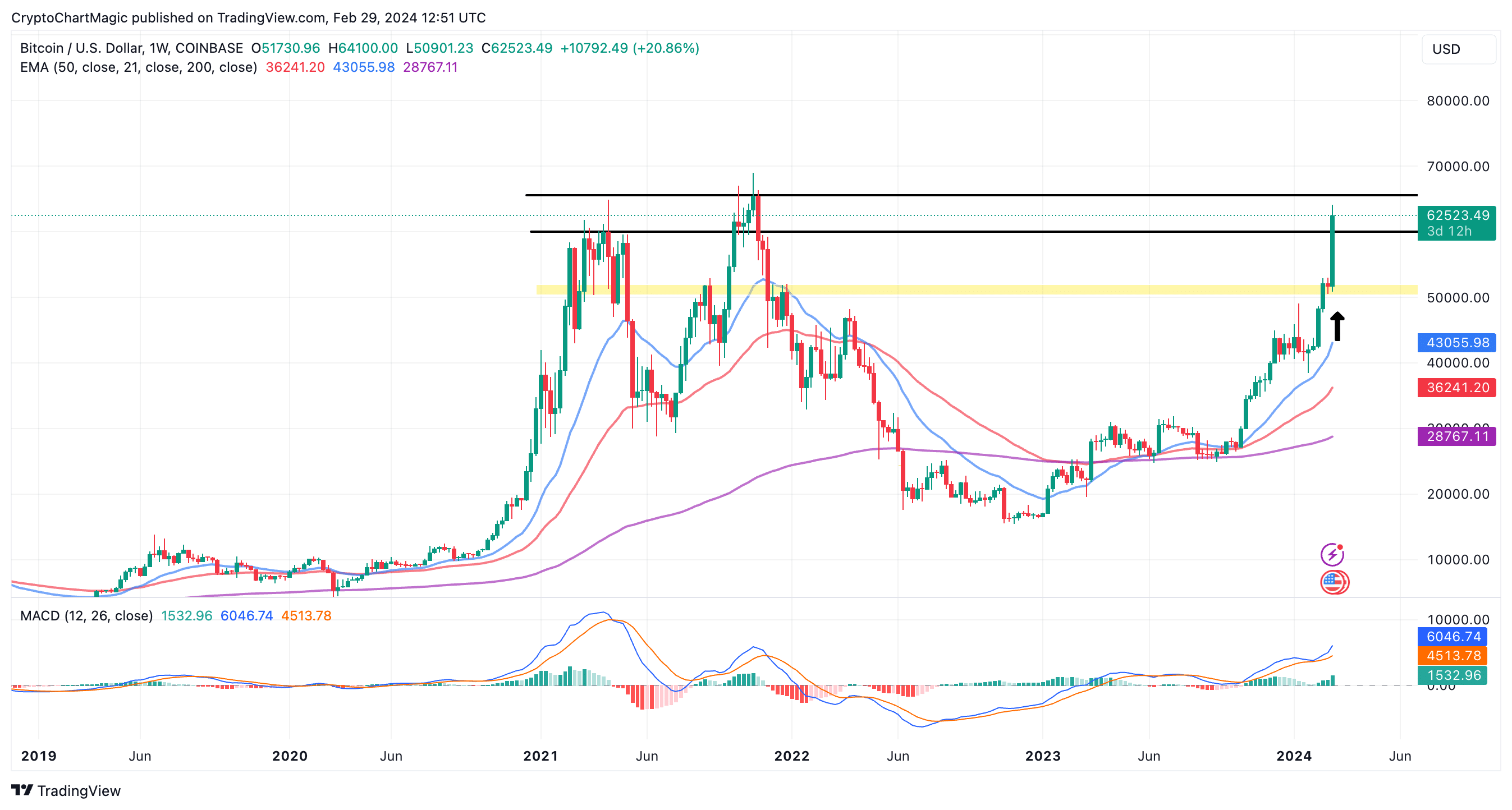

Bitcoin’s surprise circulation on Wednesday from a low of $56,738 to $63,913 sparked neatly-liked tag will increase amongst altcoins with Ethereum (ETH) leading the tag to $3,500. In line with basically the most up-to-date crypto tag prediction, each fundamentals and technical ranges are sturdy for a persevered rally towards the all-time excessive come $70,000 and BTC’s eventual climb above $70,000.

Bitcoin Worth Prediction: Can BTC Attain $70,000 In March

Several factors are utilizing BTC on its unstoppable north-going thru trajectory. The beginning of role Bitcoin ETFs in January considerably changed the crypto landscape no longer easiest for Bitcoin but furthermore for altcoins, especially majors corresponding to ETH and Solana (SOL).

Primarily based utterly on SoSoValue, a platform monitoring the efficiency of the ETFs, the total rep influx reached $673 million on February 28, marking another bullish shuffle, Chinese reporter Wu Blockchain highlighted on X.

Primarily based utterly on SoSoValue files, on February 28th, the total rep influx for Bitcoin role ETFs used to be $673 million. The day gone by, Grayscale’s ETF GBTC had a rep outflow of $216 million. The Bitcoin role ETF with the highest rep influx on that day used to be BlackRock’s ETF IBIT, with a rep… pic.twitter.com/vMglAXclJd

— Wu Blockchain (@WuBlockchain) February 29, 2024

BlackRock holds as basically the most productive-performing ETF with $612 million in rep day-to-day influx and $7.15 billion in total rep influx.

The rising quiz for Bitcoin as a result of ETF is striking buying force on the rally and alongside with growing optimism sooner than the halving in April, promise a big rally.

Bitcoin will endure its four-three hundred and sixty five days halving cycle in April. At some stage in this event, miner rewards are in overall halved to manipulate the availability and protect BTC a deflationary asset.

It is that this noticeable lower in present and with quiz rising or staying the same that adjustments the dynamics of the market, thus the expectations of a bull bustle after halving.

Bitcoin tag furthermore tends to rally, weeks or just a few months before halving, catalyzed by growing passion amongst investors who desire to rep the rumor. After this halving cycle, miners will likely be rewarded 3.125 BTC down from 6.25 BTC.

Amid the hyped-up market sentiment, Bitcoin is valued at $62,274 presently. An engulfing weekly candle saw bulls elevate the reins a exiguous above $50,000 early this week.

Moreover the bullish technical indicators relish the MACD and the RSI, FOMO is a noteworthy stronger force now and can likely protect BTC on the circulation in the brief term. Except profit-booking takes precedence, Bitcoin reveals indicators of rising to original all-time highs in March.

Instructed: Bitcoin Worth Prediction: As $750M Rushes Into ETFs, Here’s Why BTC Could perchance Top $70,000 Pre-Halving

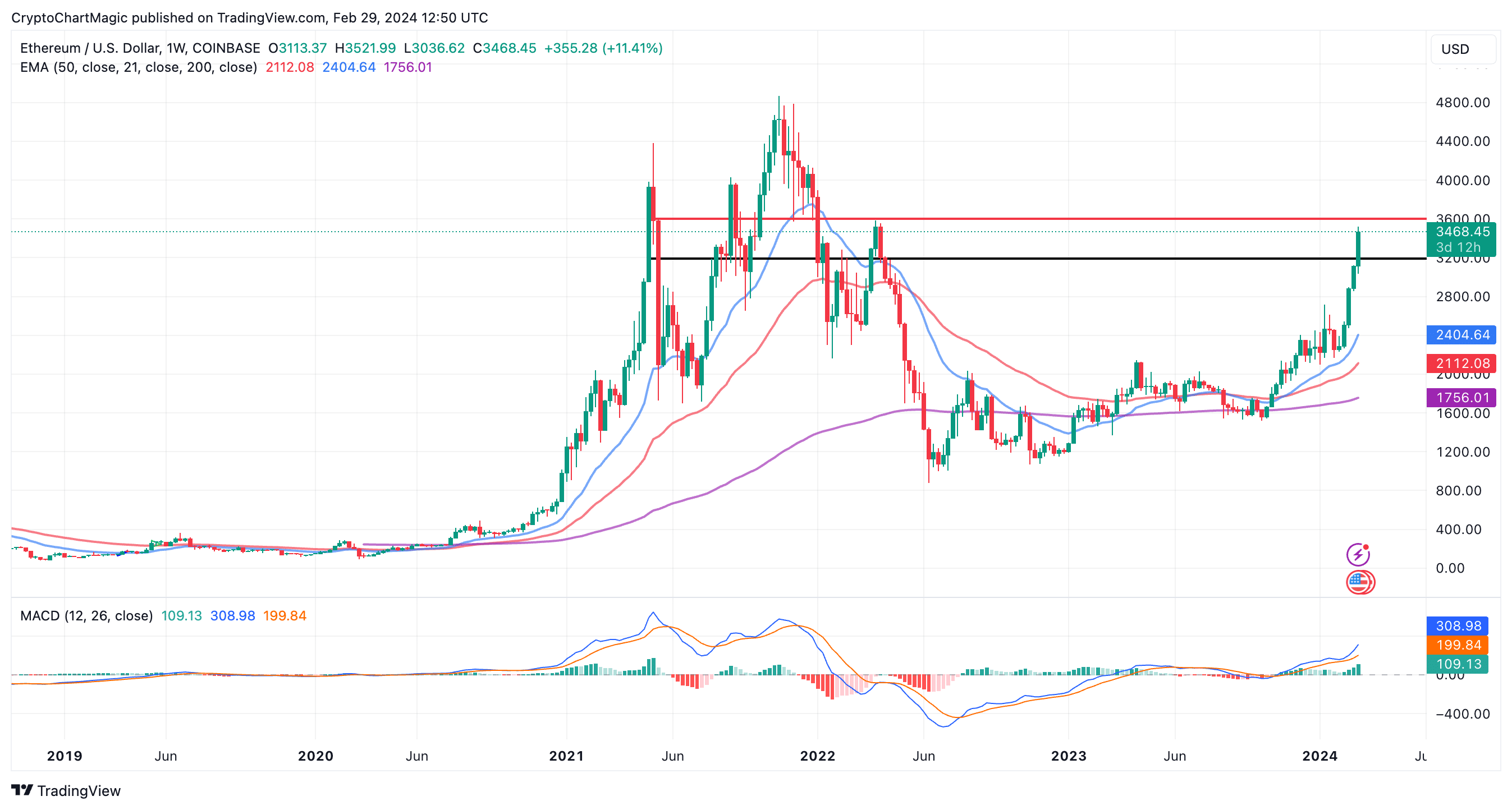

Ethereum Worth Evaluation: Is ETH Chasing After Contemporary ATH

The 2d most treasured cryptocurrency, boasting $416 billion in market cap and a 24-hour trading quantity price $37 billion launched above $3,500 on Thursday bolstered by the in overall bullish market and its main upcoming toughen called Dencun.

Investors are furthermore buying Ethereum while speculating just a few attainable role ETF approval. The greenlighting of Bitcoin ETFs has considered attention shift to Ethereum and with the eye role BTF ETFs are getting, the affect on ETH tag would be monumental.

Fancy Bitcoin, Ethereum tag has taken a breather after touching highs around $3,500. As the token teeters at $3,464 for the duration of US industry hours, merchants are fervent to role bouncebacks, in spite of all the pieces, dips contain confirmed to be a hit in the bull market.

One of the critical crucial major ranges to protect tabs on are elevated strengthen at $3,400 and resistance at $3,600. Breaking above this weekly hurdle may perchance perhaps perchance speedily ship Ethereum to $4,000. If losses change into stubborn, the $3,200 stage will come in in at hand.

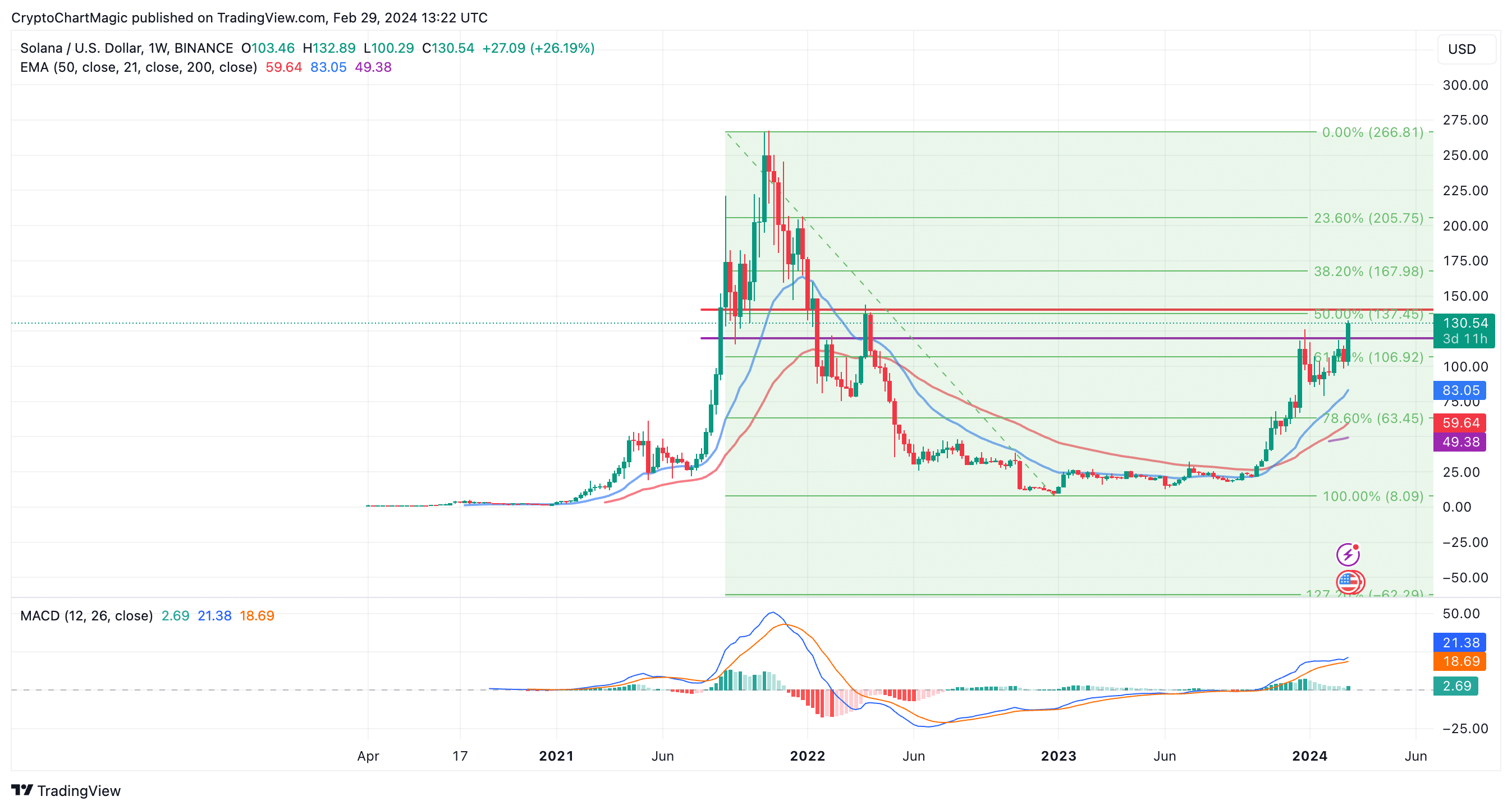

Solana Worth Forecast: Peaks Above $130

Solana blasted past its previous height at $125, topping out at $132. The Layer-1 blockchain identified for its unmatched scalability and low transaction payments, had dropped to $85 for the duration of January’s risky market stipulations.

The weekly chart reveals SOL trading above key bull market indicators relish the 20-week EMA, the 50-week EMA, and the 200-week EMA. A purchase signal from the MACD backs the uptrend, encouraging investors to protect buying as momentum will increase.

Enhance above $130 would proper the price amplify additional, with Solana tag expected to height above $140 this week and past $150 in early March.

Connected Articles

- 5 DePIN Crypto To Aquire Matching Up To Bitcoin’s Pre-Halving Bustle

- Terra Luna Classic Reaches 100 Billion LUNC Burn Landmark, LUNC Worth Jumps 10%

- Will Market Restoration Push TRON Worth Rally to $0.18 In March?