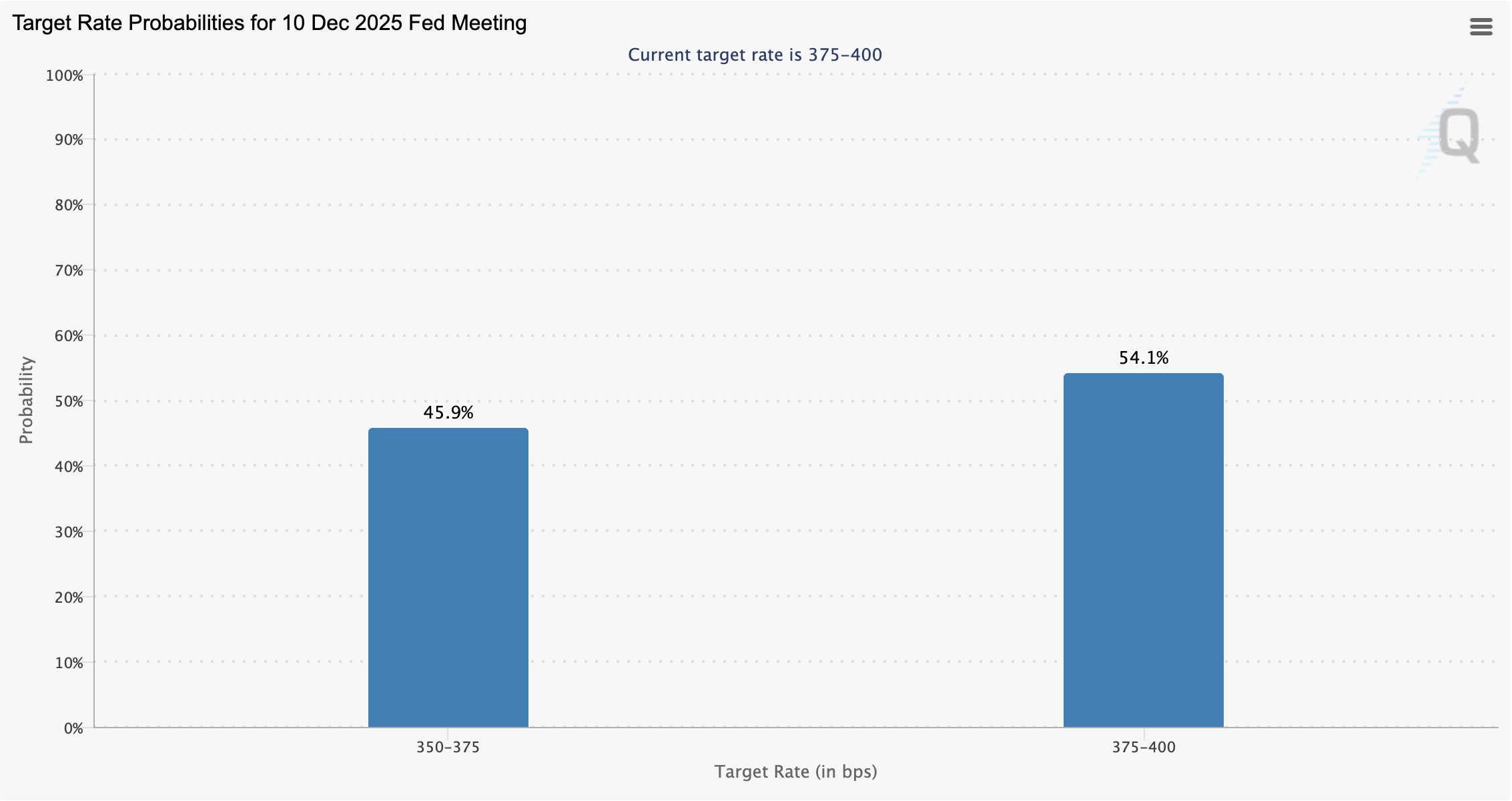

Fully Forty five.9% of merchants stay awake for an curiosity payment lower at the following US Federal Originate Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 foundation level (BPS) curiosity payment lower in December had been almost 67% on Nov. 7, in response to recordsdata from the Chicago Mercantile Swap (CME) Neighborhood.

In September, loads of banking establishments forecast as a minimal two curiosity payment cuts in 2025, with market analysts at investment banking firm Goldman Sachs and banking extensive Citigroup every projecting three 25 BPS cuts in 2025.

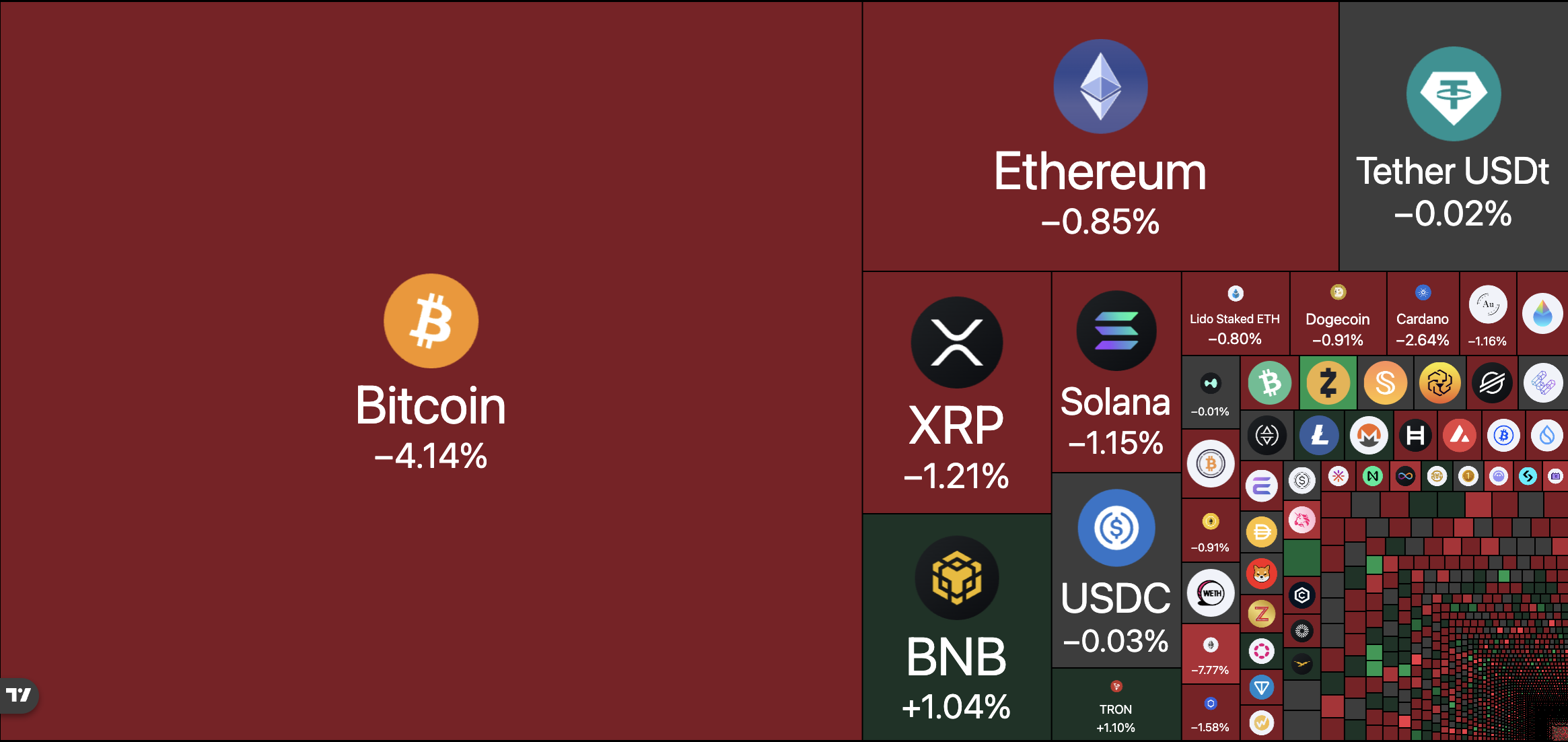

Hobby payment selections affect crypto prices. Lower curiosity charges translate into more liquidity flowing into asset markets and propping up prices, while higher charges imply liquidity and costs will seemingly be constrained.

The declining odds of a December payment lower are feeding detrimental market sentiment and can signal that more short-time length tag wretchedness is coming to the crypto market till the Federal Reserve resumes easing charges.

Connected: Stablecoin quiz is rising, and it will push down curiosity charges: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December payment lower

“There were strongly differing views about how to proceed in December. A further slit price in the policy payment at the December meeting is no longer a foregone conclusion — removed from it. Policy is no longer on a preset path,” Federal Reserve Chair Jerome Powell mentioned in October.

As anticipated, the Federal Reserve slashed charges by 25 BPS in October; nonetheless, crypto prices extended their decline following the diminished charges.

The October payment lower turned into “fully priced in” by merchants, who widely anticipated the lower months ahead of time, in response to Matt Mena, a market analyst at investment firm 21Shares.

Economist and old hedge fund manager Ray Dalio warned that the Federal Reserve is cutting charges into sage-excessive asset prices, slightly low unemployment and a harmful credit score score spreads, a historic anomaly.

In November, Dalio mentioned the Federal Reserve is seemingly stimulating the economy real into a bubble, adding that this is a feature frequent of debt-weighted down economies headed in the direction of hyperinflation and forex fall down.

Journal: If the crypto bull flee is ending… it’s time to aquire a Ferrari: Crypto Kid