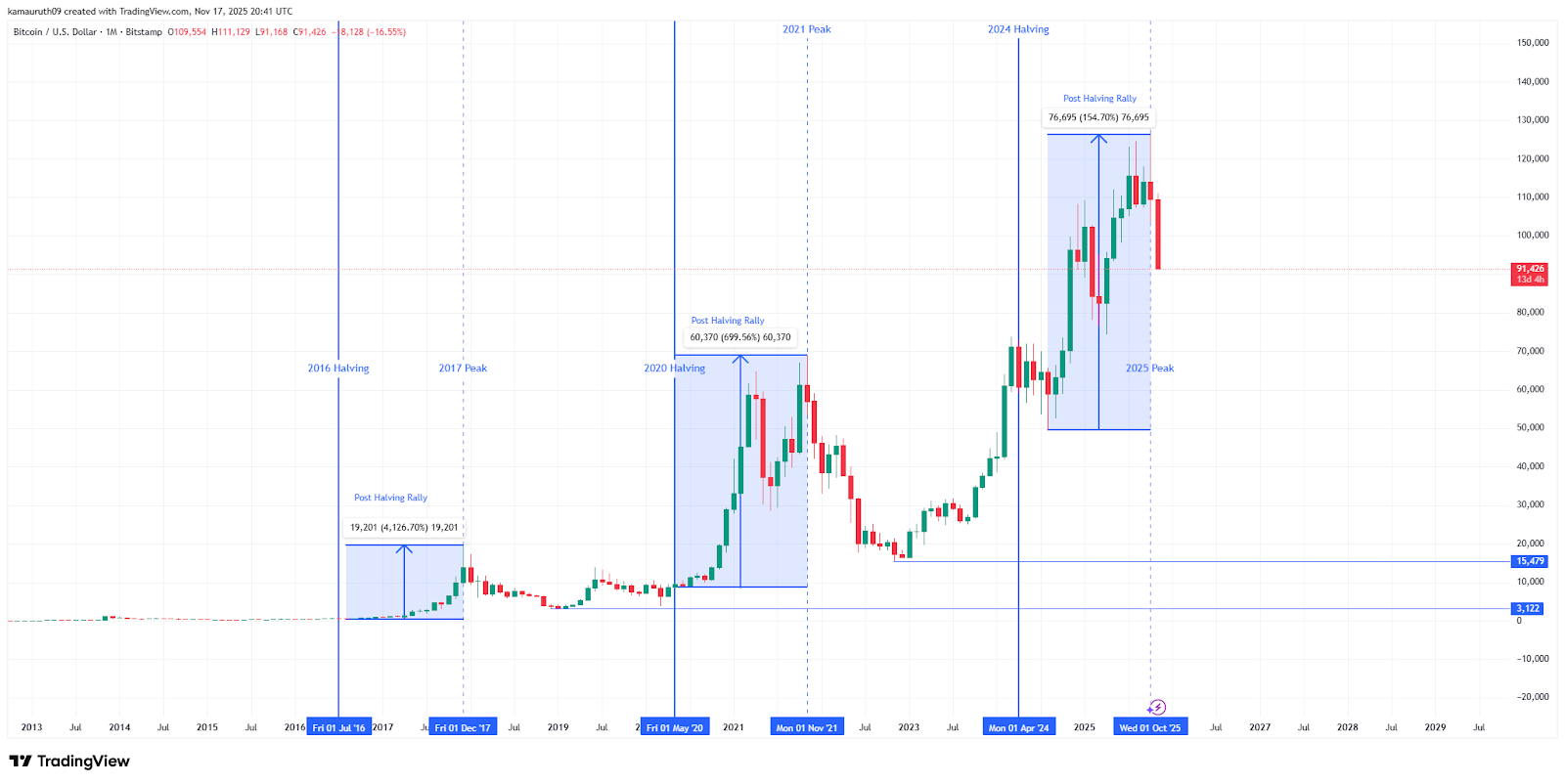

Halving Cycles: How Bitcoin In most cases Responds as Provide Shrinks

A newly updated long-length of time monthly chart highlights a habitual sample: each time Bitcoin’s issuance shrinks via a halving occasion, a multi-twelve months expansion piece at final follows. The sample is no longer speculative; it is a long way observable records tracked all the very best plan via three achieved halving cycles and the present one.

2016 Halving — 2017 Peak

- Halving Date: July 2016

- Post-Halving Rally: an approximate 4,000%

- Peak: Late 2017

- Correction: –84%

This era marked one of Bitcoin’s most dramatic multi-twelve months expansions, driven largely by the first world wave of retail adoption and an rising belief of digital shortage.

2020 Halving — 2021 Peak

- Halving Date: Could per chance perchance also 2020

- Post-Halving Rally: an approximate 700%

- Peak: Late 2021

- Correction: –77%

Institutional accumulation outlined this cycle. MicroStrategy, Tesla, and predominant asset managers sold immense amounts of BTC, reinforcing Bitcoin’s entry into mainstream finance.

2024 Halving — Contemporary Cycle Location

- Halving Date: April 2024

- Post-Halving High: $126K

- Contemporary Trace: $91.4K

- Drawdown: –27%

The sample mirrors earlier cycles: an preliminary post-halving surge followed by a mid-cycle correction. Traditionally, these corrective phases precede long-length of time expansions. Whereas previous efficiency does no longer dictate future results, the structural rhythm stays constant all the very best plan via all cycles examined.

Provide: TradingView

As easiest spherical 1,000,000 BTC live to be mined, and at a share of the slump considered in Bitcoin’s early years, the shortage dynamic becomes a extra noteworthy power all the very best plan via every subsequent halving.

Mining Economics Shift as Block Rewards Preserve Worried

The 95% tag has advise implications for miners, whose operations preserve the community stable and decentralized. After the April 2024 halving, block rewards fell to three.125 BTC per block, inserting additional stress on mining economics.

Jake Kennis, a senior learn analyst at Nansen, famed that miners also can if fact be told feel the milestone extra sharply than merchants. The reduction in rewards forces bigger reliance on transaction charges, which signify an an increasing number of crucial a part of miner income.

“Miners are already feeling the impression of reduced block rewards from halvings,” Kennis mentioned. “The 95% milestone underscores this long-length of time transition, doubtlessly pushing out much less efficient miners.”

Community records historically exhibits that after every halving, weaker mining operations shutter, while stronger, extra efficient miners consolidate or reinvest in improved hardware. The long-length of time trajectory strikes the community in the direction of a transaction-price-dominant model, as envisioned in Bitcoin’s protocol.

Marcin Kazmierczak, co-founder of the oracle provider RedStone, has the same opinion. He sees the milestone as a signal that mining is coming into its most transformative era.

“We’re transitioning from block reward-dependent miners to transaction-price-dependent miners,” Kazmierczak mentioned. “This creates stress on miners to consolidate or witness effectivity gains.”

Transaction charges already replicate this pattern. Periods of community congestion like led to price spikes, namely at some level of inscription waves. As block subsidies tumble, price markets play a better role in determining miner priorities and shaping community security budgets.

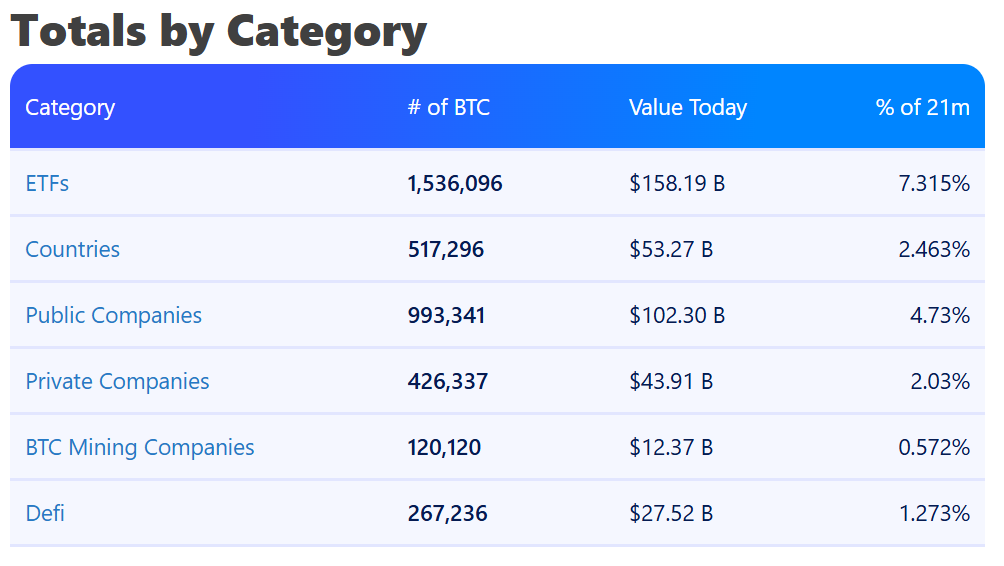

Scarcity, Institutional Accumulation, and Changing Market Dynamics

Whereas short-length of time word reactions to the 95% milestone had been subdued, its broader institutional significance is appreciable. Bitcoin trades spherical $91.4K, and despite the very fact that volatility persists, present shortage is now considered as a defining characteristic in the asset’s macro fable.

Key structural trends strengthen the shortage originate:

- Bitcoin ETFs continue collecting well-known amounts of BTC.

- Institutional demand rises as long-length of time issuance trends was extra visible.

- Replace reserves sit down end to multi-twelve months lows, cutting again available present.

- Long-length of time holders grow their share of all circulating present.

Kennis notes that the milestone is no longer a catalyst by itself but reinforces Bitcoin’s “digital gold” identification. Analysts highlight that shortage is easiest share of Bitcoin’s value; it is a long way the combination of fixed present, predictable issuance, decentralization, and world liquidity that drives long-length of time hobby.

Exterior records additional exhibits that spherical 17% of all Bitcoin is held by public corporations and countries, cutting again the free-floating present even additional and amplifying present-demand imbalances when the market heats up.

Provide: BitBo

Kazmierczak believes the milestone alerts Bitcoin’s maturation, provocative the asset from a boost-piece instrument staunch into a difficult and like a flash-present monetary asset with clearer long-length of time traits.

“The right kind inflection points had been earlier in the provision curve,” he mentioned. “This milestone represents Bitcoin’s maturity—we’re provocative in the direction of predictable long-length of time shortage.”

What the 95% Milestone Indicators for the Next Technology of Bitcoin

Crossing the 95% tag is no longer an isolated occasion. It represents a convergence of factors which had been building for years:

- Worried annual issuance

- Halving-driven reward reductions

- Rising mining voice of affairs

- Rate-based mostly security models

- Institutional accumulation

- Decrease commerce liquidity

- A rising different of long-length of time holders

Every halving makes Bitcoin’s shortage extra pronounced, every cycle distributes fewer modern money, and each modern milestone shifts the asset’s financial heart of gravity in the direction of long-length of time keeping.

The ancient records all the very best plan via cyclical charts captures the identical multi-twelve months rhythm: tightening present — post-halving expansion — mid-cycle correction — modern structural boost.

With easiest 5% of present final, Bitcoin now enters essentially the most shortage-intensive piece of its issuance timeline. The milestone alerts a transparent transition level, particular person who deepens shortage, reshapes mining incentives, and anchors long-length of time accumulation methods all the very best plan via the arena market.