Despite a caring dip on Friday, Bitcoin has survived the $100,000 smash test. Now, attention turns to Washington. The longest US govt shutdown in historic previous has drained liquidity from financial markets — and by extension, from crypto.

Analysts argue that once the fiscal gridlock ends, the identical mechanism that pulled liquidity out will push it wait on in, environment the stage for a restoration.

US Shutdown Standoff and Its Economic Affect

The govt. shutdown, which began on October 1, 2025, entered its sixth week after Congress didn’t pass current funding.

The deadlock stems from disputes over healthcare subsidies and spending levels. Both events are refusing to pass a “neat” funds invoice.

The US govt shutdown has now lasted for 36 days, making it the longest on file. Some welfare payments, including those that allow low-earnings families to buy meals, obtain been halted. The shutdown skill more than 1,000,000 govt employees are no longer being paid. pic.twitter.com/fF4ORTrg6V

— Al Jazeera English (@AJEnglish) November 5, 2025

The industrial toll has been measurable. The Congressional Budget Office (CBO) estimates losses between $7 billion and $14 billion.

Actually, the US GDP growth in Q4 is probably going trimmed by up to 2 percentage aspects.

User sentiment is shut to file lows, air shuttle is disrupted on account of air-traffic shortages, and convey programs face funding stress.

The prolonged money freeze has change real into a main scoot on the financial system.

How Did the US Govt Shutdown Affect Crypto?

In financial terms, the shutdown has frozen a lot of billions of bucks sometime of the Treasury Not unusual Myth (TGA) — the govt.’s money reserve. Every buck parked there is a buck no longer circulating within the financial machine.

Since the US debt ceiling became raised in July, the TGA balance has swelled above $850 billion, draining liquidity by about 8%. Bitcoin mirrored the pass, sliding roughly 5% within the identical duration.

This correlation, prolonged noticed by on-chain analysts, highlights crypto’s deep sensitivity to buck liquidity.

Since the U.S. govt shutdown began on October 1, Bitcoin has been in a clear decline.

The market pattern has proven oscillations between ticket phases, with out a determined direction various than downward.

The deleverage occasion became the major hit, adopted by a outdated college rebound and… pic.twitter.com/OdLYVb1h7s

— Bitcoin Vector (@bitcoinvector) November 7, 2025

Arthur Hayes calls this dynamic a “stealth QE in reverse.” Because the Treasury hoards money, liquidity tightens, threat resources plunge, and Bitcoin corrects.

But once the govt. reopens and resumes spending, that liquidity will flood wait on through banks, money markets, and stablecoin methods — successfully reversing the drain.

$BTC (yellow) -5%, $ liq (white) -8% since US debt ceiling raised in July. TGA arise sucked $ out of the machine. When US gov shutdown ends, TGA will plunge +ve for $ liq, and $BTC will rise … and $ZEC will spin up MOAR! pic.twitter.com/A9tflGuBHH

— Arthur Hayes (@CryptoHayes) November 5, 2025

Will Crypto Markets Enhance When the Govt Shutdown Ends?

The instant resolution is for sure, the crypto market is highly liable to recover or rally once the US govt shutdown ends.

Alternatively, the timing and magnitude will rely on how liquidity is released wait on into the machine.

Crypto — and Bitcoin critically — trades as a liquidity-sensitive threat asset. When buck liquidity tightens, crypto prices plunge; when liquidity expands, they rise.

https://x.com/cryptorover/spot/1986690833693765880

This sample has repeated sometime of more than one cycles:

- March 2020: Global liquidity injections drove the initiate of the COVID bull urge.

- March 2023: The Fed’s balance-sheet enlargement sometime of the US banking crisis triggered a Bitcoin rebound from $20,000 to $30,000.

- 2025: The correlation between Bitcoin and buck liquidity (as measured by the USDLiq Index) stays shut to 0.85, one of the major strongest amongst all asset classes.

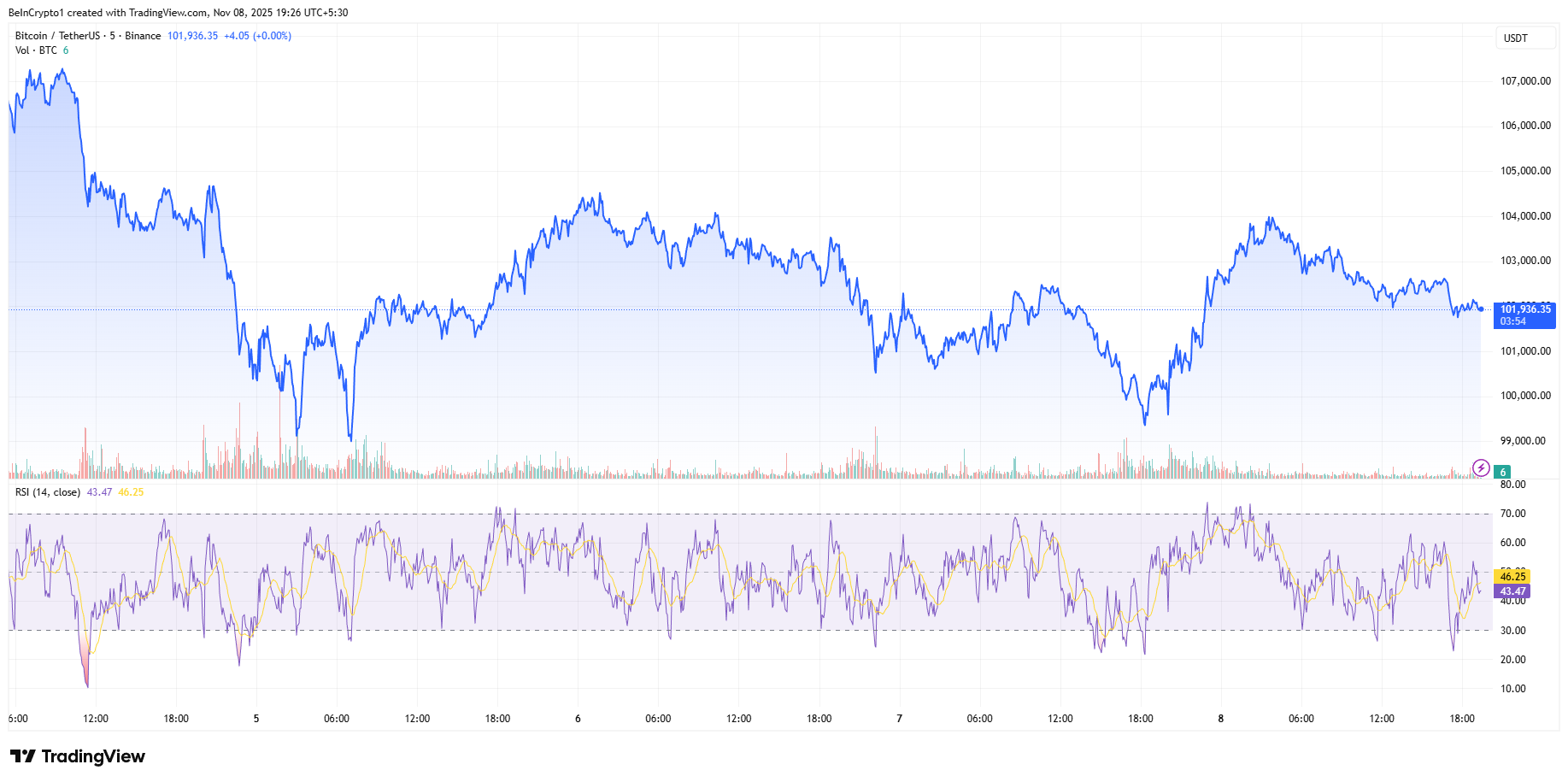

Bitcoin has closed above $100,000 for six straight months, and the RSI stays around 46, far below euphoric levels. Analysts name basically the latest section a “window of wretchedness,” pushed by temporary fiscal tightening.

The broader macro describe helps their case.

- Rate-decrease expectations for early 2026 are growing as fiscal paralysis weakens temporary growth.

- Global liquidity from China and Japan is rising, offsetting US tightening.

- Speculative leverage in crypto has been flushed out, leaving a more wholesome market inferior.

Collectively, these factors create stipulations for Bitcoin to recover against the $110,000–$115,000 vary within the following quarter, offered no current shocks emerge.

Outlook: When Dollars Float, Bitcoin Follows

The crypto correction has less to terminate with fading enthusiasm and more with frozen liquidity.

Once the US govt reopens, Treasury spending and Fed beef up mechanisms — such because the Standing Repo Facility — will reintroduce money into the machine.

The total expectation is that crypto fell because greenbacks stopped transferring. It’ll rise after they initiate flowing again.

In functional terms, the pause of the shutdown could perhaps presumably also charge the initiate of a liquidity-pushed rebound sometime of crypto markets.

The post Will Crypto Markets Rebound When the US Govt Shutdown Ends? regarded first on BeInCrypto.