Ethereum (ETH) trading volumes stay elevated, with rising instruct on Binance. ETH instruct is changing into more speculative, because the token offers directional trading and boosts spinoff markets.

Ethereum is changing into a speculative asset, with a upward push in Binance instruct and total enhance of spinoff markets. In contrast to outdated cycles for Ether, the salvage of spinoff volumes is more famous. Beforehand, ETH location demand of drove the imprint, instantly reflecting the ecosystem’s enhance.

The token recovered to $3,615.63 after a dip to the $3,000 degree. Ether additionally showed a pattern of snappy rebuilding its originate curiosity. After a low of $18B in early November, Ethereum originate curiosity recovered to over $18B. In the past 24 hours, ETH originate curiosity recovered faster than BTC, rising by 5.5%.

ETH serene has 11.9% in market cap dominance, whereas trading at 0.034 BTC.

ETH snappy recovers originate curiosity

The most up-to-date ETH market cycle a ways surpasses the 2021 bull market in phrases of spinoff originate curiosity. Growing spinoff infrastructure and demand of for hedging by means of alternate choices possess modified the ETH market, ensuing in more speculative imprint moves.

Binance remained the ultimate market with $7.1B in originate curiosity. However, the replace is yet to salvage better its originate curiosity prime from August 2025.

ETH is more volatile when in contrast with BTC, and additionally reflects more snappy the linked old recovery for altcoins. However, the imprint recovery would no longer primarily judge Ethereum adoption or on-chain instruct, as at some level of past cycles. This time, ETH valuations would perhaps well perhaps also unbiased rely upon spinoff exchanges, with renewed have an effect on for Binance.

Binance has emerged because the principle venue for prime-quantity trading, including location and spinoff markets. The replace absorbs quite loads of the original token instruct, as smartly as speculative ETH instruct. Hyperliquid is influential, however carries valid $1.8B of Ether originate curiosity.

On the the same time, the concentration of originate curiosity on one replace can consequence in more dramatic liquidations. Which potential, previously 24 hours, Ethereum noticed $90.64M in short liquidations. Binance additionally led the liquidation instruct for the day with $7.8M in total liquidations.

Can ETH revisit $4,000?

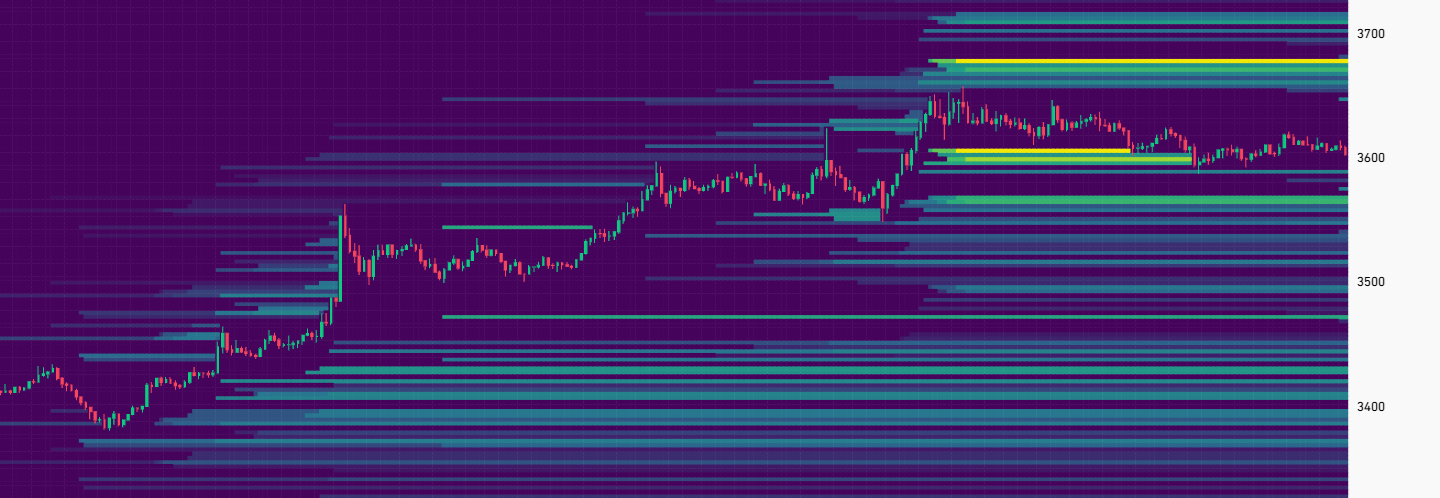

Basically primarily based on spinoff market liquidity, ETH is locked in a spread, with re-accumulation of lengthy liquidity.

On the shy away, ETH has positions down to $3,300. Rapid positions, on the opposite hand, are going up to round $3,700, signaling a movement to $4,000 is rarely any longer going in the short time length.

At its latest imprint vary, ETH sets up expectations for both a rally to a original imprint vary, and a transient fracture.

Ether traded at a puny premium on futures markets, signaling a skill breakout. On perpetual futures, ETH had a little reduce imprint and traded nearer to $3,600.