As risk sources enter a comfy section, many analysts are carefully monitoring the 65 Month Liquidity Cycle. This mannequin is believed to have accurately forecasted market peaks and troughs for over two decades.

Are we impending a peculiar tightening section where Bitcoin faces 20% downward stress, while Silver emerges as a change haven?

65 Month Liquidity Cycle: Global Liquidity Draw Enters Closing Stage

In essentially the most contemporary chart from CrossBorder Capital, the sunless line represents the Global Liquidity Index (GLI). It’s currently rising sharply, impending the crimson top space. Its motion resembles the unimaginative phases of the 2016-2021 cycle. This strongly suggests we are entering the appealing unimaginative upswing section of the liquidity cycle. At some stage on this era, asset valuations are hovering effectively previous their intrinsic price.

This is an moderate 5.5-one year cycle, first identified through Fourier evaluation in 1999. Each cycle follows a neatly-recognized sample: capital is injected strongly within the early section, peaks when monetary protection is amazingly free, after which reverses as credit and liquidity tighten.

In accordance to the slopes of earlier cycles, the next liquidity top is anticipated to seem in Q1 or Q2 2026, roughly between March and June, merely about a months away. This implies we are nearing an “overheat” section, when capital drift slows and adjustment dangers upward thrust.

If this assumption holds, risk sources—from tech shares to crypto—will rapidly enter a “re-pricing” duration. This is when tidy money begins to cleave again exposure to extremely leveraged positions, potentially main to a 15-20% correction in Bitcoin sooner than the unusual cycle backside kinds.

Even supposing the chart and total evaluation are compelling, as one analyst on X aspects out, the cycle timing on the chart is generally off by lots of years. This implies we will not be going to know for obvious whether the market has peaked, will tempo up, remain flat, or attain nothing.

“I adore the chart and the total evaluation, nonetheless the timing of the cycle is on moderate off by years on this chart. So, you don’t know whether it has peaked, whether it’ll tempo up, or attain nothing, based mostly fully on the chart. It is a coinflip,” the analyst neatly-known.

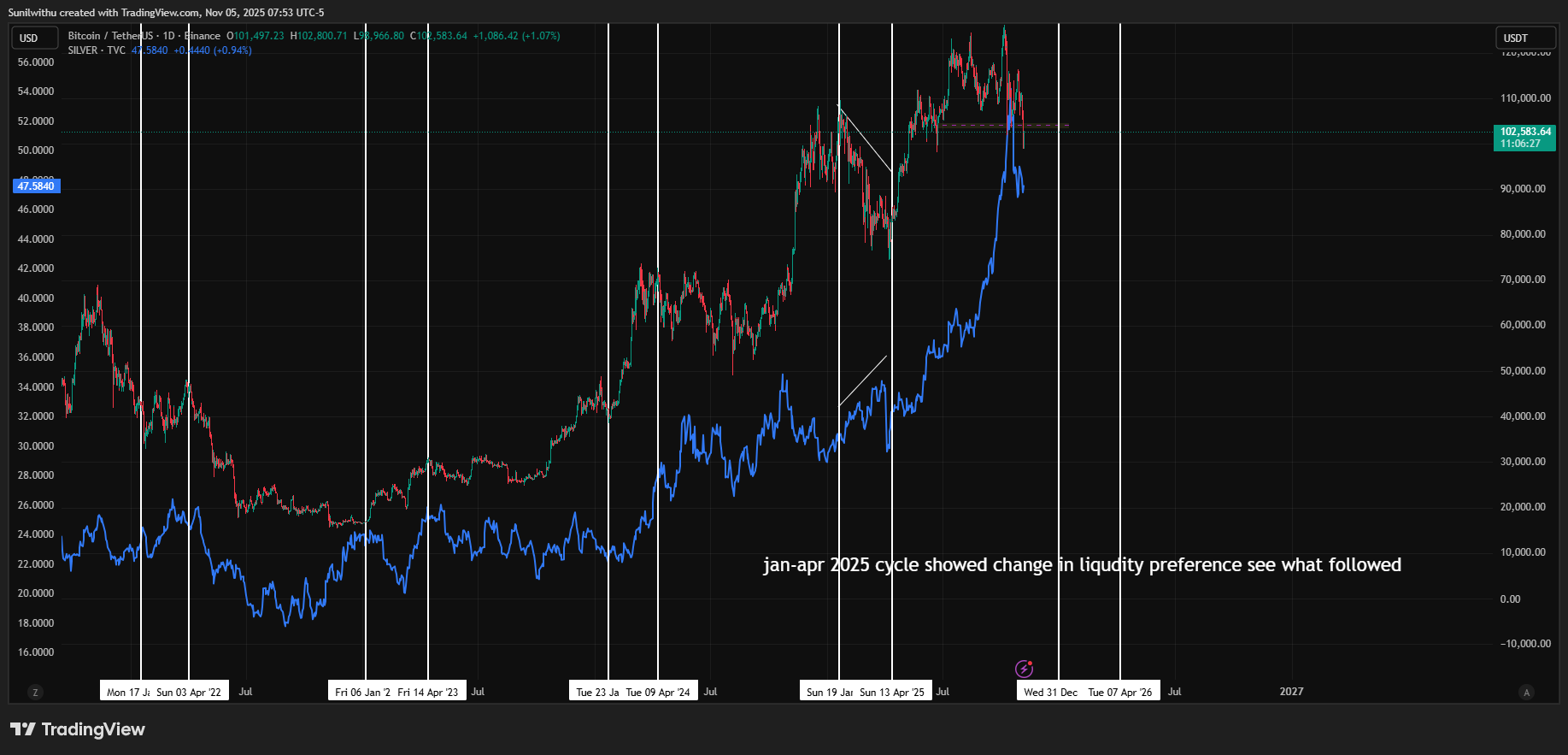

Bitcoin Drops, Silver Rises: Exact Cash Rotation Indicators

An arresting fashion in 2025 is the divergence between Bitcoin (BTC) and Silver. In accordance to charts from 2021 to 2025, Bitcoin has fallen roughly 15-20%, from $109,000 to $82,000. At the identical time, Silver rose 13%, from $29 to $33. This shows a clear shift in capital flows. As world liquidity tightens, merchants gradually exit high-risk sources, akin to cryptocurrencies, and rotate toward “collateral-backed” sources, including precious metals.

This divergence means that Bitcoin serves as a risk-on indicator, benefiting without delay from liquidity expansion. At the identical time, Silver shows dual characteristics of a commodity and a genuine-haven asset, making it extra gorgeous when inflation remains high nonetheless economic growth slows.

In accordance to stagflation indicators and historical dispositions of the liquidity cycle, many experts predict Silver might merely outperform Bitcoin all through January-April 2026. On the other hand, one year-halt 2025 rallies in both sources counsel that this shift will not occur all precise now nonetheless will be moderated by market sentiment and macro occasions.

“As we transfer into January-April 2026, we might merely survey this fashion tempo up. Bitcoin might merely simplest get better reasonably, while Silver rises sharply, deepening the rotation toward tangible collateral sources,” the analyst neatly-known.

2026: A Pivot Yr for the Cycle – Bitcoin Rebounds or Silver Continues to Lead?

Even supposing a 20% fall in Bitcoin sounds bearish, it doesn’t necessarily ticket the halt of the bullish cycle. In most unimaginative liquidity cycle phases, the market normally experiences a bright correction sooner than entering the last upswing, acknowledged as the “liquidity echo rally.” If this concern repeats, Bitcoin might merely endure a technical dip sooner than rebounding strongly within the second half of of 2026.

Meanwhile, Silver, profiting from industrial question and hedging flows, might merely take care of non eternal positive aspects. On the other hand, when world liquidity expands again in 2027, speculative capital might merely shift away from precious metals toward cryptocurrencies and equities searching for higher returns.

In summary, the 65 Month Liquidity Cycle is entering a severe section. Bitcoin is at risk of experience a non eternal correction, while Silver continues to play the market’s “genuine hand.” For long-term merchants, this might increasingly merely not be a signal to exit, nonetheless pretty a probability to reposition portfolios sooner than the next liquidity wave in 2026-2027.

The post The 65-Month Clock Is Ticking: Why Bitcoin Might per chance well Fall 20% While Silver Shines regarded first on BeInCrypto.