From its 2025 height, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of many leading crypto investment funds — has severely managed its XLM holdings at some stage in this downturn.

Mistaken market anxiousness at the conclude of the three hundred and sixty five days continues to gasoline unfavorable expectations. What does Stellar (XLM) maintain to face these headwinds?

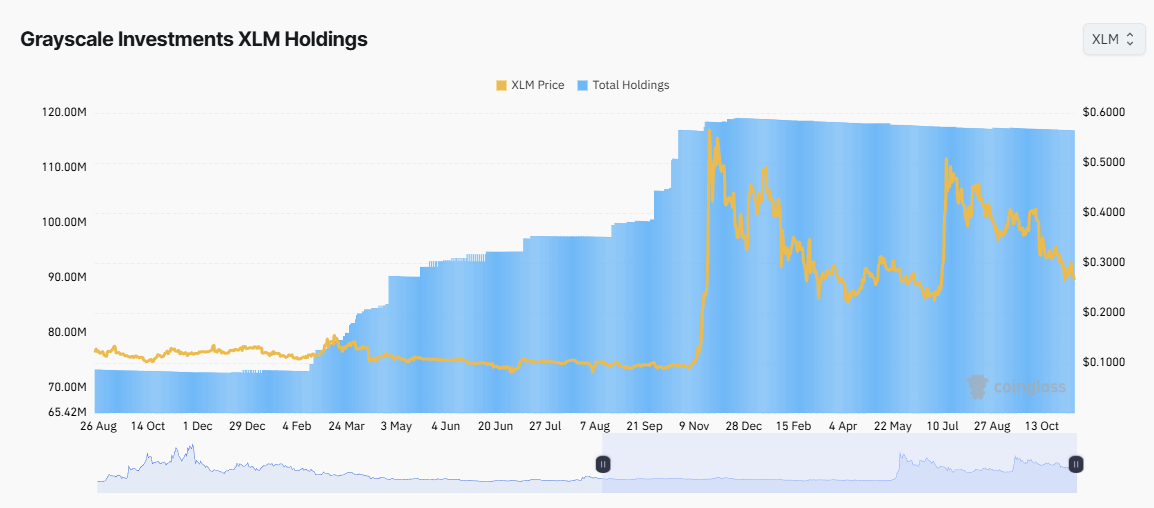

Grayscale Holds More Than 116 Million XLM

In line with the most stylish recordsdata from Coinglass, Grayscale’s XLM holdings elevated from final three hundred and sixty five days, sooner than XLM printed a “god candle” in November 2024 with nearly 600% boost.

Grayscale successfully accumulated XLM from 70 million to 119 million sooner than the rally. This transfer highlights the fund’s effectiveness as a tidy-cash participant that positioned itself sooner than predominant market swings.

Alternatively, since early 2025, the fund has stopped gathering. XLM’s ticket has stopped surroundings unusual highs and entered a downward vogue. When put next to the 2025 height, Grayscale’s XLM holdings pretty decreased to 116.8 million.

The fund’s refusal to sell aggressively reflects its traders’ long-time interval perspective. They seem to seem for XLM as a precious asset in the inappropriate-border funds sector.

More severely, shares of Grayscale Stellar Lumens Have faith (GXLM) alternate at a top price over its staunch Get Asset Effect (NAV).

GXLM’s market ticket sits at $24.85, whereas its NAV per portion is $22.29.

The market ticket is ready 10–15% better than NAV. This top price indicates that traders are fascinating to pay above the underlying asset ticket. This condition has dominated a total lot of the trading classes in 2025.

Alternatively, when evaluating Grayscale’s XLM holdings to the greater than 32 billion XLM circulating present, the fund simplest controls about 0.36% of the present. This portion remains too small to uncover any decisive affect in the marketplace.

What Does Stellar (XLM) Own to Counter Selling Stress?

November 2025 marked a pivotal moment when seven predominant crypto gamers — Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Constructing Foundation, Mysten Labs, and Monad Foundation — officially launched the Blockchain Payments Consortium (BPC).

This alliance goals to advertise blockchain-primarily based entirely price standards. BPC specializes in inappropriate-chain integration, enabling XLM to reach millions of users right thru numerous ecosystems. These traits would possibly perchance seemingly well boost request of in 2026.

“All the blueprint thru Q3, the Stellar network saw 37% boost in plump-time developers, 8 events faster than the industry boost price,” Stellar acknowledged.

In parallel, the Stellar ecosystem continues to explore explosive boost in Exact-World Resources (RWA). Full RWA ticket on the network reached a listing $654 million in November 2025, up from $300 million at the starting of the three hundred and sixty five days.

Charts from RWA.xyz demonstrate important contributions from tokenized funds, including Franklin OnChain US Executive Fund and WisdomTree Prime.

Alternatively, staunch adoption reports produce no longer constantly align with market sentiment. Recent prognosis indicates that XLM has historically performed poorly in November. With altcoins drowning in indecent anxiousness, XLM can also simply battle to flee the broader unfavorable vogue.

The put up How Grayscale Holds XLM because the Effect Drops More Than 50% looked first on BeInCrypto.