Bitcoin has been among the crucial profitable sources all the design throughout the last decade, but crypto mining stocks shall be the greater opportunity transferring forward.

Bitcoin won extra than 25,000% all the design throughout the last decade, but it the truth is now has a $2 trillion market cap. A bigger market cap makes it extra no longer easy to generate the stable mark movements that Bitcoin investors noticed in 2017 and from late 2020 into early 2021.

Crypto Miners Are Pivoting To Synthetic Intelligence

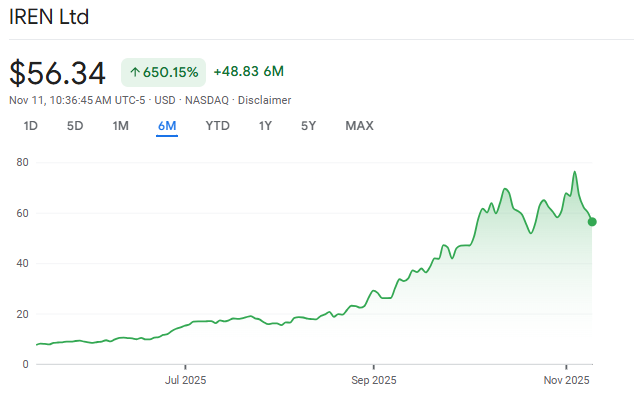

Crypto mining stocks esteem IREN and Cipher Mining weren’t even around for Bitcoin’s 2017 surge. IREN and Cipher Mining were based in 2018 and 2021, respectively.

These stocks fill smaller market caps, which methodology they don’t need as grand capital as Bitcoin to double in fee.

On the opposite hand, market cap sizes aren’t the ideally suited element that has became crypto mining stocks into the superior possibility.

The tremendous catalyst that has helped crypto mining stocks outperform Bitcoin is their pivot toward artificial intelligence.

Even alternate giants esteem Kevin O’Leary now believe in mind crypto mining stocks to be a top payment asset class.

As AI spending continues to amplify, and tremendous tech companies proceed to veil that they’ll ramp up their spending, companies that can back them effectively will fill an incredible advantage.

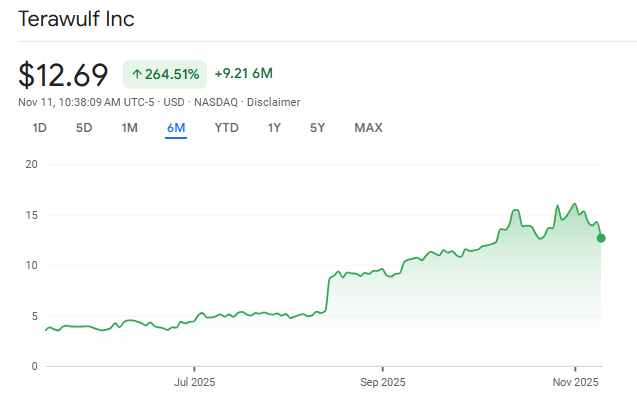

IREN, Cipher Mining, and Terawulf are among the crypto miners which fill announced tremendous deals with tech companies for AI computing energy.

These three stocks fill produced one year-to-date features of 496%, 328%, and 155%, respectively, when when put next with Bitcoin’s 11% build over the identical stretch.

Multiyear and multibillion-buck deals fill enormously changed how investors stumble on mining stocks over a short length.

Their crypto mining efforts fill given them the foremost infrastructure to home AI calls for.

These sources are furthermore extra unstable than Bitcoin. A 2% build or loss for IREN is a quite tame day, while 2% mark swings are tougher to procure for Bitcoin.

CIFR and WULF had been less unstable than IREN all the design throughout the last month, but those two stocks soundless fill a big selection of 5%+ mark movements in both directions.

Bitcoin Aloof Plays A Tall Feature In Total Income

Even despite the truth that the pivot to AI has been the tremendous legend for a big selection of crypto mining stocks, these companies soundless rely on their crypto mining to generate revenue and earnings.

They are the utilization of crypto mining to fund their AI recordsdata centers, which ends up in extra gorgeous margins when tremendous tech deals come.

If $BTC & $ETH originate to rally over the following couple of quarters…

Right here is my “of curiosity” crypto-linked stocks:

Bitcoin-Centered$BITF, Bitfarms (worldwide BTC miner; low-mark hydro)$WULF, TeraWulf (zero-carbon miner; pivoting to AI/HPC)$ASST, Strive (BTC treasury; social buzz)⭐️… pic.twitter.com/3wUIPn3Whx

— Luc (@investingluc) November 10, 2025

As extra multibillion-buck deals come, crypto will fill less of an impact on crypto mining stocks’ earnings, and this fashion is already taking form.

Bitcoin has misplaced 17% all the design throughout the last month, while the CoinShares Bitcoin Mining ETF, a fund that tracks varied crypto mining stocks, is up by 3% all the design throughout the identical stretch.

The fund’s 137% one year-to-date build further distances itself from Bitcoin, but the 3% build in opposition to a 17% loss all the design throughout the last month is quite the shock. It represents a decoupling, where Bitcoin’s mark movements no longer dictate what will happen to crypto mining stocks.

Most incessantly, these two sources fill moved up and down in lockstep, but the flurry of tremendous tech deals all the design throughout the previous couple of months has minimized their lengthy-term reliance on crypto mining for revenue command.

Extra Traders Are Paying Attention To Crypto Mining Stocks

Even despite the truth that crypto mining stocks had a quite tiny viewers appropriate a one year within the past, they fill got turn out to be common sources attributable to their newest features and connection to artificial intelligence. This rising consideration is well-known due to it’s identical to how Bitcoin first went mainstream in 2017.

Bitcoin had a $16 billion market cap on January 1, 2017, and it ended the one year with a $237 billion market cap. Ripple used to be essentially the higher winner, increasing its market cap from $231 million to $89 billion.

Crypto mining stocks are initiating to acquire consideration from analysts and TV personalities, that will maybe well pause up in identical features over the following couple of years.

Compass Point, Roth Capital, and Cantor Fitzgerald are among the companies that no longer too lengthy within the past hiked their IREN mark targets.

IREN has the most consideration within the intervening time, but other crypto mining stocks had been garnering mark target upgrades as effectively.

Even supposing crypto mining stocks fill delivered tremendous one year-to-date returns, they haven’t turn out to be mainstream esteem Bitcoin and the Magnificent Seven quite but.

When that stage of consideration arrives, the crypto mining stocks could well further lengthen their lead over Bitcoin’s newest features.

The submit Are Crypto Mining Stocks Turning into Extra Winning Investments Than Bitcoin? looked first on BeInCrypto.