For years, South Korea used to be the worldwide heartbeat of crypto speculation. It grew to became the reputation where digital coins traded at a premium, and where retail investors moved markets overnight. The “Kimchi Top class” grew to became shorthand for a national obsession: Rampant and frenetic shopping and selling activity unrivaled by any field across the globe.

Nevertheless by unhurried 2025, the memoir has reversed. The the same traders who as soon as hunted for the following altcoin gem on Upbit are in actuality glued to Korean stock change tickers, swapping meme tokens for memory chips and high-bandwidth semiconductors. The crypto charts appreciate long gone peaceable — and a brand recent speculative engine has taken their reputation.

A market long gone mute

Upbit, as soon as the undisputed hub of Korean crypto mania, now trades at a bit of its feeble tempo. Moderate day-to-day volumes appreciate dropped on the sector of 80% from a 365 days within the past, slipping from roughly $9 billion in unhurried 2024 to only $1.8 billion by November 2025. Bithumb, Korea’s 2nd-largest change, has suffered a the same destiny, shedding more than two-thirds of its liquidity over the same period, in step with reporting from Wu Blockchain.

What used to be as soon as a nightly national pastime, the never-ending churn of little-cap coins and chatroom rumors, has evaporated. Even volatility itself has collapsed. The put day-to-day volumes as soon as swung wildly between $5 billion and $27 billion, 2025’s shopping and selling bands appreciate flattened to a muted $2 to $4 billion differ.

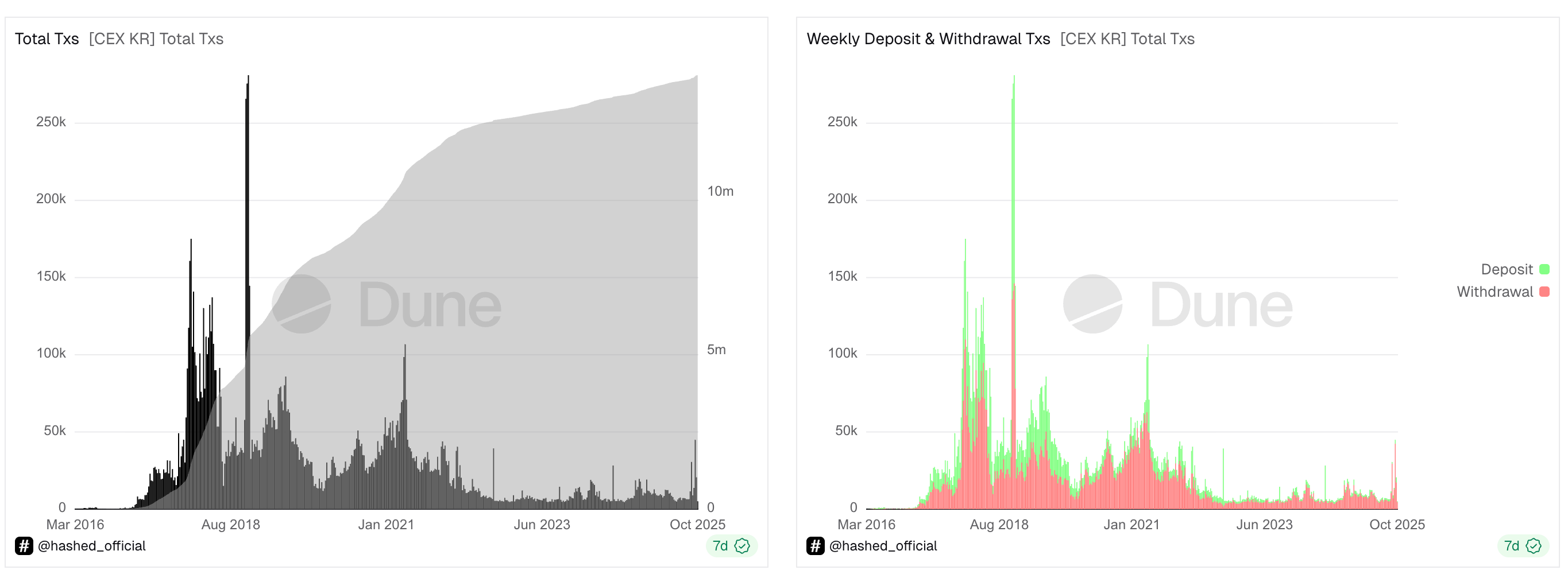

Knowledge from analytics supplier Dune reveals that the tumble in activity is compounded in contrast to 2018, when at the mania’s high Korean exchanges facilitated 280,000 deposits per day; the day-to-day figure hasn’t exceeded 50,000 since 2021.

The rise of a brand recent obsession

The vacuum left by crypto didn’t ultimate long. Retail investors merely migrated to a special table — the Korean stock market, which has staged one of essentially the most explosive rallies in its history.

The KOSPI index has surged more than 70% 365 days-to-date, environment a possibility of advise highs. In October on my own, it posted its strongest month-to-month accomplish since 2001, climbing 21% and logging 17 recent intraday recordsdata. The frenzy has been led by AI-linked giants care for Samsung Electronics and SK hynix, whose combined day-to-day turnover now makes up more than a quarter of the total change.

In a country that after traded crypto as a more or less collective hobby, the psychology feels familiar. The the same spirit of retail speculation has resurfaced, most productive this time it’s sporting a swimsuit of semiconductor shares.Knowledge reported by the Korea Cases confirmed the quantity of active shopping and selling accounts within the nation jumped from 86.57 million at the flip of the 365 days to 95.33 million as of Oct. 31.

Retail euphoria spills over into equities

No longer like the meme-pushed altcoin rallies of feeble, Korea’s equity divulge has a more tangible backbone. AI is the worldwide boost myth of the decade, and Korea occurs to manipulate one of its most crucial provide chains.

As Nvidia and AMD gasoline remarkable of the sector’s rely on for AI hardware, Korean corporations care for SK hynix and Samsung appreciate became important. Their dominance in high-bandwidth memory (HBM), a key element for AI training, has turn into them into national champions.

Add to that a government interested by revitalizing home markets, and likewise you acquire what some analysts name a “coverage-backed bull speed.” President Yoon Suk Yeol’s administration has pushed reforms to attenuate the long-standing “Korea Good deal,” encouraging elevated dividends, tighter governance and incentives for retail and institutional funding at residence.

Same spirit, varied casino

Speculation within the Korean crypto group used to be never about restraint; it used to be about rhythm and tempo. That hasn’t modified. Margin lending is booming again, leveraged ETFs are flying off the cupboards and retail participation has doubled in fair a 365 days. In step with Bloomberg recordsdata, leveraged retail positions now manufacture up on the sector of 30% of entire holdings, with youthful traders main the rate.

In other phrases, the migration from crypto to equities isn’t a retreat, it’s a reallocation of distress appetite. Koreans haven’t abandoned speculation; they’ve fair stumbled on a venue where the leverage feels reliable and the upside patriotic.

Nevertheless this shift has consequences. With out Korean retail as a liquidity anchor, global crypto markets appreciate lost one of their most consistent traders. Memecoin rallies that after lit up Korean chatrooms now fizzle sooner. And the broader market in most cases is brief of a spark; bitcoin currently trades around $100,000 irrespective of recording an all-time high one month within the past, whereas loads of altcoins lost upwards of 20% over the past month.

Looking out ahead to the following spark

Crypto’s “Kimchi traders” could presumably appreciate stepped away, but history suggests they obtained’t be long gone with out a kill in sight. When the AI change cools, which analysts are suggesting would be on the advance horizon, or when the following main crypto myth arrives, the same traders could presumably presumably come roaring wait on, armed with recent capital and sharper reflexes.

For now, Korea’s retail traders appreciate swapped blockchains for circuit boards, chasing the same bustle in a special arena.