Hopes of a crypto bull hasten rose on Monday as Bitcoin and most altcoins jumped to their multi-week highs, following a senior Fed expert’s demand more payment cuts.

- The crypto market rally resumed on Monday as hopes of a executive shutdown ending rose.

- Fed’s Mary Daly pushed for more payment of interest cuts in the upcoming assembly.

- The carefully-watched SOFR payment of interest plunged to 2022 lows.

Bitcoin (BTC) tag jumped to $106,000, whereas the market capitalization of all cash tracked by CoinMarketCap jumped by 1.forty five% to $3.54 trillion. Among the most stay gainers in the crypto market had been Starknet, World Liberty Monetary, Trump Coin, and XRP.

What’s riding the market at this time time

The first motive of at this time time’s crypto market rally is the hope that the US executive shutdown is set to full. These hopes jumped after eight Democrats voted with the Republicans to attain a funding equipment. This suggests the equipment has a high chance of passing in the Senate and the Rental of Representatives.

The tip of the executive shutdown is principal for the crypto market as this would possibly possibly per chance moreover lead to sooner altcoin ETF approvals, that will lead to more request from institutional investors.

Hopes of a crypto bull hasten also rose after a Federal Reserve expert warned on leaving rates of interest high for see you later. In her reveal, Mary Daly mentioned that the bank would possibly possibly per chance moreover soundless steer particular of the mistake of leaving rates of interest high for see you later. She mentioned:

“We ogle a labor market that’s softening and wage growth that is moderating, so you’re genuinely no longer going to spy a range of stress coming on the tag side of labor. We don’t want to assign the mistake of conserving on too prolonged for rates most efficient to search out out we’ve injured the economy.”

Her reveal came as odds that the Federal Reserve will minimize rates of interest in December jumped to 73% on Polymarket.

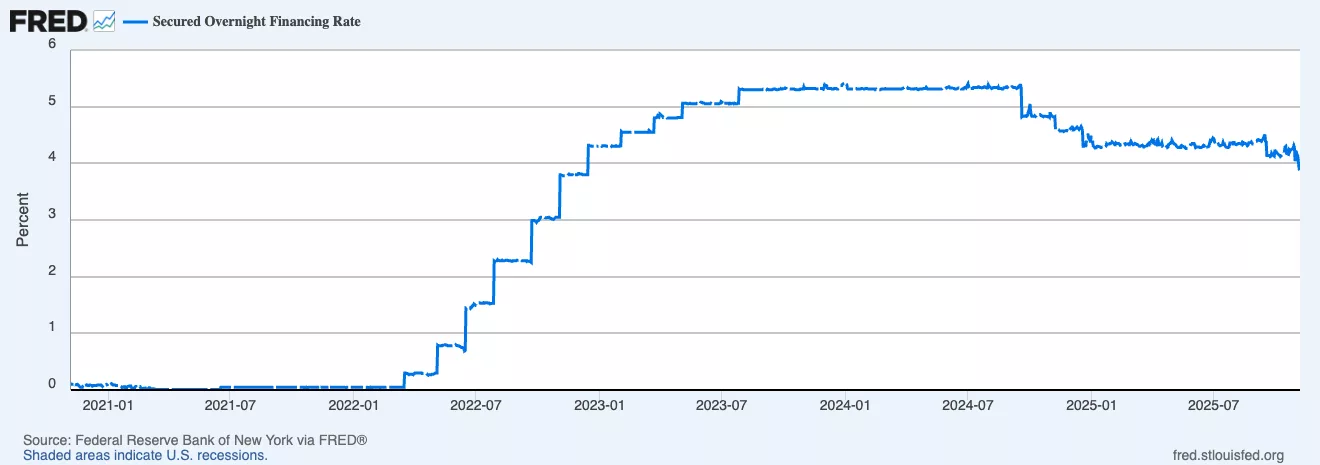

Most importantly, the carefully-watched Secured In a single day Financing Rate, customarily is assumed as SOFR tumbled to the bottom level since 2022. SOFR is a payment outmoded by banks and assorted companies to win entry to financing from the Federal Reserve in the in a single day market.

The falling SOFR payment, coupled with the proposed $2,000 stimulus take a look at, system that unstable property admire cryptocurrencies and shares would possibly possibly per chance moreover leap encourage as liquidity rises.

Beware of a dreary-cat leap

Silent, there would possibly possibly be an elevated chance that the ongoing crypto market restoration is allotment of a dreary-cat leap, a in model scenario as of lifeless.

A dreary-cat leap is a declare the put an asset in a free topple bounces encourage fleet and then resumes the downtrend. It is miles most regularly known as a bull lure on yarn of it customarily attracts inexperienced retail investors.

One warning that this customarily is a dreary-cat leap is that the Crypto Wretchedness and Greed Index stays in the phobia zone of 29.

One more is that Bitcoin and most altcoins stay under their instant- and prolonged-term engaging averages and the Supertrend indicators, a tag that bears are soundless up to velocity.

Attributable to this fact, a clear crypto bull hasten is most regularly confirmed as soon as the Wretchedness and Greed Index strikes into the greed zone and momentum pushes property above the instant- and prolonged-term engaging averages.