Bloomberg Intelligence’s senior commodity strategist Mike McGlone has warned that Bitcoin’s (BTC) fresh underperformance would possibly per chance well deepen within the upcoming months, potentially sending the cryptocurrency tumbling toward $50,000.

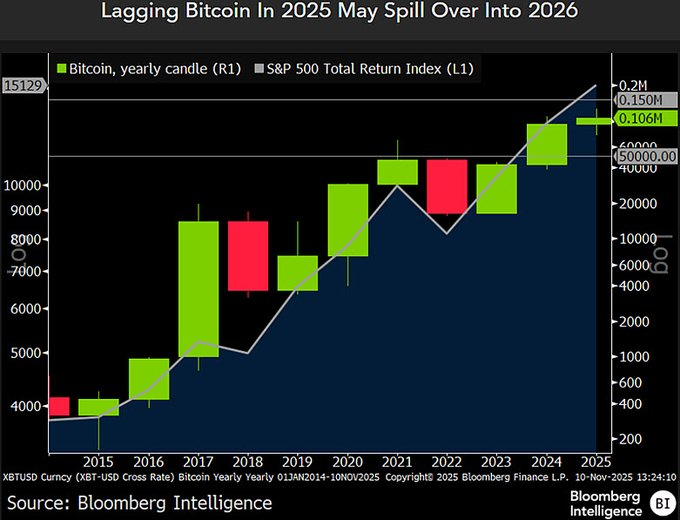

McGlone favorite that Bitcoin has lagged within the support of the S&P 500 Complete Return Index in 2025, rising easiest 13% when put next to the stock index’s 17% put by November 10.

This weakness, he defined, comes no matter stable ETF inflows and Bitcoin’s fundamentally elevated volatility, suggesting that the cryptocurrency’s bull market would possibly per chance well very well be working out of steam, per an X put up shared on November 11.

Severely, Bloomberg Intelligence knowledge helps McGlone’s warning, showing Bitcoin’s yearly candle smooth obvious but losing momentum as it approaches the stop of 2025.

Basically based totally on his diagnosis, Bitcoin’s fading momentum relative to same outdated “beta” property would possibly per chance well raise reversion dangers into subsequent year.

He cautioned that the pattern mirrors outdated cycles the place slack-stage Bitcoin rallies gave manner to intriguing corrections, hinting at a doubtless procuring and selling vary between $50,000 and $150,000 in 2026.

Cooling high dangers property

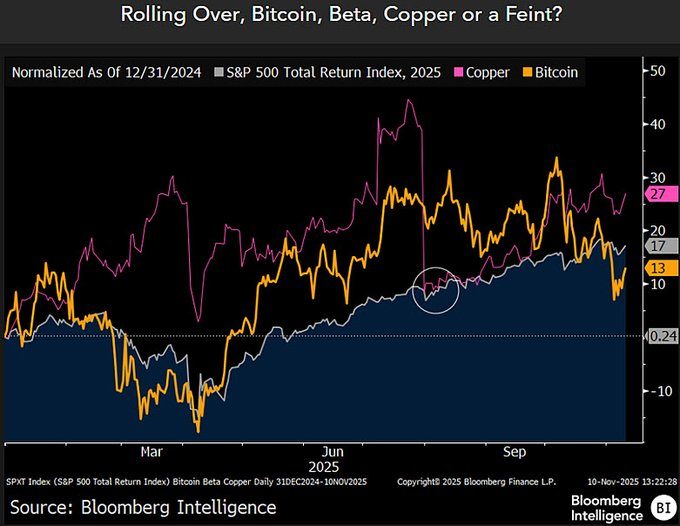

The investor also linked Bitcoin’s weakness to broader signs of cooling in high-threat property similar to copper, which noticed its file-atmosphere 2025 performance tumble support in step with the S&P 500 after tariff-connected fears subsided in July.

McGlone advised this would possibly per chance maybe well signal a shift toward a more deflationary ambiance, striking additional force on speculative property like Bitcoin.

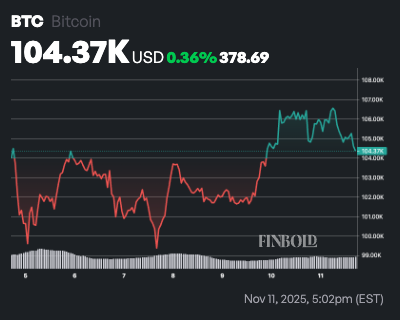

His warning comes as Bitcoin struggles to preserve above the $105,000 toughen level. Severely, after losing below $100,000, Bitcoin made a tiny recovery following studies of a doubtless U.S. authorities reopening, but momentum has since stalled.

Bitcoin mark diagnosis

At press time, Bitcoin became once procuring and selling at $104,366, having fallen almost 2% within the previous 24 hours. On the weekly timeline, the cryptocurrency is up a modest 0.36%.

As we insist mark, Bitcoin is pinned against its 200-day straightforward involving average (SMA) at $105,751. The value sits $7,900 below the 50-day SMA of $112,216, confirming quick-time length bearish alter and a clear downtrend since mid-October.

The 14-day RSI at 47.76 is neutral but cooling with out notice from overbought levels, signaling easing promote-off force and nearing zones (below 40) the place rebounds fundamentally ignite.

A sustained preserve above $105,751 would retain the macro bull trend intact, focusing on a doubtless snapback to $112,216–$113,264. Alternatively, a day-to-day shut below this level would flip sentiment bearish, opening the door to a retest of $100,000.

Featured image by potential of Shutterstock