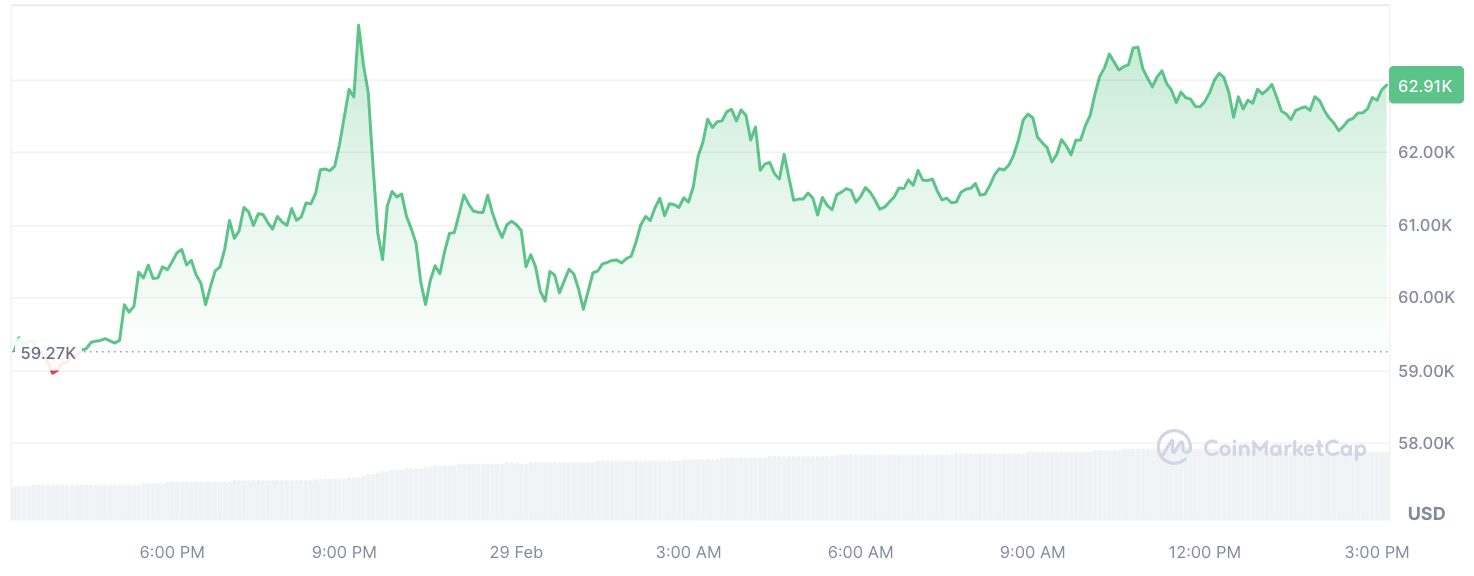

In the realm of cryptocurrency, the previous few days had been nothing attempting electrifying as Bitcoin’s rate surged by over 21%, marking a foremost jump in its trajectory. Primarily the most up-to-date spike propelled Bitcoin to a staggering $64,000, inching ever nearer to its outdated all-time high.

Within this whirlwind of market job, Dogecoin creator Billy Markus, better known by his moniker “Shibetoshi Nakamoto,” shared his apprehensions regarding Bitcoin’s volatile ascent.

Markus expressed his trepidation, admitting to a formula of uncertainty sooner than retiring for the night, acknowledging the prospective of waking up to a vastly assorted Bitcoin panorama — both skyrocketing to $100,000 or plummeting to $10,000. His sentiments echo the broader sentiment among cryptocurrency followers, who are carefully monitoring Bitcoin’s meteoric upward push and its capacity implications for the broader market.

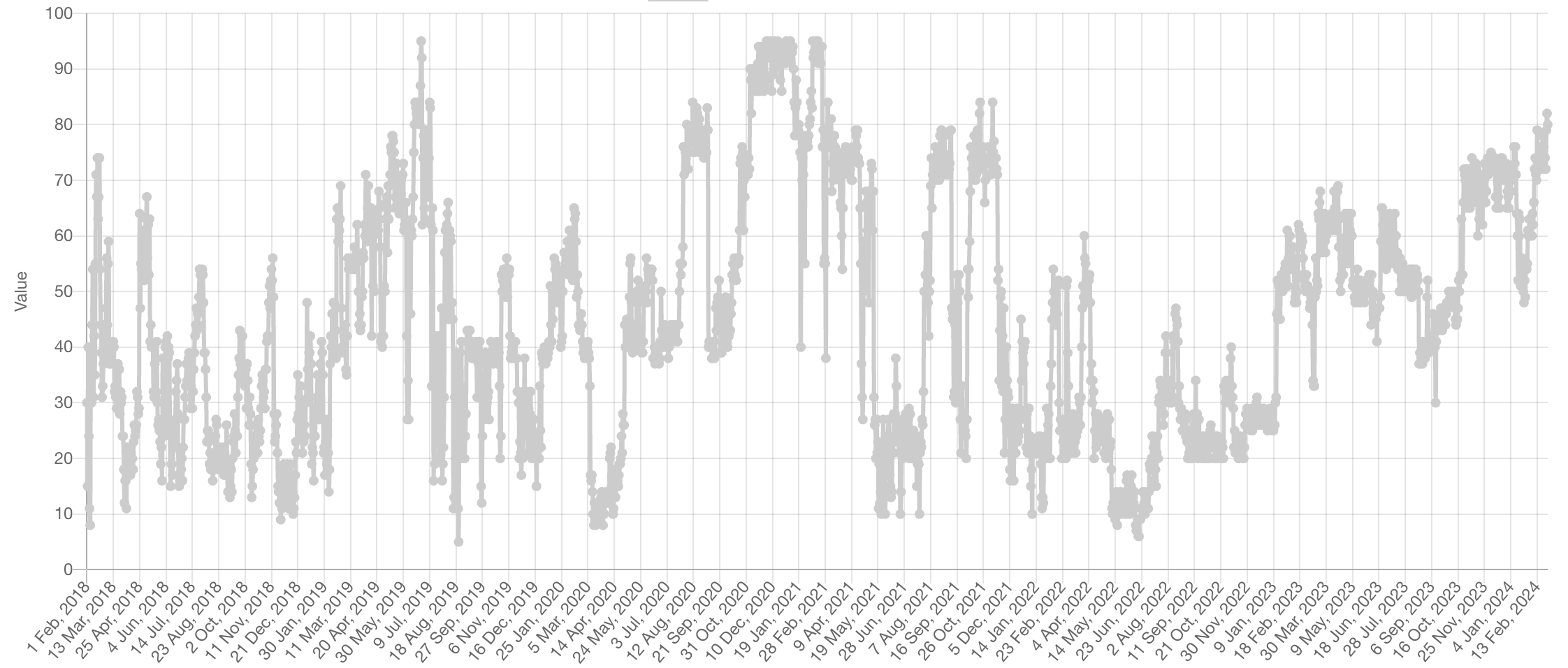

Greed hits stages no longer considered since 2021

Drawing parallels to Markus’s response, analysts present the Distress and Greed Index — a metric on the whole old-fashioned to gauge market sentiment — which currently sits at a staggering 80, indicating a pervasive ambiance of indecent greed. This level of exuberance has no longer been witnessed since November 2021, at some level of Bitcoin’s outdated flirtation with its all-time high of $69,000.

The convergence of Markus’s apprehension and the existing sentiment of indecent greed underscores the volatility inherent on the cryptocurrency market.

As BTC continues its upward trajectory, reaching tantalizingly shut to its outdated high, traders grapple with the uncertainty of whether or no longer this bullish momentum is sustainable or if a correction looms on the horizon.